The End of EcoCash Holdings

Did a Lack of Focus Contribute to Their Struggles?

When EcoCash Holdings (then called Cassava SmarTech) was listed in 2018 its share price was $1.49 today its share price is about $0.07.

How could a company set up for success struggle so much?

Before we dig in let me provide some context.

Based on the latest Cautionary Announcement, it looks like EcoCash Holdings will transfer all of its businesses except for Steward Bank to Econet Wireless thereby marking the end of EcoCash Holdings as we know it today.

This also effectively reverses the demerger that occurred 5 years ago.

In 2018 when EcoCash Holdings, then called Cassava SmarTech demerged from Econet Wireless the below reasons were given to shareholders.

There is a lot to unpack but for today we will focus on the reasons highlighted in the slide below of "enhanced management focus" and "focused implementation".

When it comes to strategy, focus is one thing that sounds simple but is incredibly powerful for big and small companies alike.

Unfortunately for EcoCash despite "focus" being a key reason the business was demerged, it doesn't seem to have been their strength.

In one of the first communications to the world, EcoCash (formerly Cassava SmarTech) introduced itself as an "Integrated Smartech Business" working on Fintech, Social payments, Healthtech, E-commerce, Insurtech, Edutech; Agritech; and On-demand services.

That's a lot.

Most if not all of these business segments would have been hard to tackle individually as they either had established players e.g. insurance Old Mutual, Nicoz Diamond or were new segments without a developed market e.g. e-commerce or on-demand services like ride-hailing.

Despite this EcoCash did try to tackle them all.

Let's see how things went starting with their E-Commerce platform "Ownai" which from the presentation below looks was relaunched in December 2018.

My guess is Ownai was supposed to be like Amazon or Takealot but it gained limited traction. As of today, it is not in the top 10,000 most visited websites in Zimbabwe.

It is also far behind the classifieds.co.zw website, which can be viewed as a competitor. On websites most visited in Zimbabwe classifieds.co.zw is number 27 whilst ownai.co.zw is number 14,453.

Next is Vaya.

Vaya Mobility in FY 2023 managed to do 40,400 trips based on information in the Annual Report.

Assuming the average trip is $10 that would be revenue of about $400k. Not much of a contribution to a company which should be able to pull in over $100m in revenue. (in 2017 EcoCash had revenue of $77m)

On Edutech, Akello seems to still be in the early days of figuring out what the ideal business model is.

Akello was recently restructured and the KPIs for the business are mainly non-financial. Most likely this business is still in the loss-making/investment phase.

On the HealthTech end, EcoCash then Cassava SmarTech had talked a lot about Maisha Medik.

This was supposed to be a healthcare super app with the ability to schedule medical visits and manage medical records including prescriptions, lab results, scans etc.

After appearing in all the previous annual reports Maisha Medik is no longer mentioned in the 2023 annual report.

The Maisha Medik app on the Play Store only got about 1,000 downloads and hasn't been updated since 2021. It looks like this could be another business that wasn't able to scale.

The insurance business has made some traction and is the only other business that today is big enough for EcoCash to report separately as an operating segment. Everything else is so small it just falls under "Other" in the segment reporting (see slide below).

In 2020 the insurance business was close to half the size of the Digital Banking business but as of 2023 is now nearly the same size based on revenue. This indicates that there has been some growth.

The blemishes are that the InsurTech business was not profitable in FY23 (which is forgivable) and when you look at industry data it looks like it hasn't gained that much market share since 2019 (about 1%).

So it has made progress but is still not a leading player.

Now consider this, in every segment mentioned above EcoCash as a whole was probably bigger and had more money and more staff than most competitors.

But all those strengths were not focused but split into multiple efforts and ventures.

This is also a lesson for small businesses.

When competing against a big company, you can use focus as a strategic weapon by being focused on a specific market or customer.

