OK Zimbabwe's $20 Million Rights Issue: Rescue Mission or Money Pit

OKZ needs $20 million to stay alive. Here's the investment psychology and math you need to consider.

Last week, OK Zimbabwe (OKZ) released their 38-page circular to shareholders about the proposed rights issue to raise $20 million from shareholders.

Without this cash, OKZ says that creditors may sue the company, essentially driving it into bankruptcy.

To incentivise shareholders to subscribe, OKZ is offering a 15% discount to existing shareholders.

Is this a good deal? Here are the questions to always ask when evaluating a rights offer.

Investing Decisions and Sunk Costs

Deciding on rights issues is fundamentally the same as any investment decision. You should make it based on whether the investment will generate a return above your required rate of return.

In reality, however, it’s easy to get trapped into making suboptimal decisions regarding rights issues due to the sunk cost fallacy.

The sunk cost fallacy is the tendency to continue with a course of action because you've already invested time, money, or effort—even when it is no longer the best choice.

If you are offered a rights issue, it means you have already invested in the company.

As a result, you may look at your earlier investment—likely sitting at a loss—and try to “rescue” it by investing more. In reality, you shouldn’t because that past investment is gone. It’s a sunk cost.

The only question now is: is this new money you’re putting in likely to earn an attractive return?

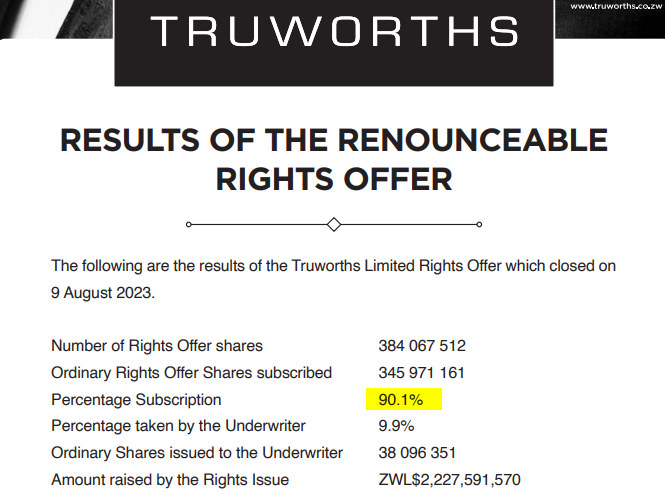

This trap has caught many investors before. A year before Truworths went under, they had a rights issue, and most shareholders participated.

However, many of those who participated would probably not have invested if they weren’t already shareholders, trying to save the business from collapse.

So with OK Zimbabwe, will this rights issue create long-term value for investors?

Modelling the Numbers

To answer that question, we need to model some scenarios of what OKZ could look like in three years.

Here are the baseline assumptions if the turnaround succeeds:

