Jumia's Q3 Financial Results: Meaningful Progress, But Headwinds Remain

Jumia just released their financial results for Q3, and it seems it Jumia is moving in the right direction (fewer losses) but will it get to its final destination (profitability)?

Let's unpack all the details.

🧵 THREAD 🧵

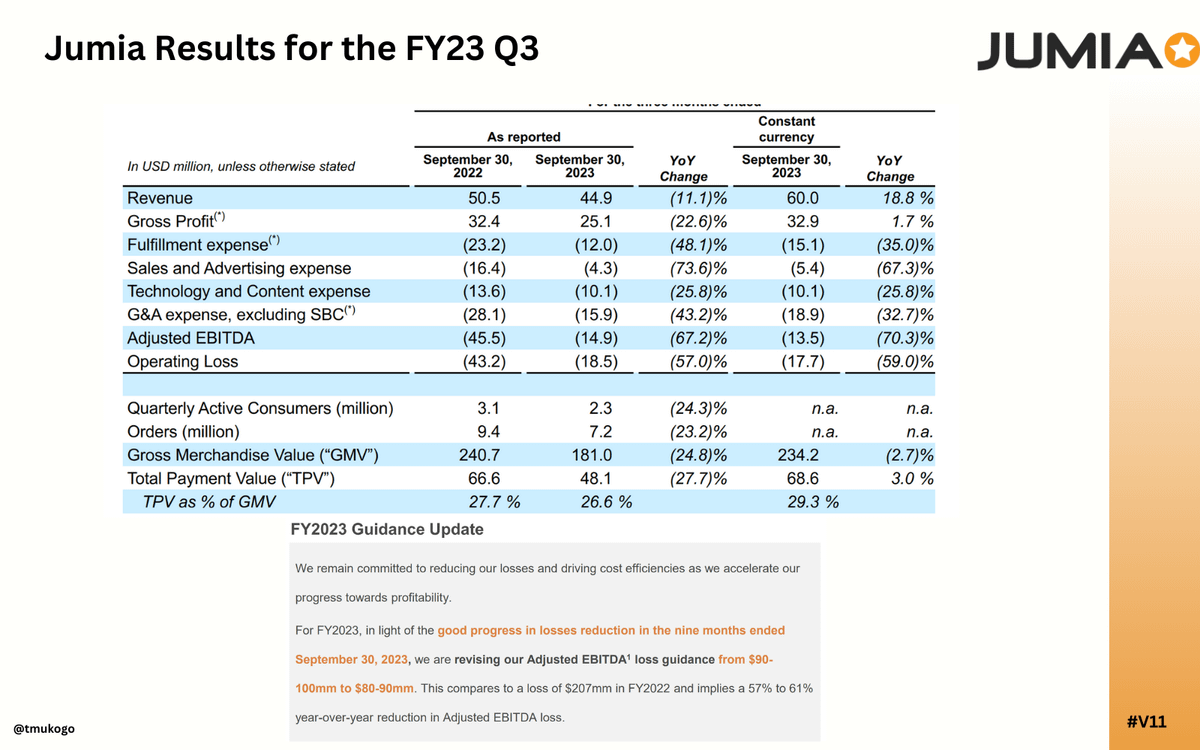

The new management must be given some credit for delivering on their promise of reduced losses. Adj EBITDA was down 57% vs last year from $45.5m to $14.9m.

They even raised their own loss reduction target by another $10m from the previous quarter due to "good progress".

The measures have taken have been drastic. General & Admin expenses are down 33% driven by a 19% headcount reduction and relocating some team members from Dubai to Africa.

PS: This is going to be a trend for many other start-ups especially with the currency depreciation.

The biggest cut has been in Sales & Advertising 74%. This is an interesting one.

It seems Jumia's new big bet is that the biggest issue in Africa is not generating demand – i.e. persuading people to buy but rather ensuring supply - i.e. having everything a customer wants.

This is the reason why Jumia has been able to cut sales and advertising so much. They are no longer focused on marketing any more.

Below is the extract from their results publication explaining their approach of focusing on supply rather than demand.

They may have a point. Demand in Africa is not lacking, especially in their core categories: Phones, Electronics, Home & Living, Fashion, and Beauty.

What they maybe underestimating is that while there is significant demand, the real limiting factor is affordability.

This explains why Jumia was growing fast (e.g. slide below from Q3 2021) when it had high sales & advertising expenses (i.e. discounts)

You will always have customer growth if you sell $100 for $50.

Now that Jumia has pulled back these discounts the growth has stalled.

