Everything You Need to Know About Econet's Delisting (And Why Some Numbers Don't Add Up)

An objective analysis of the exit offer, the delisting option, and what the valuation really says

This is a comprehensive deep dive covering:

The exit offer: why InfraCo's $1 billion valuation appears inflated and may overstate the real exit value

Remain in the delisted company: How this will work, and the benefits and pitfalls including the OTC mechanics, the year-one buyback

How delisting creates a $1.5 billion valuation (up from $900m today)

What major shareholders gain vs. the tradeoffs minorities face

The “fair and reasonable” test: which path makes more sense for minority shareholders

Reading time: ~15 minutes

One of the fundamental ideas behind companies is that they exist to make the owners, also known as shareholders, money.

In private companies, the way this happens is that you put a management team in place, they sell things, make a profit and then pay a dividend to shareholders.

If the management team is not able to make profits, the board, which represents the shareholders, fires the management team and looks for a team that can.

In listed public companies, that is similar but also a bit different. While dividends are important, the primary way shareholders make money is through the share price of the company increasing.

Now, usually, if you make good profits, the share price does go up. However, sometimes it doesn’t, and sometimes this can happen for a long time.

Now, as the board, what do you do in this case? You can’t fire the management team because they made profits, they did a good job, so what’s your next move?

Well, one option is you can “fire the Stock Exchange” and delist the company, essentially saying this stock exchange isn’t working for us, let’s operate outside of it.

But another difference between a private company and a listed public company is that in a public company, there are many owners, and each owner may see things differently, and each owner is allowed to give their opinion.

One small shareholder may say, “You know what, as long as the profit is going in the right direction, I am happy to wait until later for the share price to go up. Also, I like being able to buy and sell my shares at any time. Let’s stay listed.”

Another major shareholder may say, “I have other plans and projects I need to do, and this low share price isn’t working for me. I would be better off having this company delisted, where I can make my own plans and execute strategies to increase the value myself.”

Now, as the Board, you need to find a way to be fair and reasonable to all shareholders, who are your bosses.

So what do you do? You set up a “family meeting” for shareholders and send out a plan, a “circular”, of what you are going to do.

This brings us to the circular that Econet published last week about their delisting.

The Exit Offer: Two Paths Forward

One of the important parts of managing different shareholder interests is providing options.

Usually, when a decision to delist is made, the major shareholders are already backing this idea. It wouldn’t have gained any traction otherwise.

The challenge is accommodating minority shareholders who may not like the idea of delisting.

Econet’s proposal offers two main paths for minorities:

Path 1: Take the Exit Offer - Get paid US$0.50 per share and walk away

Path 2: Stay in the delisted company - Remain a shareholder in the delisted company with certain protections

Let’s examine each path.

