The Business of Telecoms and Econet's Struggles

Ten years ago, Econet had its best-ever year, with revenues of $753 million, a profit of $194 million, and an award for the “Best Telecom Services and Solutions in Africa.”

Since then, revenue and profits have dropped, and recently, Econet had a significant network outage that hurt its reputation.

What is happening with Econet? Is it still a good business, or have other factors weighed it down?

Let's unpack!

To analyse Econet, we need to take a step back and break down the telecommunications (telco) business model into its simplest form.

The telco business model comprises four sequential, simultaneous, and repeating cycles.

Borrow - Build - Sell -Service.

This is obviously a simplification, but let me explain each cycle and then use MTN as an example before moving to Econet.

The first thing telcos need to do is BORROW because telecoms is a capital-intensive business, and self-funding is not viable.

The average debt-to-equity ratio for telecoms is 1.15, which means that for every $1 of capital, you need to borrow another $1.15.

Once you've borrowed, you BUILD (and maintain) the network and infrastructure that people will use (think base stations, etc.).

After that, you SELL people access to the network so they can make calls, send texts, use the internet, etc., and with the sales, you generate profits.

Then, with those profits, you SERVICE the loans (i.e., pay back the banks), and since you've serviced the loans, you can then BORROW more money, and the cycle repeats.

As long as all four cycles work well, you can repeat this continuously and make loads of money. Let's look at MTN's financial statements for a concrete example of this.

Starting with 2017, MTN had R80 billion in borrowings by the end of their financial year. As one of South Africa's biggest companies, MTN generally can raise capital.

MTN also has a higher credit rating than most African companies. For example, MTN has Moody’s credit rating of Ba2, compared to Dangote Cement's much lower rating of Caa1.

Borrow: ✅

MTN used this capital raised to build and maintain its network, as shown by its gradually increasing capital expenditure (CAPEX) from R26 billion in 2018 to R41 billion in 2023.

Build: ✅

With the network in place and working well, MTN was able to sell more services every year, as shown by the 11% annual revenue growth between 2018 and 2022. This led to an increase in return on equity (a measure of profitability) that nearly doubled.

