Econet's Struggles: A Decade Long Financial Rollercoaster

Ten years ago, Econet had its best-ever year, with revenues of $753 million and an award for the “Best Telecom Services and Solutions in Africa.”

Since then, revenue and profits have dropped, and recently, Econet had a significant network outage that hurt its reputation.

What’s gone wrong?

Here is the untold story of Econet's struggles.

In Part 1, I discussed how the Telco model revolves around four sequential and simultaneous cycles: Borrow, Build, Sell, and Service.

If you missed this, I recommend reading it as well, as I explain each phase in great detail.

The short version of what we discussed is that in Telecoms, first, you Borrow to Build the network, then after that, you Sell services on your network, and with profits, you Service (pay back) the loans, which allows you to Borrow more money and repeat the cycle.

If all these steps are working well, you make a lot of money, just like Econet did between 2010 and 2014, when they clocked over $1 billion in EBITDA (a type of profit). But then, after 2014, we started to see some cracks in the business model.

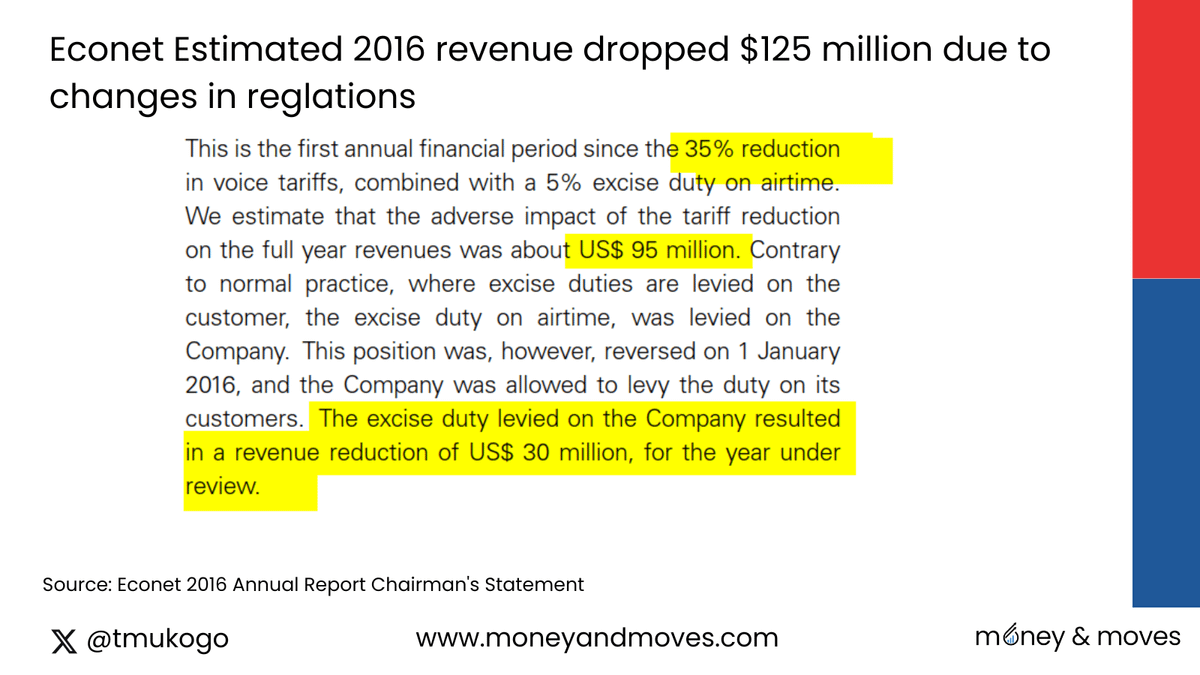

Firstly, at the end of 2014, telcos were directed to cut voice tariffs by 35% and pay a 5% excise duty on airtime sales. In its 2016 results, Econet estimated that this resulted in a revenue decrease of $125m ($95m for voice tariffs and $30 for excise duty).

Ouch!

This was the equivalent of getting into work and being told you are getting a 20% pay cut. Econet was naturally aggrieved and took the regulator, Potraz, to court on the voice tariffs but lost, so the reduction stood.

What made Econet's judgement more bitter for them was that in 2013, they had to pay a $137.5m license fee in one payment, which their competitors did not pay (and I think they still have not paid in full).