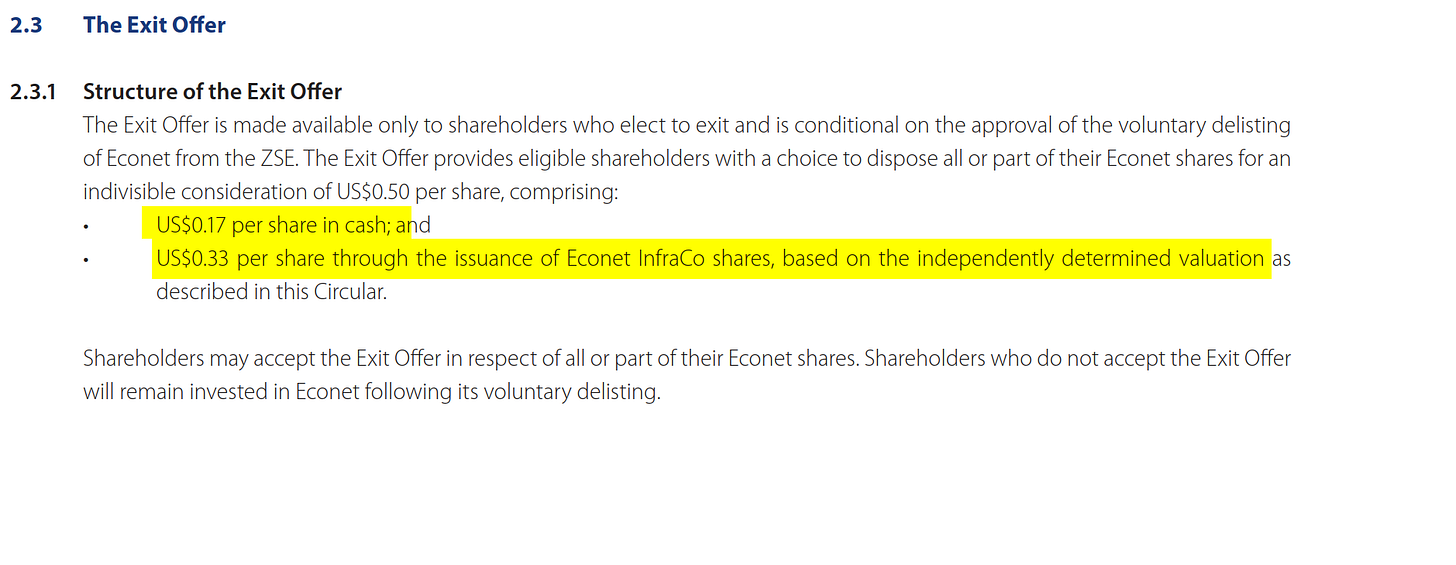

Path 1: The Exit Offer Structure

For shareholders who want out, Econet is offering US$0.50 per share. Currently, the share has been trading at about US$0.30 and in the recent past ranged at around US$0.17.

On paper, this looks attractive. A 67% premium to today’s prices and a 194% premium to prices before the board made their announcements. Not bad at all!

However, there is a catch. The offer isn’t all cash.

The Exit Offer Structure:

US$0.17 in cash (34%)

US$0.33 in Econet InfraCo shares (66%)

This complicates things a bit.

Most exit offers are all-cash deals. Here, two-thirds of your payment is in shares of a new company called Econet InfraCo that will be spun off from the existing Econet business.

The circular values this new company at US$1 billion.

This means the exit offer only makes sense if Econet InfraCo is really worth US$1 billion.

If InfraCo is actually worth significantly less, then your US$0.50 offer is worth significantly less. So let’s examine that valuation closely.

The InfraCo Valuation: How to Create a Billion-Dollar Company

There are two ways to create a billion-dollar company.

The first way is to start a business, solve customers’ problems, work for years to generate profits, and then finally you have a billion-dollar business.

The other way is to create it in Microsoft Excel!

The following could be a good example of that.

The two main methods used to value Econet InfraCo were:

A Discounted Cash Flow (DCF) analysis

A Comparable Multiples valuation

Let’s unpack this further.

The DCF Analysis: An Unusually Low WACC

A DCF is one of the most popular ways to value businesses. The concept is simple: you project future cash flows and discount them back to today using a rate that reflects the risks of the business.

One of the critical inputs in a DCF is the Weighted Average Cost of Capital (WACC). This represents the minimum return that investors and lenders expect given the company’s risk profile.

The lower the WACC you use, the higher the valuation you get.

In arriving at the US$1 billion value for Econet InfraCo, the independent financial adviser states in their report (Annexure B2, page 34):

“DCF Analysis: We stress-tested the 5-year projections, applying a Weighted Average Cost of Capital (’WACC’) of 11.79%”

I am sure this is not what happened, but I can’t help imagining an analyst running an Excel model for the valuation, continuing to adjust the WACC downwards until it gets to 11.79% and the cell labelled “valuation” says $1 billion.

A billion-dollar business created!

The main point here is that the WACC at 11.79% is incredibly low, which helps make the value incredibly high.

For context:

Delta Corporation’s WACC: 26.40% when evaluating its businesses (source annual report)

Zimbabwe country risk premium: 11.66% (which is 7.76% above South Africa's 3.90%)

Could Econet InfraCo’s risk profile really be half that of Delta Corporation? Could it actually have a lower risk profile than MTN?

