Capitec’s Results Part 2: The Magic of Serving the Underserved

If you want to grow faster than the market, find the people the market forgot.

Quick note before we get started: Earlier this week, I shared that I’ve been nominated for the Capital Markets Advocacy Award - People’s Choice! Thank you so much for your support and nominations.

Unfortunately, the voting link I provided was broken—my apologies! If you’d like to vote, here’s the correct link. Click through and scroll to the Capital Markets Advocacy Award section at the bottom to cast your vote. Thanks!

Capitec’s Results Part 2: The Magic of Serving the Underserved

At the heart of every magic trick lies a simple principle: making something appear from nothing.

Capitec does the same thing, only with profits. Its magic lies in turning overlooked customers into new income streams.

That’s the real power of serving the underserved — and it’s a play any business can copy.

Let’s unpack!

The Underserved Customer Advantage

In Part 1, we discussed how Capitec built its foundation by targeting a previously ignored segment of the market: low-income South Africans who needed access to unsecured credit.

Now we’ll explore what makes this strategy even stronger: customers who have been neglected in one area are probably underserved in another.

If customers have difficulty opening an affordable bank account and getting credit, it likely means they also lack access to many other financial services.

This gives a business targeting these customers two pathways to growth.

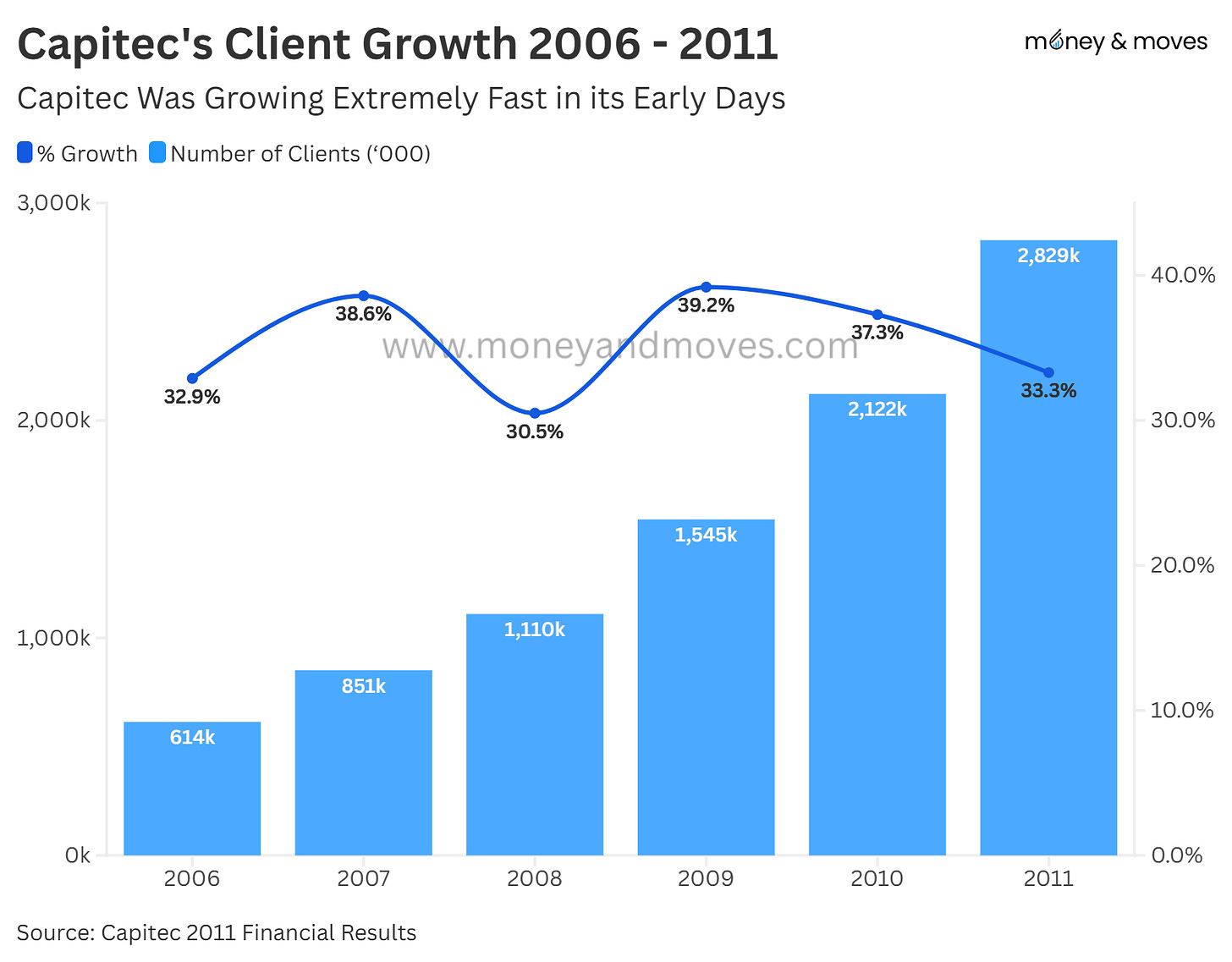

First, the business can grow quickly in absolute terms by simply acquiring clients who were previously ignored.

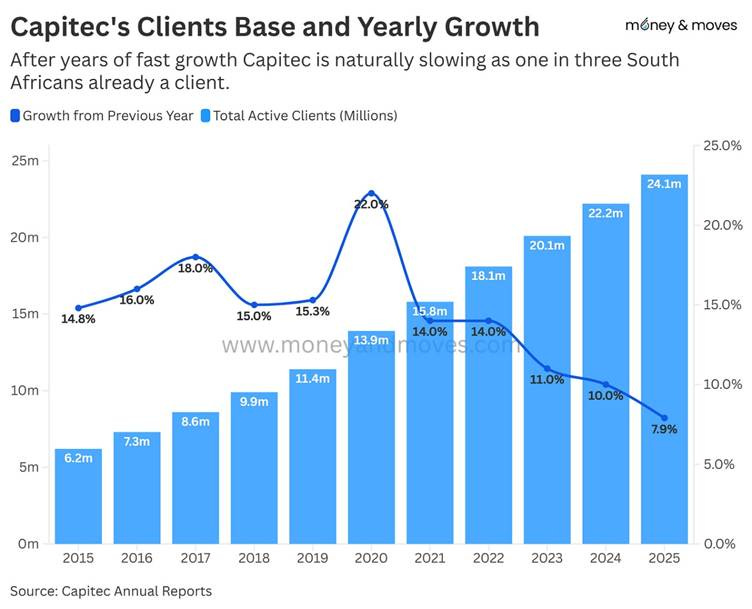

This is precisely what Capitec did—growing their customer base rapidly to the point where today, one in three South Africans is a Capitec client.

However, absolute client growth eventually slows.

This is where the second advantage becomes critical: people who are underserved in one area are often underserved in multiple areas.

This means once you’ve built trust and a relationship with these customers, you can add new services and continue growing—even when customer acquisition starts to plateau.

Diversifying Beyond Lending

In the last few years, Capitec has focused on diversifying income away from just lending.

Their insurance business has grown from R1.6 billion in 2021 to being on track to pass R4.5 billion in 2026.

This means while customers have increased by about 50% the insurance income has increased by about 200%.

