Happy New Taxes! Zimbabwe is Actually Undertaxed—So Why Do You Feel Overtaxed?

Several new taxes kick in this week including 15.5% VAT and the 15% Digital Services Tax

The start of the new year typically brings new resolutions, plans, and this year, new taxes.

For Zimbabwe, several taxes have kicked into effect, including the higher VAT rate of 15.5% and the new Digital Services Tax, 15% withholding tax on payments for services from foreign digital platforms (streaming, apps, internet, etc.).

The general sentiment seems to be that Zimbabweans are overtaxed.

What’s interesting, however, is that Zimbabwe actually collects very little tax revenue relative to the size of the economy.

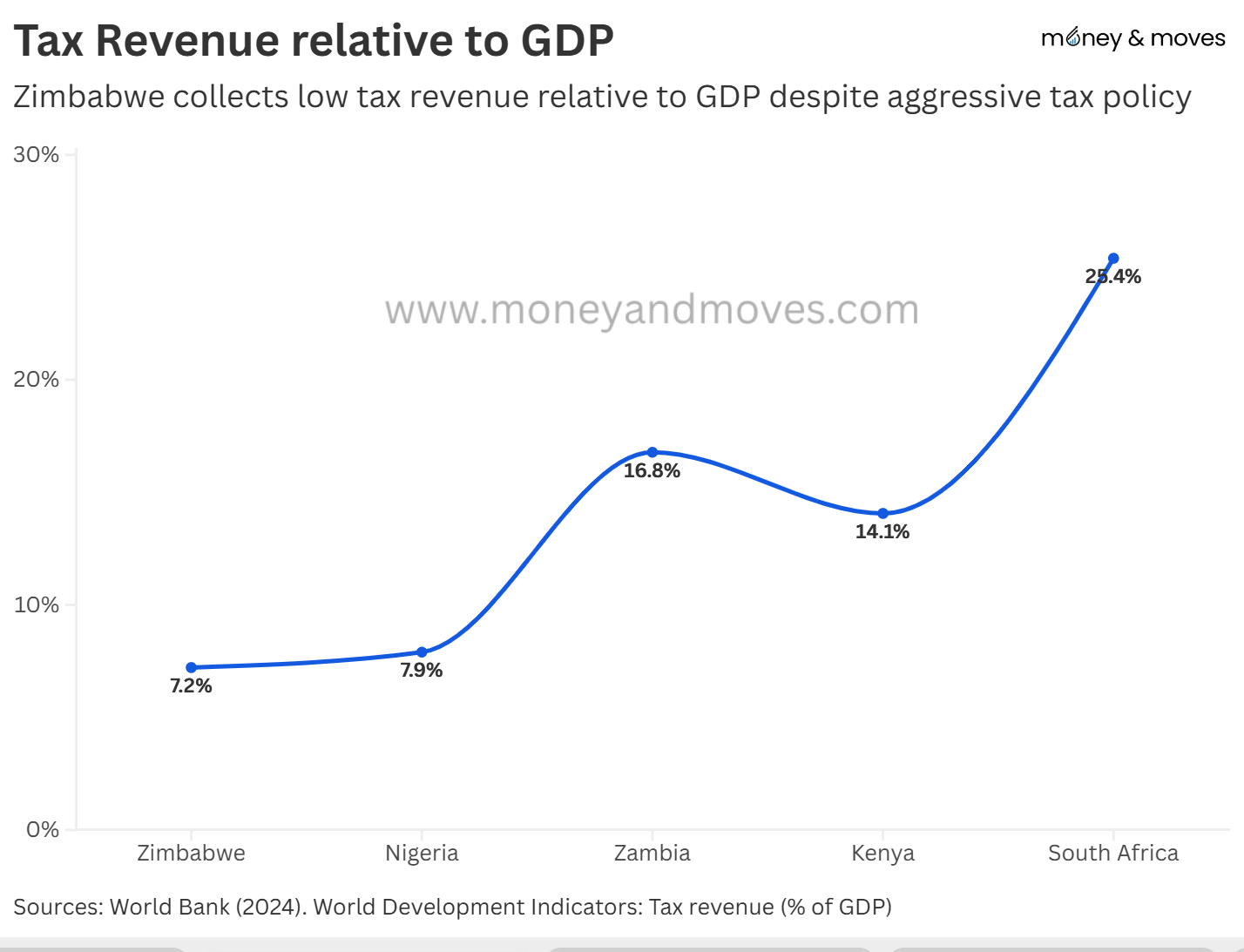

The chart below shows tax revenue as a percentage of GDP—the lower the number, the less tax revenue collected relative to economic output.

As you can see, Zimbabwe sits well below its African peers. In fact, the African Development Bank has long-term targets of 27.2% for African countries.

In other words, Zimbabwe would need to increase its tax collection by about four times to reach that target.

By these measures, one could interpret that Zimbabwe is actually “undertaxed.”

So why does this feel like the complete opposite for most taxpayers?

