Could Formal Retailers Be Positioned for A Remarkable Comeback?

It has happened before

Formal retailers have had a horrible time lately, but here is why you should not count them out yet.

Back in 2008, when inflation peaked, formal retailers were struggling. The stores were empty; you may recall images like the one below.

To emphasize how bad things were, OK Zimbabwe’s CEO highlighted an “acute shortage of products on the formal market” and the “resurgence of the informal market” in the 2008 annual report, among other challenges.

Sounds familiar?

However, just a year later, the outlook had changed entirely with the dollarization of the economy. OK Zimbabwe (OKZ) was doing well, registering a profit of $1,8 million in its first six months after dollarisation.

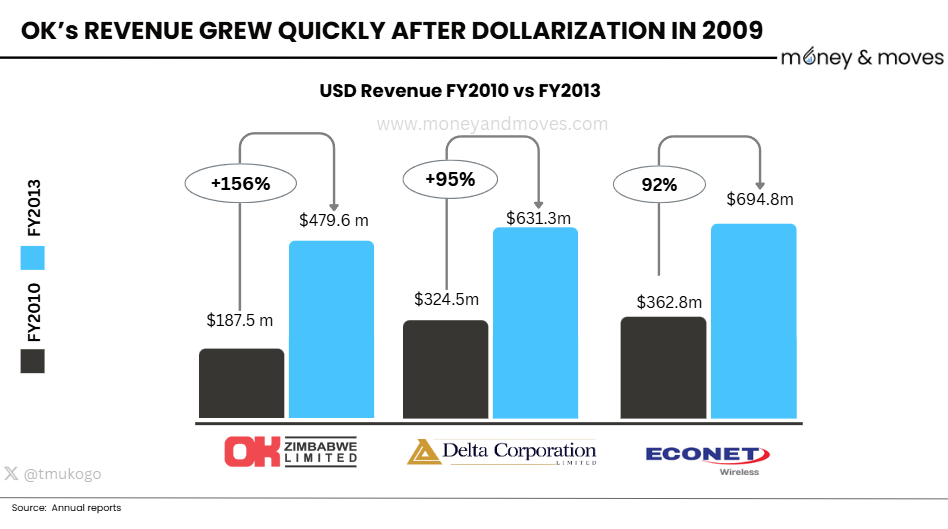

However, what is particularly interesting is comparing how fast OK Zimbabwe recovered relative to other companies. Below is a comparison of the revenue growth between the Financial Year (FY) 2010 and 2013 of OKZ, Delta Corporation and Econet Wireless.

Delta and Econet were used as benchmarks because they are two of the country's biggest companies and have year-ends (March and February) similar to OKZ's (March), allowing for a like-to-like comparison.

The above chart shows that OKZ’s revenue increased by +156% between 2010 and 2013, about 50% more than Delta and Econet. This indicates that OKZ had a much more significant and quicker recovery when the economy stabilized.

In terms of market capitalisation (a measure of a company’s value), between the start of 2010 and the end of 2013, OKZ’s market cap increased 4.5 times while the rest of the stock market increased 1.4 times.

One could say that OKZ was doing three times better than the average listed company.

Formal retail seems to be a volatile sector in Zimbabwe. In the world of finance, one could say formal retailers have a high beta.

Formal retailers outperform other businesses when the environment is ideal, with low inflation and currency stability. However, if the environment is challenging, formal retailers perform much worse than everyone else.

Where is the Money? What’s the Move?

Currently, most businesses are building their strategies around the informal market. This makes sense as this is where the bulk of business is and where it’s more straightforward to find USD.

However, the best strategies solve for the present while preparing for the future.

Maintaining good relationships with formal retailers as a supplier and or service provider could be a wise move, even if one limits their exposure. The current situation is not sustainable in the long run, and will have to rebalance to formal retailers, at least to some extent.

Those who have positioned themselves well in the interim will likely benefit.

As mentioned in the previous post, most formal retailers may be undervalued relative to their potential, which also presents a buying opportunity for investors.

However, it does require a much deeper evaluation. Often, it’s better to buy a business that is doing exceptionally even at a high valuation (think NVIDIA last year) than a business that is struggling at a low valuation.

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so. It’s completely free.

![It's better to buy a wonderful company at a fair price than a fair company at a wonderful price" - Warren Buffett [800x362] : r/QuotesPorn It's better to buy a wonderful company at a fair price than a fair company at a wonderful price" - Warren Buffett [800x362] : r/QuotesPorn](https://substackcdn.com/image/fetch/$s_!HTx-!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F8124116e-ddc7-4e55-a25e-332466c0eabb_800x362.png)

Interesting read as always brother. I do worry about retailers ultimately because the events that changed their fortunes in 2009 were out of their control. More fortuity then business acumen. Will be interesting to see what happens this time around

To buy a formal retailer in the current Zim environment would require very patient and deep pocket money to weather the storm,