Paying $137.5m at once is a serious lift and would have meant less money available for capital expenditure (Capex) or servicing loans. Econet’s challenges are a good lesson on factors to consider when selecting a business to invest in: the level of regulatory risk.

If you are selling fried chicken, the risk is much less that a regulator will tell you how much to charge compared to if you are providing an essential service like telecoms.

This is also not just a Zimbabwe thing. Telcos and regulators are like couples in a marriage of convenience: always fighting but still needing each other.

For example, Airtel in Chad was Charged $8.3 million by the regulator because of deteriorating network services.

In Cameroon, all four telcos were fined a total of $9.8 million for a similar reason. Most famously, MTN was fined $5.2 billion in Nigeria, which later dropped to $1.6 billion for not disconnecting lines on time with improper registration.

To be fair, I can see how the regulator in Zimbabwe could have thought a reduction was needed. In South Africa, the most expensive Telco charged 8c/min; in Zimbabwe, it was 25c/min.

I don’t expect Zimbabwe to be cheaper than South Africa due to higher costs of capital, a more challenging environment and less scale. However, if Zimbabwe was three times more expensive, there was probably some room for a decrease.

The question is was a 35% decrease too harsh?

Who knows?

Back to Econet. With sales decreasing from a peak of $753m in 2014 to $621m in 2017 and profits falling just as much, Econet was in a weakened position. Econet had borrowed a lot in USD, but by 2017, foreign currency was in short supply so servicing the loans became challenging.

Econet had to resort to a rights issue (where shareholders are asked to contribute more money) to pay back the loans and raise additional debt through a debenture program, as acknowledged in their 2017 circular.

Putting all this together from 2017 onwards: sales were decreasing, the ability to service loans was decreasing, the ability to borrow was decreasing, and capex was decreasing. The cycle was no longer working.

Borrow ❌, Build❌, Sell ❌, Service❌

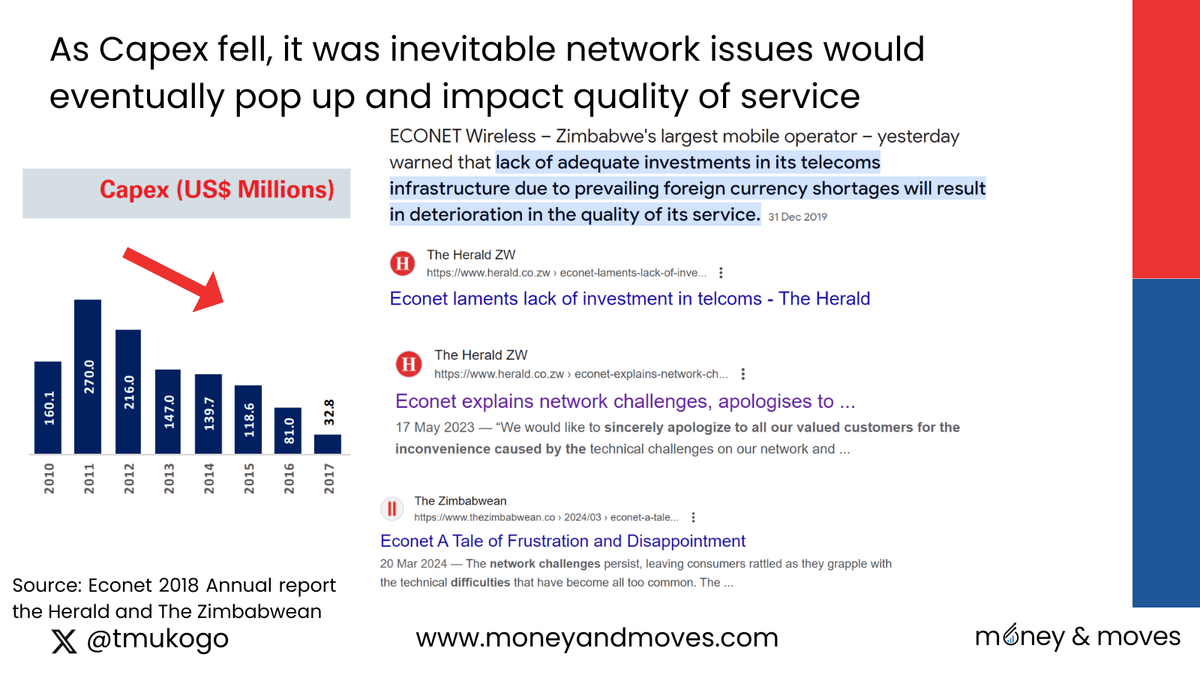

As Capex declined, there wasn't enough investment in the network, and so naturally, quality started to drop.

