Caledonia Mining's Financial Results, Zimbabwe Gold Investment Conference

How a 40% Gold Price Jump Drove Caledonia's 467% Profit Growth

Caledonia Mining: How a 40% Gold Price Jump Drove 467% Profit Growth

Caledonia Mining’s stock has tripled in 2025, making it one of the best-performing gold miners on both the Victoria Falls Stock Exchange and the NYSE American.

The Q3 2025 results make it clear why.

Revenue up 52%. Free cash flow is now $5.9 million. EBITDA jumped 163%. Profit spiked 467%.

But here’s what’s really interesting: production barely moved. Gold production increased just 1%.

So how did profit surge 467% when production was essentially flat?

It comes down to the economics of mining — and why rising gold prices are so powerful for gold miners like Caledonia.

Let’s unpack.

Simplified Mining Economics

Unlike most businesses, the easiest part of gold mining is sales.

There’s always a customer (Fidelity in Zimbabwe’s case) and always a price (set with reference to international markets). If you’ve mined it, you’ll sell it.

This means the heart of mining is getting gold out of the ground today and preparing to extract more tomorrow.

The cost to produce an ounce is measured using AISC (All-In Sustaining Cost) — which includes labor, electricity, maintenance, development work, sustaining capex, royalties, and overheads, but excludes taxes, interest, and major growth projects.

The goal is to keep AISC low, but that’s not always in your control.

Blanket Mine started operations in 1904 and has been producing, with some interruptions, for over 120 years.

After more than a century of digging, Caledonia has to go deeper. Blanket used to mine at 750 meters; today it’s pushing around 1,100 meters underground.

Deeper means more electricity for ventilation and cooling, more labour for complex logistics, more equipment maintenance under extreme conditions, and more development work to access distant ore bodies.

Even an efficient operation will have a higher AISC simply because that’s where the gold is.

The other critical point: many of these costs are fixed. Ventilation keeps running. Pumping continues. Maintenance must happen. Labour stays on payroll.

This high fixed-cost structure is what creates leverage. When gold prices rise, almost all the extra revenue flows straight to profit because the costs don’t increase proportionally.

Here’s exactly how that played out at Caledonia in Q3.

Caledonia by the Numbers

Q3 2025 Highlights:

Revenue: $71.4m (↑52%)

Realised gold price: $3,434/oz (↑40%)

Gold production: 19,106 oz (↑0.6%)

Gold sold: 20,792 oz (↑8.7%)

AISC: $1,937/oz (↑29%)

EBITDA: $33.5m (↑163%)

Profit after tax: $18.7m (↑467%)

Free cash flow: $5.9m vs. -$2.4m in Q3 2024

Revenue surged by an impressive 52% in the quarter, driven by a 40% increase in realised gold prices to $3,434/oz and higher sales volumes.

Production was up 0.6%, which in other businesses may seem disappointing. But for a mine that has been producing for over 100 years, steady and consistent production is actually a good sign.

The Cost Story

The AISC was $1,937/oz, up 29%. This warrants some discussion. Arguably, this was the only weak part of the results.

AISC jumped 29% due to higher on-mine costs (electricity, labour, consumables, and other costs directly related to production), plus increased administrative expenses, higher royalties driven by the elevated gold price, and sustaining capital expenditure for underground development and modernisation.

It seems especially with the on-mine costs, there were some inflationary pressures as well. With USD inflation in Zimbabwe supposedly at 13%, perhaps this played a part. Whatever the case, there is a sense that these costs are more sustained than one-off increases.

Caledonia increased its 2025 AISC guidance from $1,690-$1,790/oz to $1,850-$1,950/oz, indicating costs will remain higher.

