Beyond the Headlines: The Untold Story Behind Deloitte's Zimbabwe Exit

Last week Deloitte Zimbabwe announced it was leaving the Deloitte network.

This must have been a tough decision.

Deloitte is one of the biggest brands in the world and it comes with one of the best reputations. And for accounting firms, reputation is everything.

An accounting firm's most well-known service is audit. After an audit, an audit report is issued and all audit reports are standard and take the same format.

What makes one audit report more valuable than the other is the name signing off on the report.

In some ways, audits are like white T-shirts. They look the same but the brand on the T-shirt is what changes the value.

A Gucci white T-shirt will be much more valuable than a Mr Price white T-shirt. Likewise, an audit report from Deloitte is more valuable than one from Mukogo & Sons.

So for Deloitte Zimbabwe to say, "Our T-shirts are no longer Gucci, but please keep buying them, and we'll tell you what brand they are soon," represents a significant shift.

However, these are really smart people who wouldn't do this without very good reasons. They had to feel this was the only option.

Two things come to mind as to what could have left them feeling this cornered but first, it's useful to understand how Deloitte Africa is structured.

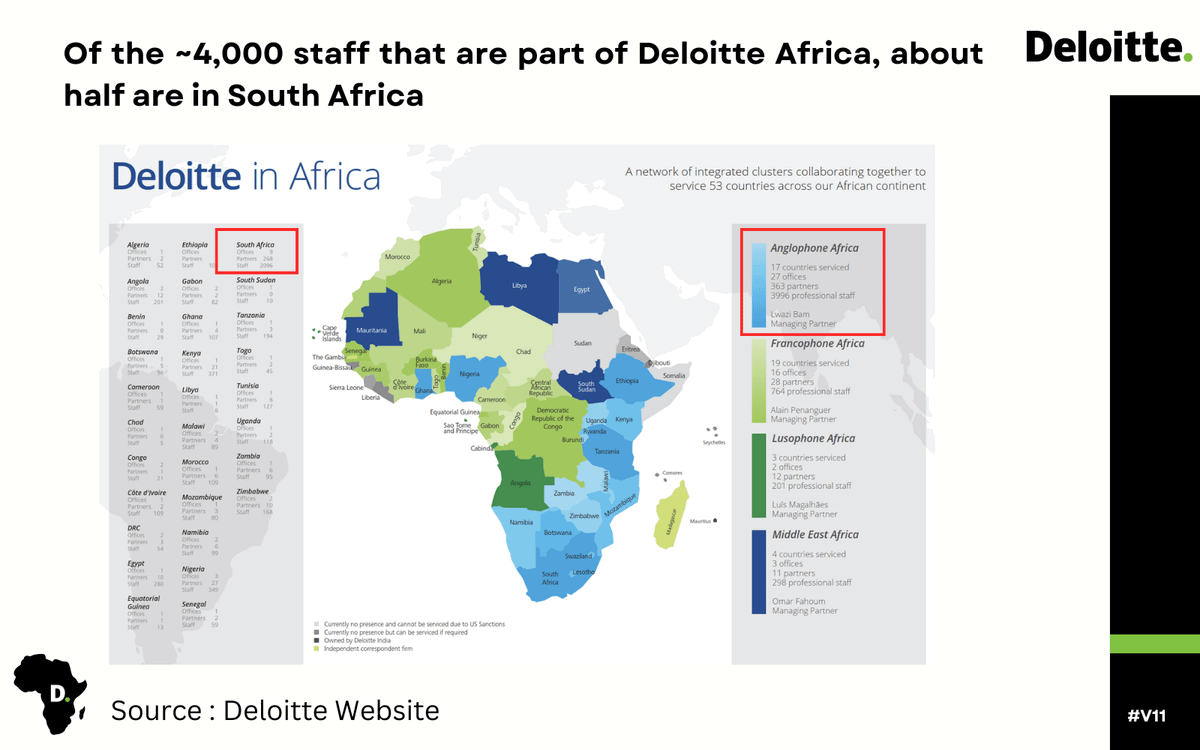

Deloitte Africa is a network of firms in English-speaking African countries that in the past operated quite independently from each other. In the 2010s there was a drive to create broader African wide wide firm more centrally coordinated.

