After 80 Years in Business, Why Hasn't OK Expanded Outside Zimbabwe

Originally published on X (formerly Twitter) and imported here as is.

OK is over 80yrs old. Shouldn't the headline be "OK Opens First Store OUT OF ZIMBABWE"

Let's use OK as a case study for how to decide on entering new markets —essential knowledge for business leaders.

🧵 Thread below👇🏾, including valuable insights from Jack Ma!

Intro: #OK is Zimbabwe's leading retailer with ~70 stores in 🇿🇼 & revenue ~US$500m. It started in 1942 & is one of the oldest retailers in Africa.

NB: It is not to be confused with OK in South Africa which is owned by Shoprite.

Now let's evaluate OK's market entry potential.

When thinking about a new market, a company should consider:

1. The market's attractiveness. (size, growth and environment)

2. The company's capabilities. (managerial & financial)

3. Other strategic considerations. (vary significantly to internal issues or market forces)

To assess market attractiveness, you can use:

- GDP and GDP per capita (size of the market and spending power)

- GDP growth (market growth)

- Ease of doing business ratings

- Competition

Proceed with caution, however, macroeconomic data and economic reality can differ.

From the macro data & ease of doing business ratings we see that markets such as #Zambia and #Botswana perform quite well against OK's home market #Zimbabwe.

Whilst not perfect indicators, at a minimum they indicate there is potential to evaluate.

For competition, we can examine established players Pick n Pay and Shoprite.

Zambia and Zimbabwe, with similar populations and GDP, should have similar store footprints. However, Zambia has far fewer stores, indicating market entry opportunities.

Another data point on competition is from a BCG study on African retail that shows that Zimbabwe has a relatively high modern retail store penetration.

This indicates that competition outside of Zimbabwe may actually be favorable for OK.

Market Attractiveness 🆗 ✅

Next we need to assess OK's capabilities to enter into a new market. For this there are two primary considerations

- Management capabilities (experience and skills )

- Financial capabilities (capital to invest)

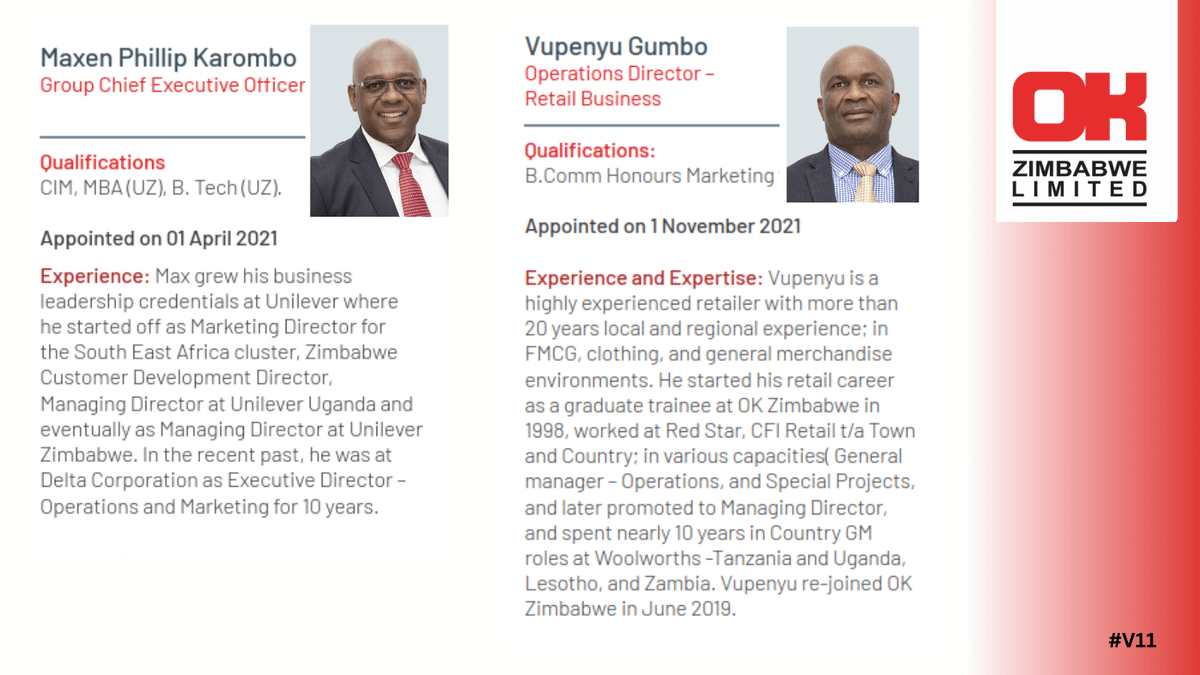

Looking at the profiles, management has what it takes

The CEO previously headed Unilevers' South & East Africa business & the Director of the retail business worked for Woolworths in Tanzania, Uganda, Lesotho, and Zambia.

The OK board is also strong. There is enough skills & experience to oversee a successful market entry.🆗✅

Financially, it seems to me that OK has capital to deploy. They have spent a lot on refurbishment and recently acquired the Food Lovers franchise in Zimbabwe.

They also still pay a decent dividend.

In addition they are venturing into retail pharmacy which is competitive & highly regulated. If they have capital for that they should have capital to bet on international expansion.

Financial Capabilities 🆗✅

That leaves the last topic, Other strategic considerations

On this it is possible OK has made a decision to protect the home base for the time being and focus on 🇿🇼 .

#Alibaba's founder, Jack Ma highlights the importance of winning your home market before expanding.

As he says in the clip below "Global Vision, Local Win".

The argument of focusing on home has its merits but is are cancelled out by the fact that OK started in 1942.

It's a grown up business. How much time do you need before you leave home?

The other topic is perhaps there is an agreement with Shoprite which owns the OK brand in South Africa. Shoprite operates in every market in SADC except Zimbabwe.

Is there an agreement that OK wouldn't enter other markets if Shoprite didn't enter Zimbabwe?

🤷♂️ anyone know?

Other than the above I don't see what other reasons there could be for OK not to expand. If anything there are many reasons they should.

1. Diversification from one market

2. Access to faster growing markets

3. Access to new talent

4. Increased customer base and revenue

In addition if you look at other leading companies in Zimbabwe they all have international operations.

Innscor / Simbisa 🇿🇼 🇿🇲 🇰🇪 🇲🇺 🇳🇦 🇲🇼 🇨🇩 🇬🇭

Econet Group 🇿🇼 🇧🇼 🇧🇮 🇱🇸 🇿🇦

Delta 🇿🇼 🇿🇲 🇿🇦

Meikles Africa 🇿🇼 🇿🇦

OK Zimbabwe 🇿🇼

🤔

In summary

1. The market's attractiveness 🆗 ✅

2. The company's capabilities. 🆗 ✅

3. Other strategic considerations. 🆗 ✅

So why is OK still OK with just being OK Zimbabwe?

I don't have an answer - what could I be missing?

OK has a strong team, so I believe there is a good reason.

Whatever the case, we need to consistently ask companies questions especially in Africa, which helps executives develop better businesses, strengthening the economy for everyone's benefit.

The moment you asked considering shop rite being the owner of ok name in South Africa and them operating in all SADC markets it became clear why they don't operate in Zimbabwe....