Pfuma REIT, the Rand, and Trump’s Foreign Policy: The Week Ahead

What a Simbisa-backed property play, a stronger rand, and shifting US geopolitics mean for investors and businesses.

These are the stories to watch this week

A new Simbisa Brands-backed REIT listing on the VFEX

What a Stronger Rand Means for Your Supply Chain and Pricing

What Trump’s Actions in Nigeria Could Signal for Zimbabwe

Pfuma REIT listing on the VFEX

There are two things Zimbabweans love as inflation hedges: the USD and property.

Real Estate Investment Trusts (REITs) are the stock market version of those two things, and perhaps explain why they are becoming increasingly popular.

With a REIT, you own a piece of property that generates USD income.

The Pfuma REIT offering is live and will be closing on the 23rd of January.

This is an interesting REIT. Part of Pfuma’s pitch is that it is backed by Simbisa Brands, which will also be a part owner.

As a result, the REIT is positioned to have a high-quality anchor tenant pulling from Simbisa’s portfolio, including Pizza Inn, Chicken Inn and several other international brands.

This is also a smart move by Simbisa. “Selling chicken” generates much better returns than developing property, and so essentially “outsourcing” the property development increases their returns on invested capital.

What Pfuma promises investors is a steady and reliable USD return of 7% - 8% on a gross basis or 5.5% - 6.5% net.

This week, I will have the opportunity to discuss more about the Pfuma REIT on a Webinar with Tinashe Kembo, from Arctic Blue Asset Management, which will be managing the REIT.

The Webinar will be on Thursday, 15 January, from 10 a.m. to 11 a.m. Click here to register for free.

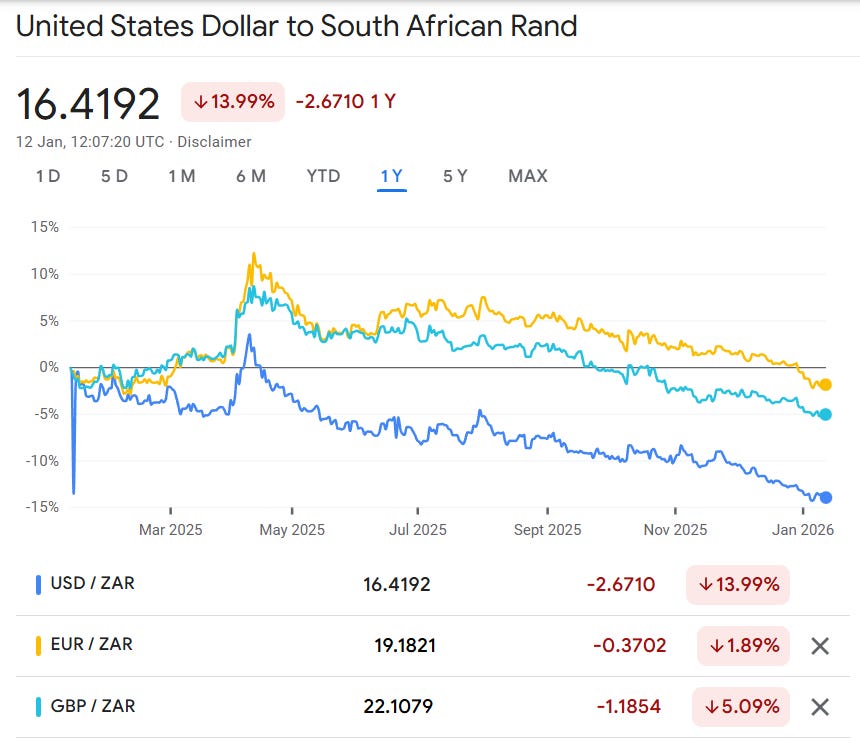

What a Stronger Rand Means for Your Supply Chain and Pricing

The rand has had a very strong last 12 months, appreciating 16% against the USD (with the USD/ZAR depreciating by 14%).

This means if you imported goods from South Africa and used $1,000 last year, this year you would need $1,160 for the same items.

This has a big impact on many businesses, as about 35% of all imports into Zimbabwe are from South Africa.

This also means that for local producers in Zimbabwe, your goods may be more price-competitive compared to South African imports at present, which could be a significant strategic advantage for gaining market share in the short term.

What Trump’s Actions in Nigeria Could Signal for Zimbabwe

President Trump warned of more strikes in Nigeria this week. The BBC reports:

In a wide-ranging interview with the New York Times, Trump was asked whether the Christmas Day strikes in Nigeria’s northern Sokoto state, targeting Islamist militants, were part of a broader military campaign.

“I’d love to make it a one-time strike. But if they continue to kill Christians it will be a many-time strike,” he said.

On paper, the reasons sound commendable. But under Trump, US foreign policy rarely operates on principle alone; it’s America First, or lobbying second.

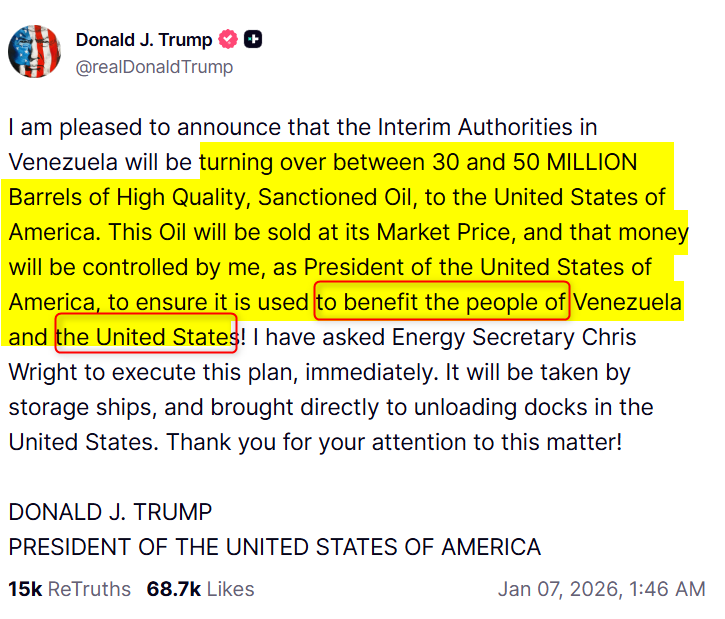

With Venezuela for example, it was clearly about oil and “America First”.

But Nigeria’s case is harder to understand. There’s no obvious direct benefit to the US.

So if it’s not America First, perhaps it’s lobbying that prompted this action. Trump drew 80% of the evangelical vote, and so to be seen as protecting Christians abroad resonates with that base.

What matters for Zimbabwe is the pattern this reveals: Trump can be lobbied into action, even on contested claims. Afriforum and others convinced him of a “white genocide” in South Africa, something widely refuted even by white South Africans. If he’ll act on that, what else might he accept?

This presents an opening for Zimbabwe. Though blanket sanctions ended in 2024, targeted designations and risk-averse compliance practices still restrict firms’ and indivisuals access to financial systems, investments and opportunities.

Trump’s willingness to override and change longstanding policies may be the best opportunity in years to push for the removal of these residual constraints.

What do you think?