Hyperinflation Induced Trauma: The Force that Runs Zimbabwe

How 25 years of hyperinflation rewired Zimbabwe’s business decisions

The biggest force driving business decisions in Zimbabwe is what I call Hyperinflation Induced Trauma (HIT).

From investment decisions to business strategy, almost everything is driven by HIT.

Here’s a breakdown of how HIT works, the link with Germany, and how you can use HIT to predict what will happen and identify opportunities.

Let’s unpack!

What is Hyperinflation Induced Trauma?

Hyperinflation Induced Trauma, or HIT, is a condition that every Zimbabwean lives with, coming from rounds of hyperinflation that wiped out savings, pensions, and businesses.

It’s an invisible force that drives every decision.

The History of Hyperinflation Induced Trauma in Zimbabwe

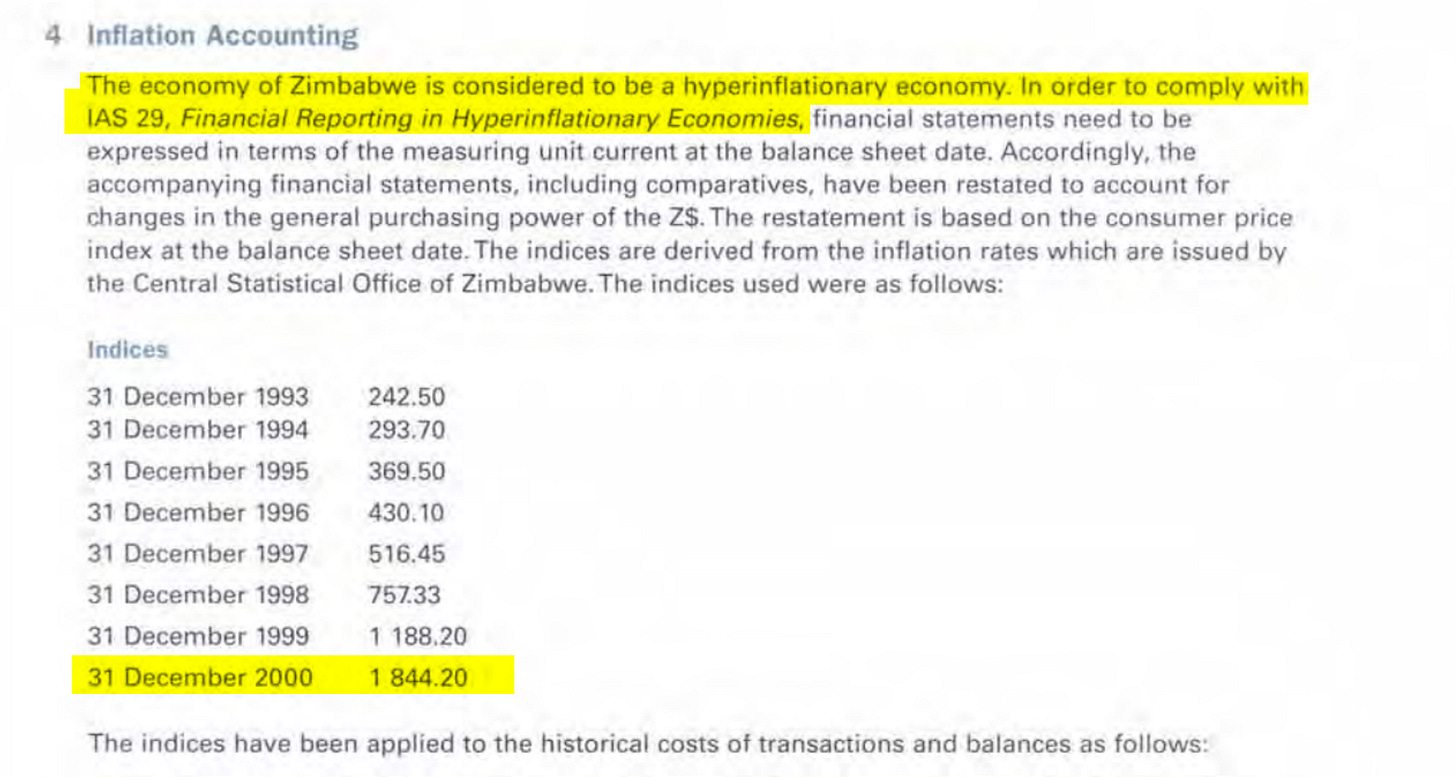

Hyperinflation is typically defined as inflation above 50% per year. For Zimbabwe, this dates back to around 1998, but the first time hyperinflation was formally acknowledged in financial reporting for companies was in 2000.