The Informal Economy Problem

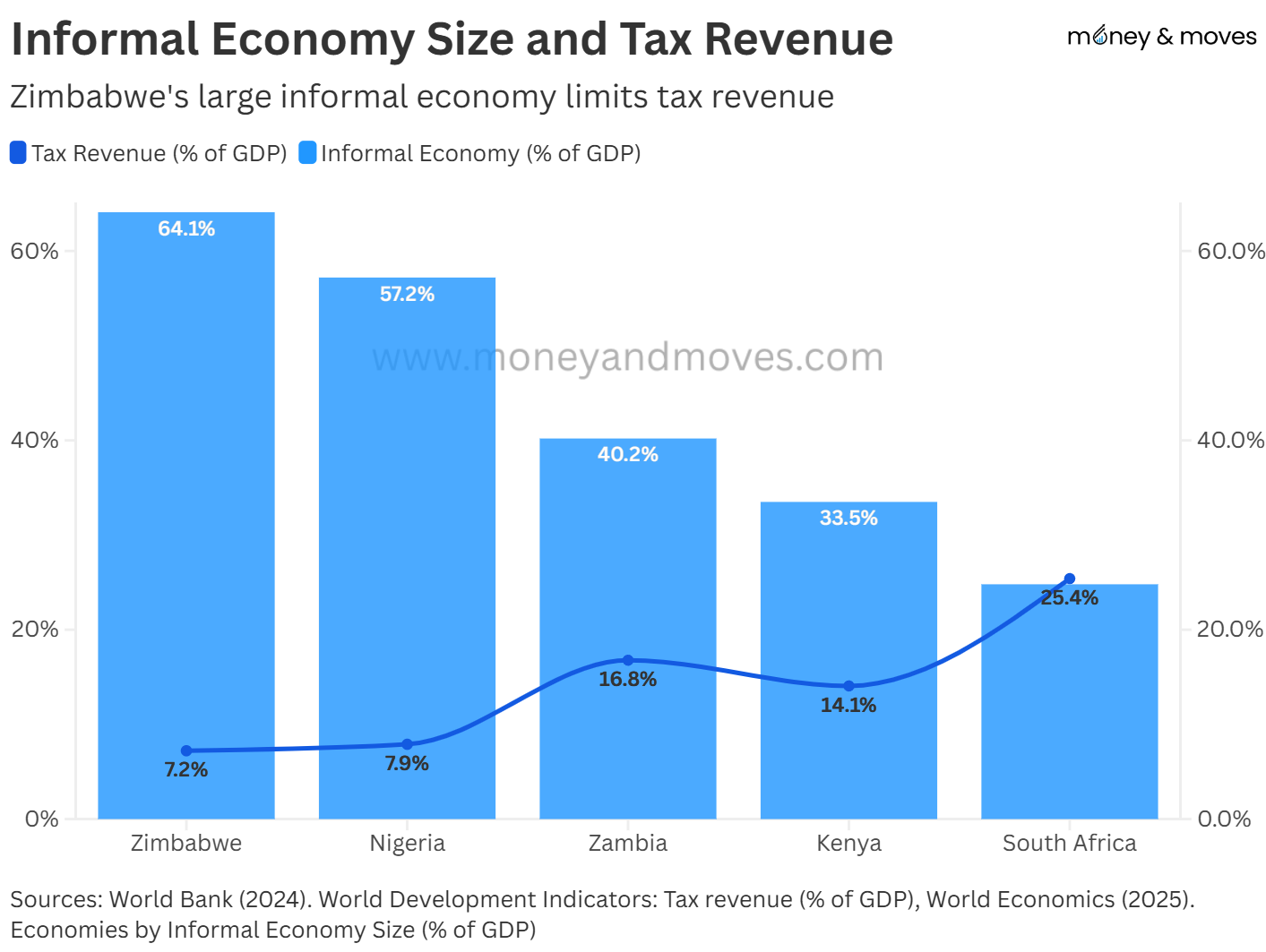

To understand this paradox, we need to look at the size of Zimbabwe’s informal economy.

When we layer the percentage of the economy that is informal alongside tax collection rates, the issue becomes clear: the informal economy is the problem.

As shown below, Zimbabwe has the highest level of economic informalisation at 64.1% and the lowest tax revenue-to-GDP ratio at 7.2%.

The relationship is clear across all the other countries as well: the more informal your economy, the lower your relative tax collection.

This makes sense; the informal sector generally doesn’t pay much tax and is incredibly hard to monitor.

As I explained in detail in an earlier article the effect of this is that more taxes are levied on those already paying tax.

This is why you might feel overtaxed, even though at the country level the overall tax collection is actually low.

Current taxpayers end up covering the shortfall caused by the informal economy, which pays relatively little tax compared to its size.

How to Solve This?

The data indicates that finding ways to formalise more businesses is key.

Currently, for informal traders, formalisation means more admin and costs without any perceived benefit.

To encouratage formalisartion International experience shows two promising approaches.

Firstly, radical simplification of tax administration.

Mexico’s RIF programme provided free web applications for accounting and invoicing, processing over 19 million operations, whilst the integration of Kenya’s iTax system with mobile money platforms shifted most tax filing and payment processes online, substantially lowering reliance on physical tax office visits.

