How Much USD Revenue Do Zimbabwean Companies Really Make?

USD revenue breakdown for Dairiboard, TM Pick n Pay, Tigere and other major companies—plus how to convert ZiG capital into USD income

This week, in an interview published by The Independent, the Reserve Bank of Zimbabwe (RBZ) Governor indicated that plans are being laid in order to move “towards mono-currency by 2030”.

This means that the RBZ is hoping to do away with the USD-dominated multicurrency regime in favour of using the ZiG as the “mono-currency”.

With this in mind, it may be a good time to look at what percentage of sales companies currently generate in USD.

How much USD are Zimbabwean Companies Generating

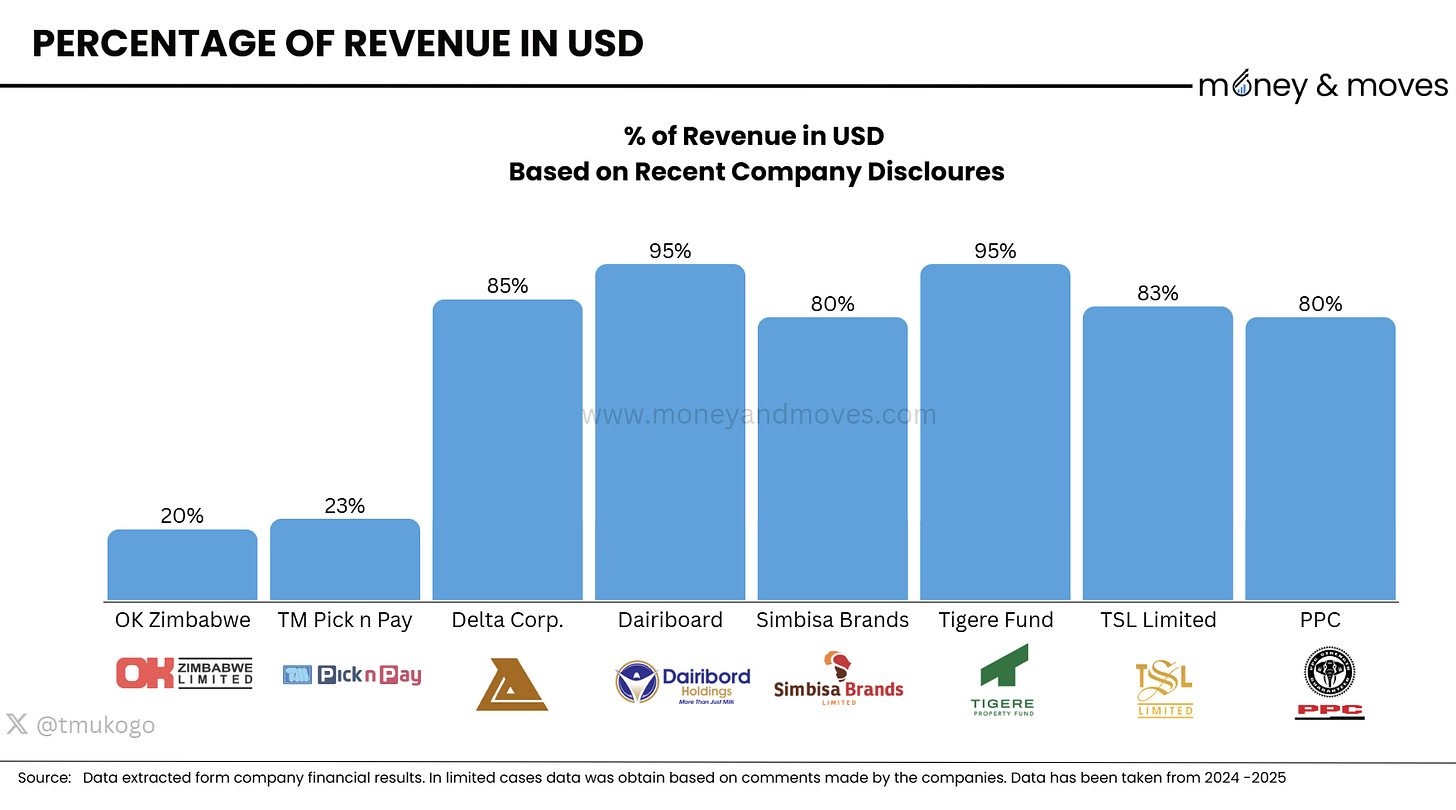

Below is a breakdown of the share of USD revenue generated by a selection of listed companies.

The list is compiled from annual reports, trading updates and other company disclosures, including those made to the press.

These numbers vary from period to period, so an effort was made to find the most recent numbers; however, this may not always be the case. Where the company disclosed an estimate, e.g., above 20%, the number mentioned is the one that has been shown.

