Think Your Taxes Are High? They’re About to Get Higher

As Delta faces a record $74 million tax claim.

Taxation Authorities Business Model

I like to think of the Taxman (taxation authorities such as ZIMRA or SARS) like a business.

When you do this, the first thing to note is that the Taxman's business model is very simple.

Number of Taxpayers x Average Tax Paid = Revenue.

Unlike other businesses, however, the Taxman can't increase revenue by mergers and acquisitions or international expansion or new “products” (tax laws are created by parliament, the tax authorities just execute).

This means the Taxman has only one trick. If the Number of Taxpayers drops, then the Average Tax Paid by those who remain must go up to maintain revenue.

In theory, the Taxman could try to increase the number of taxpayers (or Customers in the Taxman’s eye) by targeting people who are not paying taxes, such as those in the informal market.

However, that would be an inefficient strategy.

Acquiring “new customers ” in business is always more difficult and expensive. Harvard Business Review estimates that acquiring new customers can be “anywhere from five to 25 times more expensive” than keeping the customers you have.

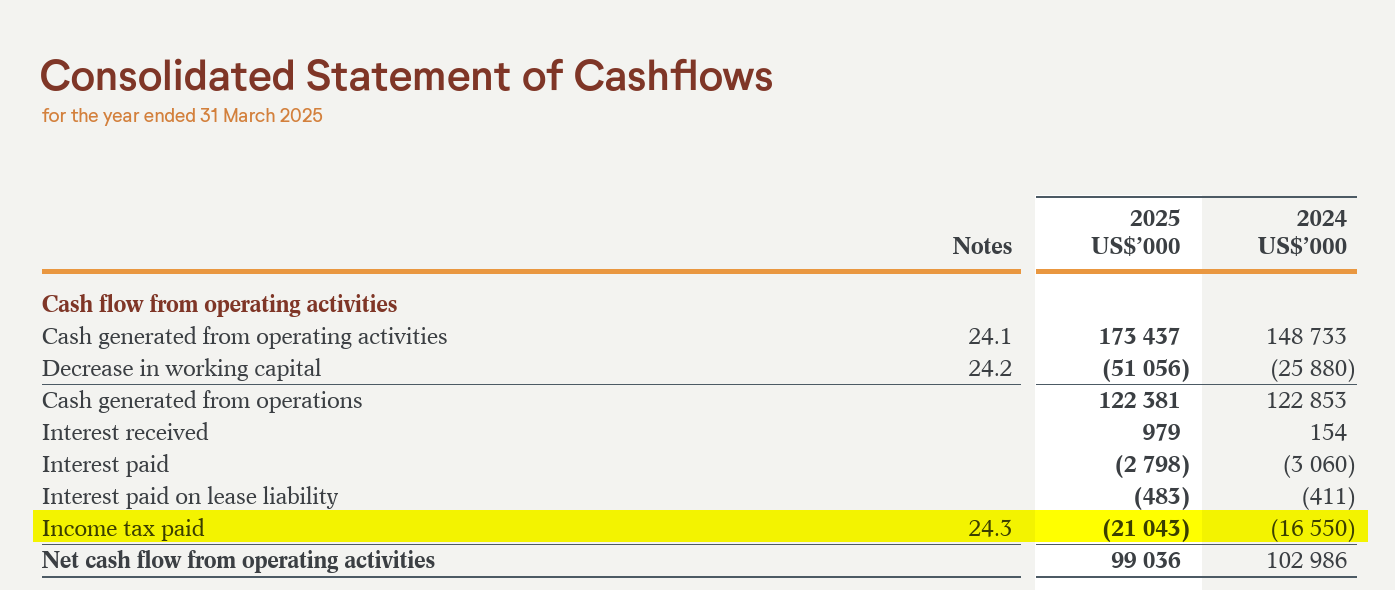

Consider this. Last year, Delta Corporation (Zimbabwe’s Largest Listed Company) paid $21m in income taxes alone.

Assuming the average unregistered informal trader generates $10,000 in profit per year, at a 25% income tax rate, it would require over 8,000 informal traders to replace the tax revenue from Delta Corporation (Delta).

Who wants to chase after 8,000 informal traders? Even if you did track them down, they may not be able or willing to pay the taxes.

Much better to target the “customers” you are already in contact with and find a way to make them pay more tax.

While on the subject of Delta and paying more tax.

