Fuel, Cement, and Beer — Dangote and Varun Shake Up Zimbabwe’s Economy: The Week Ahead

Dangote eyes Zimbabwe again, Varun moves into beer, and Delta faces new competition.

The Week Ahead: Fuel, Cement, and Beer

Here are some of the most important stories to watch this week

Dangote investing $1 billion in Zimbabwe? Is this about Cement or Fuel?

Delta’s Dominance Faces New Test as Varun Enters Beer

Let’s unpack.

Dangote Investing $1 Billion in Zimbabwe?

In an interview with McKinsey in 2015, Aliko Dangote said that “the big growth opportunities for Dangote Group are mainly on the south side of Africa.”

At the time, it seemed he had eyed a few countries with South Africa, Zimbabwe and Zambia on the watch list.

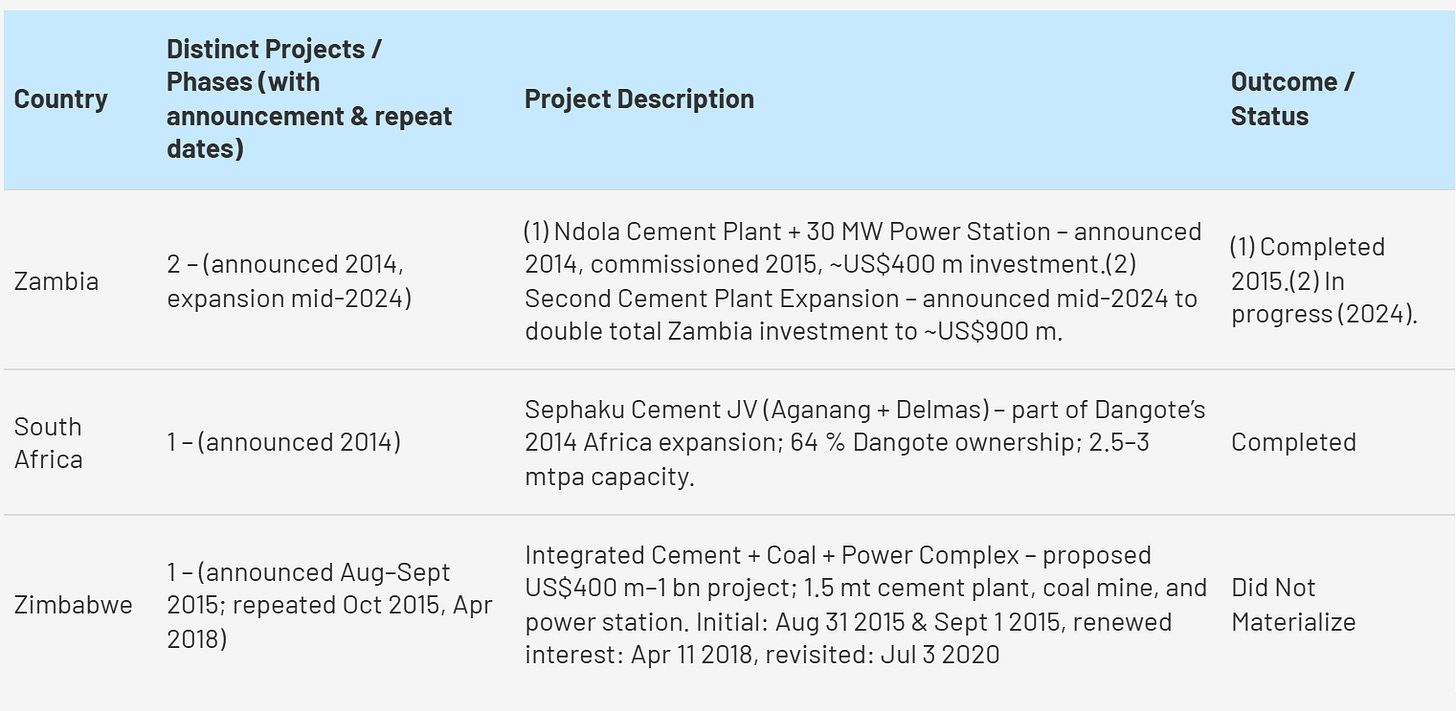

However, as shown below, while progress was made in Zambia and South Africa, nothing materialised in Zimbabwe despite following up on the initial 2015 interests in 2018 as well.

