Ziyanda vs Fieldbar: A Case Study for Entrepreneurs On Turning Ideas Into Businesses

Why did Fieldbar succeed but Ziyanda disappoint?

In 2018, two companies set out to create fresh African luxury products.

Both had great ideas, but only one succeeded.

Why did Fieldbar succeed but Ziyanda disappoint?

Fieldbar has become a huge success with its cooler box so popular that it has been sold out for weeks and they can't meet demand.

However, in 2018 when both businesses were starting the bigger buzz was around Ziyanda Appliances.

Ziyanda went viral on social media after it posted designs for its proposed list of products.

The unique designs with African inspiration caught the eye of many people in South Africa and even abroad.

Despite the insane price tag there still seemed to be strong interest that the company started taking pre-orders in 2019.

However, since then nothing has been produced or sold.

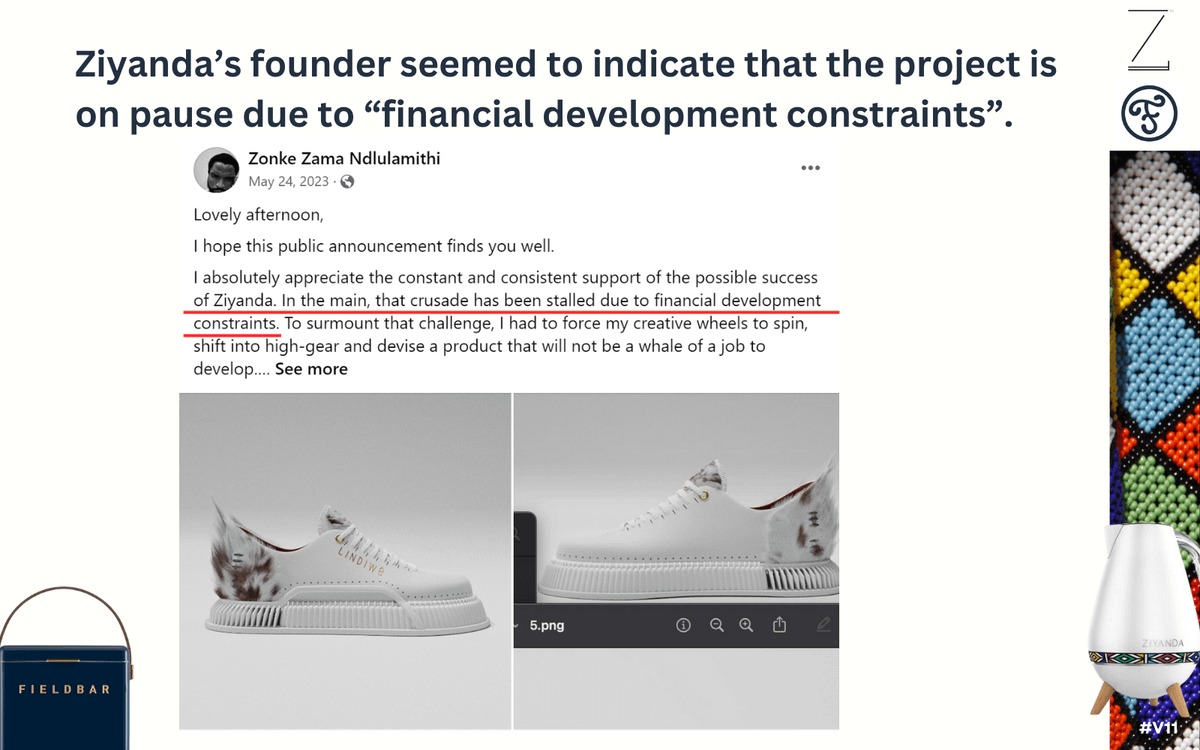

The last update was an indirect one from the founder when he was announcing another venture.

A Facebook post from the founder (shown below) suggests financial constraints were why Ziyanda was on hold.

Was this the reason Ziyanda wasn’t successful?

