Vivendi's Canal+ Plots African Domination with Proposed MultiChoice Deal

Who are the players in involved, what's their motivation and how will viewers be affected.

Vivendi's Canal+ has offered to buy MultiChoice in a deal that could massively change paid TV in Africa.

Who are Vivendi and Canal+, why do they want to buy MultiChoice and how will viewers be affected?

Let's unpack what clues we can find, including in their 468-page annual report.

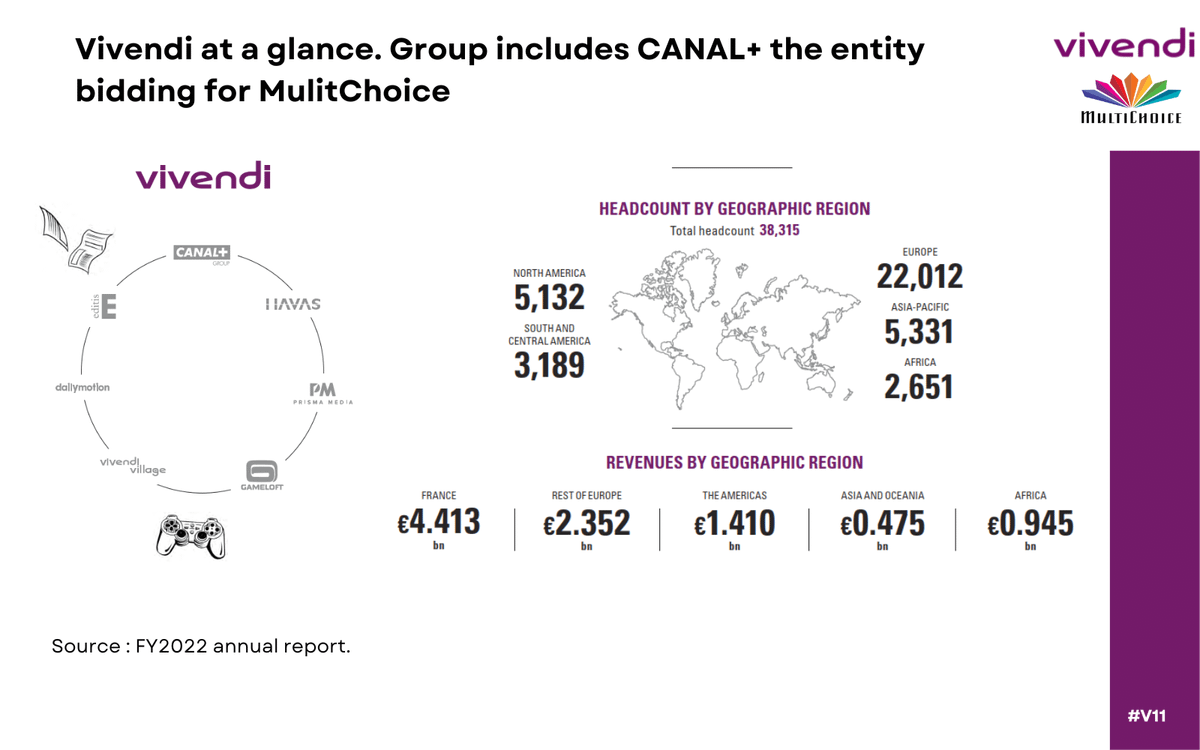

Vivendi is a mass media and communications company headquartered in France that owns CANAL+, the company bidding for MultiChoice.

It's a big company with about €9.6bn (R190 bn) in revenue which makes it about 3.2 times bigger than MultiChoice.

Vivendi might sound new to many people but they have been very active in Africa.

When it comes to TV in Africa you have two big blocks the English-speaking block and the French-speaking block.

In the French-speaking block Vivendi, through CANAL+, has strong representation with 7.6m subscribers on the continent.

This is impressive but still much smaller than MultiChoice with 22m subscribers.

With the deal, CANAL+ would effectively control paid TV in Africa

However, even if the deal doesn't go through Vivendi/CANAL+ already has a big influence on paid TV in Africa since they currently are the biggest single shareholder in MultiChoice with over 30%.

Vivendi has been increasing its shareholding in MultiChoice steadily in the way a high school boy pursues their crush.

Every year it has maintained MultiChoice is “just a friend” but now has come out and proposed to buy MultiChoice outright.

