Visual: How Capitec Forced Old Mutual to Build a New Bank

I couldn't understand why Old Mutual would launch OM Bank until I looked at this chart comparing Capitec's Return on Equity to that of other banks. Then it made sense.

It also highlights an important lesson that every business leader should know.

Let’s unpack!

About Capitec

Capitec is one of the most successful banks in Africa, and at one point in the year, it became the most valuable bank.

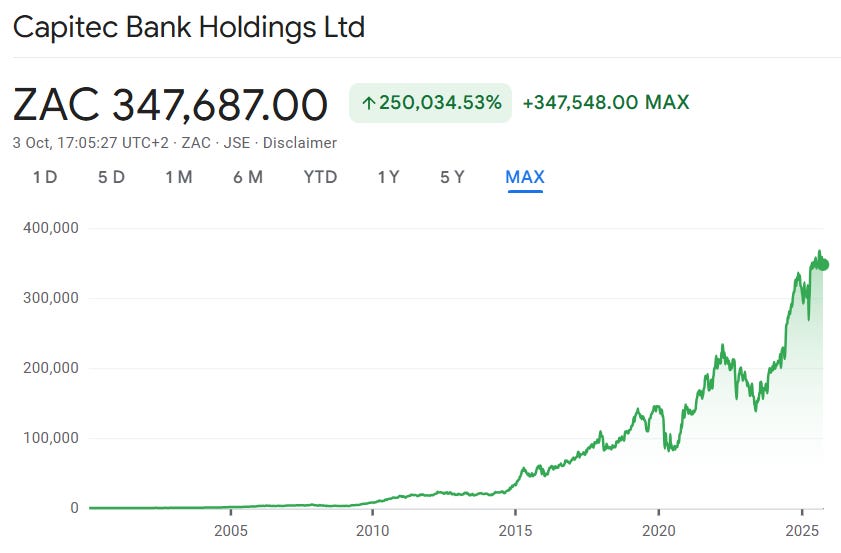

Its share price has increased by a staggering 250 thousand per cent since its IPO.

For context, if you had invested R1,000 when it went public, you would have over R2 million today.

Return on Equity and Capitec’s Numbers

Return on Equity (ROE) measures how much net income you generate from your Equity (essentially your assets less liabilities).

When comparing ROE between companies, the best practice is to compare ROE for similar businesses.

The indirect implication of this is that if companies have vastly different ROEs, then it’s a sign that their business models are very different.

While Capitec, Standard Bank, ABSA, and Nedbank are all banks, the significant gap between Capitec's ROE and the others indicates that it operates with a distinctly different business model.

Capitec targets the mass market, low-income category that traditional banks overlooked. One of their key profit drivers has been short-term, unsecured personal loans, which, as expected, have been a significant draw for this segment.

