OK Shuts Down Two Food Lover's Stores After Spending Millions — Here's the Real Reason

The inside story of a misaligned acquisition—and the tough decisions OK must now make.

In 2023, OK Zimbabwe spent millions to acquire Food Lover’s franchises in Avondale, Borrowdale, and Bulawayo.

This week, the stores in Avondale and Borrowdale announced they are closing down.

Why is this happening? What went wrong, and what happens next?

Let’s unpack.

How Did We Get Here?

Back in 2023, OK Zimbabwe (OKZ) acquired Talwant Trading, which operated three Food Lovers Stores. The idea behind the deal was to help OKZ get more into the “premium retailing of gourmet food as well as fruit and vegetables categories.”

The stores included in this deal were Food Lover’s stores in Harare's suburbs of Borrowdale and Avondale and one in Bulawayo. Worth noting this deal excluded Food Lover’s Greendale, which is still independently owned.

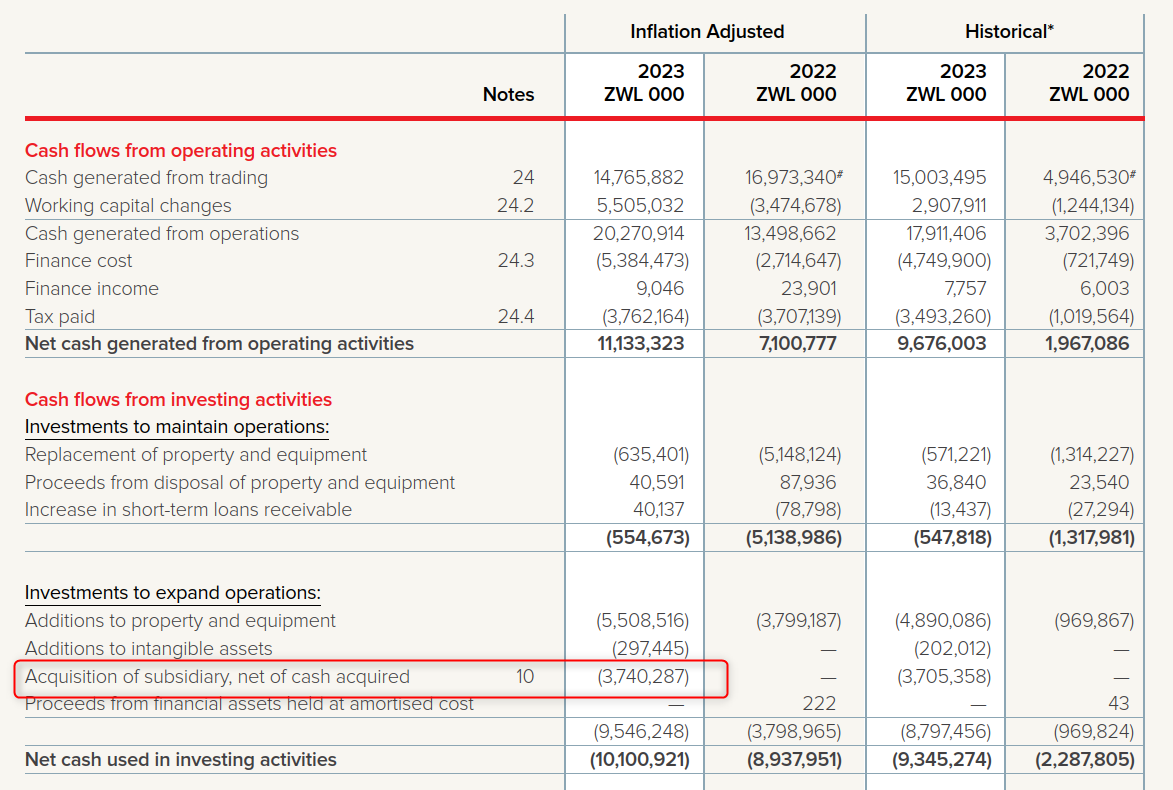

Determining how much OKZ paid for Food Lover’s is not easy from public information as the financial statements hightlight a cash outflow of ZWL 3.7 billion for the purchase.

If we take the conservative approach and apply the market rate at the end of the financial year when the acquisition was concluded, it would work out to about US $2 million.

The real value is likely more as the timing of the deal would have been earlier than 31 March 2023, but it’s safe to say “millions” were spent.

