OK Zimbabwe's Results: The Good, The Bad and The Confusing

OK Zimbabwe’s results were recently released and they were a mix of good, bad and confusing.

Let’s start with the confusing.

Normally, if you have a business selling item X. If you sell 29% more units of X, you expect the sales in monetary terms to be about 29% more.

In this case it is the complete opposite. Why? Hyperinflation accounting.

Hyperinflation accounting tries to adjust financials for the impact of inflation by using data such as consumer price indexes (CPIs), which measure the change in consumer prices based on a representative basket of goods and services.

In theory this works, but in practice, at least in Zimbabwe this is often very challenging due to a lack of reliable data and then the complexity in applying it.

When you then factor in that Zimbabwe's inflation was one of the highest in the world, it's easy to see why inflation adjusted number could produce results where OK has a 29% "increase in revenue" despite having sold 29% fewer items.

Sometimes the best way to read certain inflation adjusted numbers is with your eyes closed. The only thing more dangerous than not having any information is having a lot of information that is not reliable.

With this in mind volumes are often a more reliable indicator for how much revenue really changed.

Now here is the bad.

OKs, sales volumes were down 29%.

This makes sense; we knew early on that OK was having a tough year. I had written about this during their half year results and at the time estimated that their full year loss was going to be about $10 million in USD terms.

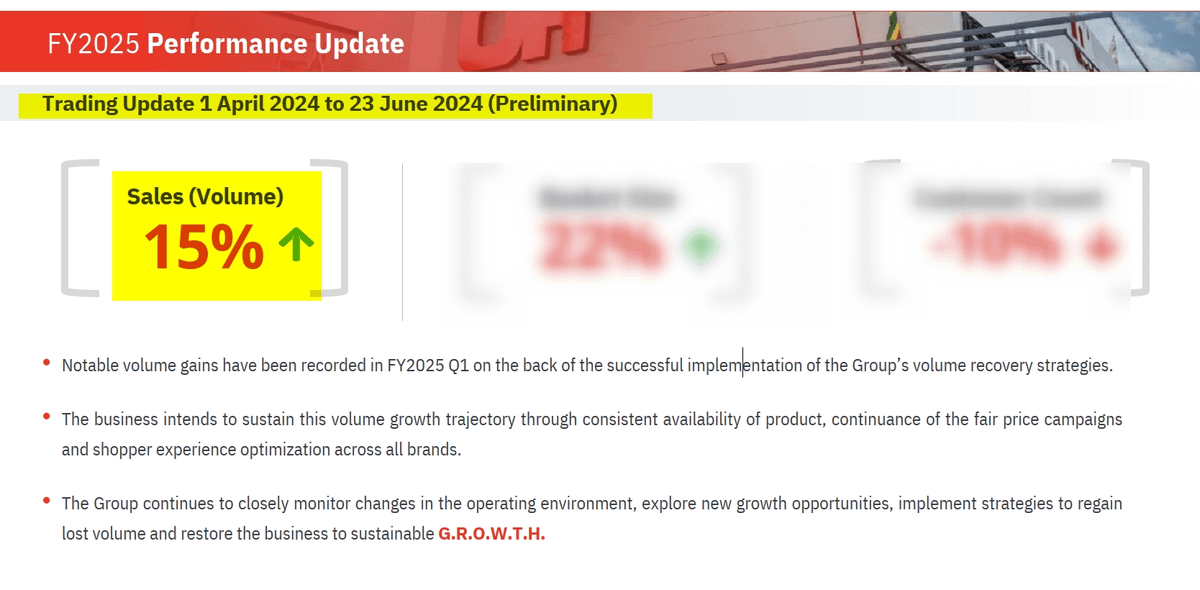

So we expected the rough performance in for the financial year (FY) 2024 but what was not expected was that volumes immediately after year end would jump 15%.

This is the good...but also the confusing. How does such a quick turnaround happen?

Such a sudden change is like your overweight friend who couldn’t finish a 5km run last month telling you they just returned from completing the 42km Victoria Falls Marathon.

You believe him when he says it, but you probably will have a lot of questions.

Let’s look at the numbers. In the first three quarters of FY24, YoY volumes fell 22%, 24%, and 32%, respectively.

The number for Q4 is not disclosed separately, but with some simplification, we can estimate it to be 32% since volumes ended up down 29% for the year.

There was a clear declining trend and with most business turnarounds there is a period of stabilization before getting a uptick in performance. To suddenly jump 15% after a volumes falling 32% is surprising.

It’s possible that part of the rebound could be explained by the fact that last year was so bad that comparing it with Q1 FY25 was easy.

Its like if you have $100 in assets, it's much easier to increase your net worth 100% in a week than if you are worth $100 million.

A low base makes it easier to grow a lot in percentage terms. This may have helped, but OK also reported it lost 10% of its customers.

They also say that loss was more than compensated for by a 22% increase in basket size.

So OK had fewer customers, but those customers bought much more on average?

How does this happen especially in this economy where people on average have less to spend? Confusing again.

My best guess is OK Mart had a fast start in Q1 driven be the OK Grand Challenge. Let me explain.

OK Mart is OK's hybrid retailer-wholesaler business that is focused on encouraging "wholesale or bulk purchases."

According to a quote from the OK CEO, OK Mart's customers are one-third households, one-third traders, and one-third corporate.

The OK Grand Challenge is the biggest promotion in Zimbabwe, with over $1 million in prizes including 50 cars which runs from April - June.

Needless to say, the Grand Challenge attracts a lot of customers which can drive sales volumes.

The big difference this year was that OK Mart was included in the OK Grand Challenge promotion which was not the case last year.

This meant that bulk traders and corporates also had an incentive to buy more. This also fits the story of fewer customers who buy much more.

This seems to have been the game changer in driving sales volumes.

With this in mind, if the driver of higher volumes was OK Mart and the OK Grand Challenge, how sustainable will it be?

The Grand Challenge ran from April 3 to June 8 this year and so fit perfectly in Q1 FY2025 to boost volumes. What will happen in Q2?

To be fair I do think retailers like OK may have recovered a bit as well.

Even TM Pick n Pay mentioned that after sales dropped 10% in the first half of the year, they recovered by 5%.

So even if I am correct, I think some of the 15% increase in volumes would be the business recovering.

However to be sure that OK has turned things around I think another quarter of similar growth without the OK Grand Challenge is needed.

If the growth is really operational or sustainable then OK may well be on track for an epic turnaround.

If this growth is not sustained, I don't see how much longer OK can continue without major changes.

I even think it could be an acquisition target. I have some thoughts that I may share depending on the interest.

As always, I am working with public information so I could be wrong or missing something. Let me know what you think. Leave a comment!

Great piece as usual Tinashe. I think "events" such as the OK Grand Challenge can not authoritatively inform the trajectory on which OK Zim is on. Q2 however will let us know. As Simon Sinek says in his Magnum Opus, Start With Why, "Manipulations don't last long".

I was hoping you could shed more on the ideas you have on the acquisition route but hopefully you will soon.

If only Zimbabwe had a ripe VC and Private Equity environment, a morganization or as it is formally called "hostile takeover" would have long happened on OK Zim. Interesting times ahead