If we simply added Zimbabwe’s country risk premium to MTN’s WACC, we’d get roughly 22%.

What if the correct WACC is actually 20-25% instead of 11.79%?

At those rates, the DCF valuation would be dramatically lower. Half the US$1 billion figure or less.

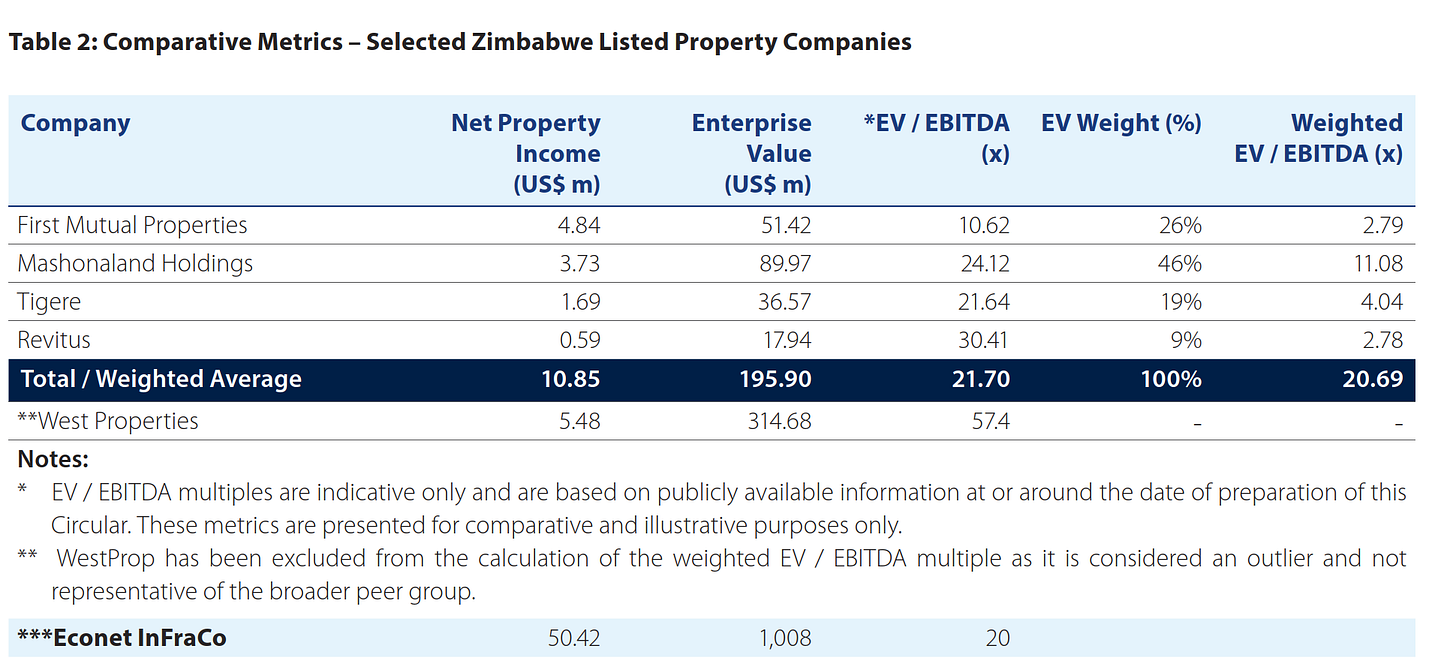

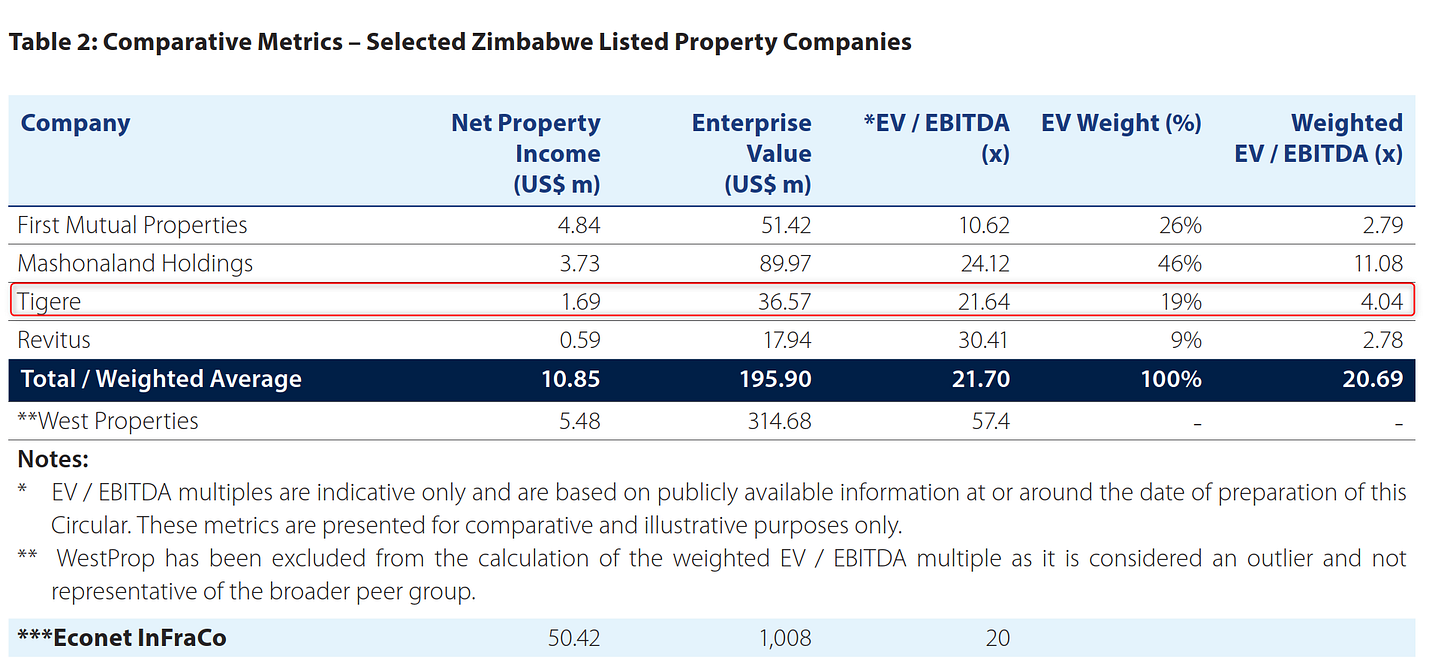

The Comparable Multiples: The Wrong Peer Group?

The other valuation approach used for Econet InfraCo is called a Comparable Company valuation. With this technique, you find companies that are “comparable,” calculate their valuation multiples, and apply those to your business.

The circular uses an EV/EBITDA multiple approach, comparing InfraCo to Zimbabwe-listed property companies (page 16, Table 2):

First Mutual Properties: 10.62x

Mashonaland Holdings: 24.12x

Tigere: 21.64x

Revitus: 30.41x

Weighted Average: 20x

Applying this 20x multiple to Econet InfraCo’s forecast FY2026 EBITDA of US$50.42 million yields the US$1.0 billion valuation.

But here’s the question: Is Econet InfraCo really a property company?

The circular itself describes InfraCo’s business model (Part D, pages 65-66), emphasising that the Tower Operations (TowerCo) division will be the “primary contributor” to operating leverage and incremental returns on invested capital.

By its own admission, Econet InfraCo is fundamentally a tower company, with the power business mainly existing to support the tower operations, and the property business being a smaller component.

So why use property company multiples?

I am sure this did not happen, but it’s interesting to imagine an analyst with an Excel model methodically including and excluding comparable companies from their peer set until the average landed right at 20x EV/EBITDA, and the cell that said “valuation” said $1 billion.

Another billion-dollar business created!

What Do Tower Companies Actually Trade At?

The circular mentions several global tower companies as peers: IHS Towers, Helios Towers, and American Tower Corporation. So what multiples do these companies actually trade at?

