Is OK Zimbabwe about to Collapse?

Last week, pictures circulating online of empty OK Zimbabwe stores created such a buzz that the company issued a press release reassuring customers and stakeholders that it was not facing any going concern issues.

To try to understand OK's current position, I looked at their most recent financial results to see if the empty stores were a temporary glitch, as OK says, or if Zimbabwe’s biggest retailer is in danger of complete collapse.

At first glance, OK’s half-year results look pretty good. Revenue was up 47%, with volumes up 28%. EBITDA (a type of operating profit) increased 44% to $17mln.

This looks good until you start examining the “Earnings Quality.”

Earnings Quality can be defined as how reliable a company’s financial results are for assessing current and future performance.

Not all profits are equal, especially in the Zimbabwean context, where significant accounting adjustments related to currency distortions can occur even when reporting in USD.

A good example is the Half-Year 2023 financials, which show a net monetary gain of $26 million, turning a $19 million loss into a $7 million “profit.” This was the same time when OK had said sales had fallen ‘severely below break-even point’.

For 2023, we already knew it was a bad six-month period, so the question is whether OK is now doing well.

OK's EBITDA in the most recent interim results is $17 million. This is very high.

For context, OK’s EBITDA for the same period in 2014, was about $9.5 million. It is worth noting that 2014 was also one of OK's best-ever years.

So how is there such a high EBITDA now when people are worried about OK collapsing?

The EBITDA is the latest results is a "low quality" EBITDA.

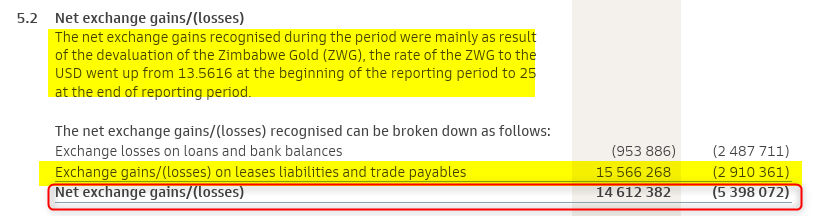

When you look at the P&L, you see that a net exchange gain of $14.6 million is included in the profit, which is not an operational profit. If you remove that one number, the profit before tax drops from $5.1 million to a loss of $9.6 million.

What makes up net exchange gain is mostly the revaluation of lease liabilities and trade payables.

Essentially, due to the devaluation of the ZiG on 27th September 2024, any amounts owed or commitments that OK had in ZiG were now worth less in USD than before, resulting in an exchange gain, which is accounted for as income.

Had the ZiG devaluation happened just 5 days later. It would have been after OK’s interim cut-off of 30 September 2024, and the number wouldn't have been included in the results.

So, this gain is not an operational improvement. In fact, it may have even hurt OK, as there may have been suppliers who had overdue ZiG balances, which would have taken big losses with the devaluation, resulting in less willingness to give credit.

Another way to check earnings quality is using the Cash Conversion Ratio (CCR).

Simplified, this ratio asks for each dollar of profit how much cash you have actually made in the business. Generally, a company should try to have a ratio above 1.0

For OK, it's CRR is 0.3. That’s not great. For context in 2014, when OK was performing well, that ratio was about 2.0, nearly 8 times better.

So, OK’s profit in the six months to September 2024 was more of an accounting profit than an operational one.

But does that mean OK is about to collapse? The financials suggest no.

OK's assets are still greater than liabilities, and its current ratio (current assets divided by current liabilities) is at 1.1. This generally indicates a business can continue to function.

This ratio has also improved from earlier in the year when it was 1.0. However, the current ratio is much lower than in 2014, when it was at 1.6.

The lower current and cash conversion ratios indicate that OK has much less working capital than before. This may also explain the “Intermittent product supply challenges” OK referred to in its press statement.

OK is not able to manage cashflows to meet all its obligations with the ease it could before.

To take some positives out of the results, there are also some signs of improvement. For example, volumes have started growing again, albeit from a low base.

What is also clear is that currency stability is a significant factor in determining how well OK will perform in the future.

Despite the devaluation in September 2024, the currency was more stable between April and September 2024 than at the same time in 2023, which coincides with the improvement in volumes of OK’s results.

I think currency, stability is a more significant risk to OK than informal traders.

If currency instability sharply increases, it will be difficult for OK to adjust. If the currency remains stable and OK can stay in the game long enough, there is a path to recovery.

So OK is still not in great shape, but the numbers do not suggest there are going concern issues......at least for now. Hopefully, OK can turn things around. It is arguably the most important retailer in the country in terms of history and impact.

Where’s the Money, What’s the Move?

It is hard to believe that OK Zimbabwe’s average market cap in 2014 was $203 million, and today, it's about $13 million despite increasing the number of stores. This also shows how much market share informal retail has gained.

As things stand, in order to make money and also get your hands on USD, you need to play in the informal market.

However, the hyperinflation transition between 2008 and 2009 taught us that when conditions are conducive, retail can recover extremely quickly.

OK’s revenues in the first financial year after dollarisation were $188 million. In only three years, that revenue had grown to $479 million in FY2013, with a profit of $12 million.

Perhaps a similar turnaround can happen if the tide turns?

Thanks for reading! If you enjoyed this, please share this with your friends or colleagues and subscribe if you are not already on the email list.

As always great read... I was reading about some American individuals who bought Zimbabwean stocks for example Nick Sleep, the guy who made money whilst investing in undervalued and unseen assets...