OK's Trading Update: A Stormy Outlook

OK just released their trading update, and it's not looking good.

OK is in a brutal storm with potentially huge losses and a cash crunch.

Will OK survive, or will they need a "Big Brother" to come to their rescue?

It's a huge thread, but it's worth it! Let's dig in!

Background: We have talked a lot about OK in recent times. If you need a recap, I have linked the previous posts at the end of this thread. So for now, I will just jump in.

The biggest statement in the update is that OK's volumes are down -22.6%. That's really bad.

Trading volumes are the best available method to assess how much sales have fallen in reality as comparing ZWL is misleading due to inflation.

To understand the full impact this we need to reconstruct a USD income statement using the data points we have.

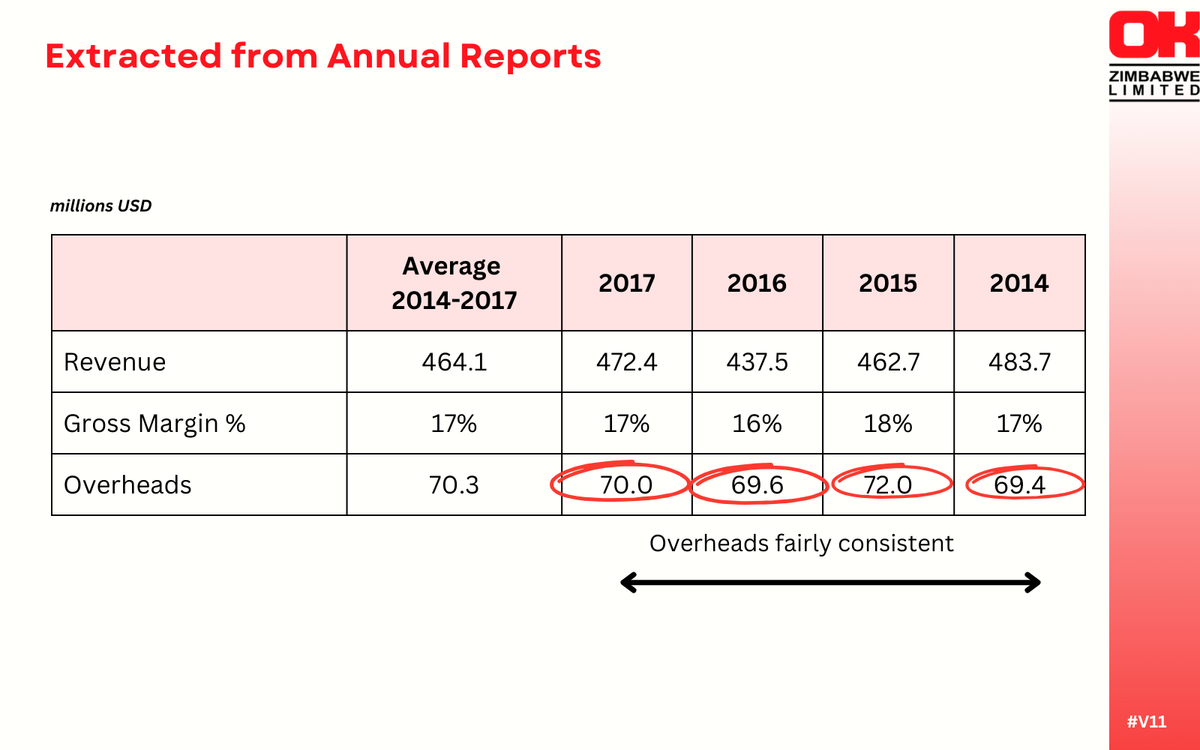

I used the 2014-2017 USD financials as a base to understand what OKs cost structure is like.

From this we see OK's gross margin the past has been about 17%.

This means if you bought something from OK for $100 they would have bought it for $83 from their supplier.

OK's overheads were consistent at about US $70m per year. Overheads include rentals, salaries, and other expenses.

The fact that these remained pretty stable even when revenue changed means they are a good proxy for their fixed costs, i.e., the costs OK can't avoid.

If we take all the data points we have we can reconstruct what the loss could be for FY24 based on the latest trading update.

Putting it altogether - its bad. OK may be on track to lose about US $10mn. 🤯

No wonder they said they are "severely below break even".📉

With that current level of loss, OK will be rapidly depleting its cash reserves, which they don't have in abundance.

This implies that they will need to continue borrowing, but it remains uncertain how long they can sustain this practice.

OK borrowed US $5mn in August 2022 and on March 31, 2023, had an overdraft of ZWL 4.6 bn (~US $3m).

OK felt it was okay as they still had unutilized facilities of ZWL 17 bn (~US $12mn).

The thing with banks, however, is they like to lend money to people who don't need it.

If OK incurs a loss of anywhere near $10 million, banks will likely become nervous and decrease their willingness to lend, if they haven't already done so.

Suppliers have already started reducing credit terms and are no longer providing as much flexibility to OK.

OK in the next 18 months could end up in a corner. Losing cash, falling market share maxed out borrowings.

When companies are such tight corners they usually call on a "Big Brother".

Most leading companies have a "Big Brother," which is essentially another company or major shareholder that can support or bail them out when things get tough.

Pick n Pay Zimbabwe has

the Pick n Pay Group, which own 49% of the Zim Operations.

Axia, Simbisa, Padenga, etc. have the same big brothers linked to the Innscor Group's shareholders.

Delta has AB InBev, Old Mutual Zim has Old Mutual Limited. Econet Zimbabwe has Econet Global.

Big brothers are very helpful when in a squeeze.