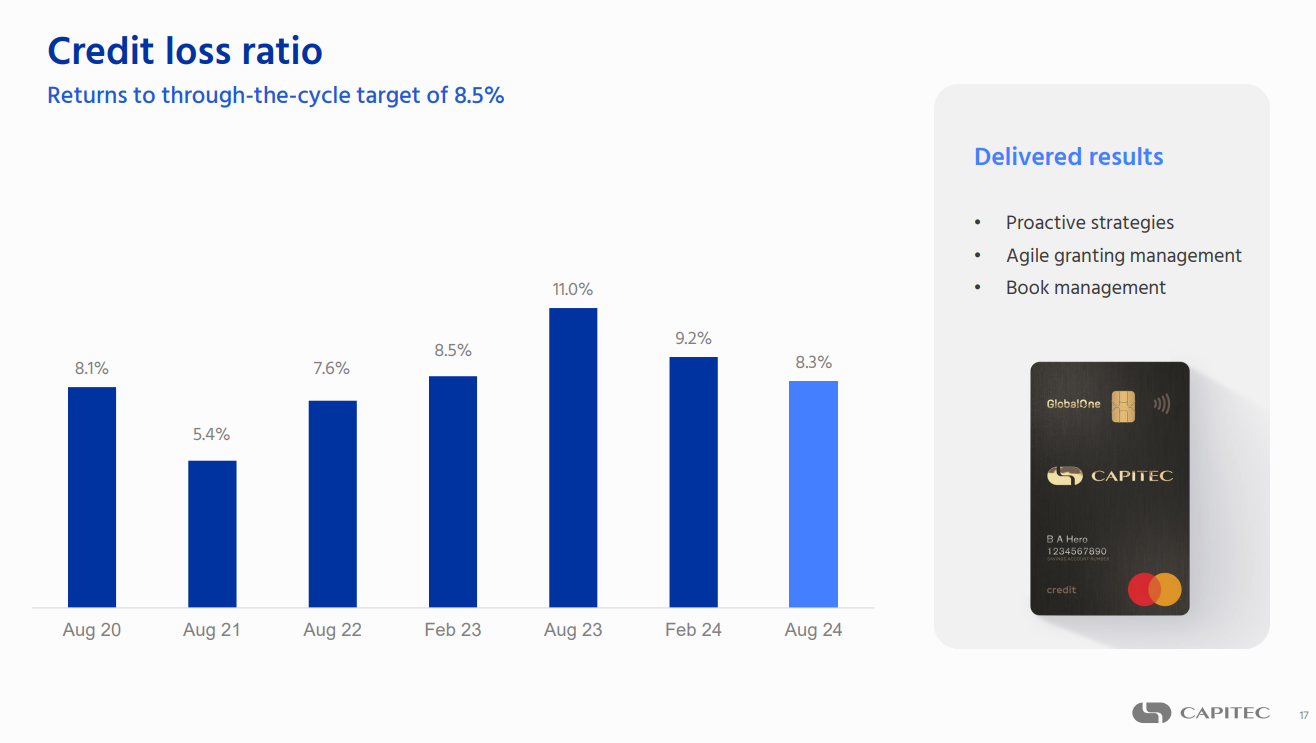

Taking this approach has meant assuming more risk, resulting in a significantly higher credit loss ratio (the estimated percentage of loans not repaid) of about 8.5%, compared to other banks, which typically aim to be below 1.0%.

The higher risk, however, has also resulted in more profitable loans, as Capitec has a net interest margin of around 8%, compared to other banks, which range between 4% and 5%.

Capitec also has a significantly lower cost-to-income ratio (the amount spent to generate income) of around 40%, compared to most other banks, which are typically around 50% or higher.

All this combined results in a significantly higher ROE, as shown in the earlier chart.

The big gap between these ratios further demonstrates that Capitec's business model is unique, and it has not had like-for-like competition for years.

It also highlights that, as a bank, it's extremely challenging to pivot your existing business model, even if there is a more attractive segment; otherwise, competition would have followed suit.

This is perhaps why Old Mutual decided to establish a new bank from scratch, despite its previous involvement in banking through Nedbank, which it controlled until 2018.

To compete in the space Capitec has dominated, Old Mutual couldn’t remodel an existing bank; it needed to build a new bank, tailored to the segment and strategy it is targeting.

That’s where OM Bank comes in.

Where’s the Money? What’s the Move?

The essence of exceptional business strategy is making your competition irrelevant. This is one of the core ideas behind Blue Ocean Strategy.

Capitec targeted a segment and built its operations to create an offering so distinct that traditional competitors became irrelevant—no other bank was structured to meet the customer needs in the same way.

If you can achieve this in your own business, you’ll unlock years of exceptional returns while competitors struggle to compete.

Consider Apple’s ecosystem: even when other phones have much better features, the ecosystem makes alternatives irrelevant to Apple users. People will just buy iPhones.

How can you make your competition irrelevant?

P.S. I studied Blue Ocean Strategy at INSEAD. If you’re interested in applying this framework to your business, let me know.

Just now thinking how long ago was the IPO mmmmm

This is very interesting especially following the first capital analysis which seem to be following the same route. Now wondering, is it mainly.about the numbers in individuals or just businesses being given loans are struggling compared to individuals being given loans. At least according to analysis done banks so far??