Navigating Currency Reporting Challenges for Nigerian Companies with Foreign Ownership

Q3 just ended, and Nigerian companies with foreign owners/investors will have a tough time explaining their numbers.

"Constant Currency Reporting" may help, but it is also a trap.

Let's unpack this using MTN as a case study, whose revenues are going to fall over 30%..🧵👇🏾

Intro: On 14 June 2023 the Central Bank of Nigeria floated the exchange rate for the Nigerian. As a result the Naira lost over 30% of its value overnight.

In the long term this should be positive. In the short term it going to cause some financial reporting headaches.

To unpack this, we are going to use MTN as a case study, but the implications apply broadly. MTN Group is listed in South Africa and therefore reports its results in 🇿🇦 Rands (the presentation currency).

Despite this, a significant chunk of its revenue comes from Nigeria.

Based on Accounting Rules (IAS 21), transactions are converted to the presentation currency based on the prevailing exchange rate.

This rate is always the official rate, even when the parallel market exchange rate is more reflective of reality.

For MTN, this meant converting the revenue for the first half of the year for MTN Nigeria at an average rate of R1:26.6₦ (This rate was equivalent to 1USD:486₦).

MTN had to use the official rate even though the parallel market rate was probably around R1:40₦.

However, the new official rate is now R1:₦40.5. If we recalculate the revenues using this rate, the ZAR revenues drop by -34% for MTN Nigeria and -13% for MTN Overall 🤯.

In situations like this, companies explain away the drop by using "Constant Currency" reporting.

Constant currency reporting eliminates the impact of FX movements by converting all the amounts using the same FX rates.

This is best practice globally. Below is an example from Microsoft. They show growth on an absolute basis but also on a Constant Currency (CC) basis.

If you don't use Constant Currency reporting you can make wrong conclusions.

E.g. a business that grows EUR revenue by 5% in a year where the EUR/USD strengthens 10%.

The USD revenue would be down -5% but it would be wrong to say the business is not growing.

FX rates, like the EUR/USD currency pair, also fluctuate up and down. Therefore, over the long run, the impacts of FX should balance out or not be too significant. As a result, you can afford to focus only on Constant Currency Growth.

The difference with the Naira, however, is that it doesn't move up and down like EUR/USD does. Every drop in value has ended up permanent.

I don't know many who would bet on the Naira being back to 1 USD:₦450 next year.

So, this change in FX represents a permanent change in the business that will not be reflected by looking only at the constant currency basis.

This has a big impact.

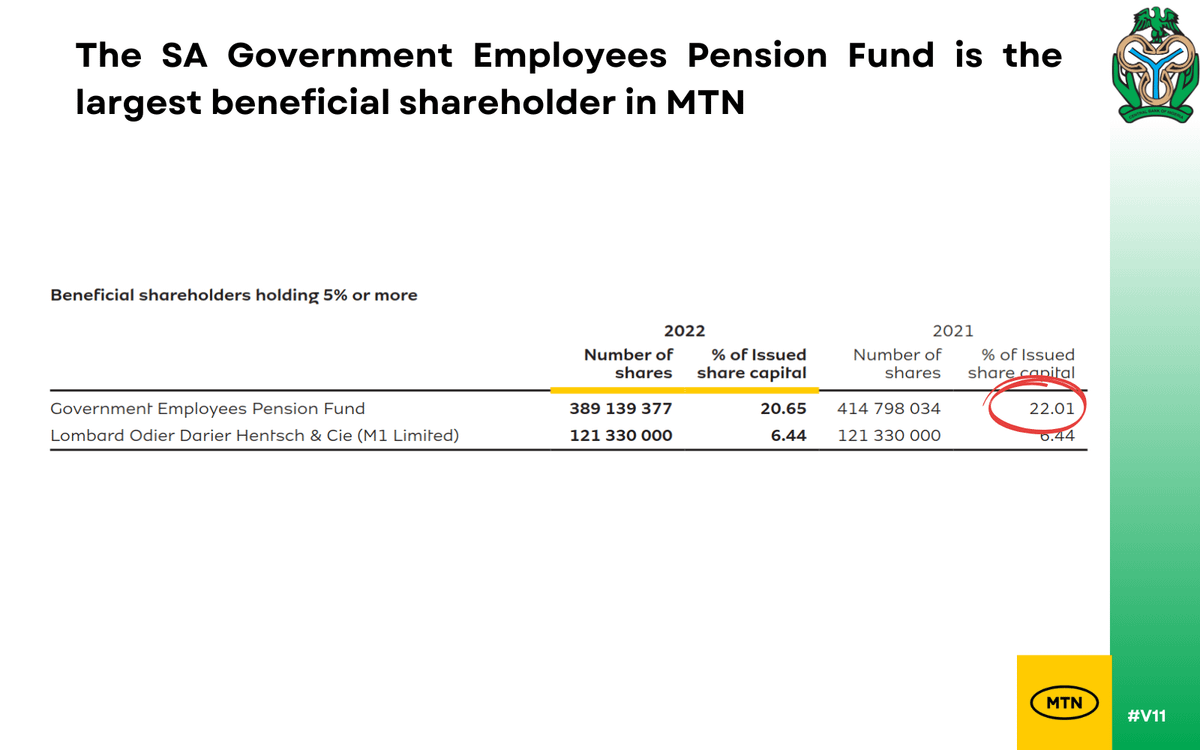

One of MTN's largest shareholders is the 🇿🇦 Government Employees Pension Fund (GEPF).