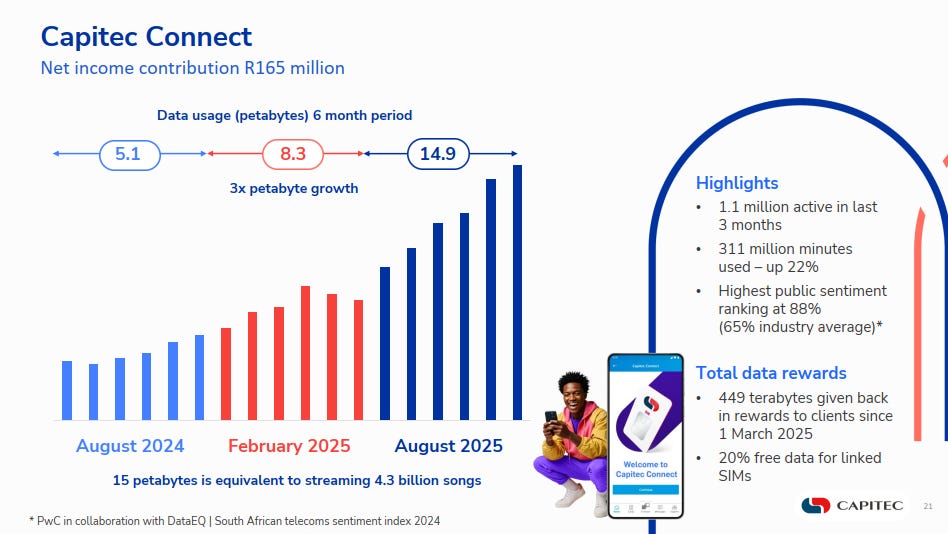

The other business line that is doing the same is the Fintech Business. This includes Capitec Connect, a prepaid mobile offering (voice, SMS & data) launched in 2022.

It operates with the same fundamentals as banking, providing clients with flat, low prepaid rates on data and no fees for recharges. This business has also grown incredibly fast over the last three years.

In addition to Capitec Connect, the Fintech segment offers value-added services (VAS) such as processing vehicle license renewals, purchasing electricity, buying lottery tickets, and sending cash. This segment has been growing rapidly as well and was up more than 40% compared to last year.

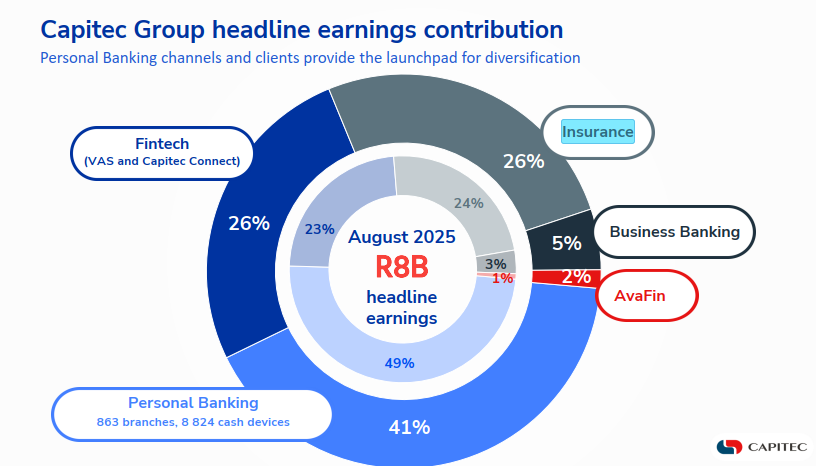

These relatively new divisions now accounted for 52% of the group's earnings in the most recent half-year, up from 47% in the previous half.

These results show that in a short space of time, Capitec was able to turn a banking client into an insurance and fintech client.

This is how magic with profit happens, and in part may explain Capitec’s P/E ratio.

