Zimbabwean Banks Overcharging You? Trump Moves on Africa’s Minerals: The Week Ahead

Zimbabwean banks face overcharging claims, while the U.S. scrambles to catch up with China’s grip on Africa’s rare earths.

Quick note before we get started: Money & Moves has been nominated for the Capital Markets Advocacy Award - People’s Choice!

Thank you to everyone who nominated us. If you’d like to support us in the voting round, you can vote here – just scroll to the Capital Markets Advocacy Award section.

Appreciate the support. Now, onto the stories to watch this week.

Zimbabwean Banks Accused of Overcharging

Has your bank overcharged you?

A story from The Independent implies this could be the case.

Below is an excerpt from the article “Zim banking nightmare: Millions vanish in hidden charges scandal”.

“Multiple Zimbabwean banks are under fire amid explosive allegations that they overcharged corporate clients millions of dollars through inflated interest rates and hidden fees, triggering what could become one of the biggest financial recovery drives in recent years.

The revelations, uncovered by the Zimbabwe Independent, point to a pattern of systematic overcharging by local financial institutions, a practice that a forensic accounting firm says has cost businesses millions in unlawful deductions.”

Source Zimbabwe Independant 24 October 2025

A few things to note before you call your banker.

These claims originate from a report by the Interest Research Bureau Zimbabwe (IRBZ), a company that examines interest calculations and bank charges on behalf of clients to support refund claims.

This means that there is an incentive for the company to claim that “systematic overcharging of clients” is taking place because it would be good for their business.

That said, the company could also claim there is equally an incentive for bankers to have “systematic overcharging of clients” taking place because it would be good for their business — provided they don’t get caught!

Incorrect charges are not uncommon, however.

In South Africa, there were 15,412 complaints about Banks made to the National Financial Ombud Scheme for incorrect charges, of which 11,535 cases were successfully closed and resulted in R29 million recovered for consumers.

Capitec, which we have been covering, actually had the most complaints with 20% of the total. However, they also have the most clients, serving one in three South Africans.

If Capitec, arguably the most digital-first and successful bank in South Africa, can incorrectly charge clients, it wouldn't be a surprise if some Zimbabwean banks have done the same.

Where’s the Money, What’s the Move?

If you are a banker, it may be a good time to ensure your systems are functioning properly. A significant mistake with a major client could not only be financially bad but also hurt relationships.

If you are a large corporation with high bank fees, you may want to recheck your bank statements and loan repayment schedules.

If you're just someone who thinks bank fees are too high, keep a lookout for this story, as it could have a big impact if this issue is really pervasive.

Trump Wants African Minerals

This is a fascinating story from Fox News with the headline “Trump administration works to break China’s rare earth mineral stranglehold on Africa”.

Here is a key extract from the article.

In Africa, China is on Washington’s threat radar, with the spokesperson continuing, “China’s dominance in global mineral supply chains — specifically in processing and refining — is a threat to both U.S. and African interests. Beijing’s state-directed strategies exploit Africa’s natural resources, consolidate control over upstream mining assets, perpetuate opaque governance structures, degrade local environments and create economic dependencies that undermine regional stability.”

The fascinating thing about the above is that the US is loosely admitting that it needs Africa, especially when it comes to rare earth minerals.

