The Week Ahead: Gold Prices, African Stocks Soar, the IMF on Economic Growth

These are the most important Stories to Watch.

For the week ahead, these are some of the most important stories to watch.

Gold prices reach another record.

Gold is to the global economy what property is to a Zimbabwean — the ultimate hedge.

Whenever uncertainty about the future of the global economy rises, gold prices tend to follow.

And when you think of the global economy, you have to think of the United States.

When you think of the United States, you have to think of Donald Trump.

When you think of Donald Trump, you have to think of uncertainty.

And when you think of uncertainty, you buy gold.

The above is a very simplified thesis of what is driving up the gold price, which hit a record $3,896 per ounce last week, marking a seven-week winning streak that’s pushed year-to-date gains to nearly 50%.

→ Reuters: Gold set for seventh weekly rise

The more technical explanation for the recent rally, at least, is uncertainty due to the U.S. government shutdown, threats to the Federal Reserve’s independence, and record central-bank buying — particularly from emerging economies diversifying from the U.S. dollar.

HSBC and Goldman Sachs both see gold passing $4,000, so the rally may have some room to go, which leads into the next story to watch.

→ Reuters: HSBC says gold could trade above $4,000/oz

Stocks Surge Across Africa with a little bit of help from Gold

African markets are outperforming the world in 2025.

Bloomberg reports:

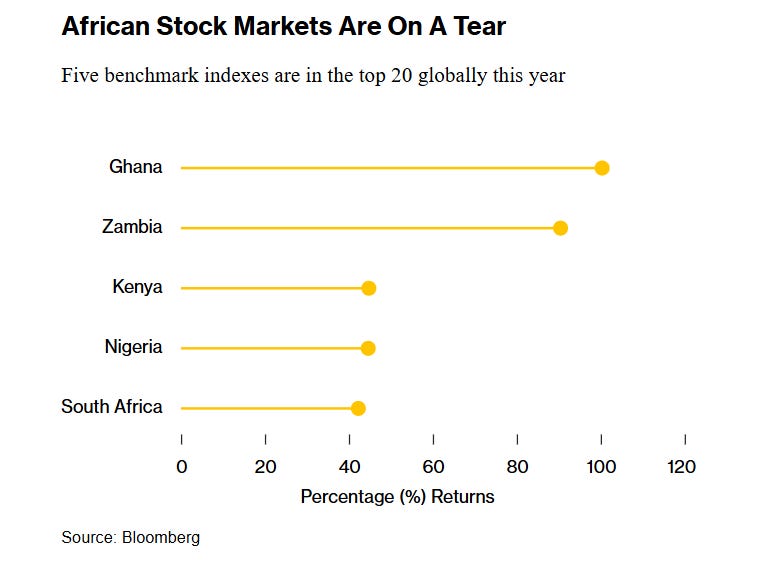

“Ghana was in first place among the world’s best-performing stock markets in dollar terms this year tracked by Bloomberg, followed by Zambia in second place, Nigeria in 14th, Kenya in 15th and South Africa in 21st spot.

The “dramatic rises” are partly due to reform, rate cuts and dollar weakness globally, said Charlie Robertson, head of macro-strategy at FIM Partners. The dollar has sold off amid investor fears that US tariffs on trading partners may threaten growth and reduce global demand, reinforcing expectations of lower US interest rates.”

→ Bloomberg: African stock markets outperform global peers

Meanwhile, Zimbabwe’s Victoria Falls Stock Exchange (VFEX) has also risen 45 percent year-to-date, driven by gold-linked counters like Padenga and Caledonia.

Caledonia, for example, is up 288% year-to-date.

If the gold price continues to rise, expect these stocks to continue on their upward trajectory.

This also shows how big an impact global trends can have on local stocks, particularly those closely tied to commodities and metals.

Zimbabwe's Economic Growth is on the rise, with a little bit of help from Gold.

The IMF projects that Zimbabwe’s economy will grow by about 6% in 2025, driven by a favourable agricultural season, remittances, and record gold output. The government's forecast is even higher at 6.6%.

→ Reuters: Zimbabwe economic growth rate to rebound to 6% this year, IMF says

This is good news; however, I often find economic forecasts challenging to interpret in terms of their implications for businesses, as many companies do not anticipate significant growth for next year.

That said, you also find other companies, such as Innscor, registering close to 20% revenue growth in one year to reach over $1 billion in revenue.

Perhaps there is more money in the economy than we initially think?

The IMF, however, also pointed out macro risks from rising fiscal pressures and the need for clarity on the plans to phase out reliance on the U.S. dollar.

Where’s the Money, What’s the Move?

For investors: If you’ve had exposure to gold-related stocks, you’ve likely done well. The rally may have further to run, so monitoring U.S. policy developments will be critical. With Trump’s predictable unpredictability, gold’s safe-haven appeal isn’t going anywhere.

For businesses: Companies in the gold sector are doing well. If you offer services they need, now might be a good time to make a pitch.

For those operating in Zimbabwe, while the environment is challenging, the economy may be bigger than you think.

Companies willing to invest more capital in strategic sectors have been able to grow meaningfully over the past few years.

If IMF projections are any indication, there is still opportunity ahead.