Visual: Zim Banks Hold More Property Than SA Giants

How local banks' investment property holdings stack up against South Africa's banking giants. The results might surprise you.

Investment Property Holdings of Zimbabwean Banks

We’ve said this a lot lately,

In Zimbabwe, banking does not exist in the typical sense.

In most cases, you have payment processors, custodians, and property companies.

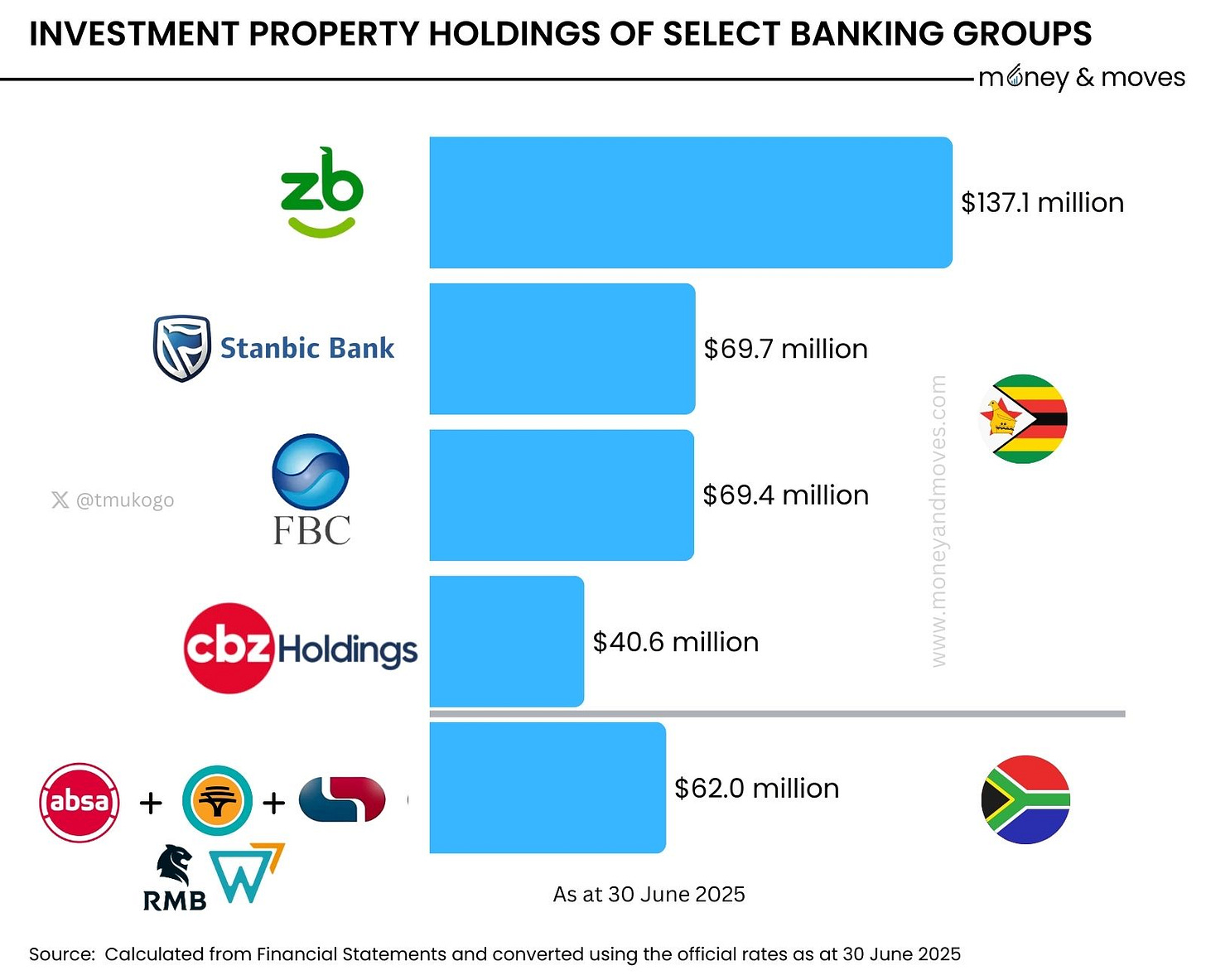

The following visual displays the banks in Zimbabwe with the largest investment property holdings, along with a comparison of select banks in South Africa.

To recap, an investment property is a property held for capital growth and/or earning rental income.

ZB Financial Holdings (ZB) has the biggest investment property portfolio at $137 million. However, this is also because it owns Mashonaland Holdings, which is actually a property company with $93 million in investment property. However, even after that is taken out, ZB still has investment property worth over $40 million.

Part of the reason CBZ wanted to buy ZB was actually due to its property portfolio. Newzwire quoted the CBZ CEO as saying.

“Our main attraction is not really banking, but the other business units, which is your insurance, which is your property”.

Zimbabwean Banks Compared to South African Banks

To show how significant Zimbabwean banking groups' investment property holdings are, the chart also includes the combined holdings of select South African banking groups for comparison.

If you add up the investment properties held by ABSA, the First Rand Group (comprising FNB, Wesbank, and RMB), and Capitec, the total comes to $62 million, which is less than the individual holdings of Stanbic, FBC, and ZB.

For context, the South African Banks shown in the visual are over 200 times bigger than Stanbic, but still hold less investment property.

This is not to suggest that this strategy doesn’t make sense for Zimbabwean banks. Property helps preserve value and can also generate USD returns from a ZWG investment. However, it highlights some of the anomalies in the market that will need to be addressed when (or if?) Zimbabwe normalises.

Where’s the Money? What’s the Move?

In terms of reading property trends, watching how the banks move could be a good indicator of when the property boom will start to cool.

Banks have a good understanding of market dynamics, have large portfolios and are currently very active. I think that for those interested in owning property, it could be worthwhile to see when banks start selling off some of their investment properties.

As highlighted earlier, banks don’t typically own large portfolios of investment properties, and so when things normalise (whenever that may be), these assets will be sold.

Perhaps this also presents a significant opportunity for someone to create a property fund focused on acquiring properties from banks?

There will definitely be a lot of market activity with properties once banks start selling off these assets.

For now, however, it appears that most banks are quite comfortable operating as property companies as well.

What do you think?

Thanks for reading. Think someone in your network should see this? Forward this email – you could help them make an important strategic decision.

PS: Some banking groups in South Africa, particularly Standard Bank Group, do hold significant investment properties, but mainly due to other business units (Liberty Group and Stanlib Asset Management). Even in this case, investment properties account for less than 1% of total assets, compared to ZB, for example, at 21%.

What a great article and very insightful for me as I am currently writing my master thesis on the absence of banking in Zimbabwe and how it affect the support for property development companies in the country..

I think the banks need to figure out other means to generate income, they still are backward in their strategies and are ignoring the fact that they can gain more money from focusing on banking only rather than competing with property developers.

Their assets should not be somewhere where they gain a lot of their income. Zimbabwe's banks should study how other international banks like Deutsche Bank, ING, Santander are doing it. They dont rely on property investments as much as Zimbabwean banks do.

...and what impact does this have on real estate prices and inflation overall? In your opinion what's the fair value of these holdings (in Zimbabwe)?