Delta Losses Tax Claim Appeal

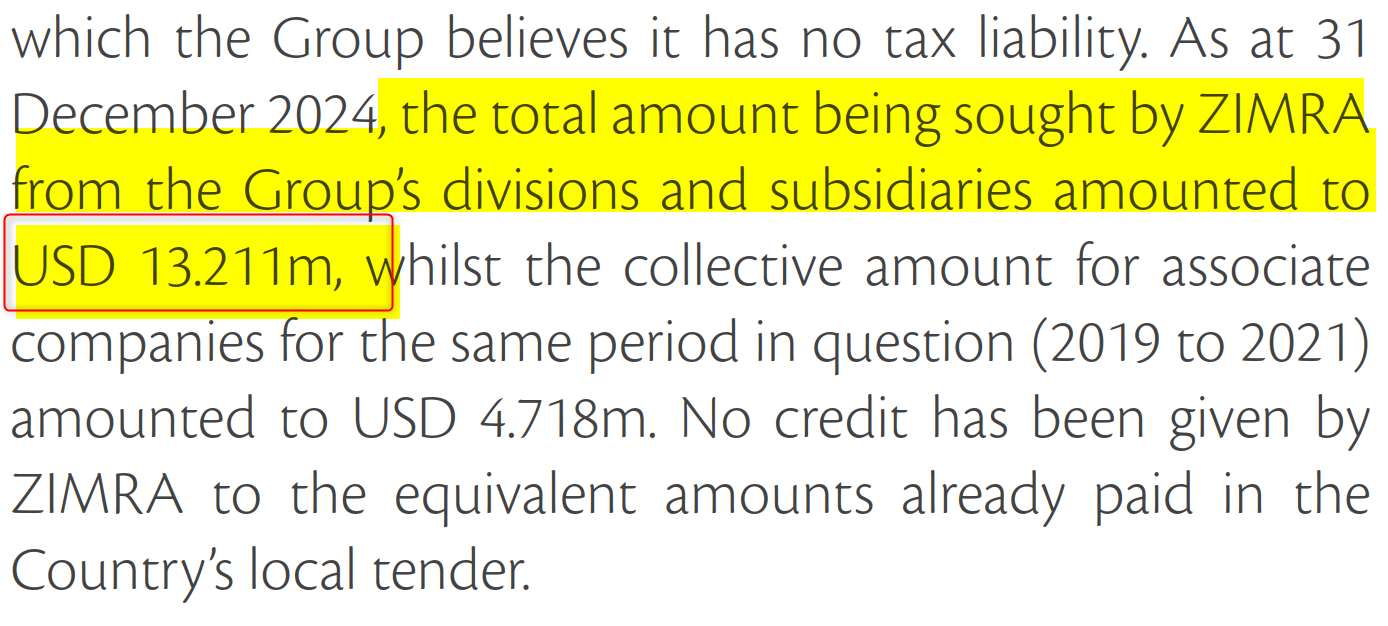

Last week, Delta lost its appeal against a record tax claim of US$74 million from ZIMRA.

The claim arises from further assessments during which the Taxman (in this case, the Zimbabwe Revenue Authority, also known as ZIMRA) argued that Delta had underpaid tax because it remitted tax on foreign income in local currency.

This claim is huge.

To put it into context, the additional tax that Delta will have to pay is more than the combined market capitalisation of all the country's listed retailers. (OK Zimbabwe, Meikles Limited / Pick n Pay)

A few things we can learn from this.

Fear God and Taxes

There is an interesting parallel that can be drawn between God and taxes.

In the Christian tradition, there is the idea that no one is without sin. Everyone messes up.

With tax, I think the same is true. If someone looks hard enough, there is always something they are messing up when it comes to taxes.

As the largest listed company in the country, Delta can afford the best tax consultants and advisors, and can even have people dedicated full-time to tax matters.

However, even they got nailed by the tax authorities. So did Carlo Ancelotti, by the way, and before him, Ronaldo and before him, Messi.

All have “sinned” and been found wanting by the Taxman.

In the case of Delta, whether or not this was “an avoidable sin” would require detailed inside information and tax experts, but the courts ruled that the fine should stand.

Prepare to be taxed

Recently, the Zimbabwe Revenue Authority (ZIMRA) stated that it is confident it will meet its 2025 revenue target of $7.2 billion, roughly an 18% increase from last year.

Now, as we highlighted above: Number of Taxpayers x Average Tax Paid = Revenue.

The number of taxpayers has been dropping due to the economy becoming more informal and companies closing. This means that for ZIMRA to meet its revenue target, the remaining taxpayers will have to pay more on average, a lot more.

Those “remaining taxpayers” are you if you are operating in Zimbabwe.

So expect more tax audits and tax fines than ever before.

Where’s the Money? What’s the Move?

In this case, it's not so much about making money as saving money by avoiding a crippling fine.

There is obviously more risk associated with being targeted if you are a large and successful entity.

This year, in addition to Delta, Innscor has already disclosed in its half-year report that ZIMRA is looking for an additional $13 million in taxes from the group.

If you are a smaller company, at the very least, ensure that your basics are in order.

There is a temptation to try to avoid tax if you are a small player or have never been audited, but it’s a risky move.

If the Economy is forecasted to grow 6% but ZIMRA wants to increase revenue by 18% they will be more aggressive.

Fear God and fear taxes, and potentially save yourself from judgment.

I think the articles title should've been THE TAXMAN FROM HELL... Anyway 😂 jokes aside. I believe since the court said Delta has to pay the tax and Delta itself haven't done any much publicity fighting means, they have the money and are capable of comfortably paying it. I now want to know how much the platinum mines are also being charged for tax? 😂😂