Struggles in South Africa's Home Loan Market

Standard Bank, ABSA & Nedbank recently released their half year financial results & they all have a common theme — people in South Africa are struggling to pay their home loans at an alarming rate🔥🚨!

🧵..Full background and analysis + V11s👇🏾

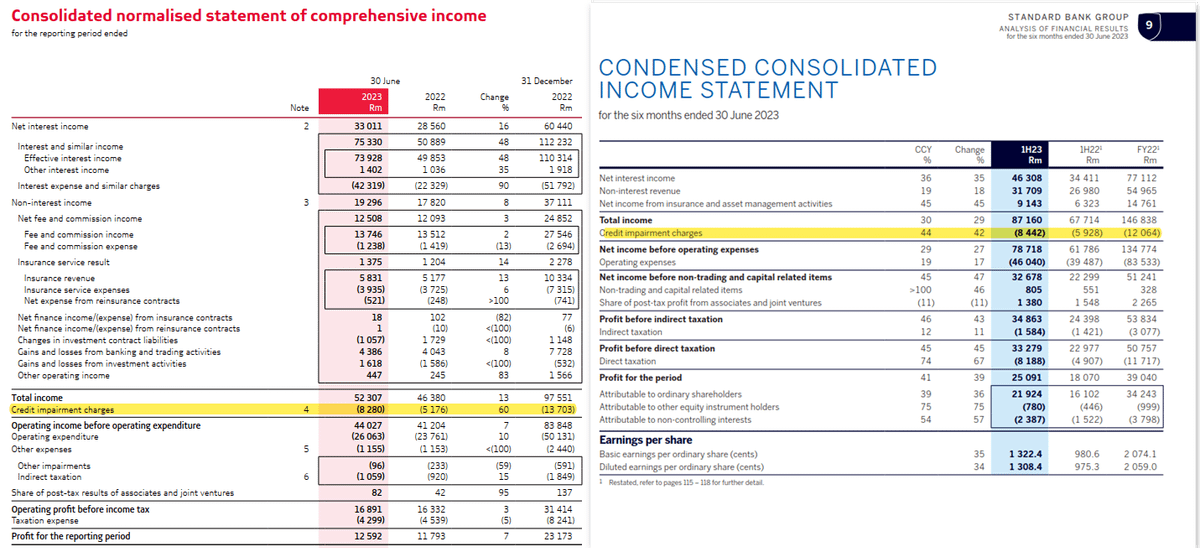

The Credit Impairment Charge, which represents the estimated value of loans that won't be repaid, has increased significantly for all banks:

Standard Bank +42% 😮

Nedbank +57% 😳

ABSA +60% 😱

It gets really interesting when we break out where the impairments are coming from.

Among all the different loan types, the most significant increase in credit impairments has been with home loans. e.g. for ABSA the charge increased +258% 🤯 from R272m to R975m as shown in their financials below.

For Standard Bank we see the same trend. The credit impairment charge for home loans increased 72% (85% if taking SA alone 😮) much higher than other loan categories e.g. in Vehicle & Asset Finance and Cards impairment charge only increased 11% and 10% respectively.

