Banking Income Insights: Property Peak, Banks Still Big On Fees (Visuals)

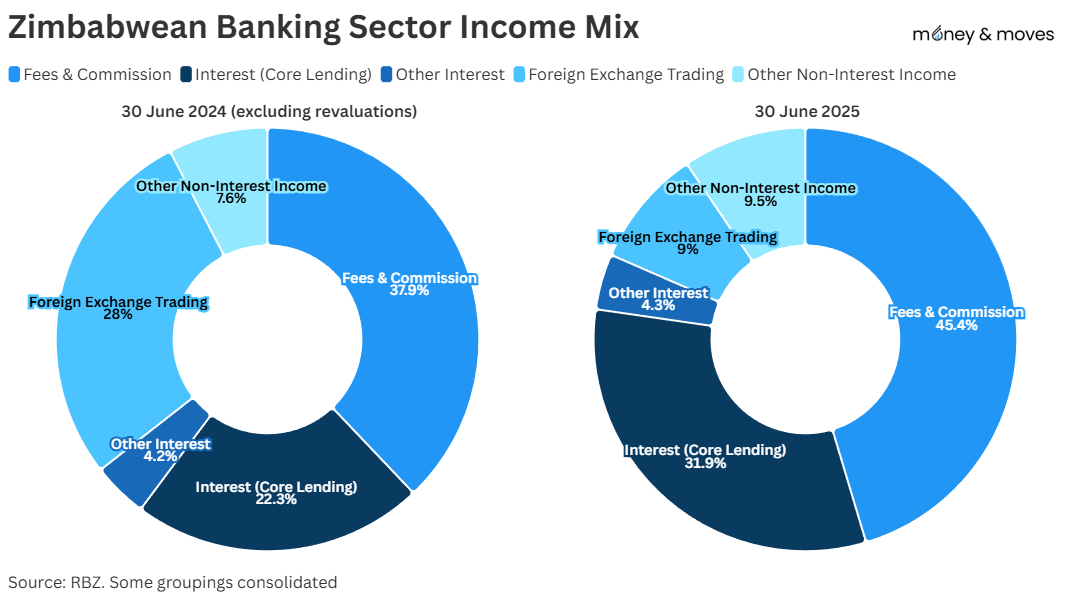

The chart above shows the banking sector split by income, comparing 30 June 2024 and 2025.

What first jumps out is that banking income is no longer skewed by massive revaluations which made up over half of all income - with revaluations of investment property contributing 25.2% and revaluation of foreign currency assets contributing 28%.

In June 2025, the contribution of revaluations if any is minimal such that it would fall into the “other” category.

Why did revaluation gains disappear?

Two things are happening at once.

First, the accounting reality. With the ZiG more stable banks no longer need to constantly revalue assets upwards to keep pace with the exchange rate.