Dangote is now reportedly planning to visit Zimbabwe, ten years after the initial discussions, to try again to enter with a “$1 billion investment”.

Will this investment happen? Hard to say since in the past so many deals have fallen through. But this time, there could be a little more incentive to take on risk by Dangote.

Is Dangote more Interested in Cement or Fuel?

Historically, when you think of Dangote group, you would think of Cement, and the deals that have been closed so far in Southern Africa have been cement-related.

However, with the launch of the refinery in 2023, the interest could be more to do with Fuel?

For context, the Dangote refinery located in Lagos is the largest single-train oil refinery in the world, built to process 650,000 barrels of crude per day, and hopefully can make Nigeria self-sufficient in refined fuel.

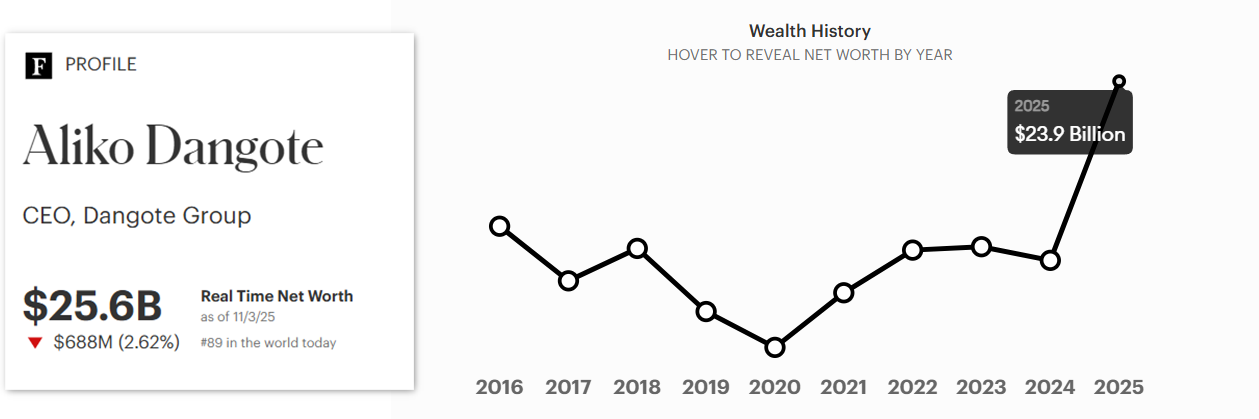

This is also what has driven up Dangote’s personal wealth in the last couple of years. The chart below from Forbes shows that Aliko Dangte’s net worth went up by over $10 billion the year the refinery started operations.

