First Capital Bank's Financial Results: A Zimbabwean Bank Making Money From Loans, Not Charges?

As EcoCash, Mukuru and Innbucks eye new opportunities, could First Capital's approach be the blueprint?

An argument could be made that in Zimbabwe, banking does not exist in the typical sense.

Instead, what you have are payment processors and custodians.

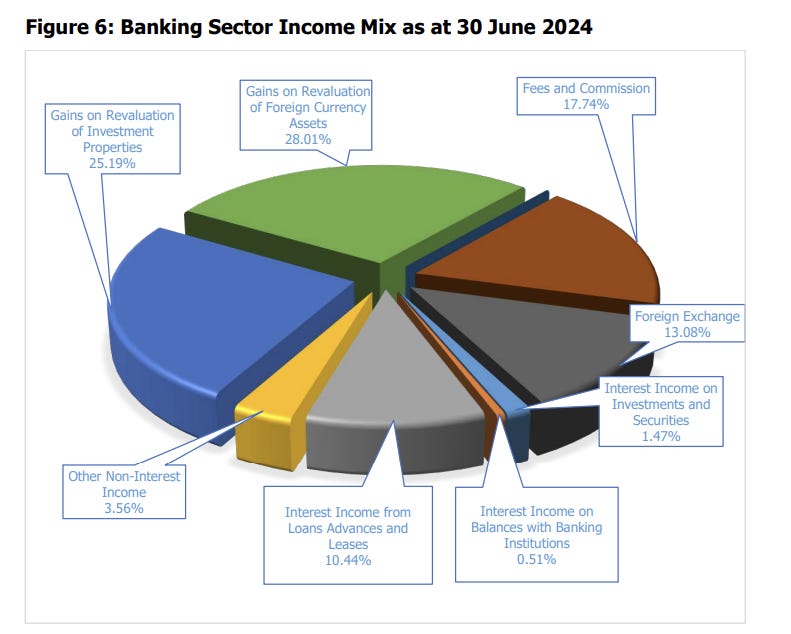

Proof of this is the fact that the banking sector generated only 10.4% of its income from interest income, which is typically the core of a bank's activities.

First Capital Bank, however, is an exception in that it still generates 46% of its income from interest income from loans and advances. Given the context, this percentage is actually quite high.

But what is more intresting is who First Capital is lending to.

This fact indicates potential market gaps that companies like Mukuru, Innbuck or even Ecocash could take advantage of.

Let’s unpack.

First Capital Zimbabwe’s Performance

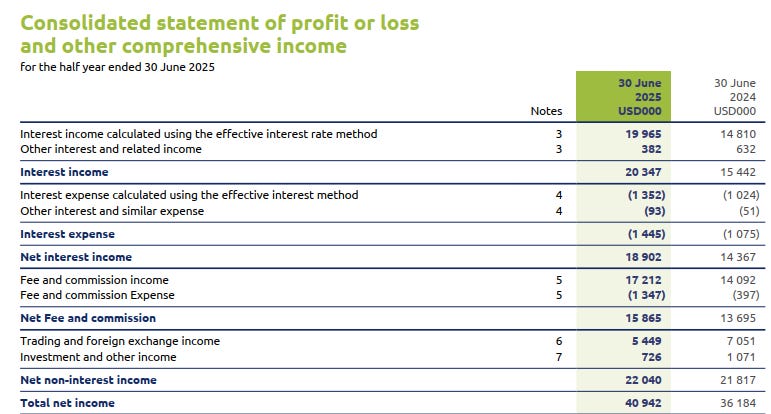

Based on their most recent results for the half-year ended June 30, 2025, First Capital Bank reported a strong start, with a 13% year-over-year increase in net income. This growth was driven by a significant jump in net interest income, which rose 32%.

Notably, the income wasn't driven by gains on the revaluation of investment property, which has been a significant source of “income” for other banks in the past. For First Capital, this was real operational income, not just accounting adjustments.