IHS Towers: around 7-8x EV/EBITDA

Helios Towers: around 9-10x EV/EBITDA

American Tower Corporation: around 19-20x EV/EBITDA

The African companies (IHS and Helios) average around 9x EV/EBITDA. American Tower’s higher multiple reflects its US market operations, which isn’t particularly relevant for Zimbabwe-focused infrastructure.

So what happens if we use the 9x EV/EBITDA that actual African tower companies trade at?

Enterprise Value = 9x × US$50.42m ≈ US$454 million

This means your Econet InfraCo shares would be worth about US$0.15 per share (not US$0.33).

Add that to your US$0.17 cash, and your total exit offer would be worth US$0.32. Not too far from what the stock is trading at today.

A Reality Check: The Dividend Yield Test

Let’s try another angle. If InfraCo is really comparable to Tigere (the closest local comparable at 21.64x), shouldn’t it deliver similar returns to investors?

Here’s what Tigere currently does:

Market cap: US$101 million

Planned FY2026 dividend: around US$4 million

Dividend yield: 3.96%

For InfraCo to match this yield at a US$1 billion valuation, it would need to pay dividends of US$40 million annually.

There’s a problem. InfraCo’s forecast for FY2026 profit is only US$26.82 million. Even if InfraCo paid out 100% of profits as dividends (which is unrealistic for a growing infrastructure company), it would only deliver a 2.68% yield. Well below Tigere’s 3.96%.

Let’s be more realistic. What if InfraCo followed an aggressive 60% payout policy?

Dividends paid: US$26.82m × 60% = US$16.1 million

Dividend yield at US$1bn valuation: 1.61%

Even if InfraCo doubled its profits next year and maintained a 60% payout:

Dividends paid: US$53.6m × 60% = US$32.2 million

Dividend yield: 3.22%

We’re still below Tigere’s current 3.96% yield. And remember, Tigere itself already trades at a premium.

Context: Econet InfraCo Beating Tech Giants?

Here’s a final reference point. A US$1 billion market cap would make Econet InfraCo the largest company on the VFEX.

In Zimbabwe, it would only be behind Delta Corporation, which generates 8x more revenue and 6x more profit than InfraCo is forecasting.

Let’s also look at the implied P/E ratio. The P/E ratio indicates market expectations for future profit growth. The higher the P/E, the bigger the growth expectations.

Based on the circular’s valuation, Econet InfraCo’s implied P/E ratio would be 37.3x (US$1bn ÷ US$26.82m profit).

Now let’s compare to some technology companies known for high growth expectations:

Google: 22x

Meta: 25x

Microsoft: 33x

So Econet InfraCo, with a P/E ratio of 37x, would trade at a higher multiple than leading global technology firms.

And what’s InfraCo’s business model? Leasing towers and providing power to NetOne, Telecel, and Econet in Zimbabwe.

Why Does This Matter?

Here’s the critical issue: The exit offer is structured to give minorities a generous premium to walk away. But because 66% of that payment is in InfraCo shares that may be valued at roughly double what they might trade at, the real value of the exit offer is likely closer to US$0.30 than to US$0.50.

If Econet InfraCo lists on the VFEX and the valuation drops sharply, it may give the impression that minorities who accepted the exit offer were misled, even if that wasn’t the intention.

Path 2: Stay in the delisted Company

Whilst the exit offer has significant issues with InfraCo’s valuation, at least there is an alternative which has genuine benefits.

If you decide not to take the exit offer, the other option is to remain a shareholder in the delisted company, which will still remain a public company (still called Econet, but now consisting of the mobile network and EcoCash businesses after InfraCo is spun off).

One of the inherent challenges of being in a delisted company is that it’s really hard to sell your shares, and when you do find a buyer, it’s really hard to know what they’re worth.

The Board has proposed some mechanisms to try to address this problem.

The OTC Trading Platform

Post-delisting, shares will be traded via OTC (over-the-counter) markets, facilitated by the VFEX.

The way I like to think about the OTC market is that it will be like those really big buy-and-sell WhatsApp Groups, with the Board serving as the Group Admin.