When Econet Zimbabwe needed cash to pay off its US $30m of debentures, they couldn't get the money locally.

So, they had a rights issue and Econet Global put in +$12 million (likely more through other vehicles).

Since 2001, when it was unbundled from Delta, OK Zimbabwe hasn't had a big brother.

This isn't always bad; not having a big brother means you can be more independent and fully implement your own ideas.

But right now, OK would love to have a big brother.

With this in mind it makes one sentence in the trading update very interesting.

OK calls out strategic partnerships with "Shoprite Group of South Africa".

Has OK spotted and distant cousin they hope will become a big brother?

Or is ShopRite considering a move for OK?

Shoprite operates in every country Southern Africa except for in Zimbabwe.

They tried to buy OK in 2009 but decided to walk away citing political instability. Could this be the time to make a move?

There is reason to believe this could make sense.

Shoprite has been burned by their international business but growth in South Africa is slowing.

OK would also be a meaningful addition. In fact, it would immediately become Shoprite's second-largest market outside SA by the number of stores. (OK has 71 retail stores)

I also think OK is a fundamentally good business that is facing difficult times.

OK is different to say Edgars or Truworths where selling clothing as a big retailer in Zimbabwe is a game that is incredibly hard to win.

At its peak OK was bringing in $12mn profit year.

The other advantage is that OK is likely to be attractive from a valuation perspective because of the challenges it is facing.

Whilst it could be a good target for ShopRite I think there are many Big Brothers who would see OK as an attractive asset.

Either way, OK will need cash, which I don't see them getting from the banks or generating through operations as things stand.

There has to be some shareholder investment. Currently, the biggest shareholders are passive investors who I doubt would bail out OK if needed.

In the meantime, OK will go into survival mode and so expect cost-cutting.

Despite the challenges, OK's headcount has been increasing, so I wouldn't be surprised if there is a headcount freeze or reduction of employees.

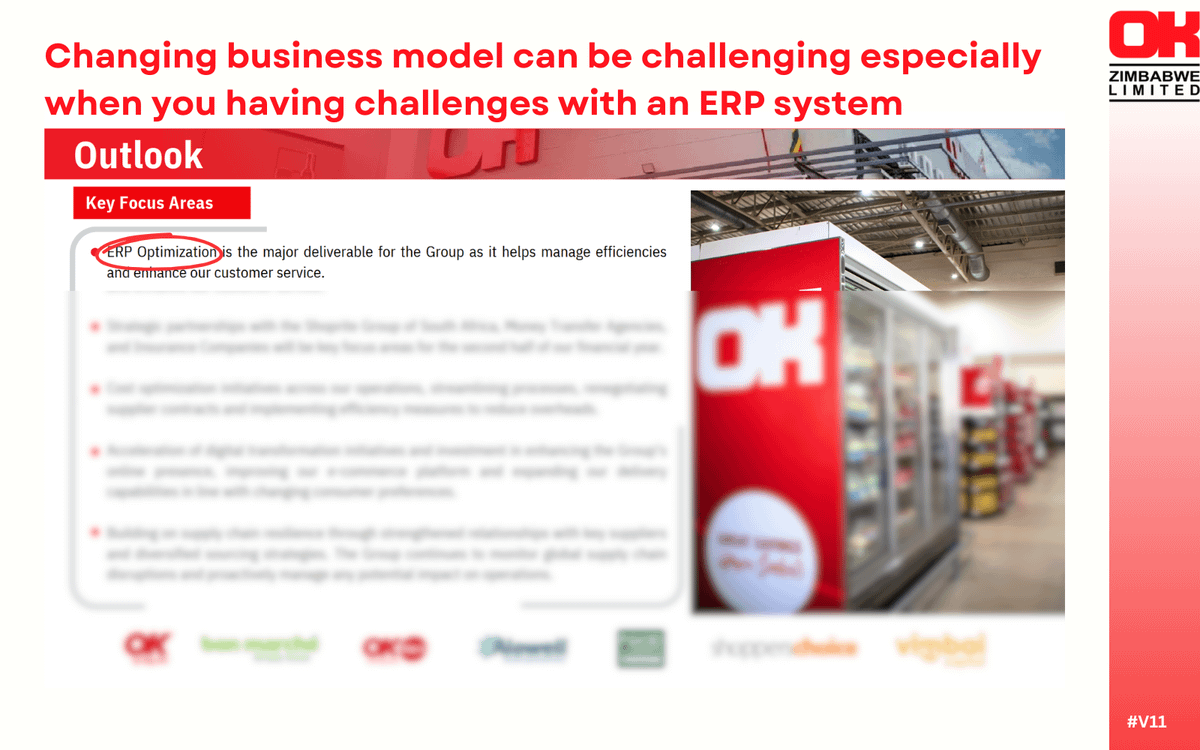

I don't think OK can make too many drastic changes in the short term however.

Some have said OK should franchise (which I don't think they can do as the franchise is owned by Shoprite) or start their own Spaza shops.

Moves like that need to be carefully considered. You don't want to create permanent solutions for temporary problems.

Also, any business model change takes a lot of time. Consider how OK has been working on changing ERP since 2021 and is still not yet finished.

In closing, OK is in a tough spot and will likely need some strong shareholder backing. Perhaps a Big Brother is coming.

But as always I could be missing something as I am basing analysis on public information.

Let me know what you think. Opposing views are welcome!

Thread 1/2!

If you found this interesting you should read the other threads on OK Zimbabwe.

https://twitter.com/tmukogo/status/1709283832556646432?s=20

Here is the last one!

Thread 2/2

Thanks for reading.