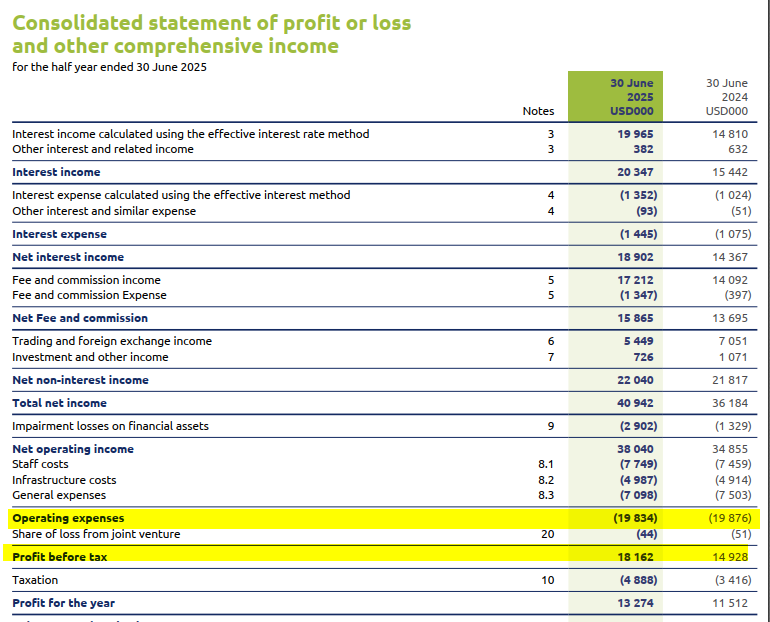

Operating expenses decreased slightly from the previous year, and considering the 13% income growth, this represents a significant improvement. This resulted in a cost-to-income ratio of 48% and an improvement from 55% in 2024. Generally, a cost-to-income ratio of less than 50% is considered favourable. It basically means it costs you 50 cents to make a dollar of income.

For reference, Standard Bank in South Africa had a cost-to-income ratio of 52% in its most recent results and back in 2015, when First Capital Bank was still Barclays Zimbabwe, it had a cost-to-income ratio of 83% (which was not good).

Overall, it appears that First Capital is performing well, as evidenced by a profit improvement from $11.5 million in the previous half-year to $13.3 million for the half-year ended June 2025.

As mentioned earlier, the driver of this growth is the interest income from its loans, and the breakout of where these loans are going is quite interesting.

Who is First Capital Lending to?

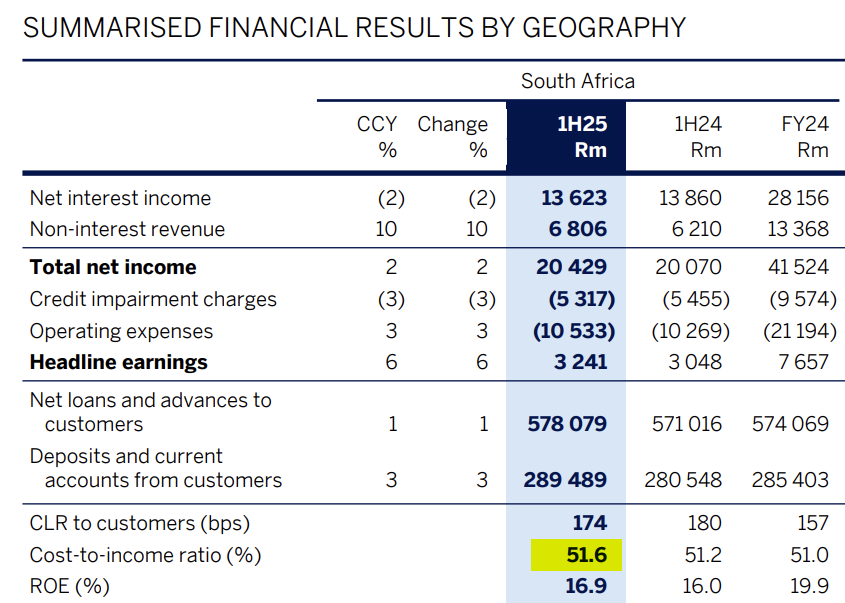

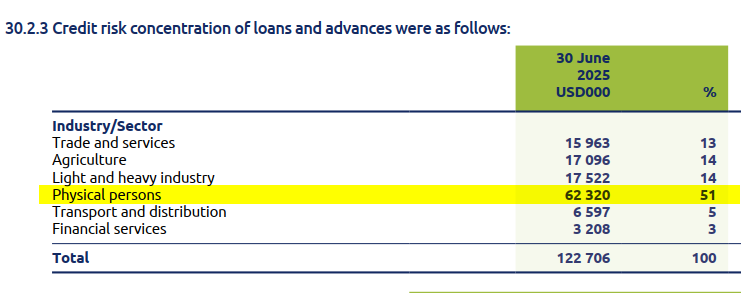

Currently, 51% of loans and advances are given to individuals who are classified as“Physical Persons”. This indicates that more money is lent to individuals than to corporates and other institutions.

By comparison, the share of loans granted to individuals at other banks is significantly lower; for example, ZB Bank at 21%, Ecobank at 7%, and NMB at 27%.