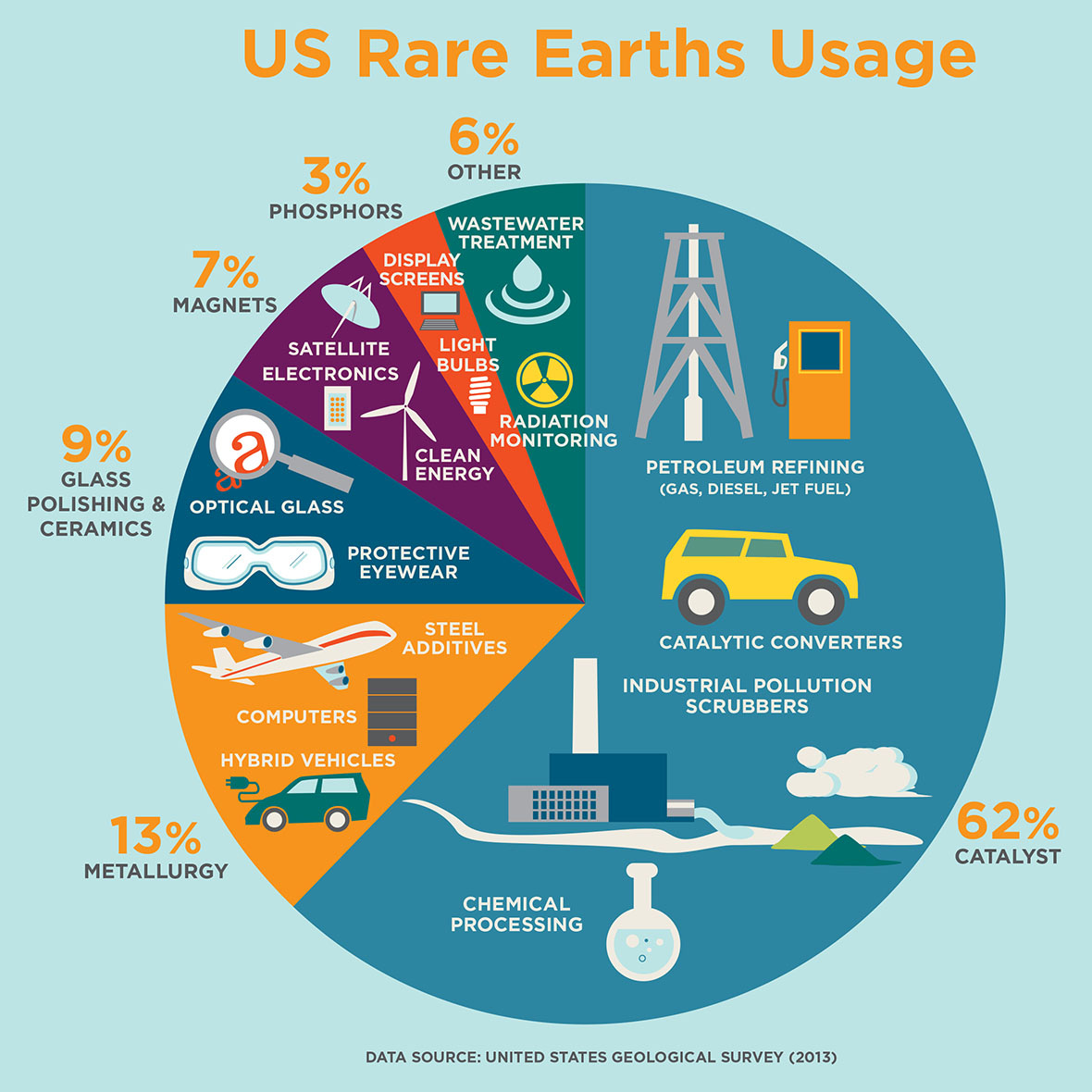

Rare earths are a group of 17 elements that are used in consumer electronics, electric vehicles, aircraft engines, medical equipment, oil refining, and military applications such as missiles and radar systems.

China controls over 69% of the production and processes 90% of the global supply. Considering how critical these rare earths are, it is obviously not a situation that the US likes.

Here is another data point from the African Union’s African Metals Development Centre.

Benchmark Mineral Intelligence indicates that 37% of Africa’s future rare earth supply is already committed to Chinese buyers, with the rest available for other markets. By 2029, eight new rare earth mines in Tanzania, Angola, Malawi, and South Africa are expected to start production, potentially contributing 9% to the global supply.

In short, Trump recognises that the US has fallen far behind in securing African rare earth partnerships and is now scrambling to catch up. This is likely positive for Africa. Competition for the continent’s resources creates leverage and better terms.

Where’s the Money, What's the Move?

Generally, it seems the mining sector under the Trump administration is poised to perform well.

Rare earth miners are likely to experience a boom, and this year, as mentioned earlier, has already seen record prices for many metals.

Strangely enough, thanks to many unintended consequences, Trump has so far been relatively good for Africa. Who would have thought?

For countries like Zimbabwe that have faced sanctions (directly or indirectly), the Trump administration may present the best opportunity in years to have them lifted.

Trump’s predictable unpredictability means that, given the right incentive and motivation, he could break from long-held US policies if he thinks it’s a good idea or believes it will benefit him.

Let’s see what happens next.

Thanks for reading. Do you think someone in your network should see this? Forward this email – you could help them make an important business decision.

I Voted. Do I get a sticker 😁👌🏾💰

The link to vote is broken Mukoma