Visual: The Staggering Drop in Value of Listed Formal Retailers

Featuring Edgars, Truworths, OK Zimbabwe and TM Pick n Pay

The Visual below compares the market capitalisation (market cap) of all the listed formal retailers in Zimbabwe from the beginning of 2014 to the beginning of 2025.

From this, we can draw three key insights.

1. All formal retailers are struggling, but some much more than others

While the stock market overall has fallen about 50%-60% over the same period (yes, it’s been pretty rough), the drop-off in market cap for most formal retailers is staggering. Truworths, once worth $15 million, effectively went to zero as it filed for corporate rescue in August last year, and OK Zimbabwe (OKZ) is now 96% off its market cap in 2014.

The only retailer that seems to have done relatively well compared to the broader market is TM Pick n Pay, which has dropped by 27%.(see the note at the end of this post on how TM Pick n Pay’s market cap was estimated).

With Choppies recently existing from Zimbabwe and the news that wholesaler, N Richards is closing two outlets in Harare, it is clear that formal retail is currently a very difficult business.

2. Deep pockets and relationships may not be enough to win as a formal retailer

The company which looked like it had the most potential to get back to winning ways in formal retail was Edgars, a portfolio company of Sub Sahara Capital Group (SSCG).

SSCG is a private equity firm that seems quite well capitalised, as evidenced by its readiness in 2023 to invest $8 million in working capital into Metro, Peech & Brown after spending $5 million to acquire the wholesalers’ assets.

SSCG also seems to have a valuable close working relationship with Innscor Group companies, judging by the frequent overlap in business transactions.

SSCG purchased Capri from Innscor, and another of its portfolio companies, Gain Cash & Carry, was previously a business sitting in National Foods, another Innscor business.

