Econet’s Delisting: Unlocking Value or Locking It Away?

A deep dive into Econet’s proposed delisting, the InfraCo carve-out, and what it really means for minority shareholders

Quick Note: Thank you all so much for voting 🙏🏽. I was truly honoured to receive the Capital Markets Award – People’s Choice Winner for Money & Moves 🏆Grateful for all the support!

Zimbabwe’s second-largest listed company just announced it’s leaving the Zimbabwe Stock Exchange.

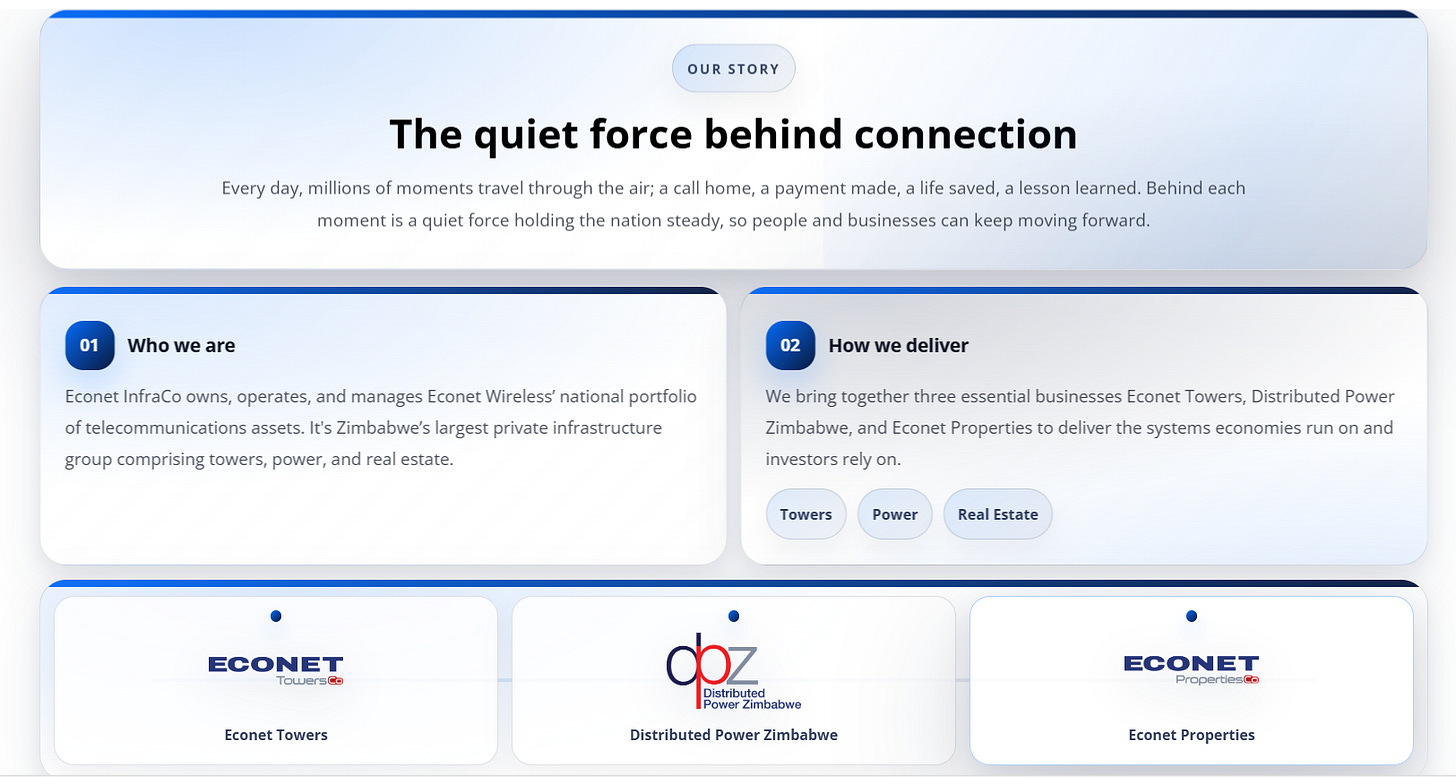

Econet Wireless plans to voluntarily delist from the Zimbabwe Stock Exchange (ZSE) while carving out its infrastructure assets (real estate, towers, and power) into a new entity that will list on the USD-based Victoria Falls Stock Exchange.