From the chart, it is clear that traditional grocery retailers, OK and TM Pick Pay, fall far behind all other businesses in generating USD revenue, with both collecting about 20% to 30% of their sales in USD.

Customers see these retailers as places to get rid of any ZiG they have. Ironically, it also seems that people are willing to spend USD on fast food with Simbisa Brands, but not on groceries.

All the above also explains why these retail chains are more reliant on currency stability. If the ZiG devaules, over 80% of their revenue is affected.

Dairiboard’s High Share of USD Revenue

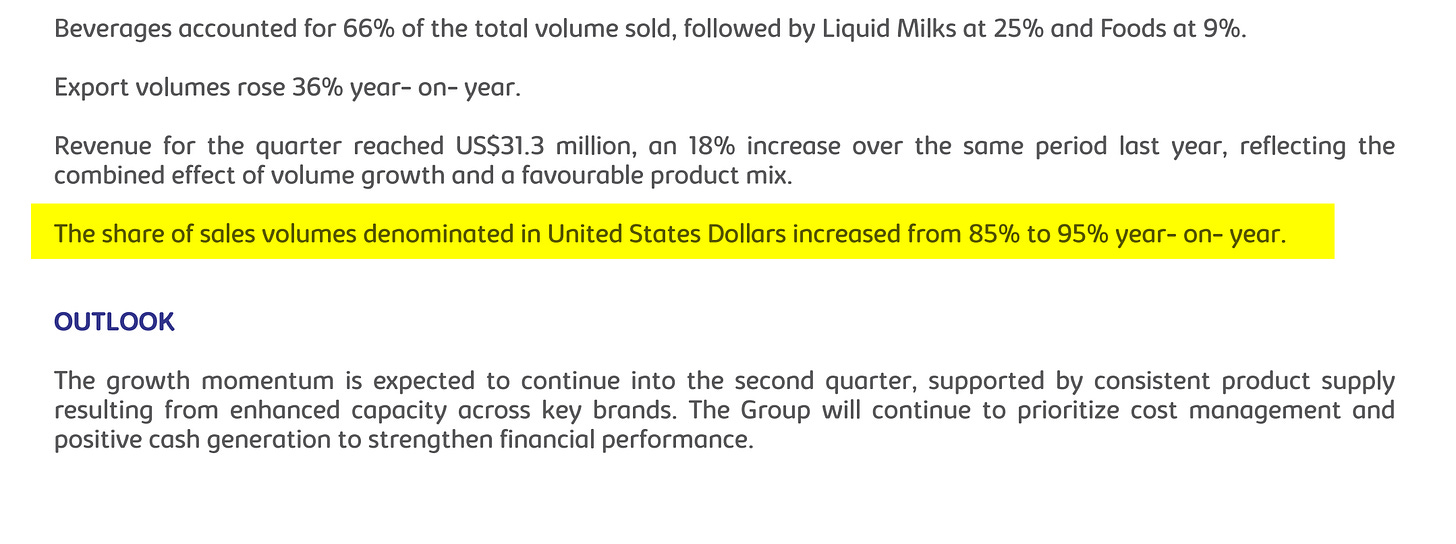

On the other hand, one of the companies with the highest proportion of USD sales is Dairboard, which in Q1 of 2025 recorded 95% of its sales in USD, up from 85% the previous year. This is quite impressive.

This high percentage of sales in USD is likely boosted by exports as well.

While exports accounted for only 7% of sales volumes in 2024, there has been a drive to increase this number. In Q1 2025, exports rose by 36%.