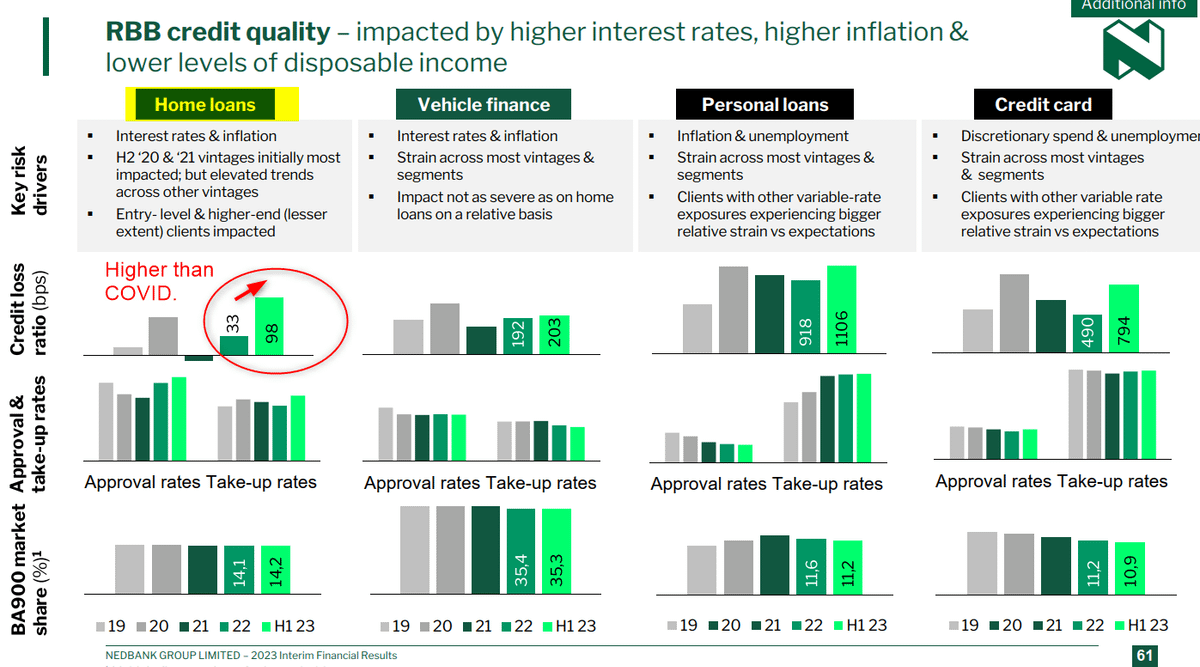

At Nedbank the credit loss ratio tells the same story. Simplified this ratio is the value of loans that won't be repaid as a % of all loans. For home loans this has increased 3x, from 33 to 98bps. For other categories e.g. credit card debt the increase has not been as steep.

Despite these challenges, Standard Bank's (SA only) headline earnings were up 17%🚀. However, Nedbank and ABSA's (SA only) earnings felt the impairments and were down -1% and -17% 🤕 respectively. The pain could have been worse if it were not for the high-interest rate environment.

Important Tangent - This is something some people may not know.

Interest rate hikes are generally good for the banks and generally bad for you (especially if you have a big home loan). This is explained well below👇.

Home loans are the most unforgiving type of debt.

If car payments become overwhelming, you can sell your car in a day & move on. However, selling a house takes 3 months & significantly impacts lifestyle e.g. it can mean the kids' schools are now too far away.

Home loan repayments also tend to be the biggest single household expense so when interest rates rise it stings. 😣💸

And since Nov 2021 there have been 10 interest rate hikes totaling 4.75%.

Such hikes can wipe you out as will be shown next.

In 2021 if you earned gross R51 686 p/m and net R39 776 p/m you could qualify for a home loan worth R2 million with a payment of R15 505 p/m.

This would mean after taxes and loan repayment you would be left with R24,271 (R39 776 - R15 505).

Today, for the same loan, you pay ~R21,674 p/m because of rate hikes.

So your cash left over is now only R18,102 (R39,776 - R21,674) instead of R24,271. 😭

Effectively, you've had a 25% pay cut - ouch! 😣

What makes this worse is people in SA are already deep in debt.

The latest Credit Stress Report from Eighty20 shows that among the higher earners in SA, 60%-70% of their income goes towards a monthly debt instalment.🤯

So, imagine what a 25% "pay cut" would do to them. It's like a team that is losing 5-0 & then sees Messi warming up.

This is also what worries me about companies like Balwin Properties the lifestyle-themed property developer. They have a huge inventory of apartments on hand.

In the Johannesburg suburb of Waterfall alone, at year-end, they had 4,188 apartments to sell...😱

Judging by their marketing, such as offering Louis Vuitton bags, Balwin is targeting young, lifestyle-conscious buyers 📸🍾🛍️, a segment that credit reports indicate is under financial strain.

With the macro environment, I also don't see this segment growing quickly.

My concerns have probably been priced into Balwin's stock already, as their P/E ratio is low at 2.7 📉

For reference, MTN's is higher at 18.2, which makes sense since MTN has more growth potential.

Balwin is good at what they do; it's just a difficult environment. 😩

The good news is that after 10 straight rate hikes, there was a pause in July.

The bad news is the Reserve Bank is still open to more hikes although most fund managers think they won’t.

If hikes do continue, we could see even more people struggling with their home loans 😰.

Personal Finance Reflection 1

To save yourself from future trouble, when taking a home loan model how much you would need to pay if the interest rate was hiked a few % to check your how exposed you could be to changes in interest rates.

Personal Finance Reflection 2

Never outsource your responsibility for good financial decisions to a bank. Just because you qualify for a loan it doesn't mean that you can afford it.

Every repossessed car or home was for a loan that someone qualified for.

Personal Finance Reflection 3

Debt can make you believe you are richer than you are.

A good wealth test is how long could you maintain your current lifestyle if you you stopped working today. Ideally, you should be able to go for at least a year.

If you enjoyed this thread I can also recommend two other earlier threads.

Recommendation 1 of 2

https://twitter.com/tmukogo/status/1676121171706671105?s=20

Recommendation 2 of 2.

Thanks for reading!

https://twitter.com/tmukogo/status/1668948904975515651?s=20

Post originally published on Twitter / X.