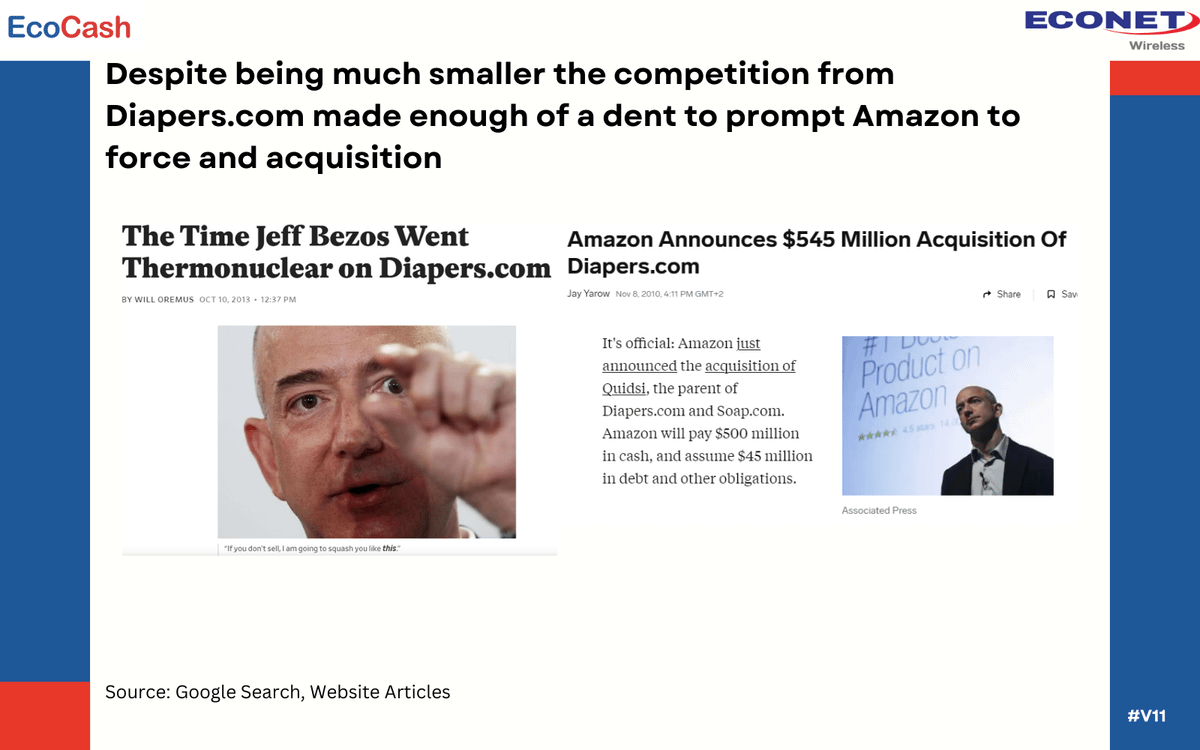

An example of this is diapers.com, which had to compete against Amazon, which is huge (by market cap it is currently bigger than all the listed companies in Africa combined).

By focusing on one part of the market, however, specifically diapers and baby-related essentials) diapers.com made significant progress in eating into Amazon's market.

It was doing so well that Jeff Bezos personally got involved in forcing the company to sell to Amazon for $545 million.

In a way, this is maybe one of the reasons EcoCash Holdings struggled.

They were bigger as a whole but were coming against more focused companies. In the end, it seems, they tried too many things and now it's hard to point to a big success that wasn't already there before the demerger.

All things considered, I understand why Econet is looking to bring EcoCash. Econet still has a very strong team so I am sure they will turn things around and I am excited to see what they do next.

Here are some guesses.

Steward Bank will be sold soon.

A lot of the experimental businesses such as Vaya Ride Hailing will be closed down and there will be more focus on core businesses.

Due to the second point above there will be some staff cuts at the management level.

Overall I think these moves could be good for the business but let’s see.

I am working off of public information so I could be missing something or just simply wrong in my analysis and so I would like to hear what you think.

Opposing views are welcome and encouraged!

Thanks for reading. If you found this interesting be sure to check out other posts on www.moneyandmoves.com. If you have not subscribed please consider signing up to never miss a post.

Every decision, whether made by an individual, a group or an organisation must be based on insight and not emotion or excitement. Critical decisions must be made based on tried and tested thinking tools that makes it difficult to make mistakes which people fail to account to. The fact that much of the sub initiatives of this entity fail, get dropped along the way and yet the trend continues speaks a lot about how decisions are made in this organisation.

On an article titled - The Fundamental Congruence Checklist — A Ten Question Smart Decision Toolkit That Will Change the World - https://shorturl.at/nwBK5, I explain the importance of adopting an effective Thinking Tool in Decision Making