Like any well-run WhatsApp group, this OTC platform comes with lots of rules, which I have simplified below:

The board sets the rules and can change them at any time

The board appoints the brokers who handle all trades

The board sets a floor price (US$0.50) and can reject any trade below it

The board must approve all new buyers and can say no for any reason

Rejections are final, no appeals, “no legitimate expectation” of approval

Silence means no. If you don’t hear back in 7 days, you’re rejected

The reality: It will be harder to trade your shares.

Before, you could be pretty certain that if you wanted to sell your shares, you would have the money in your bank account within a week. Now? Who knows.

The Share Buyback Commitment

To help ease some of the liquidity concerns, the board has made an important commitment: Econet will repurchase 10% of outstanding shares after one year for US$0.50 per share, which has also been set as the floor price for Econet shares to trade on the OTC platform.

This is meaningful. It means if you vote for the delisting but don’t take the exit offer, you should be able to sell your shares (or at least some portion of them) back to Econet in a year or so for US$0.50 per share.

That represents a decent gain considering today’s share price of around US$0.30.

The Hidden Benefit: Creating a $1.5 Billion Valuation

There’s something else happening here that’s worth understanding.

By committing to buy back shares at $0.50 and setting that as the OTC floor price, Econet is essentially establishing a minimum valuation of $1.5 billion for itself as a company.

This seems like a pretty smart way to unlock paper value with a bit of financial gymnastics.

Here’s the maths:

Shares outstanding: ~3 billion

Floor price: $0.50

Implied market cap: $1.5 billion

Now, you might say, “Wait, just because Econet says shares are worth $0.50 doesn’t make them worth $0.50.”

And you’d be right, except unlike with Econet Infraco, this valuation is actually quite defensible based on fundamentals:

Expected FY2026 EBITDA: ~$400 million (estimated from half-year results)

Valuation $1.5 Billion

Implied EV/EBITDA: 3.75x

Comparable EV/EBITDA ratios: MTN 5x, Vodacom 6x

Valuation is an art, but the implied EV/EBITDA of 3.75x is quite reasonable or at least reasonable enough to persuade people that the company’s valuation is $1.5 billion, especially if some people start buying and selling the stock on the OTC at that valuation.

Econet currently trades at around a $900 million market cap on the ZSE. By delisting and establishing the $0.50 floor, the company’s implied valuation jumps from $900 million to $1.5 billion.

This solves the original problem that triggered the delisting idea, which we talked about at the beginning: “My profits went up, but my share price didn’t.”

Now the company can reasonably claim a $1.5 billion valuation.

Why could this matter for shareholders?

If Econet shares represent a significant portion of your personal or institutional balance sheet, this valuation uplift is extremely valuable:

Strategic flexibility: Higher stated valuations make it easier to raise capital for other ventures or use shares as currency in deals.

Net worth statements: This uplift can also represent a material increase in reported net worth.

Other: I am sure there are a lot of things you can do that I am not smart enough to know of!

I can see how these could be good reasons to push for a delisting.

Creating a higher, more stable valuation that shareholders can use for their own strategic purposes.

The catch for minorities?

The repurchase is good, but it also depends on whether Econet has the cash to fund these commitments. At least based on the most recent half-year results, Econet is on track to have about $150m in free cash flows, which seems quite healthy.

So Is the Delisting a Good Deal?

Let’s see who benefits.

If You Are a Major Shareholder: Definitely Yes

Major shareholders get:

Ability to execute long-term strategies without the additional scrutiny from the public

Elimination of market volatility affecting their net worth

Greater strategic flexibility for corporate actions

A credible $1.5 billion valuation they can use for balance sheet purposes

Increased relative ownership of a fast-growing business (EcoCash revenues grew 102% last year, and as we’ve seen with companies like Safaricom, mobile payments can sustain significant growth for extended periods)

By the way, the fact that this is a good deal for major shareholders isn’t a bad thing.

You should always assume that if a major shareholder initiates or backs any corporate action, it’s good for them.