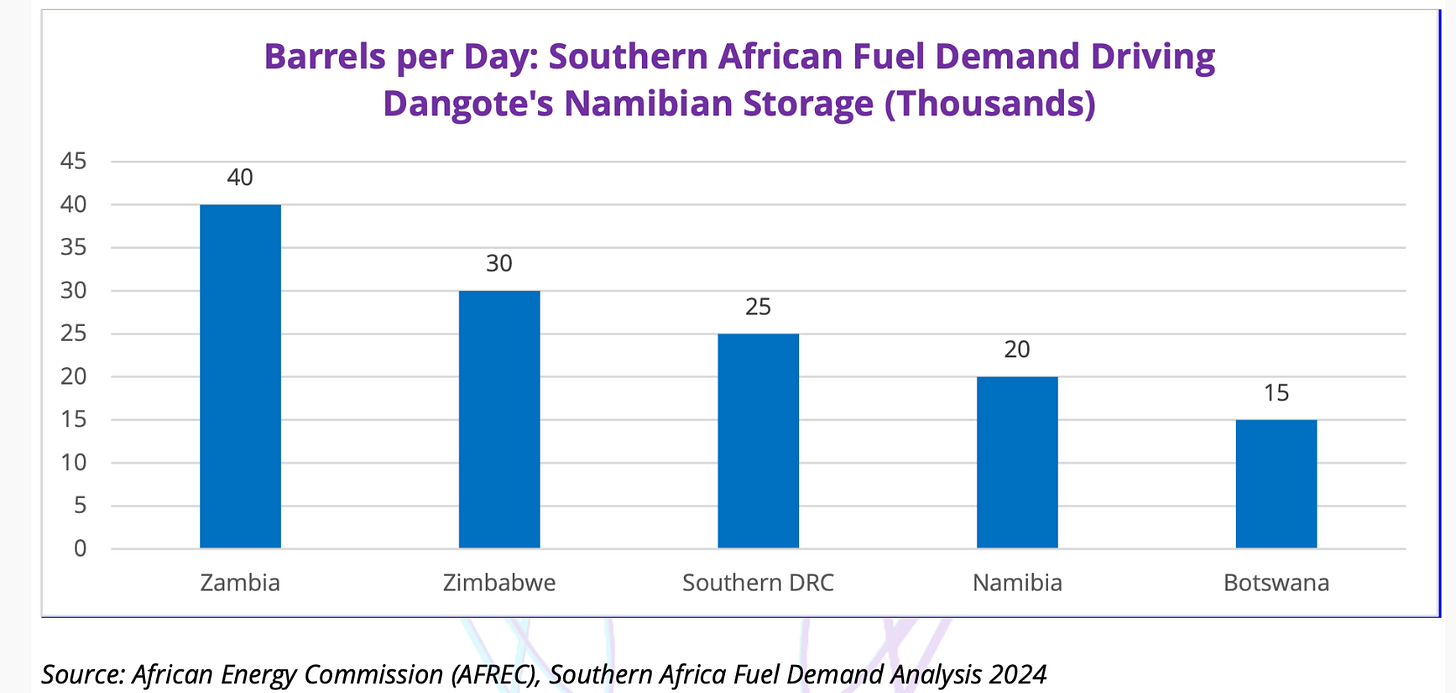

The significance of the refinery to Southern Africa is that Dangote has planned a 1.6-million-barrel storage facility in Walvis Bay, Namibia, that could reshape energy access across the region.

The facility will target five primary markets: Botswana, Namibia, Zambia, DRC, and Zimbabwe, together consuming more than 120,000 barrels of fuel each day.

Many countries in the region import fuel from the Middle East and Europe, facing lengthy shipping times and price volatility. This facility could supply 15-20% of Southern Africa’s current demand, potentially reducing the region’s $10 billion annual fuel import bill.

With Zimbabwe, one of the largest importers, which also doesn’t have many options, could this be the opportunity that has spiked Dangote’s interest again?

Who knows, but it’s worth watching either way. It will also potentially give some hints at how the Government plans to ease investors’ concerns around dedollarisation.

Delta’s Dominance Faces New Test as Varun Enters Beer

Everyone wants to crash Delta’s party.

Last week, Varun Beverages, the PepsiCo bottler, announced its first push into alcoholic beverages, starting with distributing Carlsberg beer in Zimbabwe.