Second, linking taxation to tangible benefits.

Brazil’s SIMPLES program combined tax payments with social security contributions, significantly boosting formalisation. By turning part of a tax into a pension contribution, Brazil made the shift to formal business more rewarding.

Pension benefits might not appeal much in Zimbabwe because of hyperinflation-induced trauma. Instead, it could be a “unified license”—a single, low-cost flat tax covering all permits and licenses needed for trading.

This could reduce admin for traders and the constant harassment and monitoring that often leads to the “unofficial tax” of bribes that don’t reach the goverment.

That said solving tax issues is very complex and so some of the above although well intended may not work.

What is clear that without addressing the issue, current taxpayers will end up paying more taxes on average, which will eventually become unsustainable.

What do you think should happen with taxes?

Thanks for reading; if you found this helpful, please forward this article to someone in your network and subscribe to the newsletter if you have not already done so.

Excellent piece. It will be interesting to know how much the informal sector contributes to GDP against their 'little' contribution towards tax revenue/ how much the formal sector contributes towards tax revenue against their corresponding formal sector contribution towards GDP

Excellent piece Tinashe. Reminds me of the interview of the SARS Commissioner just yesterday. While it wasn't about 'how to formalise the informal economy', their approach, philosophy, and structures to encourage people/corporates to pay their taxes is very very instructive.

https://www.youtube.com/watch?v=2YVZnX7wdq8&t=938s