Was this a bad deal?

It's easy to say this was a bad deal in hindsight, but at the time, a reasonable case could have been made for the deal.

OKZ had historically been quite one-dimensional when it came to corporate development, and the only acquisition in the last 20 years was the purchase of Makro Zimbabwe, which later became OK Mart, OKZ’s wholesale business.

A new management was appointed in 2021 and naturally wanted to redefine what the OKZ of the future would look like. Considering the past, finding news businesses to buy would have been a reasonable approach.

OKZ's acquisition of the Food Lover’s stores was one of those moves. As we discovered in the last article, succeeding in the Fresh Food segment, as Food Lover’s Greendale has done, can be a very powerful competitive advantage.

So the deal could have made sense.

The challenge, however, was that in OKZ’s ecosystem, Food Lovers didn’t seem to quite fit. Bon Marché was already geared towards the premium segment, a fact acknowledged by the previous management in its own Brand Portfolio slide.

So there was a clear overlap.

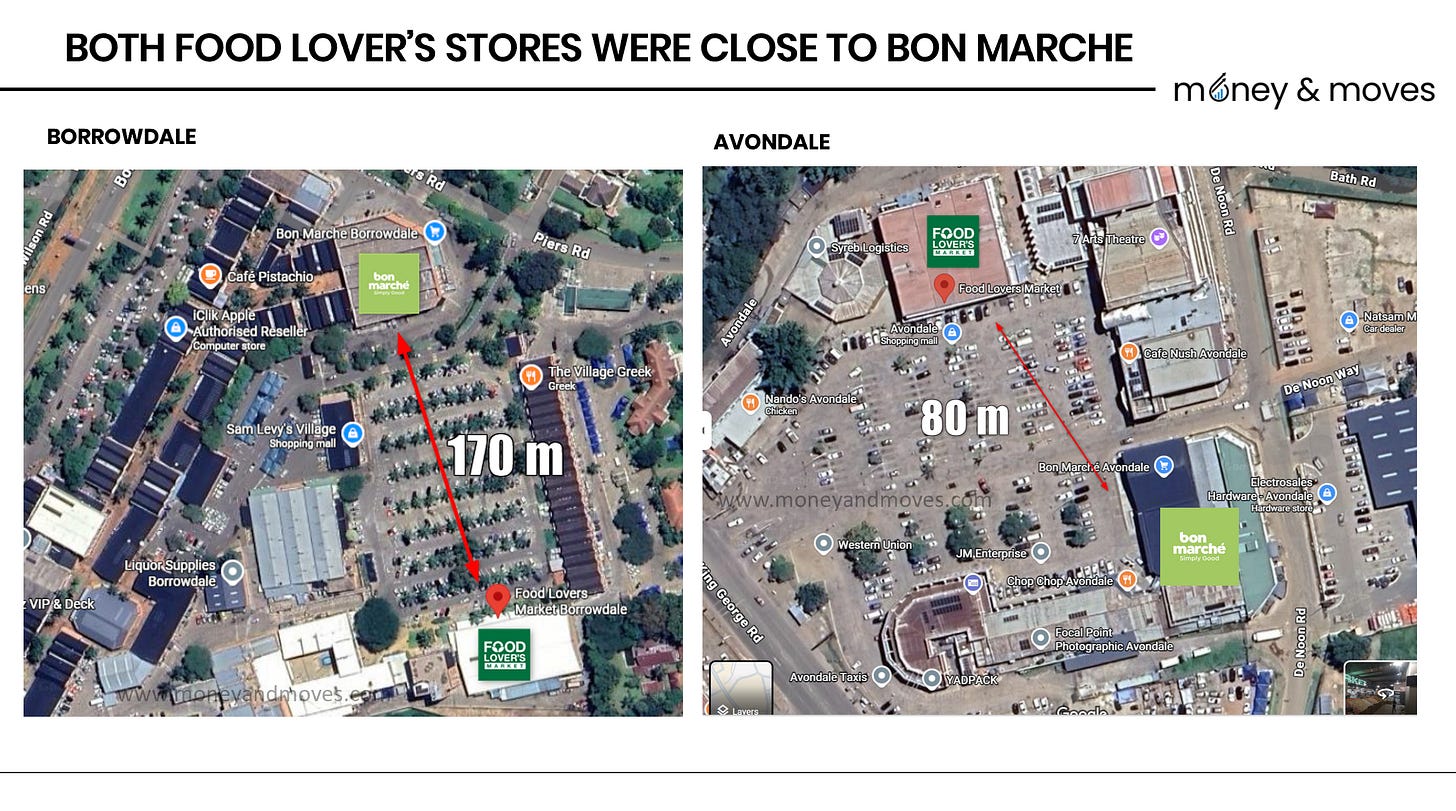

However, perhaps the biggest issue was the two stores that have now closed, literally competed with Bon Marché.