Revenue: $325 million

Net Income Percentage: 1.50%

Net Income Absolute: $5.3 million

Earnings Per Share: 0.17 cents

Price to Earnings Ratio: 10

Evaluation period : 3 years

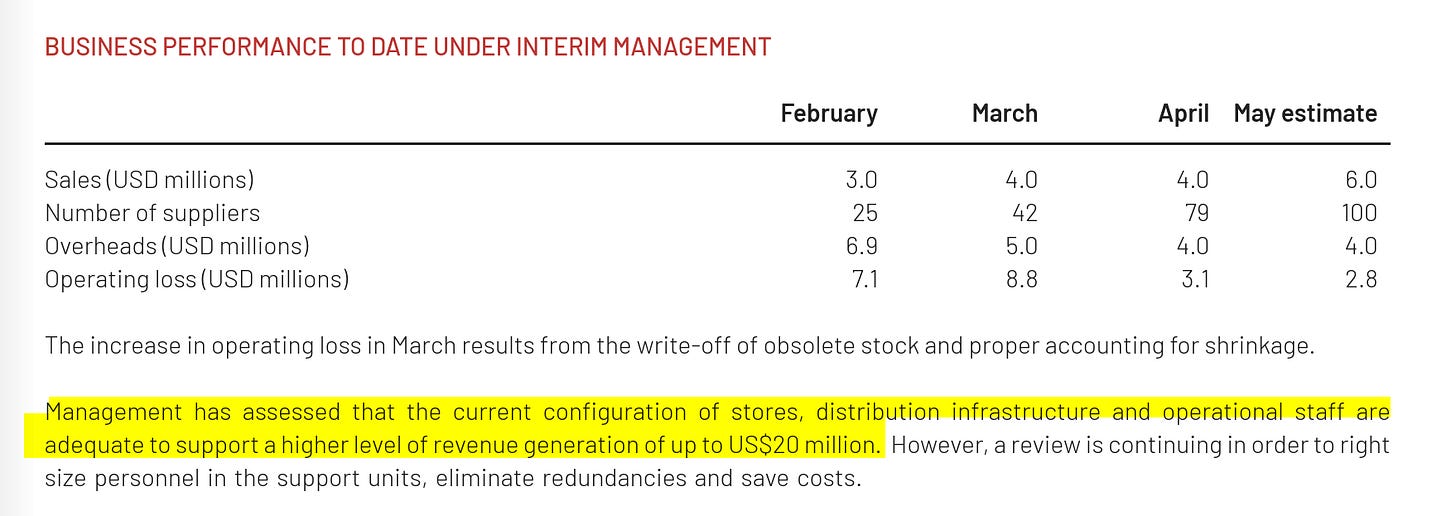

OKZ’s revenue for the eleventh months to February 2025 was $239 million, and currently, management states that with the current setup, they can generate approximately US$20 million per month, or $240 million per year.

At its peak, OKZ revenue was just under $500 million. Given those data points, a target of $325 million in revenue in three years seems reasonable.

Net income (profit margin) for retailers that are performing well, like Shoprite, ranges between 2% and 3%. OKZ has reached these levels in the past, but is currently making massive losses, so as a starting point, we can use a net income rate of 1.5% will be reached at the end of year three.

The next major assumption is on Price to Earnings Ratio (PE Ratio), which is a measure of how much investors are willing to pay for each dollar of earnings (profit). This is one of the easier valuation methods to use quickly. This has been assumed to be 10 times.

This is lower than regional norms; for example, Shoprite has a P/E ratio of over 20, but valuations in Zimbabwe are currently depressed. For example, Simbisa Brands, which has been performing well, has a PE ratio of 11. Based on this, 10 seems like a reasonable baseline.

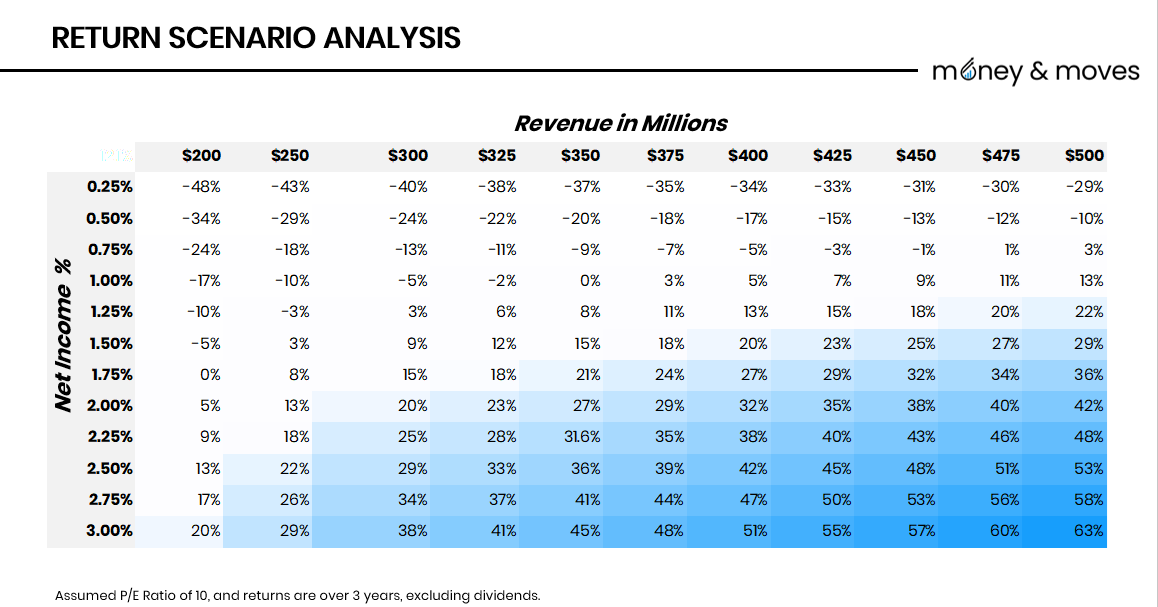

If we model the above, taking into account the cost of the rights issue, we arrive at a potential annual investment return of 12% (compound annual growth rate, or CAGR). This does not include dividends, which I believe are prudent to exclude for now, as OKZ has also stated that they won’t pay dividends before 2027.