The move will wipe 20% off the ZSE’s market cap and force minority shareholders to make a decision: accept an exit offer or hold shares in an unlisted company with limited liquidity.

Below, we unpack whether this strategy makes sense and who wins and loses.

Econet is “Grossly Undervalued”

The events leading up to the delisting began with a bold statement from the Econet Board: the company is “grossly undervalued”. In their announcement, Econet references their low EV/EBITDA ratio compared to African peers.

The board’s position makes sense, as there is a lot of data you can use to conclude that Econet is undervalued.

Another data point you could use is the P/E Ratio.

Despite the blockbuster half-year results, Econet trades at a PE ratio of around 4, compared to MTN at 12, Vodacom at 14, and Kenya’s Safaricom at 14.

Relative to its African peers, Econet does look undervalued.

Why Is the Stock Undervalued?

Stocks typically trade at a discount for several reasons.

One reason is complexity—when investors struggle to understand a business, they apply a discount.

While most people understand Econet’s business model, its ZiG financial statements can be incredibly hard to understand.

It’s still somewhat puzzling why Econet hasn’t switched to USD reporting or at least revealed what percentage of its revenue is in USD, especially since this has become standard practice.

Of the seven largest listed companies, Econet is the only one that didn't report in USD or provide additional context on its performance in USD terms.

In their 2025 financial statements, the directors offered some explanation for reporting in ZiG, pointing to various factors such as economic conditions and regulatory requirements.

However, all the reasons, even if valid, led to an adverse audit opinion on ZiG financials, making it much harder to interpret the company’s performance.

Despite the above, this is probably not the driver of undervaluation.

How Markets Price Stocks

The hard reality of stock markets is that share prices rise not because a stock is undervalued, but because enough people are willing to buy it at increasingly higher prices.

While strong performance matters, buyers and sellers determine the stock price.

Unfortunately, the ZSE lacks this critical mass of buyers and liquidity.

For example, the total value of Econet shares traded in November was ZiG 31 million, roughly equivalent to about US$1 million.

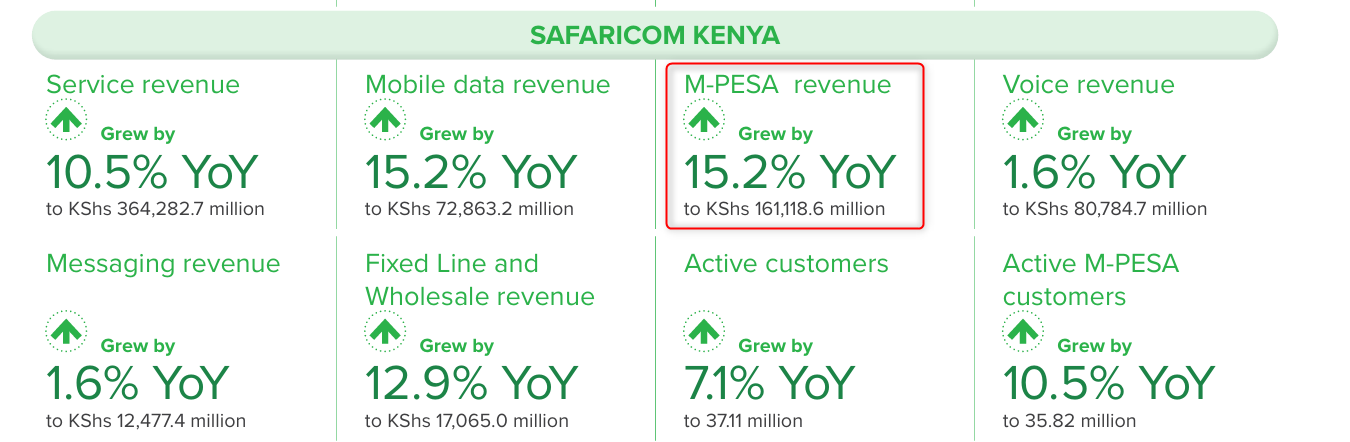

Safaricom’s current daily average is US$1.8 million. In other words, there’s almost twice the activity in Safaricom’s shares in a single day as Econet had over an entire month.