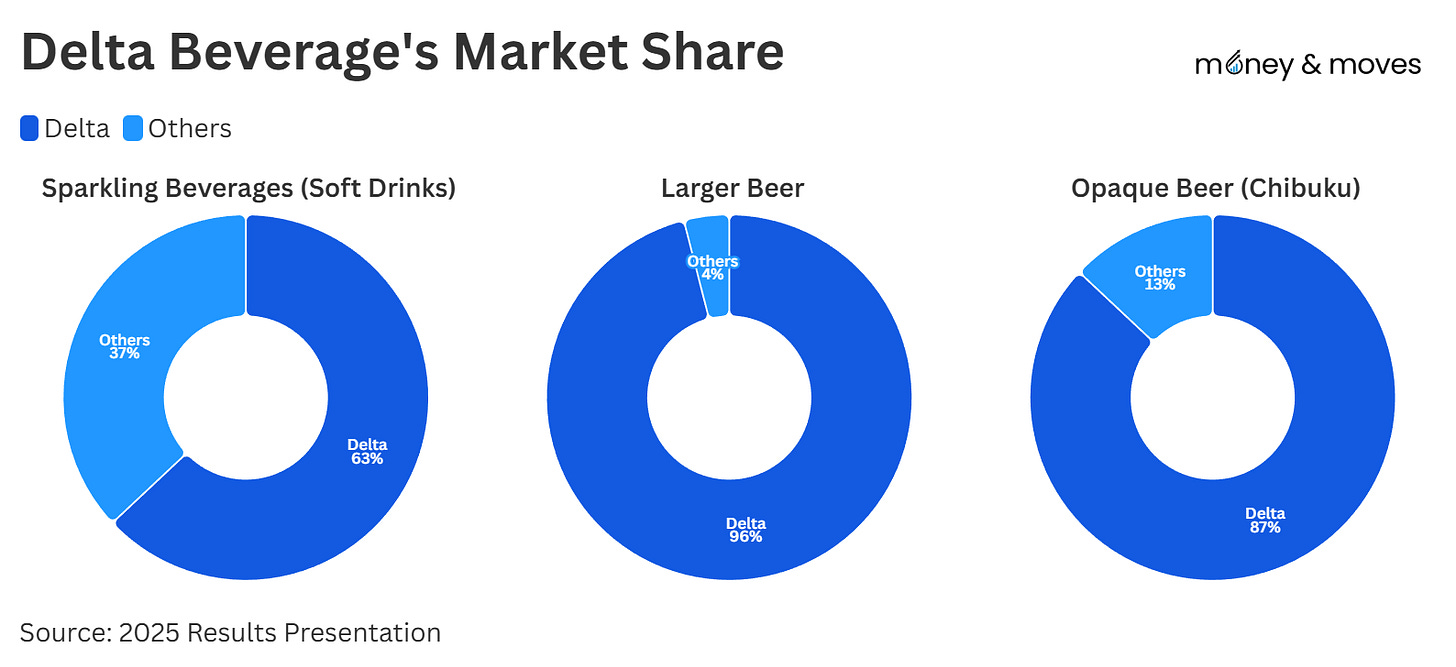

For context, Delta is the largest beverage manufacturer in Zimbabwe. The company holds the Coca-Cola license in the country and also manufactures beer, in which the company has been particularly dominant.

Delta holds 96% of the market share in the beer segment that Varun is now targeting.

Varun Beverages Limited is an Indian-listed bottler for Pepsico, operating in 10 countries. Its markets include India, Nepal, Sri Lanka, and several African nations like Mozambique, Zambia, South Africa, and Zimbabwe, which it entered in 2015.

It’s notable that the initial market where Varun is testing beer distribution is Zimbabwe. This indicates several key dynamics.

First, the risk-to-return trade-off in Zimbabwe is much more attractive than global markets might suggest.

While RMB ranked Zimbabwe the Worst Investment Destination in Africa, for Varun, it appears to be one of the first markets worth exploring for this new product category.

Second, Delta’s business must be inherently healthy. When you have both Innscor and Varun Beverages trying to enter a market aggressively (Innscor with its Nyathi beer brand and now Varun with Carlseberg), the unit economics of the business must be good.

How will Varun’s move impact Delta? There may be a need to unpack this in more detail, but let me leave you with a question that offers a hint.

Varun entered Zimbabwe in 2015 to challenge Delta in the soft drinks market. Did Delta’s beverage sales volumes increase or decline since then?

The answer: Delta’s soft drinks volumes between 2016 and 2024 increased at a growth rate of 7.5% per year, even outpacing other parts of the business.

Here’s a fascinating paradox: dominant companies often grow when serious competitors emerge, rather than shrink as you’d expect. Take Econet’s data business after Starlink arrived—the pattern holds.

This warrants a full deep dive, but that’s a topic for another time. Let me know what you think?

Your analysis misses a key point that Varun is riding on massive tax exemptions, so the investment is funded by Zimbabweans, they got free forex from RBZ, the allocations are on public record. That’s what they have asked for to enter the beer market, fact. That will be vigorously opposed. They are faltering in CSD without the forex benefits and a dollarised economy.

Delta's 7.5% annual volume growth despite Varun's soft drinks entry shows the market expansion thesis over cannibalization. The 96% beer market share makes this a fortress but Carlsberg's global brand equity and Varun's distribution infrastruture could create a viable premium segment challenger. The key varable will be whether they pursue volume through pricing or margin through positioning, given the forex constraints and competitive dynamics you highlighted.