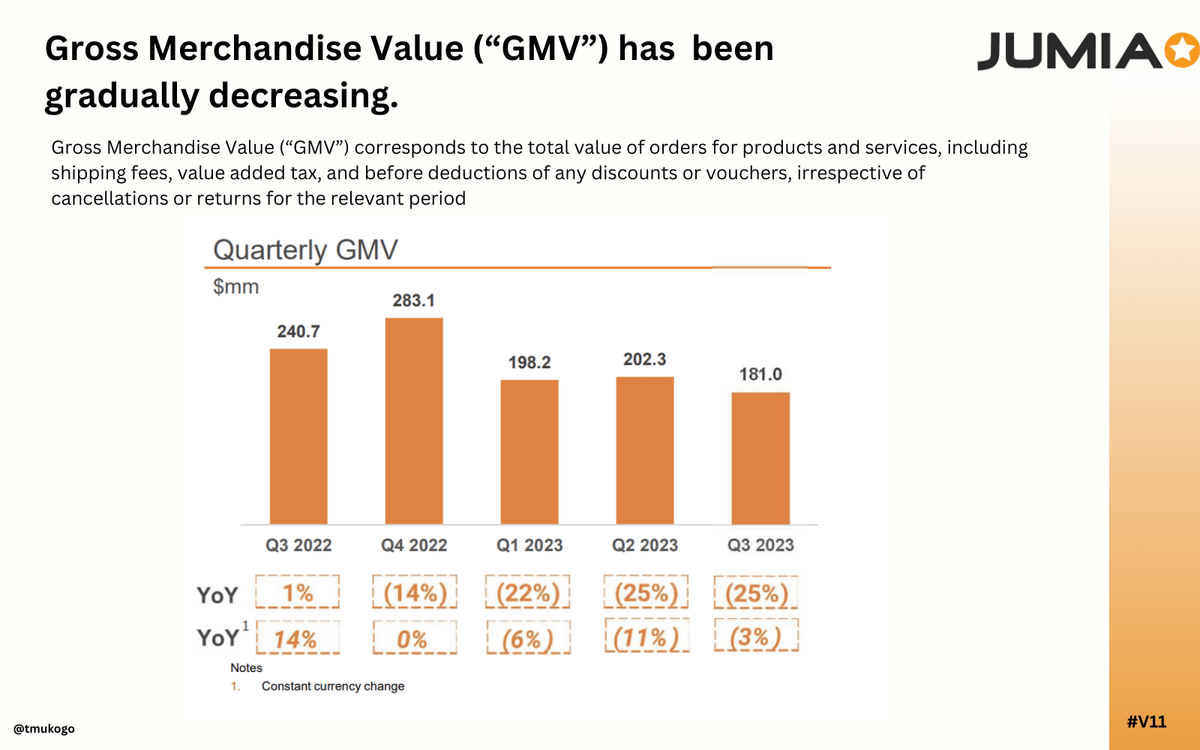

Compared to last year Active Consumers are down down 24% and are flat vs Q2 this year.

Nothing is harder then keeping a customer who got used to lower prices.

This trend is concerning. Normally a tech company = growth.

If you are growing fast & profitable – fantastic!

If you are growing fast but not profitable – still ok.

If you are growing slowly and unprofitable – well no one knows what to do with you.

Hitting targets from cost cutting can help with creditability but cost cutting can only go so far. There needs to be real growth in revenues.

Jumia does try to sprinkle some optimism saying that in 5 countries GMV increased despite the over 25% drop.

I am a little bit skeptical,about this GMV growth in these 5 countries, which could just be increases in prices due to inflation or smaller countries that grow inherently due to their size.

I will need a little more to be persuaded that there is real, meaningful growth.

Jumia also needs to act fast. Cash on hand is $147m and this quarter Jumia spent on average $8m a month operations .

With that run rate, Jumia has about 18months before running out of cash and without a compelling growth & profit story it will be difficult to raise money.

I think the management team has done well to build some credibility with cost management but now there needs to be some measures on the revenue side that can inspire confidence. Declining or flat growth Quarter to Quarter won´t cut it.

It wont be easy, the macro situation is challenging and we haven’t yet even talked about the impact of FX. When you look at the numbers in USD terms it can get depressing very quickly with revenues down 11.1%.

But for now one problem at a time.

Without a big change in the revenues, in a weird turn of events the "old and slow" brick and mortar stores may just end up beating out the "fast and cool" tech start-up.

What do you think?

Please leave a comment!

If you found this thread interesting, you may also find the below threads worthwhile.

Recommendation 1 of 2.

https://twitter.com/tmukogo/status/1712840797840896054?s=20

Recommendation 2 of 2.