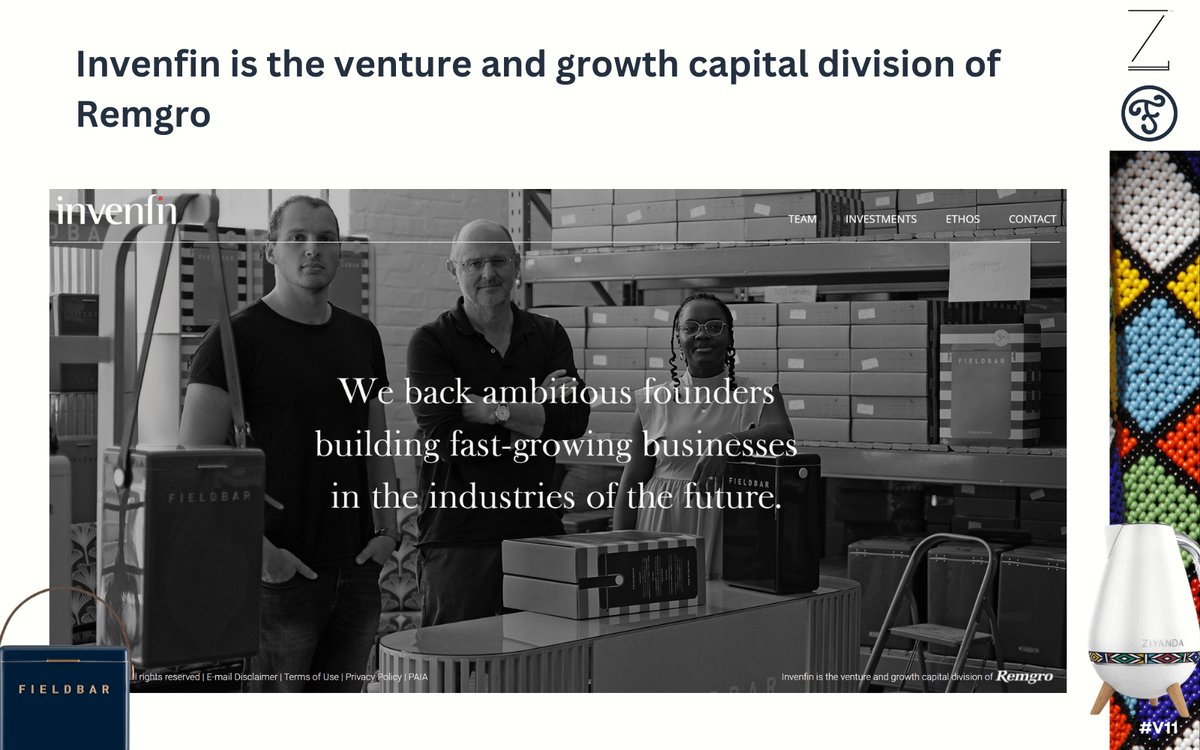

It is hard to say, but what's clear with Fieldbar is the company did well in securing strong backers early on.

Fieldbar’s early investors were Invenfin, the venture capital arm of South African investment group Remgro Limited (R80bn JSE listed company).

According to the South African Venture Capital Association, the average investment that Invenfin makes is around R25 million.

Which sounds about right for what Fieldbar would have needed early on.

Getting such backing is not a given - Fieldbar had to demonstrate a strong value proposition and a working prototype (not sure if Ziyanda ever developed this)

Below are the reasons Invenfin say they invested in Fieldbar.

Even with this backing, it still wasn’t easy. It took about two years to make meaningful progress on how to manufacture the cooler boxes they imagined.

They also had to invest millions in the necessary machinery before they were able to make any sales.

What gave Fieldbar the faith to press ahead was the early excitement on the product survey they had done.

Ziyanda also had the same initial excitement around the product images but perhaps they realised that manufacturing the designs was a lot harder than anticipated.

Many businesses rely on China to manufacture goods and then stick their brand on it (white labelling).

Perhaps this was the initial plan when they started taking pre-orders.

However, since their designs were very unconventional, even with white labelling they would have needed customized manufacturing which would take much more time, effort and money to set up.

Something that they may not have factored in.

Perhaps they created designs but never considered all the other elements needed to make a business.

A common mistake creative people make.

The business model canvas below is a tool that illustrates all the pieces you need to have a business.

It's more than 3D renders.

Another possibility is that maybe they had everything in place but demand was low despite the hype.