Why do they want MultiChoice?

When we look at Vivendi’s latest annual report we get a bit of the rationale.

The company has 3 strategic pillars: Transformation, Internalization, and Integration.

The one to focus on is Internationalisation.

Vivendi makes most of its revenue from France, which like most of Europe is not a high-growth area so it's no wonder there is a push for “Internationalization” especially through Mergers & Acquisitions into new markets.

Where better than to expand into Africa?

Despite Africa’s challenges, the growth potential is there for those who are patient.

So, buying a company that would mean you control paid TV in the continent which will have the largest labour force in the world by 2050 seems like a good play.

Also, MultiChoices's stock price has been falling for a while and so is relatively cheaper than before especially if you also factor in the depreciation of the rand.

Furthermore, the pressure from international players has been greater leaving MultiChoice looking weak.

Vivendi may also want to strike before other players get interested.

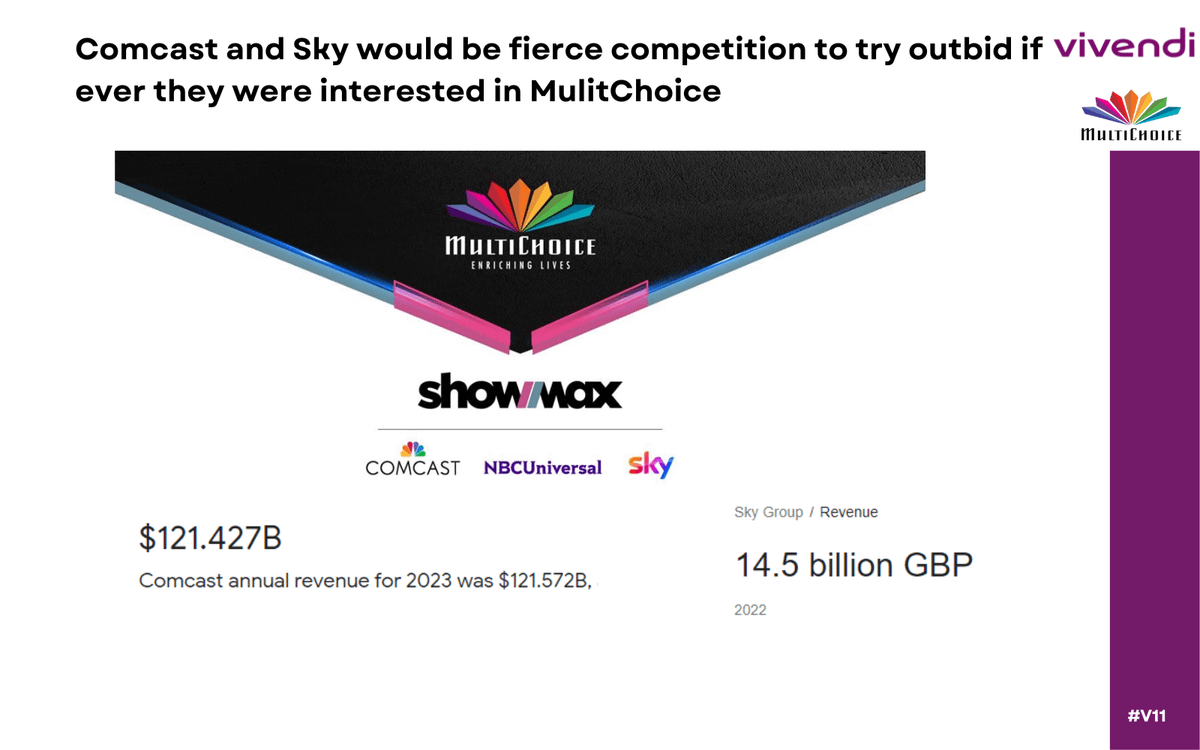

MultiChoice has partnered with Comcast's NBC Universal & Sky on the new Showmax.

Sky, on a revenue basis, is nearly 2x the size of Vivedi, while Comcast is over 10x bigger.

These factors combined mean that now could be a good time to strike for Vivendi.

Will the deal go through? It is hard to say there are several issues. For one there is a law about what % foreign investors can own in a broadcaster.

Vivendi already made mention of this in their annual report.

There seems to be some way to make this work however by limiting the voting power as already Vivdendi/CANAL+ is above the 20% threshold.