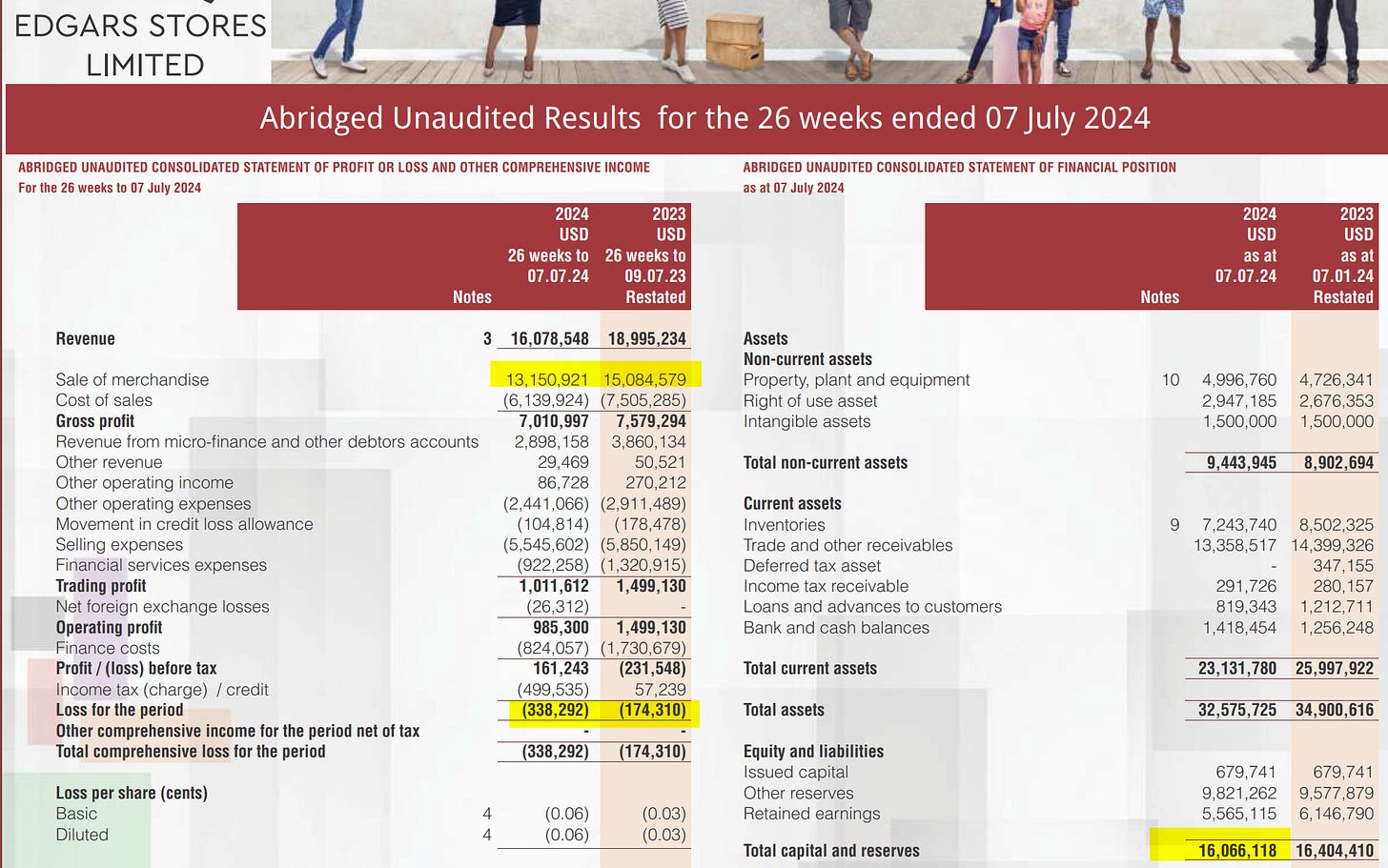

Despite the above, a new management team and a new strategy, Edgars still seems to be struggling against informal players. In their most recent half-year results, revenue was down 15%, and the company recorded a loss of $338k.

If Edgars is still struggling, it’s no surprise that Truworths went under. Truworths was in such bad shape that even Truworth's sister company, Truworths International, did not want to be associated with it.

When asked about its investment in Zimbabwe, Truworths International, according to news reports, said it had “been acquired at a non-material cost and had been fully impaired” and “the group had not made any financial assistance, whether in the form of loans, guarantees or otherwise” and also “did not have any operational involvement.”

Ouch!

But it’s not just Truworths International who gave up on Truworth’s Zimbabwe. Its next largest shareholder was Mega Market, which has invested in many listed companies, including Meikles, Mashonaland Holdings, Fidelity Life, Seedco, Turnall, Masimba Holdings, Art Corporation, Zimre Holdings and more!

Clearly Mega Market also has a lot of capital. The fact that they also decided not to invest further in Truworths shows just how little faith there was in the prospects of the business.

3. Did TM Pick n Pay do something right, and OK Zimbabwe do something wrong, or both?

Both OKZ and TM Pick n Pay have had drops in market cap. However, OKZ’s market cap has fallen 96%, while TM Pick n Pay's is down about 27%.

This huge gap seems hard to explain with just the challenges formal retailers are facing as TM Pick n Pay would have faced the same conditions.

Is there a fatal error that OKZ made at some point?

Back in 2014, which was peak time for retailers, OK Zimbabwe was even bigger than Old Mutual in terms of Market Cap and was pulling in a profit of $9.6m, nearly double that of TM Pick n Pay, which had $5.9m.

Some possible missteps have been covered here before on capital allocation, but was capital allocation the only issue?

Could there possibly could be something more or maybe TM Pick n Pay just managed things better?

Ironically, TM Pick n Pay hasn’t made any significant changes to its business over the last few years, compared to OK, which acquired Food Lovers, started a Pharmacy network (Alowell), launched a financial service arm (Vimbai Capita) and rolled out a new ERP system.

Was doing less better than doing more?

Where’s the Money, What’s the Move?

Depressed valuations can provide opportunities to invest in these companies, provided you can get the timing right.

Edgars' and OK Zimbabwe’s market caps are well below their net asset values, which, in theory, is a sign of an undervalued asset. Could this be a strategic time to enter?

The key question is when the tide will turn to favour formal retailers.

While informal retail is thriving right now, it is also not sustainable. Formal retail is an essential contributor to tax revenue and a significant creator of employment. Surely formal retail needs to be saved?

There will be a turning point; the question is when. Whoever can predict that will happen will likely make a lot of money.

PS: I am working with publically available information, so I may be missing something or just wrong in my analysis. Please let me know what you think!

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so. It’s completely free.

Note on TM Pick N Pay market cap calculation. TM Pick n Pay is part of Meikles Limited, which is the listed entity. Various measures were looked at to estimate what % of the Meikles Limited market cap related to TM Pick n Pay, including revenue, operating profit and net assets. In addition, since Meikles unbundled its second-largest business, Tangada, the relative market caps of Tanganda and Meikles were also used as a reference. The effective allocation used ended up being 67% of Meikles Limited's market cap was attributable to TM Pick n Pay in 2014. For 2025, it was just assumed to be 100% as TM Pick n Pay is now over 95% of group revenue.

Awesome article

What about the economy? To what extent did it affect the financial stability of these retailers.