Pick n Pay’s Zimbabwe Write-Off: Real Risk or Reporting Failure?

Behind the write-off is a lesson in hyperinflation, accounting rules, and reading beyond the noise.

On May 30, a story made headlines: “Pick n Pay writes off entire Zimbabwe investment.”

The story, which was shared over seventy thousand times, sounded like TM Pick n Pay was in crisis, and that its South African partner had suddenly walked away.

But here’s the catch: that write-off happened in 2024, and the business may actually be doing better now than last year.

Beyond the headline, this story offers a valuable lesson: how accounting rules, currency risk, and media framing can distort the true picture of a business.

Let’s unpack.

News that’s Not News

The story referred to above starts with the following two paragraphs.

“South African retail giant Pick n Pay Group Limited has reported an unrecognised loss of R51 million from its Zimbabwean associate, TM Supermarkets, for the 53 weeks ending March 2, 2025 - marking a dramatic reversal from a R212 million net contribution recorded in the previous financial year.

The losses, driven primarily by Zimbabwe's severe currency volatility and hyperinflationary pressures, have prompted Pick n Pay to fully impair its 49% stake in TM Supermarkets. The group has written down the investment by R254 million, effectively reducing its carrying value to zero.

Let's start with the first paragraph.

The loss of R51 million in the current year is not a dramatic reversal from a "R212 million net contribution”.

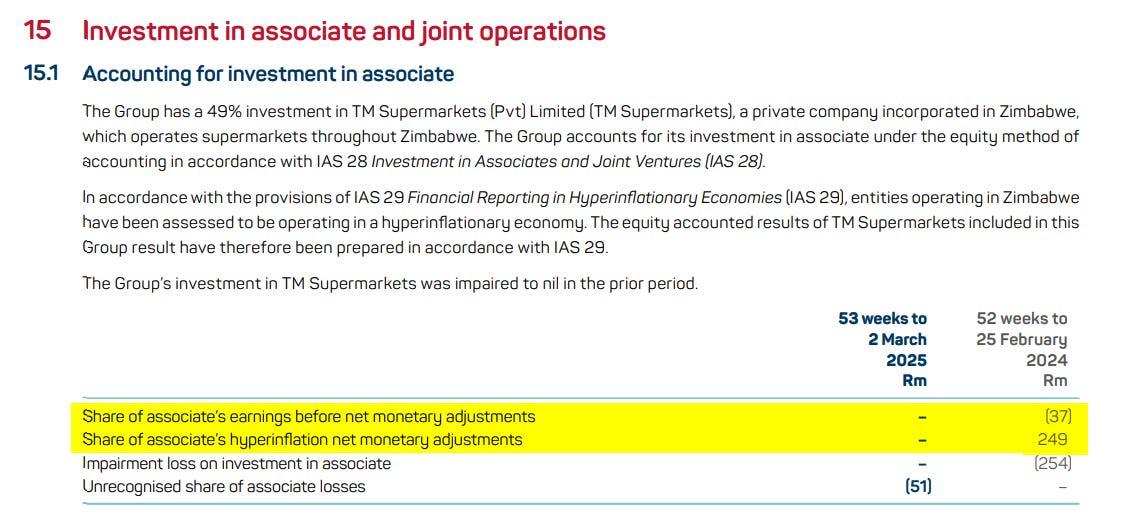

When you look at the financial statements of Pick n Pay Group, you see that the “R212 million” net contribution is driven by “paper gains”.

To arrive at R212 million, the author added the share of earnings and the net monetary adjustments. (-R37 million + R249 million = R212 million).

The main problem with the above is the net monetary adjustments. These adjustments are paper gains based on hyperinflation accounting.

How do net monetary adjustments work?

The hyper-simplified explanation is that in an economy with high inflation, if you owe more in monetary liabilities, inflation effectively benefits you, as it erodes the real value of what you owe.

It’s a bit like taking out a big loan during hyperinflation. As inflation rises, your assets might retain value, but the real cost of repaying the loan falls, making you “richer” in a way, even though no actual cash gain occurs.

In theory, this makes sense, but in practice, can you call this a gain that reflects favourable performance in the same way operating profit does?

I don’t think so.