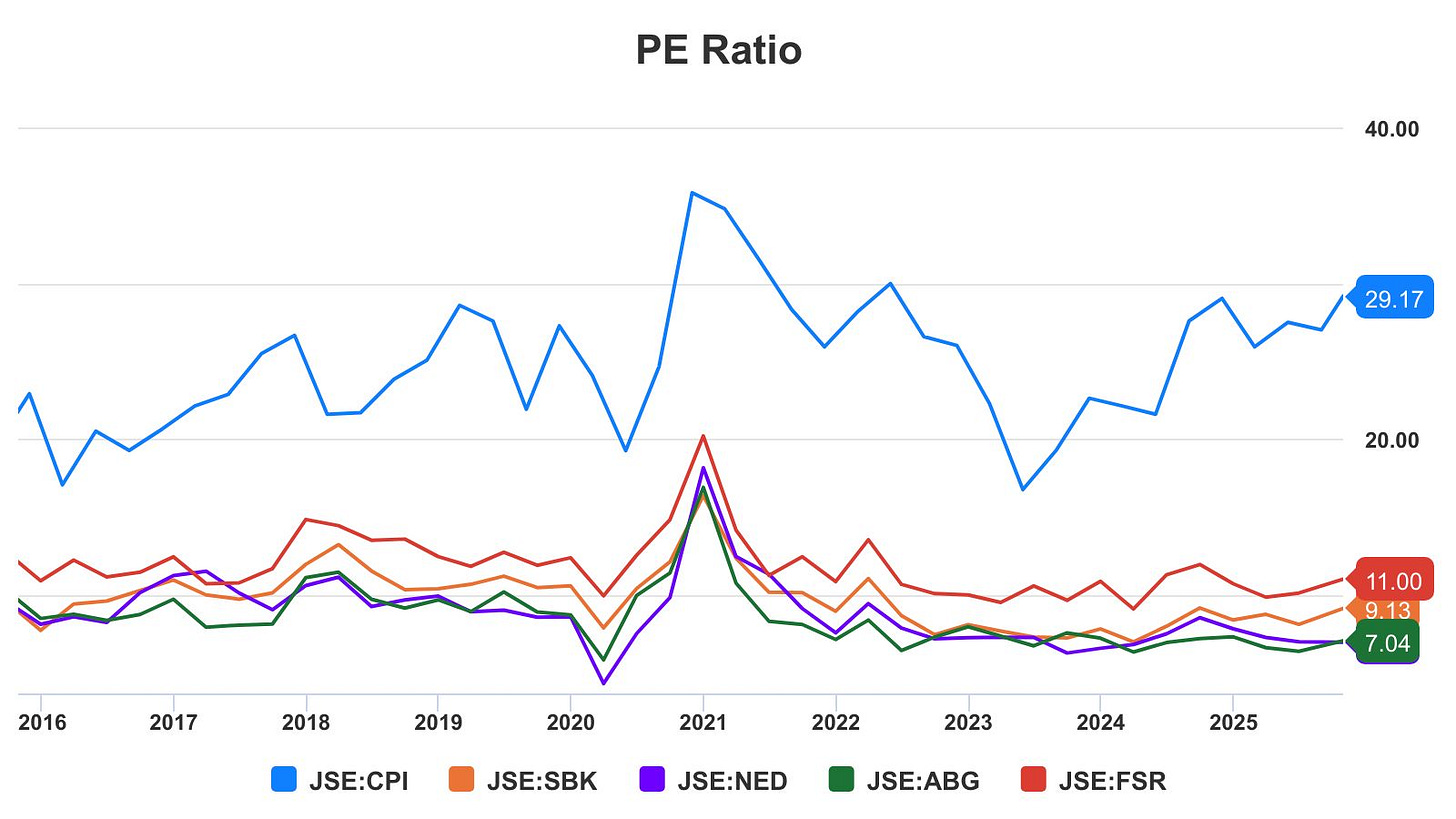

Understanding the P/E Ratio Premium

The P/E ratio indicates market expectations for future growth in earnings.

In some ways, it also marks how good the market believes your business is at “magically” making profits appear.

As can be shown from the below, Capitec's P/E ratio has historically been higher than the other banks largely because Capitec has been able to grow earnings faster than its peers.

All of this has been based on identifying an underserved segment and then riding the wave that comes with it. Capitec has been able to grow consistently above the market for 20 years because of this.

The Competition Question

Now, while Capitec had a really strong set of results showing continued growth, the future will have more challenges as more players join the party.

Could the“underserved” mass market soon be the “overserved”?

TymeBank launched in 2019 and now has 10 million users. OM Bank will go live this year and has spent about R3 billion to build out the new bank. All these and other banks are going for that segment that was once ignored for years.

Perhaps recognising this, Capitec is now diversifying.

The acquisition of Avafin—expanding outside South Africa for the first time—suggests an acknowledgement that growth in the domestic market may be approaching its limits.

This also poses the question for the other banks: if the best dancer starts eyeing the exit, is the party as fun as it was before?

Where’s the Money? What’s the Move?

The broader lesson for any business is clear: finding profitable underserved markets can be a powerful differentiator.

How can you identify these market segments?

Look for segments where four conditions converge:

a large customer segment facing a significant pain point,

limited available solutions,

high prices relative to value delivered,

and complacent incumbents.

When these factors align, you’ve likely found a profitable, underserved opportunity.

I think this applies to lending in most African countries, so there may still be scope for more Capitec-like banks.

However, there are many other areas where this applies. Student accommodation, insurance, and affordable transportation are just a few that come to mind.

What do you think?