The GEPF needs ZAR returns to pay pensions.

MTN is no longer able to pay out the same ZAR returns as its results previously implied, also compounded by the fact that repatriation of ₦ profits will be at a higher FX rate.

Constant Currency reporting won't reflect this.

The other challenge is inflation. A classic example is the one below, where MTN 🇳🇬 grew revenue by 21.6% & was given a green light for hitting their target.

But inflation was 22.8%. Did they really grow?

That 21.6% "growth" also then pushed MTN's overall growth to 15.1%.

However, the bigger issues is not with MTN. They have an army of people to analyze this (their FX financial disclosures could have been better though).

The concern is the 🇳🇬 startups that have foreign investors tracking performance in USD who may have the same questions.

If an investor had not been fully briefed on the FX impacts or had been relying on ₦ financials, it is going to be tough explaining why USD revenue is down over 30% and what that means in the long run.

It also doesn't help that despite the liberalization of the rate, it seems a parallel market is mushrooming again, which can further confuse investors as to what is the real value of the ₦ and how to evaluate performance. Official rate or parallel rate?

Ideally, startups should have sent an investor update the day after the exchange rates were liberalized, explaining the impacts on the business, financial reporting, and returns.

If this hasn't been done yet, now would be a good time, especially since Q3 has just ended.

In addition, startups may need to consider maintaining a set of USD accounts. Officially, companies will still need to report in Naira, but keeping track of USD figures may be worthwhile.

This is common in places like Zimbabwe, where currency instability has been ongoing.

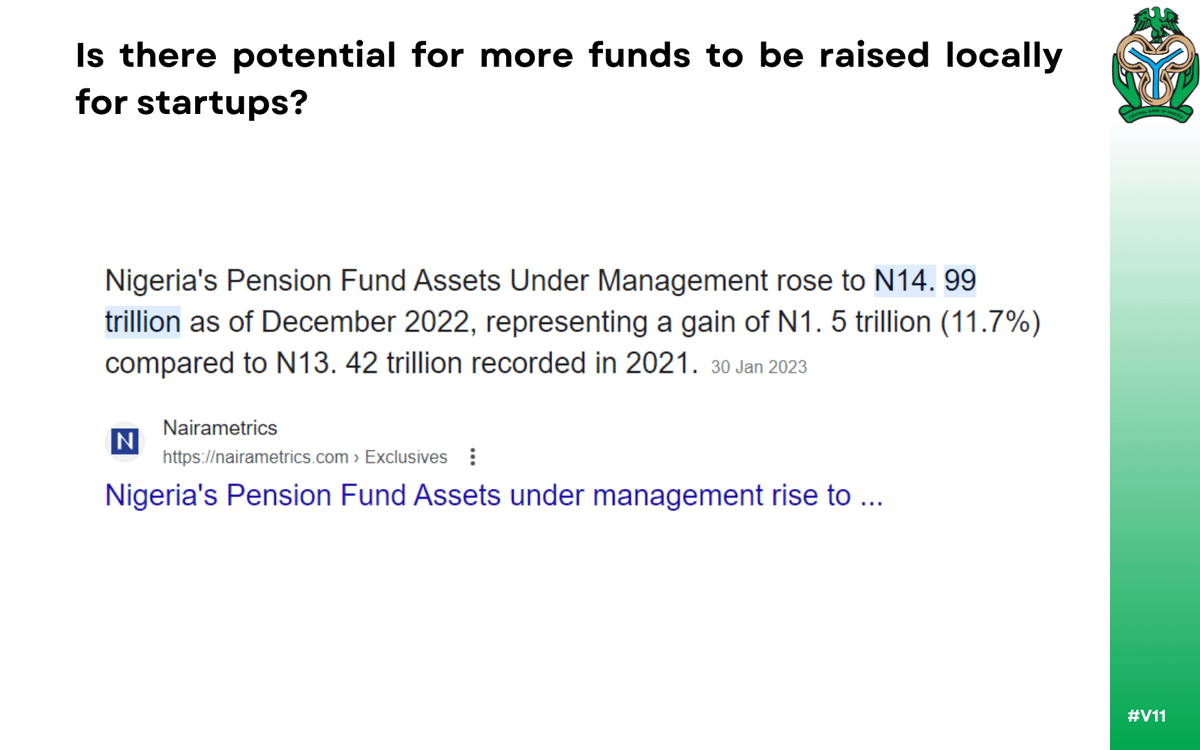

The other possibility is perhaps Nigerian startups and companies should seek out more local investors who are happy to get returns in Naira?

I don't have any insights on this. Anyone know if this is viable?

In conclusion, for the next year or so, there will be a lot of financial reporting that may be not reflect economic reality.

It won't be easy to detect, but one should be alert.

But this is just my two cents on a potentially complex topic.

What do you think?

If you enjoyed that thread. You may also enjoy the below.

Recommendation 1/2

https://twitter.com/tmukogo/status/1692191844262883719?s=20

Recommendation 2/2

Thanks for reading!