Simbisa Brands Results: If You Like Cash, Sell Chicken

How Chicken Inn's Owners are generating cash and how that may shape their strategic decisions and how investors see them

Simbisa Brands: A cash printing machine.

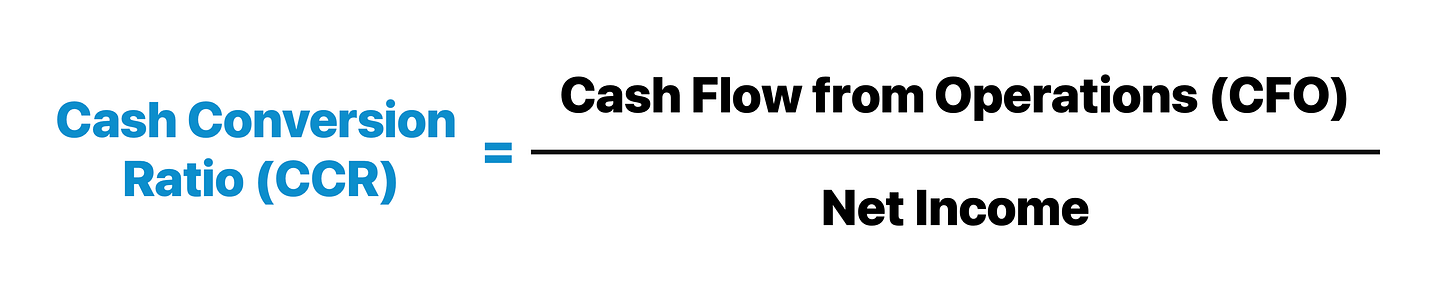

A good Cash Conversion Ratio, which measures a business's ability to turn profit into cash, is typically anything above 1.0. Simbisa Brands has a Cash Conversion Ratio of 2.6 based on its latest results.

For comparison, Innscor and Delta, both companies that are performing well, have cash conversion ratios of 1.0 and 1.8, respectively.

Simbisa is doing what most companies struggle with: turning profits into lots of cash. Here’s how—and why investors should take notice.

About Simbisa Brands

Simbisa Brands is in the Quick-Service restaurant business. Their biggest offerings are related to chicken, with brands like Chicken Inn, Nando's, and Galito’s. They also have a strong presence in other categories, such as Pizza, with Pizza Inn.

Financial Results and Cash Generation

In its latest half-year results, the business showed solid growth, with revenue up 7% and operating profit up 2%.

The real highlight of the results, however, is the net cash generated from operating activities—$23 million, up 51%.

Profit is good, but if it does not convert into cash, it's useless.

For example, in OK Zimbabwe's last half-year, before officially disclosing that it was in severe financial distress, it made a “profit” of $3.7 million. In reality, the company had a funding gap of well over $10 million at that time.

Cash Conversion

This is where looking at the cash conversion ratio can be helpful. With OK Zimbabwe, it was only 0.3 compared to the ideal of 1.0, which was a red flag, despite the accounting profit.

In the case of Simbisa, it's the exact opposite. The profit is good, but their cash conversion is exceptional at 2.6. This means that for every $1 of profit, they actually realise $2.60 in cash.

One of the reasons they have more cash than their profit indicates is that their profit numbers include a significant amount of depreciation, which is a non-cash expense. The increased depreciation is due to Simbisa's aggressive expansion drive, particularly in Zimbabwe, where they are setting up new locations.

We covered this earlier in another article titled “Simbisa Brands Results: Be greedy when others are fearful.” In short, Simbisa knows that for QSR restaurants, the most important element for success is location.

So while international players are shying away from Zimbabwe, they seem to want to buy up all the strategic locations, thereby creating a competitive advantage in the future.