Remember this point.

The creation of Deloitte Africa was driven by the South African office.

South Africa is still by far the biggest part of Deloitte Africa with about half of all staff. As a result, decision-making is driven from South Africa where all the Deloitte Africa CEOs have been based.

In the early days of Deloitte Africa, Zimbabwe played quite an important role. The Zimbabwe Office was made the head of Deloitte Central Africa which included Zambia and Malawi.

Even the former CEO of Deloitte Zimbabwe became the Transitional Leader of Deloitte Nigeria, a very important market.

What also helped was Zimbabwe was going through a period of growth and increased investment after dollarisation.

Audit fees between 2010 - 2015 were on average increasing.

For example, OK Zimbabwe's fees increased by ~88% during this period. Deloitte Zimbabwe also had won huge consulting work with the Zimbabwe Electricity Transmission and Distribution Company (ZETDC).

In short, Deloitte Zimbabwe had its challenges but still was valuable to Deloitte Africa.

So what changed?

Now we can go back to the two things I mentioned earlier.

The first and most obvious change is the environment in Zimbabwe. I won't dwell on this too much as this is well-known and documented.

The second factor, which has been less discussed, is the changes in South Africa.

In the last few years, Global Professional Services firms have had a tough time in South Africa.

McKinsey, KPMG and Bain all got entangled in state capture drama and the impact was huge. McKinsey ended up repaying fees of R1 Billion and Bain was banned from government work for 10 years. KPMG had to cut jobs to adjust to the client exodus brought about by the state capture scandal.

Deloitte SA also had its challenges.

A good example is the mess with the sugar producer Tongaat Huellet, which also had significant operations in Zimbabwe.

Tongaat Execs pulled off accounting fraud that was estimated to be over R3.5 billion and naturally, Deloitte as the auditors came under fire.

In the end, Deloitte settled claims related to Tongaat for R261 million.

Then there was Steinhoff — the biggest accounting fraud in South African history at $7.4 Billion, more than half Nambia's GDP.

Deloitte was the auditor and so obviously was harshly scrutinized.

To what extent Deloitte was at fault is debatable as sometimes the expectations placed on auditors are unreasonable.

Whatever the case these incidences meant more scrutiny and pressure.

The relevance of these examples is to put into context the recent state of mind of the Deloitte Africa leadership — limit risk as much as possible.

And it seems this is what they have been doing. This can be confirmed by the 2023 Deloitte Risk Culture Survey which measures how focused on managing risk people believe Deloitte Africa to be.

Between 2021 to 2023 the rating increased from 89% to 98%-

Now imagine if you are trying to limit risk exposure but have to deal with companies in Zimbabwe which come with the risks related to:

Hyperinflation

Compliance risks (both local and sanctions-related) -

Foreign Exchange controls

Fraud and Corruption

So much more

Simply put a lot could go wrong in Zimbabwe and so I imagine the Deloitte Africa Leadership would have tried to limit risk by putting many controls, rules and checks on Deloitte Zimbabwe. I also expect that they may not have been very flexible with these rules.

Typically, these controls could include stopping Deloitte Zimbabwe from working with certain clients or requiring additional reviews for work done. Such rules would make Deloitte Zimbabwe slower, less flexible, and more expensive.

In summary, Deloite could become uncompetitive.

This seems to be confirmed by the statement from Deloitte Zimbabwe where they highlight the need for "flexibility and agility" as one of the reasons for Deloitte leaving the Deloitte network.

Hopefully, this is not the end of Deloitte in Zimbabwe forever as there were many benefits of being connected to a global firm.

Deloitte has also pulled out of and then reentered a market before.

In 2012, Deloitte left Ethiopia after a change in regulations and disagreement with the local team in part due to concerns over South Africa having too much influence.

This year, however, Deloitte is planning to reenter Ethiopia.

So what happens next with Deloitte Zimbabwe?

I have some thoughts but perhaps that's for a Part 2.

PS: I worked for Deloitte in the past but these are my personal views based on publicly verifiable information.

Tough one to take in

PWC has followed suit, also on its way out