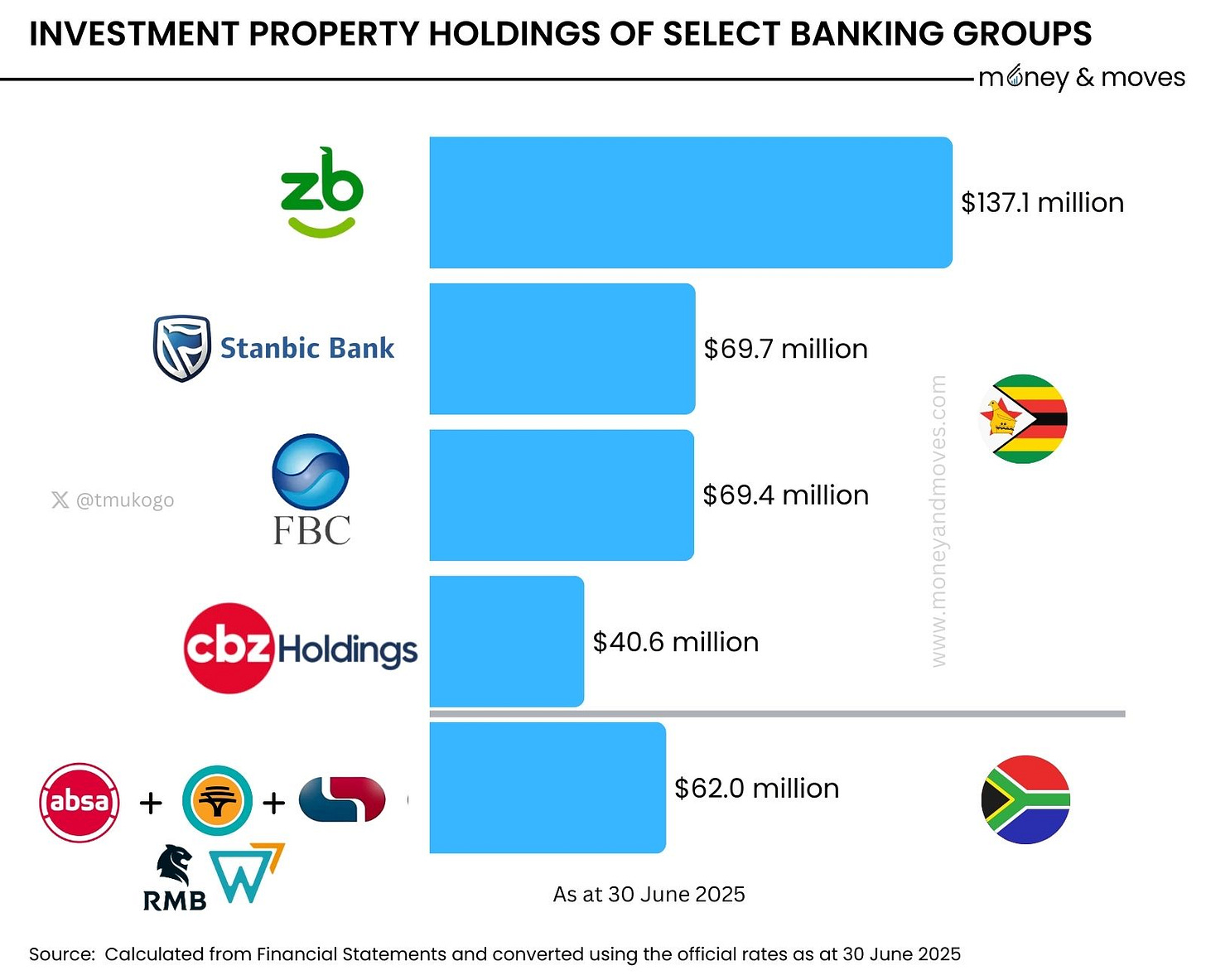

But the second factor is more telling: USD property prices are likely levelling off.

If real estate values were increasing in USD terms, we would still see healthy revaluation gains, especially since banks have so much investment property.

The fact that this line item has essentially disappeared suggests the property values are reaching their peak.

How Revenue Actually Looks

Now, to compare the two years below, we have removed the impact of the revaluations in 2024 to have a more like-for-like comparison. This is the adjusted view.

The biggest category is still Fees & Commissions, making up 45% of all income in 2025 with net interest income from loans, advances and leases (core lending) at 32%.

Banks still make money primarily from charges rather than interest income.

In South Africa, for example, net interest income is typically around the 60% range; Standard Bank of South Africa was at 59% and Nedbank was at 56%.

Part of this is to do with policy conditions that make lending, especially in ZiG, challenging.

However, making money from charges is actually a much easier way to generate income as a bank, and so there may be a temptation to continue that way even if the environment changes.

With lending, there is a risk you won’t get the money back. You have to monitor the loan book, perform credit assessments, etc.

With charges, it’s guaranteed, recurring, and low-risk income.

The New Tax on Withdrawals

It will be interesting to see if the new additional taxes will have any impact on banking margins.

Based on the new regulations, if you have already withdrawn over $10,000 in USD cash in a month, and you want to make another withdrawal, you will be taxed 3%.

Then add another 2.5% which is the typical fee banks charge. So, taking out another $10,000 will cost a company $550. Ouch!

Considering how high this is, will banks eat up part of the tax and reduce their fees on cash withdrawals?

When the Sugar Tax was introduced, which increased the cost of most soft drinks, most players like Delta and Innscor, etc, ate up some of that cost rather than pass it all to the customer.

Will banks do the same? If they don’t but manage to maintain business, then it would further prove that it’s much easier to make money with charges than lending!

Naturally, the most likely response from customers will be never to let your money get into the bank. I suspect the amount of cash outside the banking sector will only increase.

I wouldn’t be surprised if there is more money in safety deposit boxes than in actual bank accounts.

The FX Trading Income Drop

The final interesting point is on the decrease in FX Trading income from 28% to about 9%. This is a big swing and one which I honestly am still trying to get my head around.

Could this indicate that more individuals and companies are finding ways to settle foreign currency obligations outside of traditional banking platforms?

Or is this just lower volumes of trades since ZiG is harder to get a hold of, so people are settling with their USD balances? Or could it just be the removal of the 5% trading margin for the interbank market? Is it the move to a Willing Buyer, Willing Seller market?

What could it be?

Where’s the Money, Where’s the Move?

As long as fees primarily drive banking, there will always be excess demand for lending. This is still a massive untapped opportunity.

When you also consider that gold mining, for example, is doing so well and that it’s also predominantly a cash-based sector, the amount of money outside the banking sector is massive.

A lot of these individuals also have lending needs, but are not plugged into banking.

Linked to the cash-based economy, if you are in the safe deposit or cash storage business, there is no better time to be alive.

Honestly, there is a case to be made for building an entire operation around this.

Zimbabweans have been paranoid about banking due to Hyperinflation-Induced Trauma (more about that here). The likelihood is that this new tax will make people avoid banking even more.

What do you think?

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so.

PS: I am working with public information so I could be missing something or simply wrong in my analysis.

Sharp dissection of banking income shifts - especially the observation that fees (45%) still dominate lending (32%) despite the ZiG stabilization. That preference for low-risk, recurring charges over credit intermediation speaks volumes about the underlying risk environment and its ripple effects on business credit access. TCLM often explores similar terrain: how payment friction, regulatory taxes, and cash hoarding reshape trade terms and working capital flows for companies. A grounded, useful read.

(It’s free)- https://tradecredit.substack.com/