Simbisa Brands Financial Results:"Be Greedy When Others Are Fearful"

Simbisa Brands recently released their financial results, and it seems they may know something about Zimbabwe that most people don't.

They are investing heavily in a way that may be surprising but could set them up to dominate in the future.

Let’s unpack!

Simbisa Brands is a fast-food operator that owns, operates and franchises a selection of well-known Quick Service Restaurant brands in nine African Markets.

These brands include Pizza Inn and Chicken Inn, and Nandos and Steers of South Africa.

Simbisa’s results for the half year ended 31 December 2023 were solid driven by 7% revenue growth (4% increase in customers) to $147m.

This is not necessarily blockbuster compared with the previous year, FY23, which had 23% growth (24% increase in customers).

However, when you consider the environment where companies like major retailer OK Zimbabwe volumes are down 28% and Truworths units sold crashed 34%, growth of 7% growth sounds pretty good.

This then filtered down to a profit (from continuing operations) of about $10.6m with a 7% profit margin. Profit was down from last year but a lot of that was due to an increase in depreciation which some would argue is not really an “operating expense.”

However, the most interesting financial highlight was an increase in capital expenditure which sticks out like someone wearing a neon green dress at an all-white party.

Capital expenditure is essentially long-term investments that the business makes for future growth. In the case of Simbisa, this can be buying or renovating a new site to put a restaurant.

This half-year capital expenditure was up 61% to reach $19.2m. – That’s a big jump.

What’s also interesting about the Capital Expenditure is where it is going.

In 2022, $10m or 42% of the $24m Capital Expenditure was attributable to Zimbabwe with the balance going to the rest of the region (e.g. Kenya, Zambia etc).

In 2023 this shifted upwards with $19m or 63% of Capital Expenditure attributable to Zimbabwe.

In the most recent half-year results, this has increased again, with 81% of the Capital Expenditure falling under Zimbabwe.

So Simbisa has not only been investing much more in general but also has been increasing how much it has been investing specifically in Zimbabwe.

This is significant for two reasons.

Firstly, Simbisa is one of the few listed businesses in Zimbabwe that genuinely has a presence in multiple African Markets.

This means if they wanted to invest more in other markets they could.