But does this work when you control 100%?

I don't know.

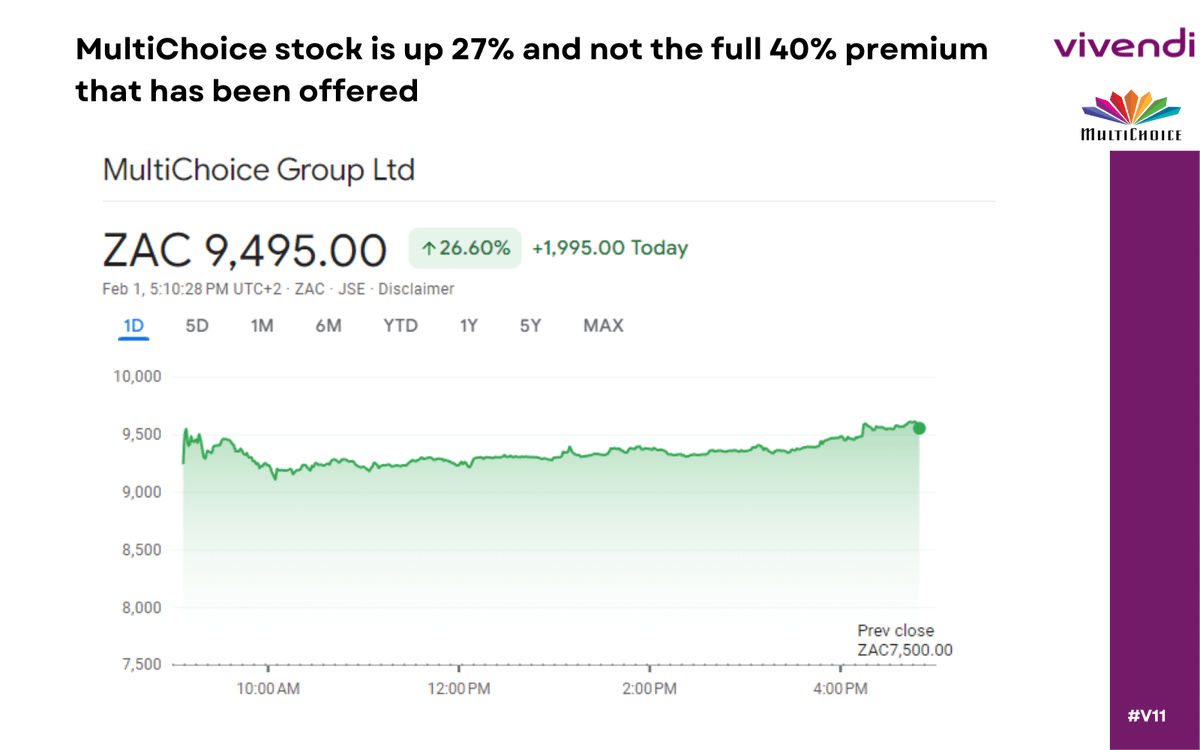

Today, DStv’s stock has jumped 27% as of writing compared to the 40% premium being offered.

This means that the market is pricing in about a 67% chance of the deal going through.

If the chances increase the share price will edge closer to 40%.

One tricky topic Vivendi may need to navigate is how some French Organisations are at times perceived as imperialist.

They may need to tone down statements like these.

"Vivendi is one of the few groups that can spread the influence of European culture worldwide"

I get what they mean and I am sure it was well-meaning but it doesn't come across well and unfortunately, broadcasting tends to be a sensitive topic also politically.

To be in a position to control paid TV in Africa and be accepted requires additional sensitivity.

It is still early days so I expect a lot can happen. For the consumers at least in the short term, there will be minimal impact but for the management team of MultiChoice, I can imagine this could be difficult to navigate.

I am working off public information so I could be wrong or missing something. I would love to hear what you think so please leave a comment.

Important announcement: If you want to get these posts by email in the form of a newsletter please leave your email in the link below.

This way you won't miss a post and will also get more detailed information and analysis.

https://forms.gle/KtUAdow8Yjm8FmPc9

If you enjoyed the above post you may also enjoy the below!

Recommendation 1 of 2.

https://twitter.com/tmukogo/status/1739549101950439918?s=20

Recommendation 2 of 2!