Truworths Falls: The Winners and Losers

Let's start with one of the Losers - Mega Market

Truworths Zimbabwe filed for corporate rescue last week, meaning the company that made millions just over 10 years ago now can't pay its bills.

There will be many winners and losers. Let’s unpack the losers, starting with Mega Market - one of the most fascinating companies in Zimbabwe.

Mega Market is run by 38-year-old entrepreneur Shiraan Ahmed and is based primarily out of Mutare, breaking the conventional Harare bias.

Its core business is manufacturing and distributing fast-moving consumer goods (think rice, salt, flour), but in recent years, it has also operated like an Investment Firm.

Yes, the company that trades rice also trades listed stocks.

Mega Markets' stock portfolio is impressive. As a start, it is the second largest shareholder in Dairibord and Meikles, with 22.3% and 9.9%, respectively.

But that’s not all.

In the last five years, it has held or still holds significant stakes in Mashonaland Holdings, Fidelity Life, Seedco, Turnall, Masimba Holdings, Art Corporation, Zimre Holdings, Truworths and more.

All this is from a business in Mutare run by a 38-year-old.

Mega Market has generally done well over the last few years, but the investment in Truworths will not be one of the success stories.

Megamarket owns about 30% of Truworths and reportedly started buying up that stake in 2020 when it bought 6% of the company.

At the time, Truworths's market cap was less than $1 million, so it could have seemed like a good deal, especially considering that at its peak in 2013, Truworths had a market cap of over $20 million.

But here lies one of the strange things about companies and stocks: "What goes up must go higher, and what goes down must go lower." This means companies performing poorly generally get worse, and those doing well generally get better.

To quote Warren Buffet “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Truworths was probably bought at a wonderful price but the company was far from wonderful.

My estimation is that Mega Market invested around $500,000 - $750,000 in Truworths (based on the market cap and market rate at the estimated times the purchases were made).

Those investments will probably be worth $ 0 after the corporate rescue proceedings.

For those unfamiliar with it, corporate rescue is like an ICU ward for companies in critical condition that would be killed off by creditors’ claims without special treatment from the law.

The goal is to save the company, which hopefully can find a new lease of life and pay off its creditors.

Theoretically, the corporate rescue proceedings could result in all the creditors being paid in full, and shareholders like Mega Market (who get paid last), getting something back.

But it doesn't look promising when you look at how Truworths has been struggling and the fact that it doesn’t have a significant asset base

There is probably a better chance that the Australian Breakdancer “Raygun” will win a medal at the next Olympics than Mega Market and other shareholders recouping their investment.

However, I don’t think this will be a big hit on Mega Market.

Based on current market caps, its investments in Meikles (9.9%) and Dairboard (22.3%) alone are worth over $20 million.

So whatever happens Mega Market will be fine.

That said, no one likes to see their investments go to zero.

It also must be a little irritating that this is the second big corporate rescue in less than a year that Mega Market has lost money in.

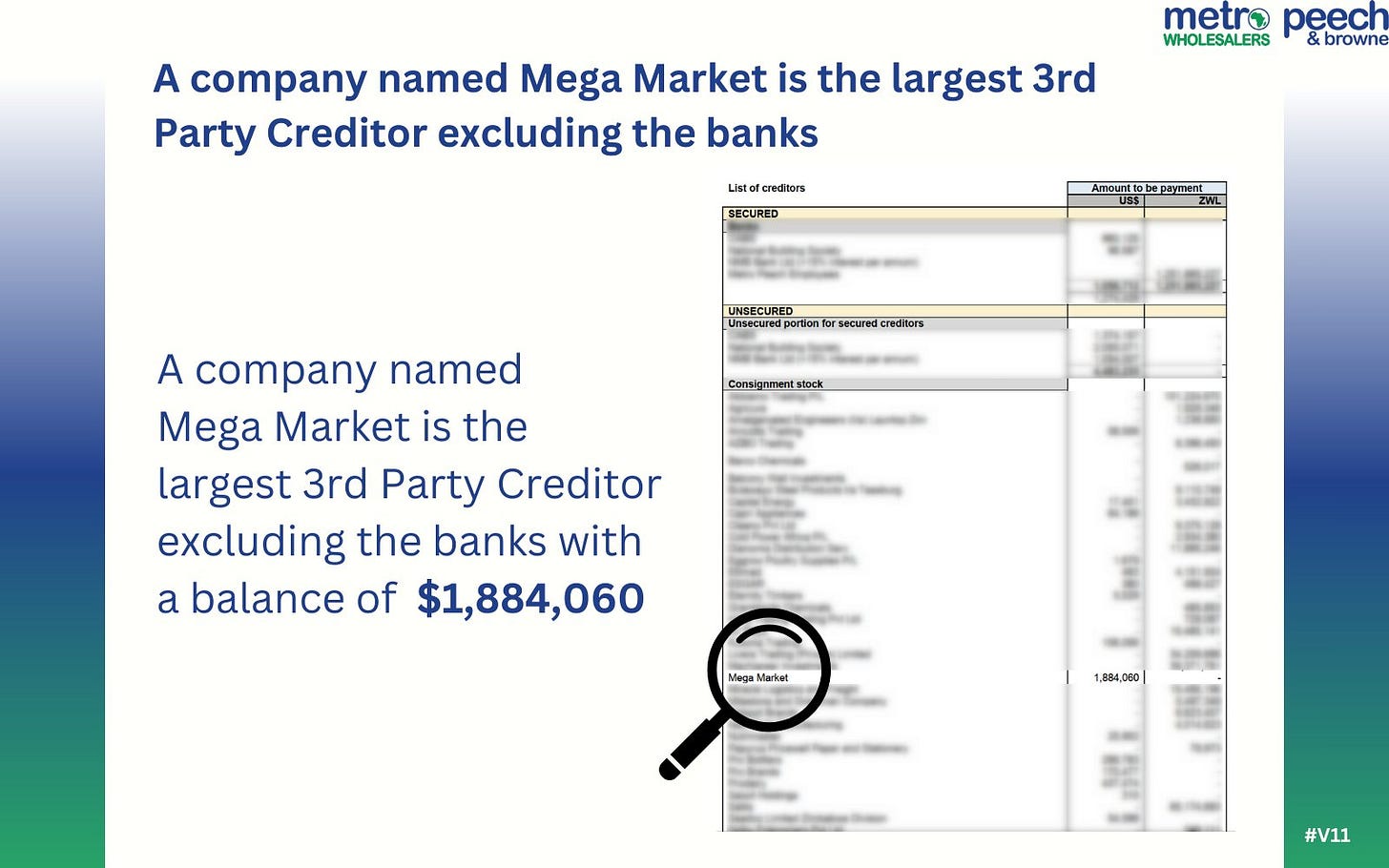

I covered this in a previous article on Metro Peech & Browne’s corporate rescue proceedings.

Mega Market was the largest 3rd part creditor excluding the banks with about $1.9 million owed.

In the end, creditors were paid 32 cents per dollar, so Mega Market lost about $1.3 million.

There are still a few other losers, but let's unpack that in Part 2.

If you enjoyed this, please share the post or subscribe to the mailing list if you are not already on it.

P.S. I am working with publicly available information, so I could be wrong or missing something.

Thanks for reading!

One question from a carpenter; are some of our local companies not shoring up their balance sheets with asset revaluations?

Chances of Truworths bouncing in the near future are quite slim with way things are going, the informal market is taking over and the nations tax policies are just not favorable for doing business in the formal sector.Out of interest, how is Edgar's doing ?