That’s just rational behaviour.

The question one should ask as a minority is whether minorities also get a fair deal.

If You Are a Minority Shareholder: It Depends

Minorities face a more complex decision with tradeoffs depending on which path they choose:

Path 1: Take the Exit Offer

Minorities who take the exit get:

Immediate USD liquidity (US$0.17 cash per share, valuable if you originally bought shares in ZWL)

192% premium to pre-announcement prices (shares traded around US$0.17 before the circular), about 70% premium to current prices (shares currently trading around US$0.30). There are really good returns.

No ongoing illiquidity concerns

InfraCo shares that could be quickly sold after listing

But:

Headline value of US$0.50 likely overstates the real value as InfraCo shares appear overvalued

Path 2: Stay in the Delisted Company

Minorities who stay in the company get:

Potential to sell at US$0.50 in year-one buyback (about 67% gain from current prices). 192% premium to pre-announcement prices if realised at US$0.50. These are also really good returns.

Increased relative ownership of a fast-growing business (EcoCash revenues grew 102% last year, and as we’ve seen with companies like Safaricom, mobile payments can sustain significant growth for extended periods)

Ability to participate in Econet’s long-term value creation without market volatility

But:

Significant illiquidity (harder to sell your shares)

The Fundamental Question: Is This “Fair and Reasonable”?

All things considered, the exit offer’s headline value of $0.50 looks attractive on paper, but two-thirds of that is in InfraCo shares that seem overvalued. This makes it difficult to pass the test based on the current structure. Had the valuation been more defendable I think one could have called it fair.

As things stand, the delisting option looks more like “fair and reasonable” in my view.

The $0.50 buyback commitment (backed by Econet’s strong cash flow generation) provides a clearer path to realising that value, even accounting for the illiquidity and allocation uncertainties.

Ultimately, minorities have a genuine choice here. Take the exit (with InfraCo risk), stay in the company, which will be delisted (with liquidity risk), or split between both options.

Different shareholders will reasonably weigh these tradeoffs differently based on their own circumstances and risk tolerance.

Whether the overall transaction passes the “fair and reasonable” test may depend on where you stand and what your situation is. And that’s a judgment call each shareholder will need to make for themselves.

Where’s the Money? What’s the Move?

Ordinarily, I always end with this section where I propose some ideas of what moves you can make to make money from the situation.

Today, I think it’s wise to wait and see what happens next, as this is a complex transaction with significant implications for all Econet shareholders.

Despite this being a long, deep dive, there are still issues I was not able to touch on. If you have a significant holding in Econet and would like additional insights sooner, please reach out.

Thanks for reading, and forward this to someone who may need to see this! You could help them make an important decision.

PS: I am working with publicly available information in my analysis, and so it’s possible that there are some things that may be missing or interpreted incorrectly. I also could be wrong! This is not financial advice but intended for educational and informational purposes. Do your own research and consult with qualified advisers before making investment decisions.

Debt in Zim already attracts 12%+ interest. Equity should have a higher cost/rate of return. No way an 11.79% WACC makes sense.

Thanks very much Tinashe. I definitely share your view that InfraCo is overvalued. I usually only glance at the fair and reasonable but this time I read every word. “The valuation of US$1.0 billion for Econet InfraCo is supported by the aggressive growth in the Power Services segment…”. Why aren’t some indicative forward looking figures shared beyond 28 Feb 2026? What about capex requirements to support this growth - that could be huge.

What about segment splits in InfraCo….nothing provided and has a significant bearing on valuation. I would’ve expected more information to substantiate the $1bn valuation.

No quantified dividend policy for InfraCo.

I also did not find any guidance on Capital Gains Tax if you stay in Econet (1% of selling moves to 20% of gain, after delisting, for post Feb 2019 shares if I’m not mistaken). This is a material consideration for shareholders/ omission from the circular (I stand to be corrected). Same thing for withholding tax on dividends 10% on listed shares (for individuals etc) moves to 15%.

You’ve presented 2 options. The 3rd option is to vote against the delisting and the transaction as a whole I guess.