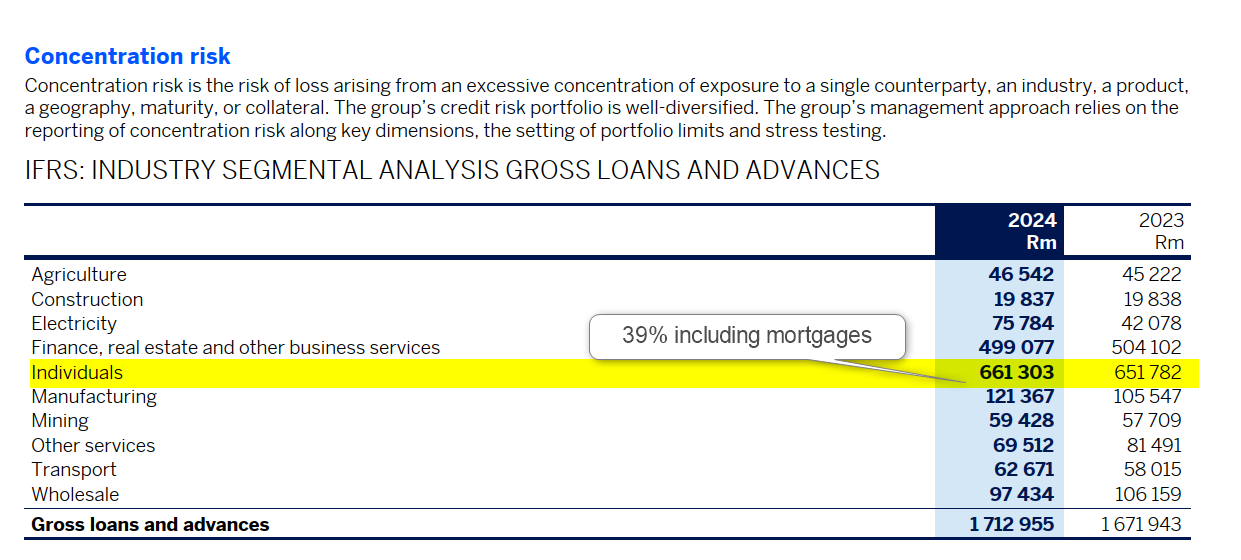

Even when comparing across the border, the ratios are much lower. For Standard Bank South Africa, the percentage of loans to individuals is 39%, primarily driven by mortgages, which are not significant in Zimbabwe. If you adjust for mortgages, the ratio for Standard Bank drops to 15%, compared to 51% for First Capital.

Based on the above data points, it appears that First Capital is focusing more on lending to individuals, and the approach is working for First Capital, judging by their profitability.

First Capital was also the best-performing stock on the Victoria Falls Stock Exchange in 2024, more than doubling in the year with returns of 116%.

Where’s the Money, What’s the Move? Personal lending.

The banking sector in Zimbabwe has arguably experienced the least amount of disruption compared to others.

While there are policy constraints, especially related to lending, bank charges and other fees have kept some banks profitable without requiring them to do much of their core business—lending.

This suggests that there is likely to be a larger underserved market in lending. Should a player enter the space with a low-fee offering that also provides lending, there will likely be strong uptake.

Who will fill this space? Will the traditional banks step up, or could this be an opportunity for the likes of Innbucks, Mukuru or perhaps even EcoCash?

Mukuru was recently granted a deposit-taking licence in Zimbabwe, enabling it to offer banking-like services. Remittances have been a great business for Mukuru , but as the space becomes more crowded, is this the new growth opportunity?

When it comes to investing, First Capital’s share price has increased by over 100% in USD terms since the beginning of 2024, whilst other banks have seen limited share price growth.

For example, both CBZ and NMB are up less than 10% in USD terms over the same period.

Is there hidden value in financial sector stocks?

Possibly, although the risks are present, and it certainly doesn’t help having to rely on ZWG financials to make a decision.

What do you think?

I commend First Capital’s strategic pivot toward increasing retail lending—it’s a remarkably swift and relatively low-risk approach for banks. Individuals have limited leverage in negotiating interest rates; essentially, the bank sets the terms, and borrowers accept them. In contrast, corporate lending carries greater exposure, as non-performing loans can escalate rapidly, requiring more intensive risk management.

On CBZ, I believe the market is currently undervaluing the company. Their ongoing restructuring efforts—evident in the recent workforce optimization—and evolving market strategy make the next 12 months especially compelling to observe. With its restructuring likely to enhance operational efficiency and strategic focus, coupled with its strong market share, I view CBZ as a strong buy.

I believe First Capital is right on track... I believe buying their stock is really gonna pay-off to anyone even after a more than 100% rally... I mean the market they are serving is largely untouched, given very risky, but if done well and hedged, it'll also being juicy returns. I believe if possible they should also try and offer loans to medium sized businesses ... They would probably get more from that as well, those guys seemingly are in need of sensible partners to lend them @ great rates and banks ( despite their high lending interests in Zim) would still be better lenders compared to MFIs...