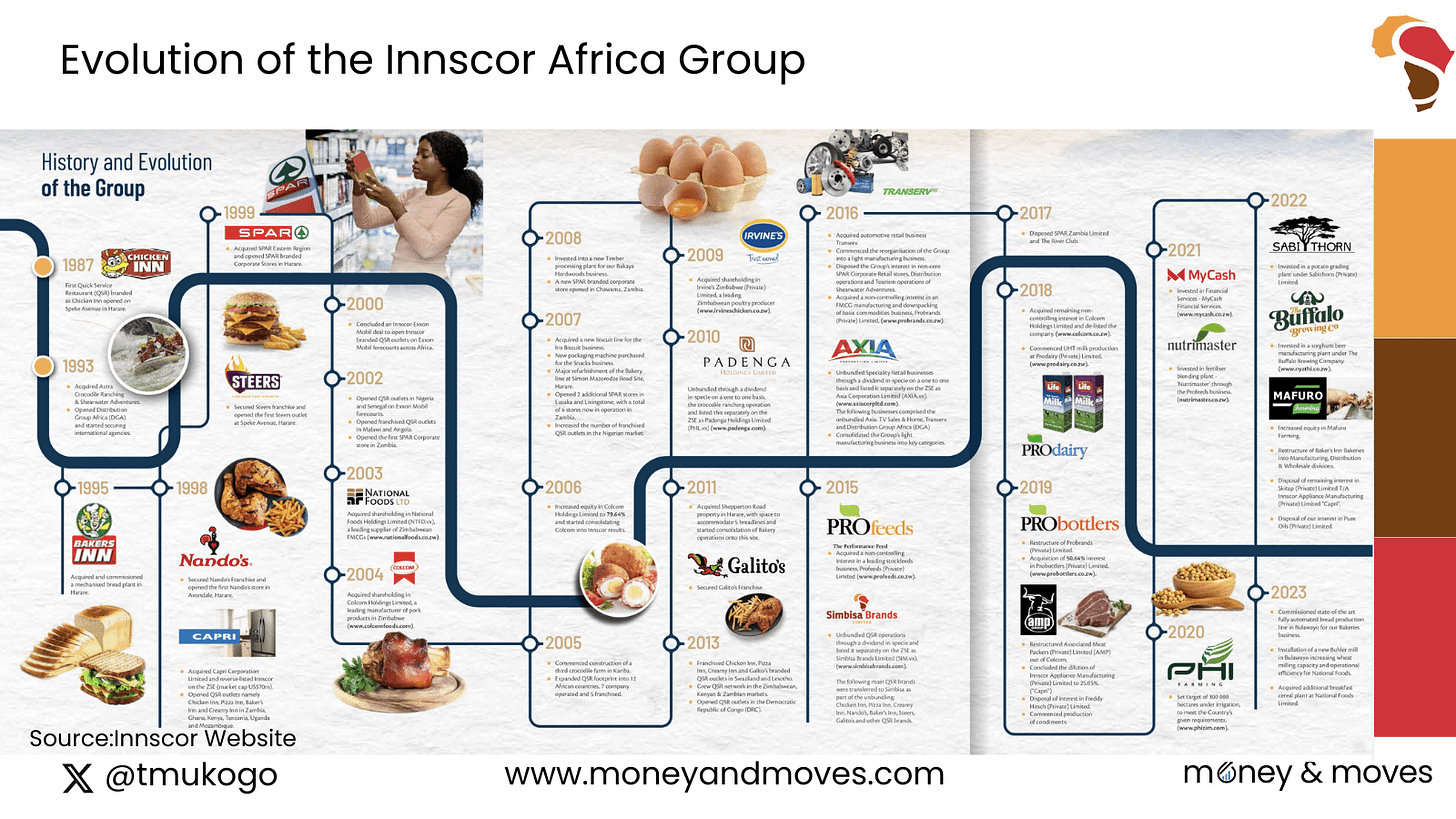

Secondly, when it comes to capital allocation “Innscor DNA Companies” (companies affiliated with or were unbundled from Innscor) have been like Real Madrid in the Champions League.

Lots of wins and very few losses.

If you look at the evolution of the Innscor Group and their DNA Companies there are not many investments or capital allocation decisions that didn't work out.

Even more recently the investment in building Innbucks looks to be another hit.

So for Simbisa to increase the capital expenditure allocation to Zimbabwe from 42% to 63% to 81% you have to take note.

Most companies would love to be able to diversify outside of Zimbabwe but Simbisa which can diversify, is increasing investment in Zimbabwe. What’s going on?

This reminds me of a saying by Warren Buffet on investing and how to make money.

“Be fearful when others are greedy and greedy when others are fearful.”

Most people fear investing in Zimbabwe.

Now to be clear I don’t think this increase in investment is a general indication of the strength of the economy overall but it does indicate that amid everything, there may be pockets of big opportunities.

For Simbisa the opportunity seems to be to acquire as many prime locations as possible while competition is still low.

An article from Newzwire shown below with the acting CEO seems to suggest this is the plan.

I can see how this strategy could be a smart move.

In an article from Harvard Business Review, the authors note that the most important success factor for a Quick Service Restaurant is location.

By securing the best locations now, Simbisa can secure its market position and fend off the likes of KFC who seem to be making an aggressive drive in Zimbabwe.

Simbisa Brands Managing Director acknowledged the threat from KFC whilst making a subtle dig at local competitor Chicken Slice in an interview with Newsday (see quote below).

If Simbisa ends up with a dominant position in terms of ideal restaurant sites and also manages to steward its brand well then it could end up with a sustained competitive advantage which is always attractive to investors.

The only other question would be based on the financials and the strategy what would be a good price point for an investor in Simbisa?

I have been thinking a lot about this and may write a follow-up article. Be sure to subscribe to this completely free newsletter so you dont miss it.

As always, I am working off of publicly available information so I could be wrong in my analysis. I provide the sources I looked at so you can challenge my analysis or form an alternative view.

Always on point. How do you compete against a company with financial muscle and outlets to walk the talk. Not forgetting the Supply and value chain. You know even as a supplier its hard to get into the system without serious competence and financing to meet the hectic demand.

As usual, well written and well researched. You raise very good points here. The CAPEX tells a lot, coupled with the PE ratio and a fair enough Dividend Yield of 4%. Simbisa stock is definitely a BUY!