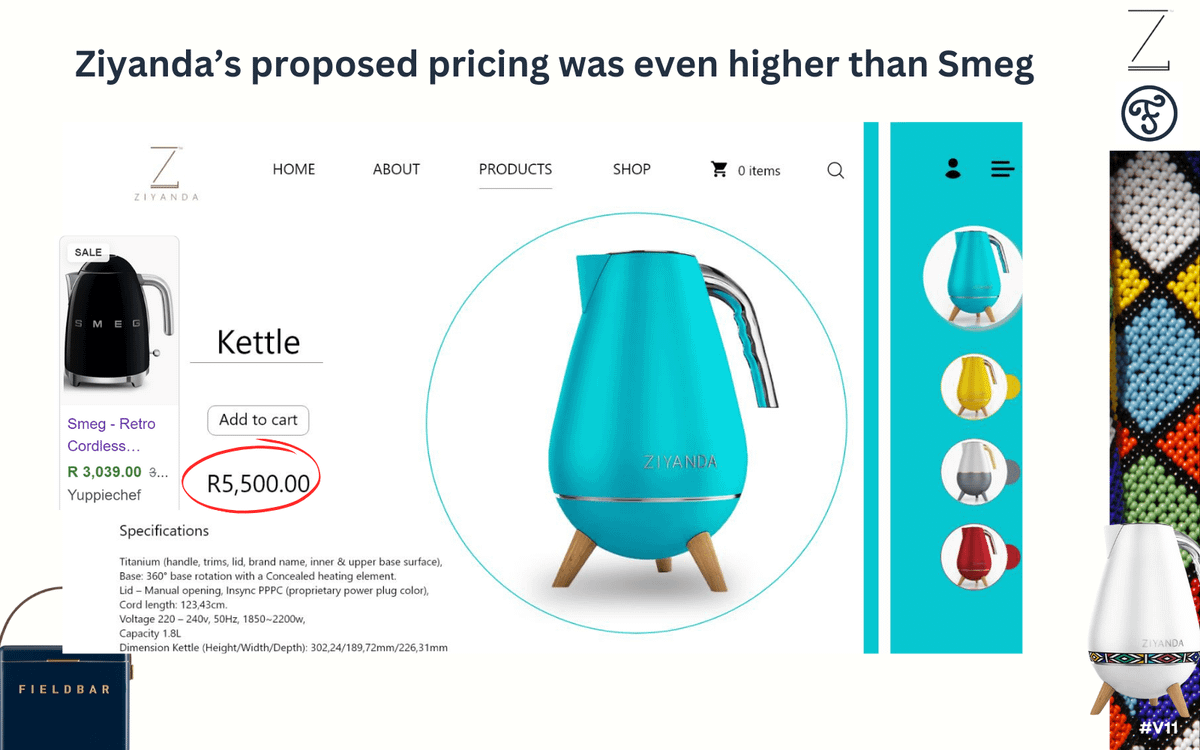

Likes on social media do not necessarily translate to sales especially when you are selling a kettle for R5,500.

That is about double the price of a Smeg kettle.

A common argument for this high pricing was that Africans are willing to pay top prices for Gucci, Louis Vuitton and other international brands why should they not do the same for African brands?

Firstly, I don't think this is an African-specific topic.

Americans prefer Swiss Luxury watches and the Swiss Prefer Italian and French luxury bags.

It is not so about how countries see themselves but the fact that luxury is about building an aspirational brand which often takes time.

It is hard to enter the luxury space others have been building for decades and expect to lure customers from day one e.g. Smeg was founded in 1948.

Gucci built his reputation working leather manufacturer, Franzi for 19 years before starting Gucci in 1921.

Loius Vuitton worked for Monsieur Marechal for 17 years then started his own business when he was 33. Brands, especially luxury brands, take a long time to build and are difficult to displace once established.

This is also why Fieldbar has an advantage. They aren't displacing anyone since there has never really been a luxury cooler box market.

So in some sense, they are creating a market rather than trying to compete in one.

They are like Gucci in 1921.

To be competitive Ziyanda's pricing needed to be lower than Smeg.

I would say around the R1,500 - R2,000 mark.

It would still be premium but attractive to people who don't want to pay R3,000 for Smeg & also attract other customers with the African designs & at a lower price point.

I don't think it's over for Ziyanda.

The concept was good and I can think of a few people who would be willing to invest in it with changes to the strategy like the pricing I mentioned above.

There would also need to be business structures put in place.

But I would love to hear what you think.

I am writing based on public information so perhaps there is more to the story I am missing.

What do you think about Ziyanda? What happened?

Would you still be willing to buy, or did they miss their opportunity and the hype is gone forever?