Econet Backed a Failing Steward Bank With $75M — Here’s Why That Matters More Than You Think

Sometimes, who backs you matters more than how well you're doing.

Between 2012 and 2013, Steward Bank (previously known as TN Bank) recorded the largest losses among all banks in Zimbabwe, amounting to a staggering $42 million.

Despite this, Econet went on to invest close to $75 million in the struggling bank to acquire and then recapitalise it, ultimately saving the bank from a potential collapse.

This poses a question: how much of success is a function of how good your business is versus how big your backers are?

Econet Acquires Steward Bank

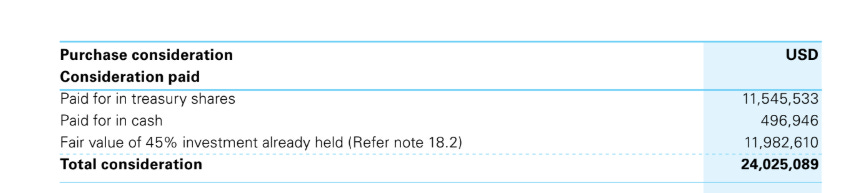

Econet first invested in Steward Bank in 2012 taking a 45% stake and then another 55% in 2013. The total cost of this was about $24 million paid in cash as well as in shares.

After the acquisition, Econet invested another $50 million to recapitalise the business. Altogether, Econet put $75 million into Steward Bank (the exact number was $74,025,089, but I have rounded it for simplicity).

This was a big financial commitment.

Econet’s logic at the time was that it needed to “accelerate the convergence of mobile telephone and financial services” and, to do that, it needed a banking license.

In theory, Econet could have considered many banks. If the decision on which bank to invest in was based on how healthy the business was, Steward Bank would not have been at the top of the list.

Steward Bank’s Struggles

When Econet took over, Steward Bank was really struggling. In year one, Econet had to provide for non-performing loans worth $28 million.

For context, that is more net interest income between 2011 and 2013.

In other words, if Steward Bank had not operated for those three years but still paid all its employees to sit at home, it still would have still been in a better financial position.

Below is a visual that shows a selection of banks' market cap and profitability. The market cap is as of 31 January 2013, when the acquisition of Steward Bank was completed, and the profitability is for the Year Ended December 2013.

With the $75 million Econet invested in Steward Bank, many other banks could have looked more attractive, on paper at least.

Why did Econet back Steward Bank?

The data suggest it was not just an economic decision. One can only assume other factors came into play. Most likely, it also came down to relationships.

Steward Bank (then called TN Bank) was part of the group founded by Tawanda Nyambiria, who was instrumental to Econet’s success, particularly in the early days.

When Econet was fighting its long legal battles to get licensed, Nyambirai took over the legal team from Antony Eastwood, who had been forced to retire after a personal family tragedy.

The impression he made can not be underestimated. Econet’s founder, Dr. Strive Masiyiwa, has said the following about Nyambirai.

“Over the years, I have had the privilege to work with great lawyers from all around the world; but I say this with all humility, Tawanda Nyambirai has one of the finest legal minds, I have ever met.”

It does help to be viewed so highly when looking for a backer.

Where’s the Money whats the Move?

For any business leader or entrepreneur, this case study offers an opportunity for reflection.

How much backing does your business have, and how strong are those links? You may wonder how your competition is outdoing you when the real reason is that they have backing that you do not.

Backing can also be the difference between extinction and survival. As we have covered before, OK Zimbabwe could do with a “Big Brother” to bail them out of their current troubles (we still think this will happen).

Having a large backer, also known as a “Big Brother”, does have its risks.

If your success heavily depends on that backing, things can become challenging should it fall away.

A potential example is Kingdom Bank. After the fallout with the Meikles Africa group, Kingdom took a big hit, with Meikles withdrawing $22 million in capital, leaving the bank undercapitalised.

Kingdom never seemed to recover after that, even after the bank was acquired by AfraAsia in 2013. By 2015, the bank’s license was cancelled, and it closed down.

So, to end with the question we started with, how much of success is a function of how good your business is versus how big your backers are?

I leave it for you to decide.

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so. It’s completely free.

PS: I am working with publicly available information, so there is a possibility that something is missing or incorrect in the analysis above.

You make a good point - and although you intention was to provoke thought on the issue the article would have been even more useful if you:

(a) indicated why the investment was made - surely not only for the connections to the prominent lawyer.

(b) indicated whether the bank gained market share in the longer term and how did the investment ultimately work out (ie as a "foreign" readers we have no knowledge whether this was a successful investment or not;

(c) do you have other stories which illustrate the same point - either invite responses on that or undertake to investigate further and circle back.

Regards

Graeme Fraser and Veldra Fraser

www.companylawtoday.co.za

email : legaleagles@srvalley.co.za

Quite an eye-opening and thought-provoking piece. From facts on the ground across various industries, who backs you matters more than how good you are at what you do.