Pick n Pay is in Big Trouble

Facing record losses and sluggish revenue, the retail giant is undergoing its biggest shake-up in over 50 years.

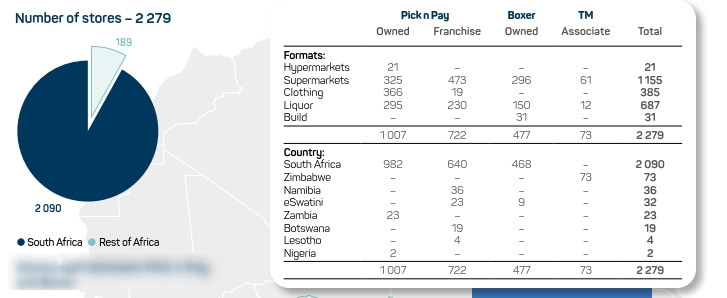

Pick n Pay is one of the biggest retailers in Africa, with well over two thousand stores.

Pick n Pay is also in big trouble.

Facing record losses and sluggish revenue, the group is undergoing its biggest shake-up in over 50 years.

We are going to unpack 5 red flags from their financial statements that highlight the crisis in one of Africa's biggest retail chains.

To start, sales have been slowing.

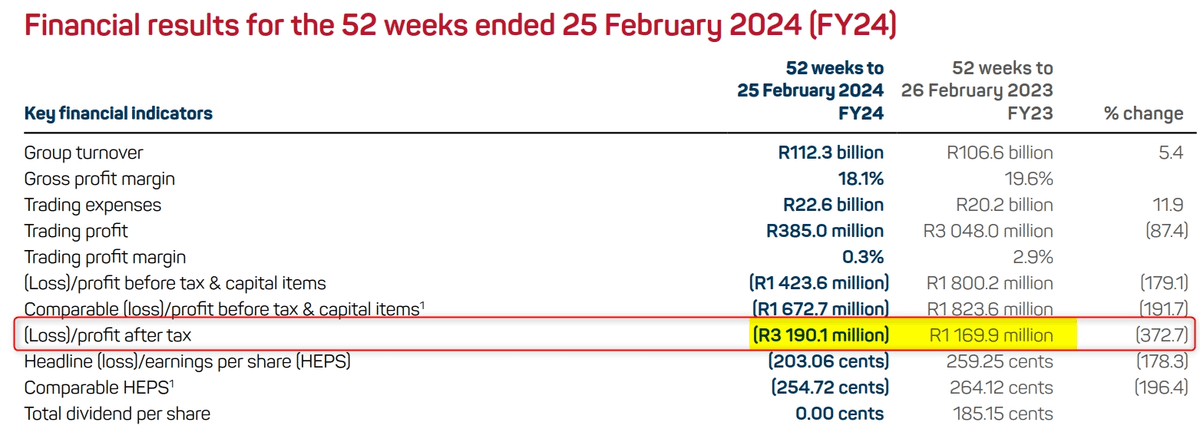

Pick n Pay's sales grew 5%, much slower than those of its peers like Shoprite, which had 17% growth in their last financial year and 14% in their most recent half-year results.

When you dig deeper, you realise that the Pick n Pay sales growth only came from Boxer, its discount supermarket chain. The growth for the Pick n Pay branded stores was only 0.3%. When you consider inflation, Pick n Pay stores probably had negative growth.