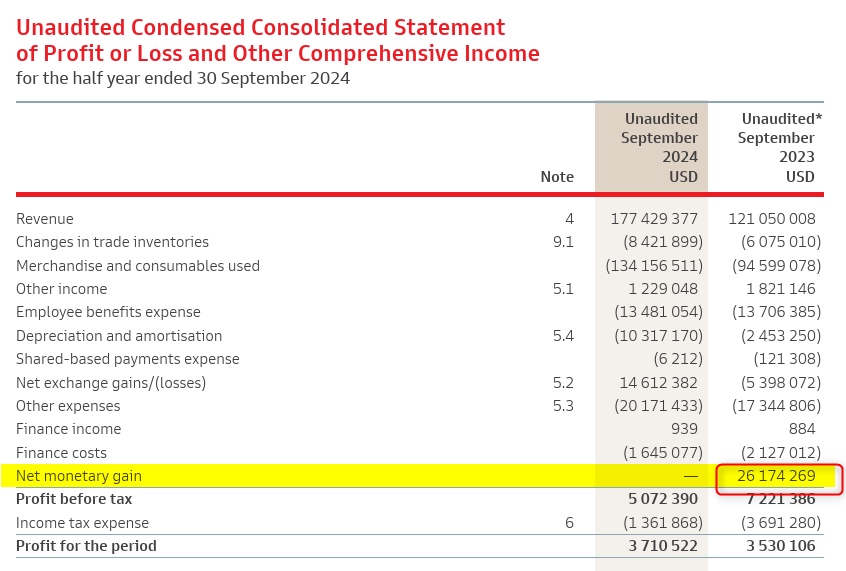

If you need further proof, just remember that OK Zimbabwe (OKZ) had a net monetary gain of R26 million, which turned a $22 million loss into a $3.45 million “profit”. Was that really a gain?

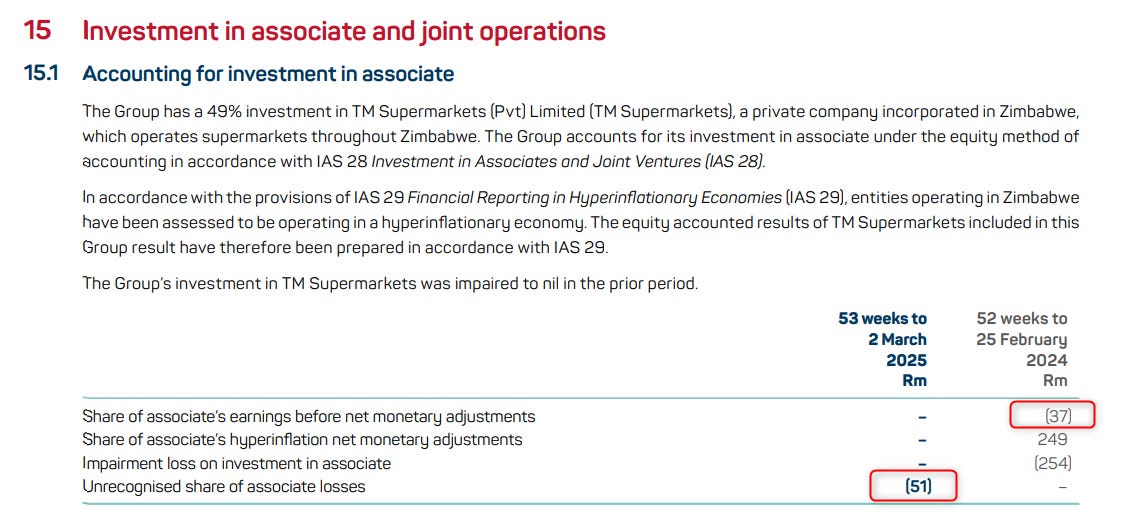

So, if you wanted to make a like-for-like comparison of TM Pick n Pay’s performance, the numbers to have looked at were the share of losses, which increased from R37 million in 2024 to R51 million in 2025.

I doubt you can call this “dramatic” and it certainly isn't a “reversal”.”

What About the Impairment?