Take NMB Bank’s financials, for example—2000 was the first year they prepared accounts under hyperinflationary accounting standards.

This means Zimbabwe has faced hyperinflation for the past 25 years, and that anyone below the retirement age (65) has spent more than half of their working life experiencing some form of hyperinflation.

Another way to look at it is that every single executive and business leader in Zimbabwe has been shaped by hyperinflation.

To understand the significance of this, we can look at Germany as a case study.

A Historical Parallel: Germany in the 1920s

Germany in the 1920s went through a Zimbabwe-scale hyperinflationary collapse, whereby in November 1923, one US dollar was worth over 4.21 trillion German marks.

A hundred years on, Germany’s history of hyperinflation still influences economic behaviour and policy decisions.

The European Central Bank (ECB) acknowledges that the “trauma of 1923 is widely seen as the source of Germany’s preference for fiscal discipline and stability-oriented central banking.”

Furthermore, a 2024 academic study from the University of Chicago showed that German households in regions hit harder by hyperinflation in the 1920s still avoid assets that lose value during inflation, such as bonds.

Even after multiple generations, the events of severe hyperinflation continue to shape investment decisions in Germany.

How much more in Zimbabwe?

How Does HIT Show Up in Zimbabwe?

One of the ways HIT manifests in Zimbabwe is an emphasis on investing in property over other asset classes.

Below are just a few examples we have covered before.

Pension funds in Zimbabwe have 15 times more capital invested in property than those in South Africa.

Zimbabwean banks hold over 100 times more investment property relative to total assets compared to South African banks.

More than half of property owners have more than 80% of their wealth tied up in property.

But the above scratches the surface. HIT is also the reason people don't save in local currency and have more money under their mattresses than in their bank.

It's the reason why many people don't believe in pensions.

In all this, there is an underlying belief that Hyperinflation will come back.

This is not to say that this belief is wrong, but it's important to point out that it’s a belief that is automatic.

Even if the environment changes or is expected to change, it will take a long time for people to adjust their investment attitudes, as was the case in Germany.

This also highlights the challenges the Central Bank of Zimbabwe faces in transitioning to a mono-currency regime that stops the use of the United States Dollar in favour of the local currency.

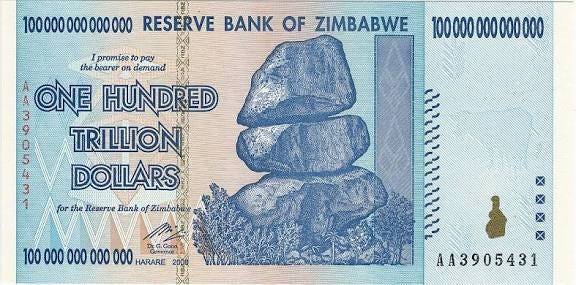

The biggest symbol of HIT was the Zimbabwean Dollar. It's going to be hard to shake off that memory.

Where’s the Money? What’s the Move?

How can you use HIT to your advantage?

The best time to sell umbrellas is when people are afraid it will rain.

In Zimbabwe, the rain is hyperinflation, and an umbrella is any instrument or asset that can be seen as an inflation hedge.

Property has been the most obvious solution, and explains why the sector is still booming even if questions around valuations are starting to arise.

However, there may be more space for financial innovation. Could Zimbabwe serve as a case study of using Bitcoin as a hedge against inflation through a Bitcoin treasury strategy, as is now being tried in South Africa?

If you are a contrarian, this could be an opportunity to “be greedy when others are fearful.” As talk of de-dollarisation picks up, many will become more defensive in their investments, avoiding equities—even when attractive investment opportunities arise.

One could invest now when valuations are depressed, as it is ultimately unlikely that a 2008-style hyperinflation will happen again. If it does, the situation would be so bad that even holding property may not save you.

Whatever the case, to understand business decisions in Zimbabwe, you need to see everything through the lens of Hyperinflation Induced Trauma.

What do you think?

One of the saddest realities I've read. @ my work place we've never gone through any of the hyperinflation periods, however every decision is made through that lense. Every plan, every goal that's gonna take more than 6 months has to make sure in the event of any sign or trigger that hyperinflation is coming, the company is able to wind off of any positions it holds as fast as possible. Very Sad. The Shona adage Kurara rimwe ziso wakasvinura is the best way I know to say how we operate.

I really don't think we will ever be ready. I'm not sure the public are ready for a mono-currency set-up although it is critical for us as a country.