It's like a car that needs service every 6 months, but because you are low on cash, you service it every 18 months. The car is going to start having issues.

If it was already challenging in 2017, consider how much harder it has been over the last six or seven years. Econet has been like that poor guy with a ZWL income trying to impress a girl with USD expenses. As the saying goes, “It will end in tears.”

This is also a lesson in business. You can be the Steve Jobs of Africa, but often, the economics of your business are have more of an impact than the you management ability.

To use a quote from Warren Buffet.👇

This is not to say that Econet did not make some missteps.

One could argue they overpaid by buying TN Bank (Steward Bank) at a valuation of $40m. Also, the communication around "disappearing data" could have come sooner and perhaps have been more innovative.

For example, Econet could invite customers to participate in an experiment where they get free data and then track their usage. For every 1MB of data that "disappears," Econet would give them $100. Something like this, I think, could be more customer-centric and convincing.

I think it will be very difficult for management to explain what is happening with the “Disappearing Data” and for people to believe them.

I also think some of EcoCash's issues impacted Econet’s brand as they are often seen as one company (which they were before and are soon to be again).

A case in point is EcoCash's attempt to become a dominant Tech Start-up Operator rather than a Tech Facilitator or Investor.

This meant Ecocash had less focus on the core business and tried all these start-up ideas that didn't scale. This also antagonised start-ups and hurt the overall Econet/EcoCash brand as start-ups accused EcoCash of stealing ideas and being a bully.

Had EcoCash gone the tech investor/facilitator route, it would have increased its chances of success (there is a reason top companies do Corporate Venturing). Also, even if all investments had failed, it would have gained goodwill for supporting start-ups.

Econet is a business I have liked from an investment perspective because of its impressive performance in the USD era and the strong team it has. However, in the last few years, with the challenges highlighted above, I've become a bit hesitant, even though its stock may be undervalued.

They can work on solving some things, like how they are perceived, but other things are environmental, so there is not much they can do outside of lobbying for better tariffs (which ironically would hurt their brand).

So what does it mean for you? Econet and other telcos have no choice but to try to increase prices to maintain reasonable USD equivalent revenues. I also expect network issues to be more frequent until things stabilise and more capital is available to invest in the network.

If the new currency, the ZiG, stabilises things, I expect Econet to benefit. If it doesn't, Econet may struggle.

Let's see what happens, but if there is one Company that can perform miracles, it's probably Econet. I would never discount their ability to turn things around, even in challenging circumstances.

I am working with publicly available information, so my analysis could be missing something or just wrong.

Please leave a comment and let me know what you think! Opposing views are welcome!

Loved the article and the follow-through on Part 1! I agree with most of what you laid out. EWZ's woes are largely a result of macroeconomic realities. Based on losses in court (actual and political opinion) there isn't much that they can do about half of what they are dealing with.

It's also reasonable to assume that the founder's deep entrenchment in the UK and the past efforts around the Liquid IPO (a bit of a "murky" corporate relationship/incest there. Probably a story for another series ;-) ) suggest that they are always aggressively looking for funds in the right places to help service the loans and improve infrastructure. Their team that does that is probably one of the best in ZWE/for a ZWE entity.

However, the one bit of self-introspection expected from EWZ lies in one part of the 4-part model you explained - Selling.

IM-probably-misguided-O product/market fit doesn't seem to be their strong suit. A look at the lineup of failed services disguised as startups is some reflection. There is an impression that the power of distribution will carry anything on the network. If it doesn't scale, the stronger units will cover the losses. It's not a bad approach in good times. Look critically at what all ZWE telcos sold to Zimbabweans in the 90s to early 2000s. But when you need a good list of winners that generate hard returns, in an environment with reduced disposable incomes + inflation etc. you HAVE to make stuff that is relevant and priced accordingly.

This is just one example, I'm sure others will share better-informed opinions on what the additional issues are and what can be done to improve the outcome.

On this one I was laughing my lungs out all the way till I finished reading, I felt the ouch, then I read selling fried chicken is not hard regulatory risk... As a former fried chicken vendor... I strongly disagree hahaha . We had the guys from health behind our backs all the time hahaha... Lord, I'm loving these reads. Zimbabwe business is not for the weak... Frankly I feel I missed a lot since you began, anyway I in the slack