Sell: ✅

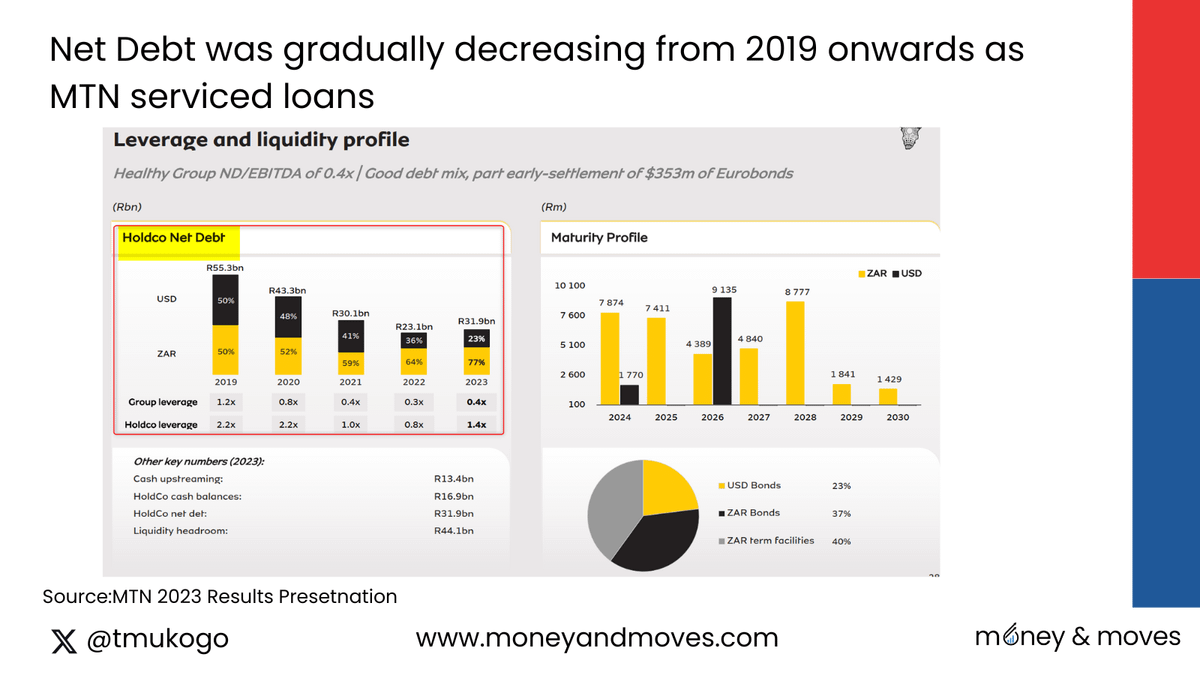

With the profits, MTN serviced its loans, as seen in the gradual decrease in net debt, which went from R55bn in 2019 down to R32bn in 2023.

You also see this in their cash flow statements, where they regularly pay back loans and then get more funding.

Service:✅

In reality, all these steps happen simultaneously. You're borrowing money, building your network, selling services, and servicing loans all at once.

When everything works, it's a beautiful and very profitable business model.

This is why telcos are often among the biggest listed companies in their markets. In South Africa, MTN and Vodacom are in the Top 10.

In Nigeria, MTN was for a while the largest listed company, with Airtel close behind. In Kenya, Safaricom still holds the top spot.

In the early 2010s, Econet was executing the Borrow - Build -Sell - Service cycle effectively.

In 2011, Econet raised a lot of debt, increasing its borrowings to $248 million – a $110 million jump from the previous year.

Borrow: ✅

Then, between 2011-12, Econet invested nearly half a billion dollars ($486mn) in capital expenditure, building the network infrastructure.

This was a huge amount. For context, that was more than double what MTN spent in Ghana in 2011 and 2012 (R845 million and R1.0 million).

Build: ✅

Concurrently, sales experienced rapid growth, with revenue more than doubling (+107%) from $363 million in 2010 to a peak of $752 million in 2014.

For context, MTN's revenue grew by only 28% during the same period.

Sell: ✅

Rising sales boosted EBITDA (a measure of profitability), providing more cash to service borrowings and reducing debt. Consequently, this improved Econet's creditworthiness and ability to borrow more.

Service: ✅

Things were going well as shown in the share price development reference in the annual report.

If you had bought Econet shares early in 2009, you would have multiplied your money fivefold by 2014.

However, even during this prosperous period, there were some flags to note. For example, with MTN, CAPEX was increasing as revenue and profits grew to build and maintain the network.

With Econet, after the surge in 2011-12, CAPEX kept decreasing even as revenue and profits were rising.

Other cracks were industry-wide, like when Econet, Telelcel, and Net One were ordered to reduce voice tariffs by 35%, which hit revenues hard. How much of an impact did that have?

In addition, did Econet also make some mistakes by spending capital on buying businesses it didn't need?

How does all this impact Econet today, and is it still an attractive business able to Borrow, Build, Sell, and Service?

We will unpack this and more in Part 2, “Econet's Struggles: A Decade-Long Financial Rollercoaster”, which you can now read by clicking on the link.

PS: I am working off of public information, so I could be missing something in my analysis or just simply wrong. I have provided the sources I have used so that you can come up with an alternate view if needed.

Let me know what you think. Opposing views are welcome!

Thanks Tinashe great read it is, will formulate a view after the commercial break, that is, upon dissecting the second instalment. Great beeakdown you make on these issues.

Econet's operating environment is challenging:

1. Potraz (huge license fees, levies, price controls, dictations e.g infrastructure sharing....

2. Macro-economics: currency fluctuations (high swinging), policy pronouncements (1:1) leading to huge losses for local businesses

3. Political/legal environment:

Then there're strategic blunders like the attempted move into TV and entertainment aka Kwese. I don't think the investment ever returned a dime!

Not sure also how other spin-offs like Maisha, insurance et al are contributing to the overall health of the company