Comparing TM Pick n Pay and OK: Which Retailer is Performing Better

Originally published on X (formerly Twitter) and imported directly as is.

How is TM Pick n Pay doing compared to OK?

This is a question often asked, especially when discussing how OK has been struggling.

If Pick n Pay is also struggling as much, then maybe formal retail is dead.

I dug through both their financials, and this is what I found.

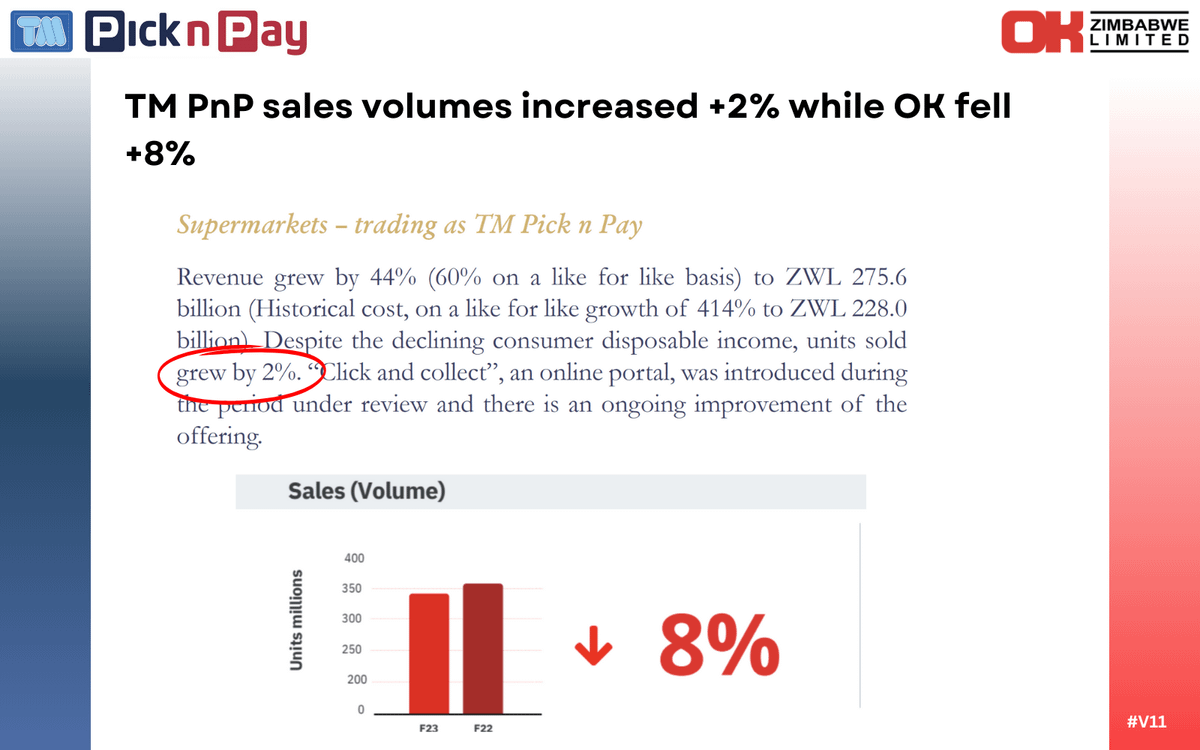

First thing to compare is trading volumes which is the best approximation of sales. We can compare these as both companies have similar year ends.

Both companies have been impacted by rise of informal traders however TM PnP less so with volumes up +2% vs OK down -8%. 🤯

The difference is huge, especially if we assume volumes drive revenue.

If TM PnP and OK have revenues of about $400m, that means the revenue for TM PnP could have been up by $8m while OK's revenue was down $32m.

This would also have a big impact on profit.

In terms of store footprint growth both TM PnP were quite similar although through different means. TM PnP opened three new stores where are OK acquired three Food Lovers stores.

OK also started their pharmacy business but it is still too small to consider in any analysis.

On retail footprint expansion I think TM PnP has a slight edge. The new stores in Madokero and Highlands Park are in new developments with less competition and should generate more growth in future.

The Food Lovers branches OK acquired are Borrowdale, Avondale, and Bradfield but exclude the popular Greendale branch.

The Food Lovers in Avondale is also near the existing OK (Bon Marche) branches, so in some cases, OK will be competing against itself.

Tangent: I am going to start mentioning Meikles so I need to pause so you understand why.

TM PnP is part of Meikles so it doesn't disclose as much information as OK. However, it is over 90% of Meikles so Meikles balances are usually TM PnP balances.

On finances, it looked like TM PnP was in a better position. Meikles had borrowings of ZWL 878bn which in USD was is about $1mn.

OK had a loan of USD $5mn and additional short term ZWL borrowings of ZWL 6 billion.

OK did have an edge on the interest rate on the loan. Meikles is paying 16% interest on its $1m loan where as OK is paying interest of 7.5% on its $5m loan.

This seems strange. Why would Meikles be paying double the interest rate of OK? 🤔

The next measure is Current Ratio (Current Assets / Current Liabilities).

For TM PnP it was 1.2 and for OK its was 0.9.

This indicates that TM PnP is better off on working capital and probably pays outstanding accounts with suppliers quicker than OK.

In terms of brand image with the customer, I would have to ask you.

Which retail brand or store or do you prefer to shop at?

Overall, the analysis suggests TM PnP is performing better than OK in most areas but both retailers have been challenged by informal traders judging by the weak growth in volumes

However, we do need to consider that OK is in an investment cycle, which perhaps may pay off.

What do you think?

I could be wrong however as this analysis based on information that is publicly available. There could be some facts I have not considered

Comment and tell me what you think?

If you found this thread interesting, you will definitely enjoy these.

Recommendation 1 of 2.

https://twitter.com/tmukogo/status/1721973759178097077?s=20

Recommendation 2 of 2.

Thanks!