Since the initial corporate action announcement, there has been a spike in trading volumes, but it also highlights the conditions leading up to the decision.

Without sufficient buyers and liquidity, even fundamentally strong companies can trade at steep discounts.

The Zimbabwe Discount

The other major factor impacting valuations is the Zimbabwe discount itself.

Zimbabwe carries a significantly higher country risk premium than most regional peers, with estimates often in the 7–9% range, meaning investors demand a materially higher return to compensate for their view of sovereign and structural risk.

By comparison, South Africa’s country risk premium is typically estimated at around 4%.

These are systemic, market-wide constraints that affect valuations across all ZSE-listed companies, not just Econet.

Put it all together, and you can see why a company could end up being undervalued.

Does Unbundling Make Sense?

To unlock shareholder value, Econet plans to separate its infrastructure assets—real estate, towers, and power infrastructure—into a separate entity.

This strategy generally makes sense.

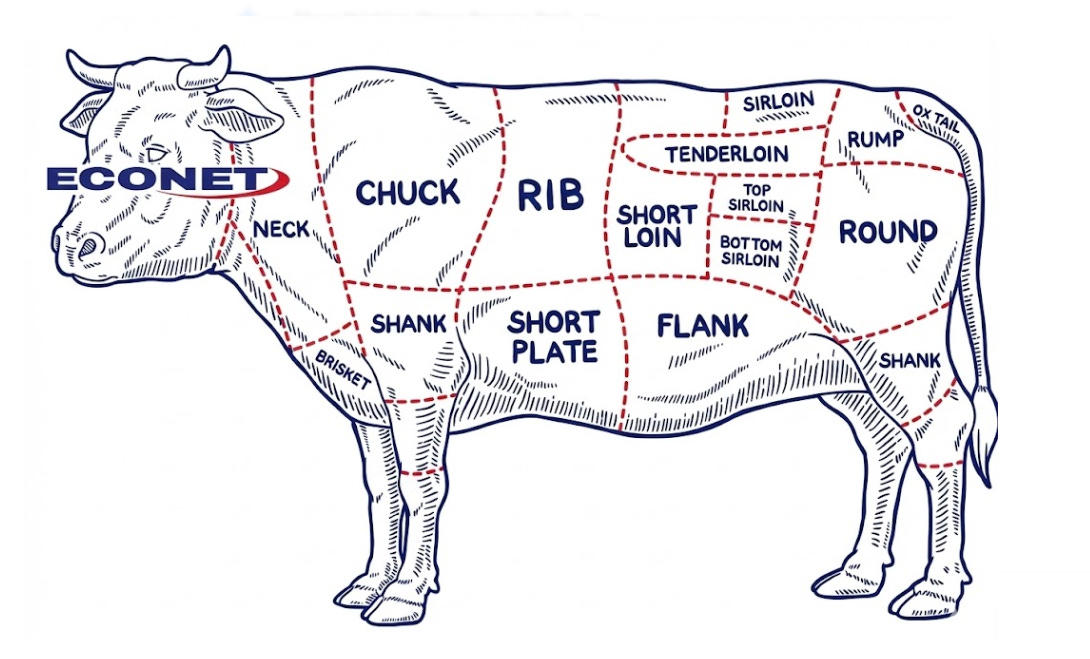

Think of it like a butchery: selling an entire cow might fetch $500, but when the cow is divided into different cuts, the total value of all the meat sold typically exceeds $500.

This happens because a lot of people don’t want a whole cow—they want specific cuts like sirloin, rump, or ox tail.

When you “slice up” companies, you often attract more buyers looking for something specific, which should drive share prices higher.

In principle, this move makes sense and is what Econet is trying to do.

However, there’s an additional step in Econet’s proposal that’s harder to understand.

Does Delisting Unlock Value for (All) Shareholders?

The current plan calls for Econet to delist completely from the ZSE while listing only the Infrastructure Business separately on the VFEX.