As shown in the image below. Both Food Lover’s Avondale and Borrowdale were located less than 200 meters from a Bon Marché.

In the case of Avondale, the stores were just 80m apart. Both stores were essentially targeting the same segment in the same location.

It’s like owning a kombi on a tough route with too few passengers, then buying another kombi to run the same route. It’s probably not the best idea.

Even if the new kombi does well, it probably means the other will struggle.

What About The Food Lover’s In Bulawayo?

Notably, there has been no announcement about the Food Lover’s in Bulawayo closing. Typically, when a company delivers bad news, best practice is to do it all at once.

So, in this case, no news is probably good news for Food Lover’s Bulawayo.

I can also see why it may make sense to keep that Branch. Firstly, unlike the other two, it doesn’t cannibalise or compete with any other OKZ stores.

Secondly, I would imagine it doesn’t require as much investment as the stores in Avondale and Borrowdale, where rentals are higher and competition is steeper. From a supply chain perspective, it probably helps being closer to South Africa, where a lot of the goods come.

I would also imagine that if you have been granted the territorial rights for a franchise (Food Lover’s Market is a South African brand), it must be rather messy to simply close all the shops. Wouldn’t there be a penalty? I don’t know.

Couldn’t the stores have been turned around?

If Food Lovers Greendale is doing so well, and selling Fresh Food is the most significant competitive advantage against the informal sector (for more of that, see here), couldn’t OKZ have turned around these stores?

Possibly, but currently, OKZ has too many problems to worry about and not enough money to go around.

We have extensively covered OKZ’s problems over the last two years, which included several missteps that led to the company falling into financial distress, prompting the previous CEO to be brought in to steady the ship.

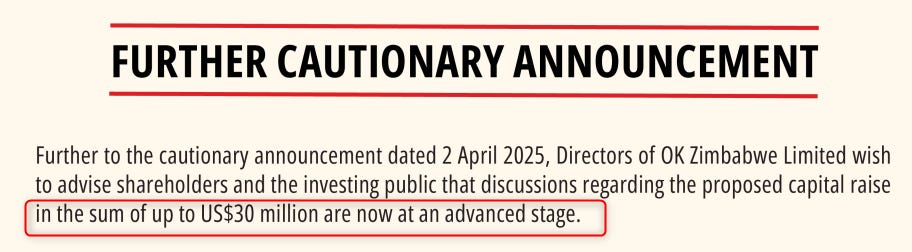

As part of the turnaround efforts, OKZ has been in the process of raising $30 million.

That sounds like a lot of money, but then, when you consider that back in 2015, OKZ’s net working capital was $19 million (current assets minus liabilities).

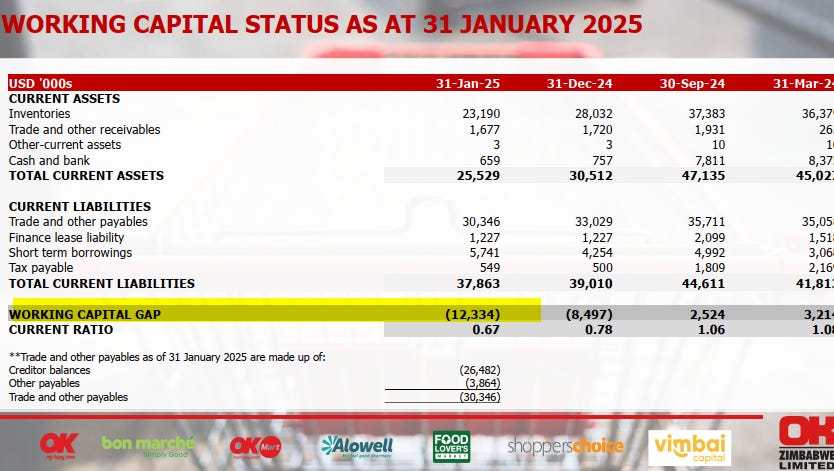

The last disclosure we have from OKZ showed a net working capital position of negative $12 million.