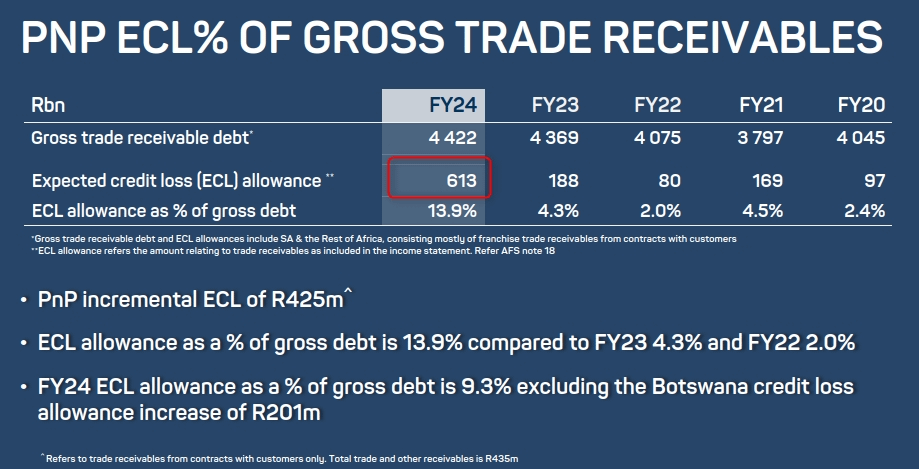

Not only is Pick n Pay struggling to grow sales, but it is also struggling to collect cash, as seen by the increase in the expected credit loss allowance.

The expected credit loss is essentially how much money the company thinks it will lose from customers, franchisees and others who don't pay their debts.

So, in general, the smaller the expected credit loss, the better.

Unfortunately, this number is anything but small. It has more than tripled between 2023 and 2024, from R188 million to R613 Million.

Now, when sales slow, and you struggle to collect cash, you would at least want to see expenses decrease. Unfortunately, it’s the opposite.

Trading expenses increased 11.9%. Even if you exclude restructuring costs and the expected credit loss, the increase is still 8.2%.

Pick n Pay has been like a rugby team that can’t score tries and also can’t defend. When you are a team like that, losses follow (pun, semi-intentional), so it's no surprise it had a loss of R3.2 billion.

For context, in the last financial year, Shoprite made a profit of R5.9 billion.

All these factors have meant that Pick n Pay’s liabilities exceed its assets and the company is now what they call technically insolvent. In other words, if Pick n Pay were a person, you would say their net worth is negative.

To make is worse Pick n Pay breached the conditions of its loans, which increased from R3.7 billion in 2023 to 6.1 billion in 2024. Fortunately, their lenders have agreed to support them by not calling in the loans as they restructure the business.

All these challenges have been building up for years, and it's no wonder the share price has significantly lagged behind that of peers. Over the last three years, Pick n Pay's share price has been down 57%⬇️ while Shoprite's has been up 58%⬆️.

If you had invested R100 in Pick n Pay three years ago, you would only have R43 today. With Shoprite, you would have R158.

Given the context, it's easy to see why Pick n Pay has been trying to make a lot of changes. One of these is that the Ackerman family, which has controlled the company since Raymond Ackerman founded it in 1967, will give up control.

The family will also give up the right to nominate the chairperson, CEO, and CFO. These are big changes that will give the new(ish) management a lot more freedom.

Pick n Pay is also raising $4 billion to reinvest in the business with a rights offer and is planning to raise another R6 billion - R8 billion from an IPO of its popular discount chain, Boxer (the one that has been growing).

Tangent—it seems spinning off and listing a business has become a popular option recently when things go wrong. The big IPO on the JSE this year was WeBuyCars. The rationale for that IPO was also to help Transaction Capital solve its debt problems, much like Pick n Pay plans to do.

So, despite the bad results, Pick n Pay is not going anywhere. They have a huge turnaround plan that also includes measures like reviewing over 100 stores to either keep, convert, or close them, which they hope will save R850 million.

For those wondering how these moves will impact TM Pick n Pay in Zimbabwe, I don’t think they will change much. The operation in Zimbabwe is still 51% owned by Meikles Limited. Pick n Pay has, however, written off its investment in TM Pick n Pay to Zero.

In reality, this is more of an accounting adjustment than anything else. Pick n Pay still received dividends from TM Pick n Pay and will still keep an eye on the business.

So now we watch to see if the new management team can turn around Pick n Pay's fortunes. What do you think about Pick n Pay? What do you think went wrong?

Thanks for reading! Please share this with your network, via email, LinkedIn or whatever platform you find best.

The more people that read the posts the more time I can spend finding insights about companies you care about the most.

The movement from a profit position in the PY to such a material loss position in CY just doesn’t make sense to me. Sure the margins dropped slightly and costs were up 11.9%. All the performance indicators are comparable except that PY trading profit. Smells like a prior period error. Unless there was a material unusual event in the PY?

I would buy the shares if they can find experienced restructuring executives.