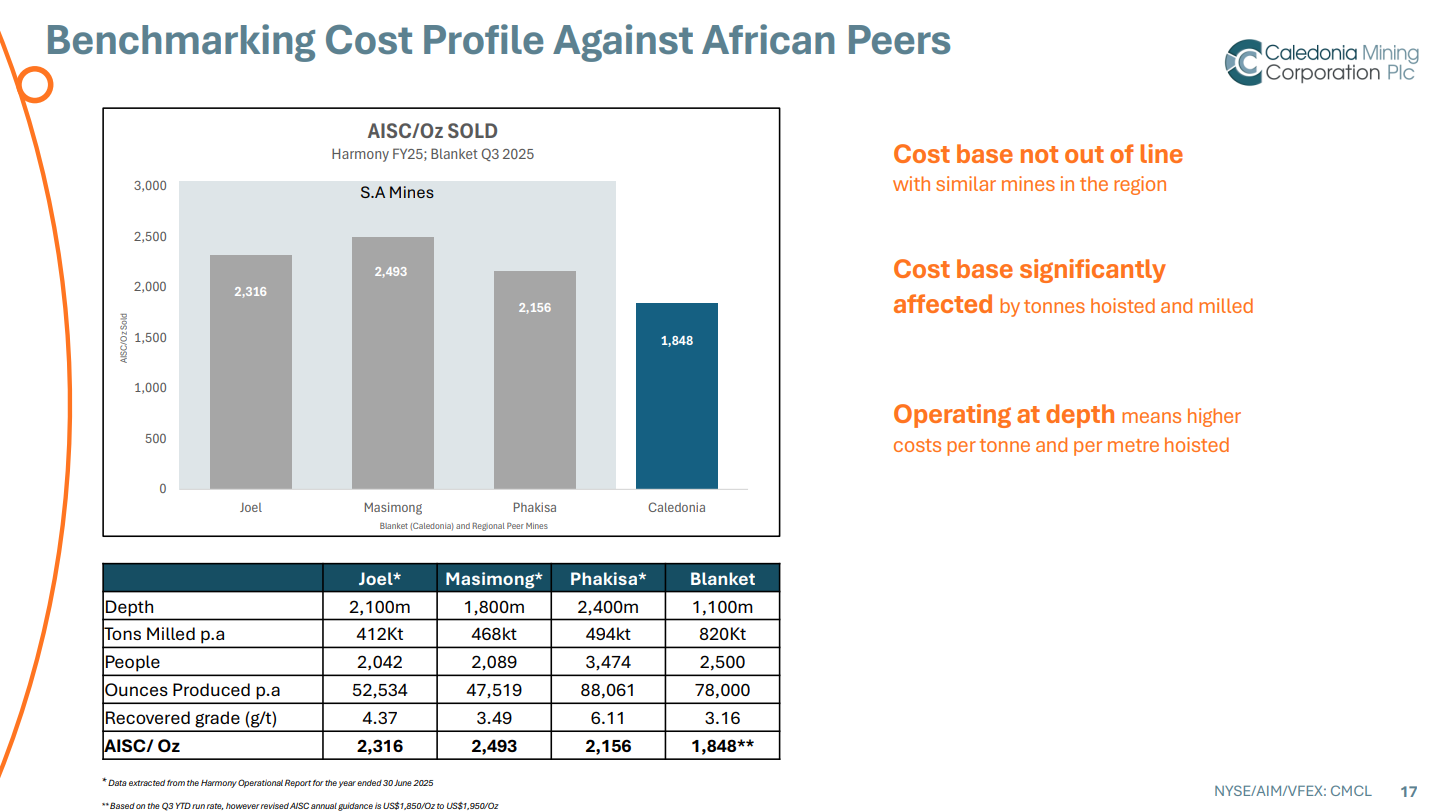

The good news, however, is that even with the increase, Caledonia still seems to compare favorably with peers in South Africa, as shown below.

Why the Profit Surge

Here’s where the high fixed-cost structure pays off. Even with the elevated costs, the margin between the realised selling price $3,434/oz and the AISC of $1,937/oz is still very big.

Because most costs don’t rise when gold prices do, an extra $1,000+ per ounce in revenue from higher gold prices flows almost entirely to profit. This is why production barely moved, but profit shot up. EBITDA and profit were up 163% and 467% respectively.

What is more intriguing is that so far in Q4, the average gold price internationally has been about $4,000/oz, nearly 20% higher than the price realised in Q3, which means Q4 results could be much stronger, even with the higher AISC.

So despite cost pressures which need to be looked at, Caledonia still seems to be in an attractive position.

Preparing for the Future

But strong current results aren’t enough if there’s no tomorrow.

Current mine life runs to 2034, so Caledonia is using Blanket’s cash flows to fund three growth priorities: expanding exploration around Blanket (deep drilling showing “highly encouraging” results with grades higher than the current mine plan), developing Bilboes (feasibility study ongoing), and advancing Motapa (maiden resource declaration expected in the coming year, adjacent to Bilboes with synergy potential).

If exploration succeeds at any of these projects, either mine life extends or future production jumps.

Where’s the Money? What’s the Move?

The gold rally appears to have room to run. Goldman Sachs is maintaining its position that gold prices will rise in 2026 with a “$4,900/toz target by end-2026”.

As these Q3 results demonstrate, higher gold prices translate to dramatically higher profitability for Caledonia due to its fixed-cost structure.

The share price increase means Caledonia is no longer as attractive as a dividend play.

While the company has paid dividends consistently for over a decade, management has signalled that windfall profits will fund future growth rather than significant dividend increases.

For now, new investors may get more from capital appreciation rather than yield, which sounds hard to believe given the stock price increase.

The bull case: “Caledonia offers high leverage exposure to gold prices — a small rise in the gold price can lead to a much larger percentage increase in profit, given its fixed-cost structure and stable production.

For example, in Q3 the realised gold price rose ~40 % and profit after tax rose ~467 % (with production nearly flat) — highlighting the leverage effect.

If you’re bullish on gold continuing its run, Caledonia amplifies that bet. With Goldman Sachs seeing further upside in Gold prices, perhaps there is still more opportunity.

The bear case: Zimbabwe carries political and economic risk. Costs are rising structurally as mining goes deeper. And operating leverage goes both ways — if gold falls to $2,500/oz, margins compress fast and profits could collapse even faster than they rose.

However, all things considered, Caledonia is a company that is hard to ignore and clearly one of the best performing in the country and even in the region.

What do you think?

Thanks for reading! If you found this useful, please share it with your network. The more people who read, the more time I can spend unpacking companies you care about.

P.S. I’m working with publicly available information from Caledonia’s Q3 2025 results. Do your own research before making investment decisions.