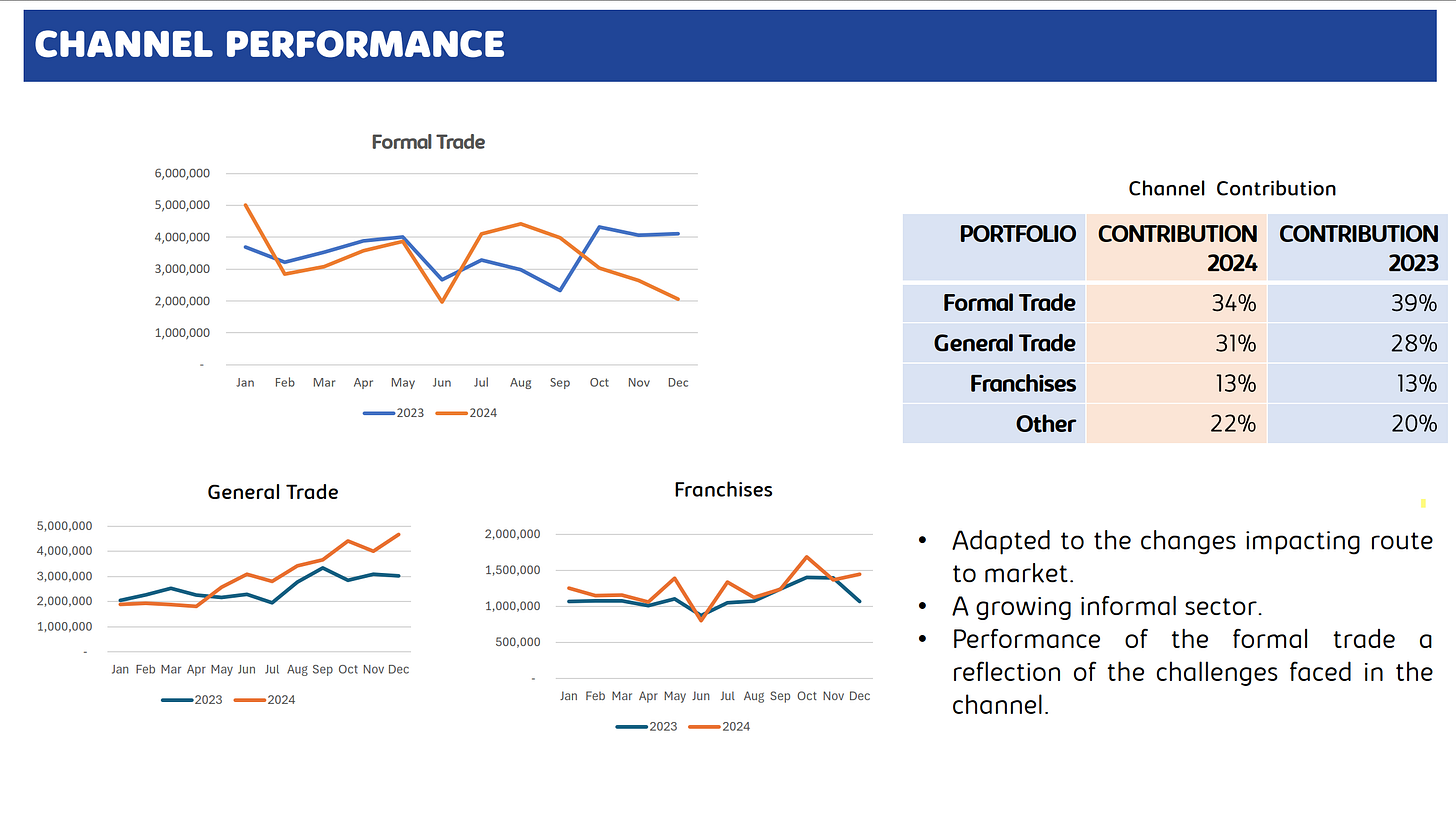

Another interesting fact about the high percentage of USD sales is that Dairboard in 2024 still sold 34% of its goods into the formal trade.

If TM Pick n Pay and OK Zimbabwe, historically the largest formal retailers, only receive 20% to 30% of their sales in USD, how does Dairboard maintain 85% to 95% of its sales in USD?

This indicates that within the formal channel, there is a significant and expanding market of smaller formal retailers that primarily trade in USD. This is where Dairiboard must be pushing a lot of its product to.

This may also mean that both TM Pick n Pay and OK Zimbabwe face stiff competition in regaining market share.