This means that to get back to trading normally in the way OKZ did in 2015, it will require about $31 million ($19 million + $12 million). This probably explains why they are raising $30 million.

However, this doesn’t leave much for additional investments, which would be needed for all the Food Lovers to remain competitive.

Given this situation, I can see the logic in pulling back from the two stores to focus the capital they raise.

Linked to this, I wouldn't be surprised if changes are coming with the Alowell Pharmacies (another business started by the previous management team).

It didn’t seem that the Pharmacy business had made much traction, so there is a good chance that it will quietly scale down or change its operating model significantly.

Where's the Money? What's the Move?

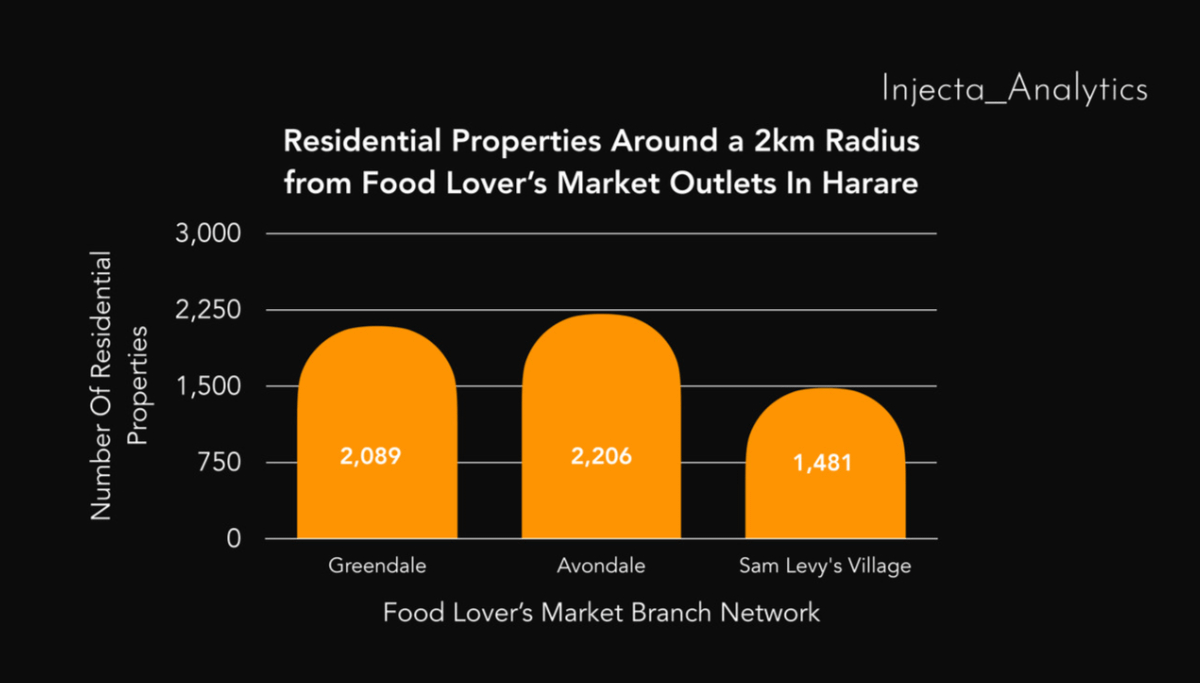

Well, it seems like there will be some prime retail real estate available soon. Based on location data, the site in Avondale is particularly interesting, with a large number of residential properties within a 2 km radius.

There is still considerable competition in Avondale, but if you can execute the fresh food strategy effectively, there may be an opportunity. Perhaps a store like Kava could make a bold bet and expand into a bigger location?

As a final note, this story highlights the importance of capital allocation for any company. OKZ spent millions to purchase Food Lovers at a time when they could have strengthened their balance sheet by paying down creditors and loan balances.

Now, most of that investment in Food Lover’s is worth zero, and OKZ has had to raise cash to pay off creditors and loan balances.

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so. It’s completely free.

PS: I am working with public information and so I may be wrong or missing something in my analysis.

You mean it only cost $2m to purchase the entire Food Lovers business? It must have been debt risen to be so cheap.

Insightful as always 👏 👌