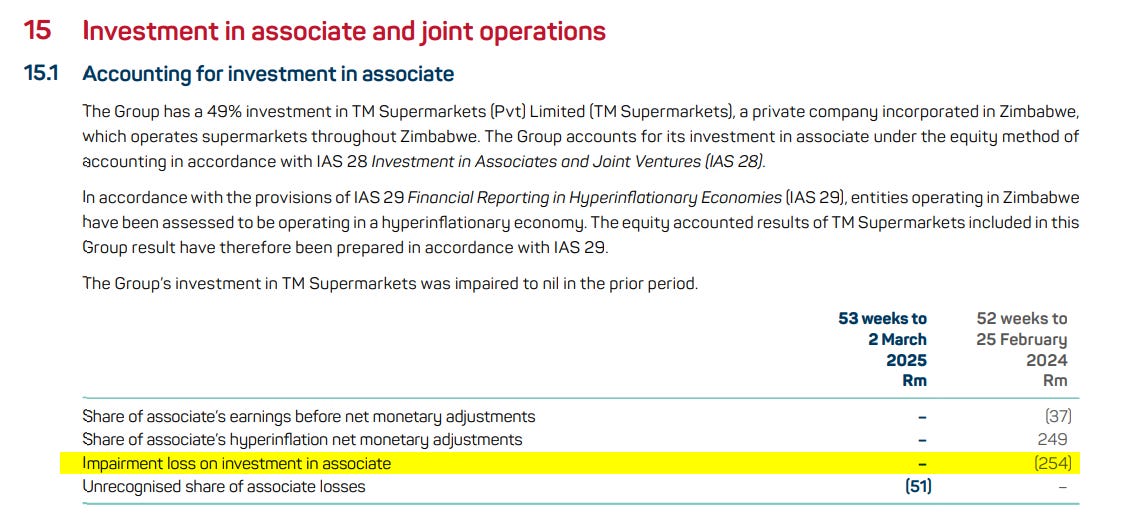

The article also says that the dramatic reversal “prompted Pick n Pay to fully impair its 49% stake in TM Supermarkets”.

As you can see from the notes, this impairment took place last year, in the 2024 financial year, and not recently.

We covered this a year ago, as shown in the article excerpt. Here is a quote from the article titled “Pick n Pay is in Big Trouble.”

“For those wondering how these moves will impact TM Pick n Pay in Zimbabwe, I don’t think they will change much. The operation in Zimbabwe is still 51% owned by Meikles Limited. Pick n Pay has, however, written off its investment in TM Pick n Pay to Zero.

In reality, this is more of an accounting adjustment than anything else. Pick n Pay still received dividends from TM Pick n Pay and will still keep an eye on the business.”

Extract from aritcle published on 10 June 2024

The same position still applies. I believe this write-off was driven a lot by the need to simplify accounting for the Zimbabwean business.

The advantages of writing off the investment are that future results are not recognised in the accounts until there has been a significant change.

This means that Pick n Pay Group doesn’t have to deal with the drama of hyperinflationary accounting and net monetary gains or losses, which makes life easier for everyone.

Who wants to explain how a business that reportedly made a loss of R37 million actually contributed “R212 million” to your profit because of hyperinflation accounting?

So, how is TM Pick n Pay Doing?

Contrary to the article, I think that TM Pick n Pay is probably doing better over the last year than it did over the same period in the previous year.

I think this is because of the stability of the ZiG compared to the ZWL, and also, it probably doesn’t hurt that your biggest retail competitor, OKZ, is struggling.

Meikles' latest trading update seemed to suggest the same. The revenue for the three months between September and November 2024 increased by 8% compared to the same period in 2023.

Meilkes has also declared a slightly higher interim dividend of $0.7 cents per share, up from the previous interim dividend of $0.6 cents per share.

This may indicate that Meikles, of which TM Pick n Pay makes up 95%, is in a healthier position than before.

I will say, however, that sometimes dividend decisions are driven by shareholder appetite rather than performance, so this is probably less weighty than the trading update above.

Reporting on business is hard - even in South Africa.

Interestingly enough, while we have discussed an article that misrepresented some issues with TM Pick n Pay in Zimbabwe, a similar incident occurred in South Africa with the Pick n Pay Group.

An article titled “True shape of Pick n Pay turnaround” prompted the CEO of Pick n Pay Group, Sean Summers, to respond with an opinion piece in the same publication to correct “a mischaracterisation of Pick N Pay’s performance”.

Below is the opening statement from that article:

“We are grateful for the right of reply to the commentary that appeared in your editorial opinion last week, which contained assertions that require correction or context (“True shape of Pick n Pay turnaround”, May 27).”

Even in South Africa, analysing a company's business performance is a struggle.

Where is the Money? What’s the Move?

If you have any interest in the retail sector as a supplier, business owner, or investor, being able to assess a retailer's performance is a skills that can make you or save you a lot of money.

Supplies have lost millions incases where a retailers suddenly collapsed.

With Pick n Pay, one of the most important factors to keep a close eye on is the exchange rate.

Pick n Pay is disproportionately exposed to the exchange rate, as about 80% of its sales are in ZiG, compared to the national average of around 20% to 30%.

As long as the exchange rate remains reasonably stable, TM Pick n Pay should be fine.

This means, for now, despite what the article suggests, there shouldn’t be any material impending risks in Pick n Pay, as we have with OK Zimbabwe.

That said, I am working with public information, and so I could be missing something or just wrong in my analysis.

Meikles Limited is expected to release its annual results soon. This will be another data point to look into.

Thank you so much for this very informative article which helps to clear the air on the TM PnP issue. However, what is missing is an analysis of the store closures of the 2 Mutare branches. Apparently N. Richard's Group just closed its doors in Mutare too.