Property Space Still Brings USD Revenue

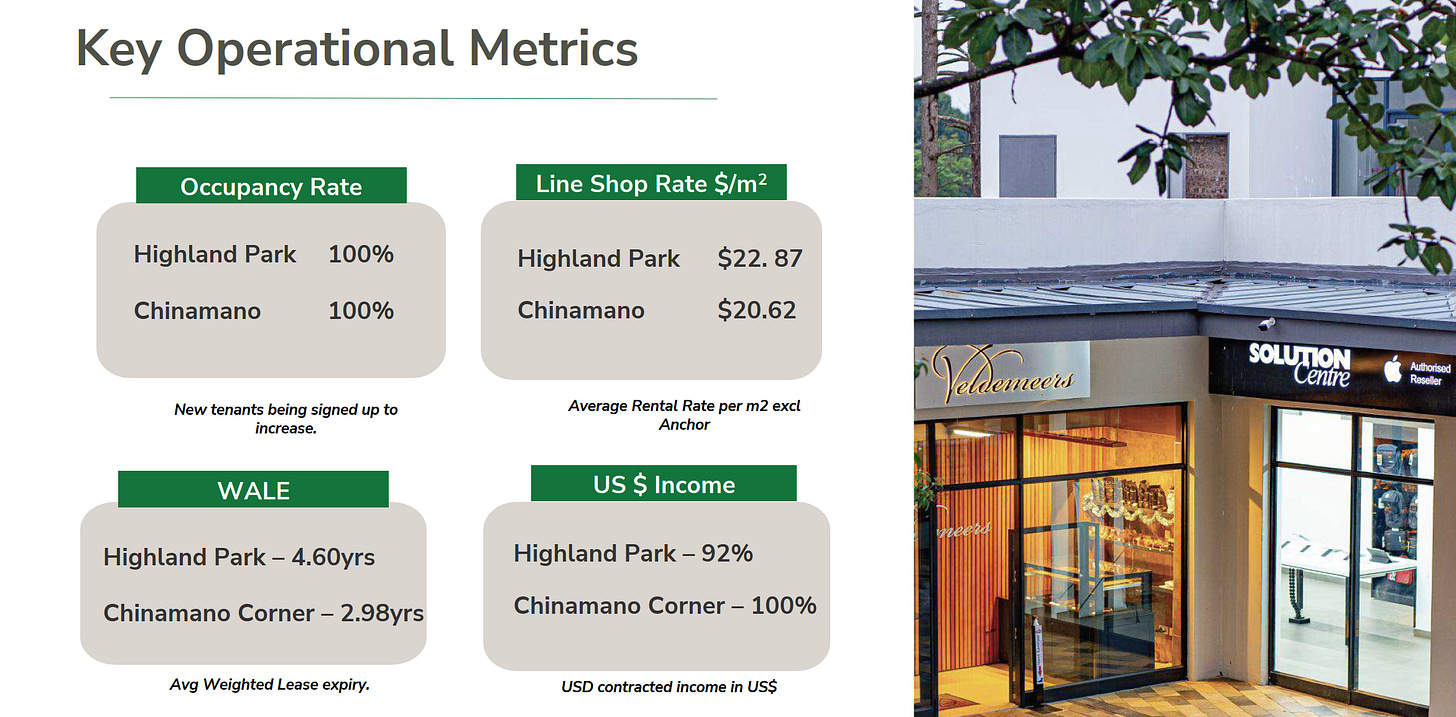

The other outlier in terms of a high share of USD revenue is Tigere Property Fund (Tigere), with 95% of its revenue in USD. Tigere is best known as the owner of Highland Park.

The high share of USD is not surprising. For whatever reason, there is a phenomenon in the country where everyone expects to pay rentals in USD, even by tenants who generate part of their income in local currency.

Is the Economy Becoming More USD-Driven?

Generally, it appears that the average share of revenue in USD is around 80-85%.

Interestingly, it also appears that the USD revenue as a percentage of the total is increasing across the board.

Dairiboard increased from 85% to 95%, Tigere increased from 91% to 95%, and Delta increased from 80% to 85%; even Meikles (TM Pick and Pay) increased from about 17% to 23%.

Where are all these dollars coming from?

Where’s the Money? What’s the Move?

Ironically, the companies that seem to have the highest share of income in USD and, by implication, the ability to pay USD dividends are listed on the local currency-denominated Zimbabwe Stock Exchange.

This means you can invest with ZiG and get dividends in USD. Zimbabwe is an interesting place.

Most companies that are paying out dividends are paying at least a portion in USD.

So in a way, having ZiG is not so bad at present. Currently, you can still find ways to allocate it in a smart way, and so far, it has held value, probably more than people expected.

Perhaps if the currency can be kept stable for another five years, in 2030, people may be willing to give it a try?

What do you think?

Vision 2030 catching strays 😂😂😂

I don't think having the local currency for local transactions is a bad thing - I want whatever money is considered legal tender and as much of it as I can legally get. The authorities just need to apply a structured approach to the system. De-monetize the USD but allow folks to hold and store value in the preferred USD - let conversions preserve the purchasing power of the $1 converted to digital ZiG and this conversion may only take place via a registered deposit-taking institution (No questions asked as to 'source of funds' for a set amount of time).

Digitization has made conversion so much easier and straightforward. ZESA does it when we purchase units from sellers. Create a system that is robust enough that the 2 can and should operate seamlessly and in sync with one another. People should be able to receive their USD just as they are from the Diaspora, but for purposes of transacting locally, they deposit the amount they need and buy or pay for local goods and services in the local units. Should one need USD for travel abroad or international settlements (where USD is the currency in use), they would simply load the USD onto their card get on a flight and go or pay their dues using the USD they have or purchasing the USD that will now have been accumulated as reserves within the system.

But any, and all local transactions are executed digitally in ZiG, with the exchange of said value pegged against the USD purchase power of the $1 equivalent.

I don't know if any of this makes sense. LOL! May the monetary fundis on this platform please school me where necessary.