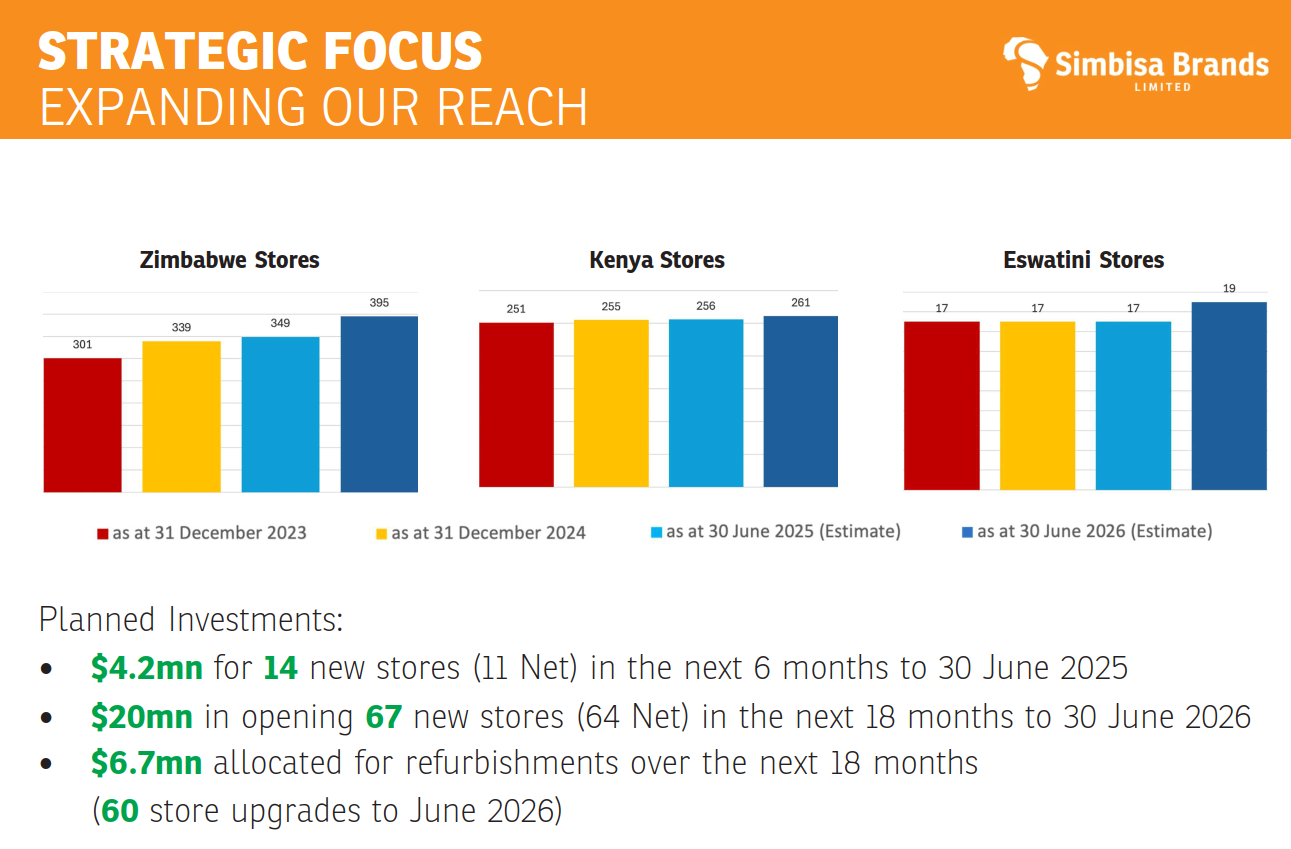

A data point that supports this is planned store growth. While Simbisa plans to add only 5 stores in Kenya, a 2% increase between the start of this year and June 2026, in Zimbabwe, Simbisa plans to add 56 stores, a 17% increase.

Another reason Simbisa generates a lot of cash is the nature of the Quick-Service Restaurant business and the strategic partnerships the company has. Quick service restaurants are consumer-facing, and people pay in cash, which means you don’t have to worry about debtors.

Despite this, Simbisa continues to receive credit terms from its suppliers that vary from 30 to 90 days, as disclosed in the 2024 annual report.

So they sell you a piece of chicken today, but can hold on to that cash for up to three months before they have to pay their suppliers.

Worth noting, one of Simbisa’s key suppliers is Irvines, which supplies chickens. Irvine’s is part of the Innscor Group, which Simbisa was a part of and still has common shareholders today.

This probably makes the supplier relationship much easier to manage and obtain favourable credit terms compared to others.

What does Simbisa do with all this cash?

If you have a business that generates excess cash, a logical next step is to use that cash to generate even more. This is where Innbucks comes in: a fintech specialising in payments, remittances, and microfinance.

While the logic above may not have been the initial reason Simbisa Brands launched Innbucks, it certainly makes sense.

Due to regulatory requirements, Innbucks had to be transferred to an associate called Ndoro Microfinance, in which Simbisa Brand owns 35%. Nevertheless, Simbisa continues to profit from the arrangement, generating $2.2 million in fee income in the previous financial year.

Ndoro Microfinance may be an associate, but it works very closely with Simbisa. In fact, the previous Group CFO of Simbisa Brands is now the CEO of Innbucks. I suspect that Innbucks will make a larger push into the lending space and leverage cash from Simbisa Brands.

Where’s the Money, What’s the Move?

For investors, Simbisa still looks like a solid business with significant growth potential and is probably one of the more attractive companies in the Zimbabwean context.

Zimbabwe is an incredibly volatile market, so businesses that generate cash in USD and have limited exposure to trade receivables are generally more resilient. Simbisa also doesn’t have significant competition, and by buying up the prime locations, it is creating a location-based “moat”.

The push into the payments, remittances, and microfinance is another growth opportunity.

Overall, Simbisa Brands is one to keep on your watchlist.

Just for some help!, who are Simbisa Brands Competitors, if any exist can they pull it off like them or Simbisa is now too big to chase ? Also I didn't know Simbisa makes so much half year profits, they would be adequate to Capitalise and register a commercial bank in Zimbabwe... I think the minimum Capital outlay you need would be like $20 million, the extra $4 million would be adequate for fees, professional labour etc... Midnight thinking 🤔

You break down financial concepts so well that even non-financial people can understand themlike true champions.

Great read and excellent analysis!”