However, what is more important than arriving at a single number is looking at the full scenario analysis. Estimating returns is what I would call an “artistic science” - you need to paint a picture with numbers to know what you are looking at.

Modelling the Scenarios

Below is a model that illustrates the levels of annual returns based on changes to the revenue in year three and the net income %. In all this, the PE Ratio has been maintained at 10.

Based on the below, if the revenue reaches $400 million and the net income is 2.5%, then the return jumps to a 42% CAGR. On the other hand, if net income reaches only 1.0%, then even with $400 million in revenue, returns are only 5%.

This suggests that profitability will be the primary driver of unlocking value, more than size. This probably also helps to explain why OK is closing stores and exiting the Food Lovers business.

Better to be small and profitable than bigger and make losses.

Where is the Money? What's the Move?

So, whether this is a good deal or not depends on how much you believe OKZ can be turned around.

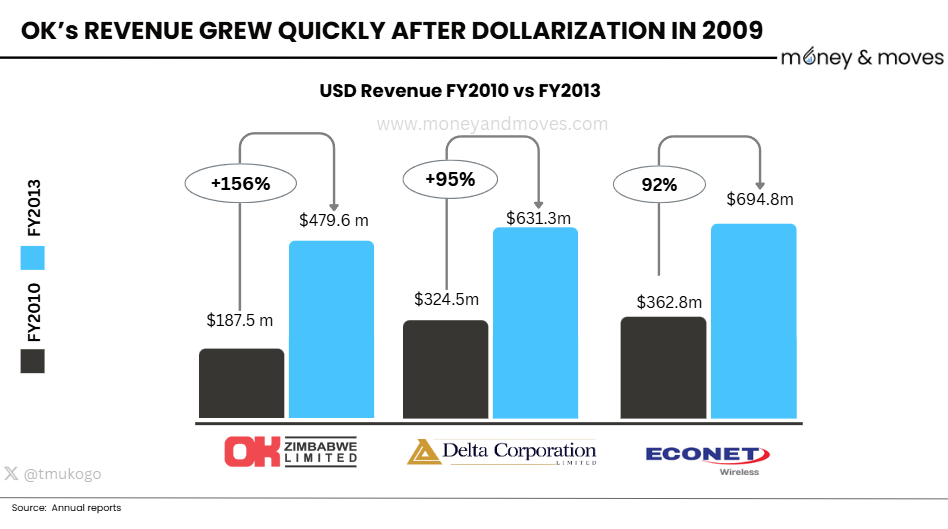

The Case for Optimism: OKZ has bounced back before. After struggling during hyperinflation, the company grew revenue from $187.5 million in FY2010 to $479.6 million in FY2013 – a 156% increase in just three years. This wasn’t just the environment; OKZ also outpaced most other top companies during the same period.

The Case for Concern: Times have changed, and the informal market is dominating. Can OKZ regain market share? The structural challenges facing formal retail in Zimbabwe may also be more long-term than cyclical.

The good news is that all the major shareholders, who collectively own 73% of the company, are already on board, and an underwriter is in place. So, OKZ will raise enough money to fight another day.

In a few years, there will be winners and losers. Which outcome are you betting on?

Think someone in your network should see this analysis? Forward this email – you could help them make better investment decisions.

PS: I am working with public information, and so I could be missing something or just wrong in my analysis.

Remember that valuation = Numbers + Story. Is the story from management trusted, can they turnaround the company in the face of stiff competition from both informal and formal sector?

OK should close a number of branches as a cost cutting measure ,innovate and open an online shop just like banks going digital and create spaza/tuckshop like agency where people can collect their groceries , therefore lowering the prices and compete with the informal retailers but leveraging with their brand.