The Intriguing Connection: Metro Peech & Browne's Collapse and Truworths

The fascinating connection between Metro Peech & Browne's (MP&B) Collapse and Truworths.

At the heart of it is a intriguing company run by a 37-year-old entrepreneur, that seems to be steadily gaining in influence.

Let's unpack!

🧵 THREAD 🧵

Recap: Sahara Capital Group (SSCG) acquired MP&B's assets for $5.2 million, positioning them as winners in the aftermath of MP&B's collapse.

MP&B's creditors were the losers, but the situation could have been much worse without the successful deal with SSCG.

The deal means related party creditors (such as Spear Capital and Greenwave) get nothing, while 3rd party creditors receive 32% of what they were owed.

The list of creditors is long, but one company stands out - Mega Market.

Mega Market is owed more than Pro Group, National Foods, and Delta combined, with a total of $1.9 million. That's huge. Who are these guys?

Mega Market manufactures & distributes fast-moving consumer goods (FMCG) & is reportedly run by 37yr old Muhammad Shiraan Ahmed.

It started as a family businesss in Mutare & seems to have done well. It now owns stakes in listed companies including over 30% of Truworths.

In fact, perhaps doing well is an understatement.

For what started as a family business to have over $5 million in listed shares, $1.9 million of stock at MP&B, and reportedly building a $25 million flour mill, that sounds like things have been going very well.

On the flipside Truworths has been struggling and has had to get support from Mega Market.

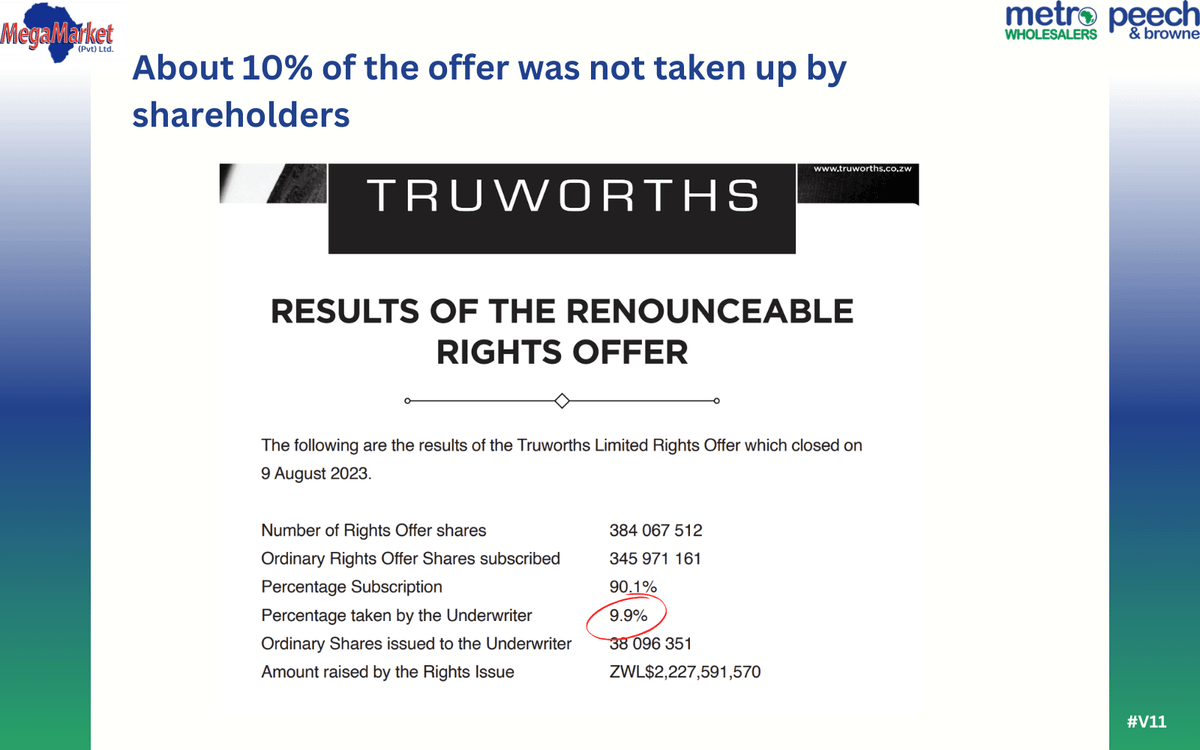

When Truworths needed to raise money this year, it was Mega Market that stepped in as the underwriter to essentially guarantee that Truworths would get the money.

This is not to be underestimated.

In principle, Mega Market was prepared to take a controlling stake in Truworths if the other shareholders chose not to fund the business.

It also seems like Truworths International, which could have been a source of help, has lost a bit of interest in Zimbabwe.

The investment in Truworths Zimbabwe was already written off to $0 in 2003, but now Zimbabwe is not even mentioned in Truworths International results.

However, Truworths Int. still participated in funding Truworths 🇿🇼 with the recent rights issue, given that the underwriter ended up taking only 10% and not over 30% as would have been the case.

All together, the rights issue raised ZWL 2.2bn in August (~US$450k).

Unfortunately, this ~US$450k probably won't last too long considering all the plans they have for it. (See slide below)

That's a lot to do with $450k. For context, back in the happier USD days in 2015, Truworth's working capital position was ~$10m.

So, what happens when Truworths needs more cash?

The banks are expensive or unwilling to lend.

Truworths International doesn't see Zimbabwe's as an important market at present.

Will Mega Market save the day?

Mega Market is going to lose about $1.3m from the MP&B collapse. Thats a big hit.

They also just helped Turnall raise cash as well.

In an environment when most corporates are struggling absorbing all that needs deep pockets. (Which they may have)

Either way, Truworths looks like a hard business to invest in confidently. Volumes are down 45%, & clothing is where the informal traders thrive.

How do you compete with suits selling for $20?

Someone needs to exlpain the cost structure that makes this possible 🤯 .

Based on this I wouldn’t blame Mega Market if they were hesitant to risk more capital and if they don't could the clothing retailer end up exposed?

I don’t know.

What it does show is how interrelated and interlinked the market is. SSCG buys MP&B whose biggest creditor is Mega Market which owns a major stake in Truworths which competes with Edgards which is controlled by SSCG.

Let's see what happens next. It's not clear to me what Mega Markets plans are.

It's hard to pick a common theme from investments in Truworths (clothing), Turnall (building & construction), and their core FMCG busnisess, but it is a company to keep an eye on.

As always, I could be off in my analysis and missing something.

Please leave a comment and let me know what you think.

The recent public announcement by Truworths that is has entered corporate rescue add an interesting dimension to the Truworths corporate story and their relationship with Mega Market. Keen to follow the development.