This is unusual.

While there are many examples of listed companies carving out their tower or infrastructure businesses, I can’t think of an instance where the parent company was then delisted.

It also seems like it could decrease the impact of the carve-out.

As mentioned earlier, when businesses are well understood, they typically command higher valuations.

Consider this: the largest customer of the infrastructure business will be Econet’s existing operations, made up of the Mobile Network and Ecocash—let’s call this Econet Services.

To gauge the risks in the InfraCo business, wouldn’t investors need insight into how well Econet Services is performing?

Private companies don’t have to share as much information and aren’t subject to the same scrutiny or oversight as public companies.

This can make the infrastructure business more difficult to understand, which in turn could lead to a lower valuation.

It’s like buying an investment property that already has a 20-year lease with a tenant. If you were unable to get any information about the financial situation of the tenant, wouldn’t that make the property less attractive to buy?

Minorities Have to Walk Away

The delisting could also lock away value for minority shareholders.

As a minority shareholder, you’ll face two options.

The first is holding onto your shares in the newly delisted Econet Services business.

The challenge here is that once private, it becomes extremely difficult to trade your shares and even harder to determine their fair value.

It’s already challenging being a minority investor in a public company—imagine how much harder it becomes in a private company where the major shareholder will likely be even more dominant.

The second option is accepting the exit offer, which will be a mix of cash and shares in the new Econet InfraCo. This presents several challenges.

There’s a broad consensus that Econet is undervalued, especially given its recent results. So why would you want to exit when everyone agrees the price is low?

To be fair, the exit offer terms haven’t been fully disclosed as yet—my guess is there will be a premium paid.

So perhaps it will adequately compensate for the sale. This will be interesting to watch.

The final issue for minorities is the change in investment exposure.

Previously, owning Econet shares gave you exposure to both infrastructure assets and the core business—Econet’s mobile network and EcoCash.

These are the high-growth business areas of Econet. For example, M-Pesa is over 15 years old but is still growing revenue by 15% per year.

In addition, in the latest results, EcoCash was the fastest-growing revenue line with over 102% growth based on the inflation-adjusted accounts.

Now you’ll only be able to own Econet’s infrastructure business, which likely will be more like owning a REIT than a fast-growing business.

If Econet Services remained listed, you would be in a much better position to choose what business you wanted to bet on.

The Big Loser: The Ecosystem

The delisting has significant implications for the broader ecosystem.

Econet is the second-largest listed company in the country and had one of the most famous IPOs in corporate history.

The complete delisting from the ZSE would result in a 20% drop in market capitalisation and remove one of the few high-quality stocks that the average investor could invest in.

It would also send a negative signal about the exchange itself. If the biggest companies are calling it quits, what about the others?

Where’s the Money, What’s the Move?

This situation does pose some questions about whether the Zimbabwe Stock Exchange needs to make some changes. One idea would be to allow people to buy ZSE-listed stocks in USD.

This may not make much of a difference, but it could potentially improve some liquidity, as some estimates suggest that 80% of the economy is transacting in USD.

For most minority investors, the current phase is about information gathering and preparation for what happens next. For example, how will the exit offer be valued?

For Econet, I still believe a complete delisting from the ZSE is worth reconsidering, as it’s not clear how all shareholders would benefit.

At the moment, Econet Global, the major shareholder, appears to be in the strongest position under the current structure, unless a compelling exit offer is made to the minorities.

As for Econet Infraco, that business is already moving full speed ahead with a management team already in place and a website with all the information about the company.

Naturally I am working with public infomation and so there could be other driving factors at play that I may have missed.

What do you think?

I have many more thoughts to add, but for now, I’ll end here and leave it for follow-up posts, which will likely be necessary as this story develops.

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so.

PS: I am working with public information so I could be missing something or simply wrong in my analysis.

It's a balanced take, as there are a lot of moving pieces. Thank you for this, Tinashe! However, one can't help but have that gut feeling that staying (even increasing exposure) in Econet post-delisting might be that once-in-a-lifetime moment to ride the wave

I will dive deep into this analysis of the capital markets , just realized that I've been missing on something.