Caledonia's Financial Results: The Week Ahead

These are some of the most important stories to watch this week.

Caledonia Mining’s Financial Results

Caledonia Financial Results

This morning, Caledonia released its latest Q3 financial results. For those who don’t know, Caledonia is the VFEX, AIM and NYSE-listed gold miner and the best-performing stock in Zimbabwe.

We’ve been talking a lot about how the gold price has been good for gold companies, and this is further proof. Below are some of the highlights of their results.

Caledonia Mininig Q3 2025 Highlights

Revenue: US$71.4m, up 52%

Realised gold price: US$3,434/oz, up 40%

Gold production: 19,106 oz, up 1%

Gold sold: 20,792 oz, up 8.7%

EBITDA: US$33.5m, up 163%

Profit after tax: US$18.7m, up 467%

Free cash flow up to US$5.9 million vs negative US$2.4 million in Q3

2024.

Caledonia had one of its strongest quarters in its history. The combination of a 40% jump in gold price realised and steady production has resulted in a big windfall.

Just to put into context how strong that revenue growth is, Innscor posted 19% growth, and we described that as blockbuster. I am not sure what phrase I could use for 52% growth!

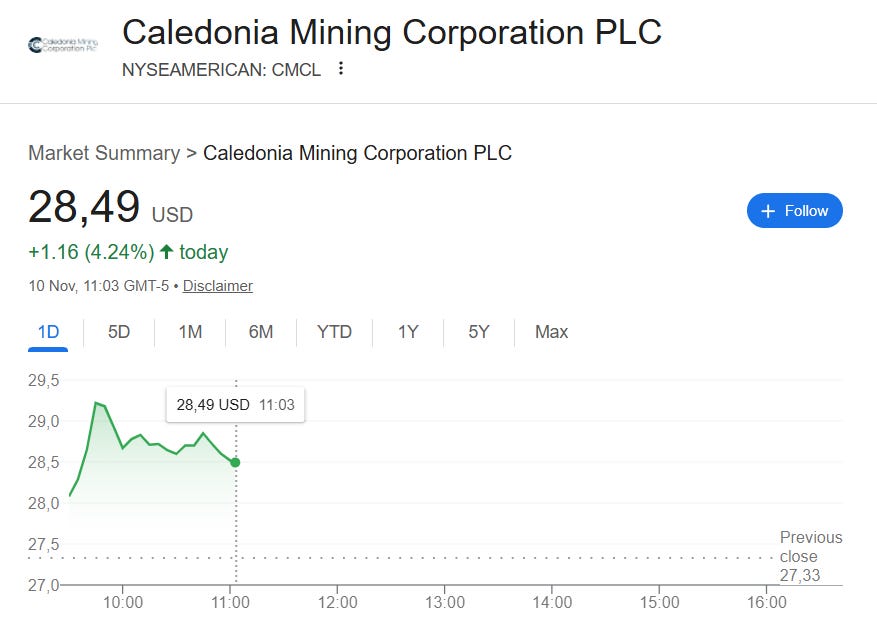

Granted, a lot of that growth was from the 40% increase in realised prices, but it shows that if the gold price holds or continues to rise, Caledonia has a solid business. As of writing, it seems the stock market liked the results, with the stock rising over 4% after the results.

The trick question is how much upside is still in the stock after tripling in value this year? I will need to dig into the results in more detail, however, and will cover them later this week, but for now, this is definitely a story worth watching.

Why have they not increased production