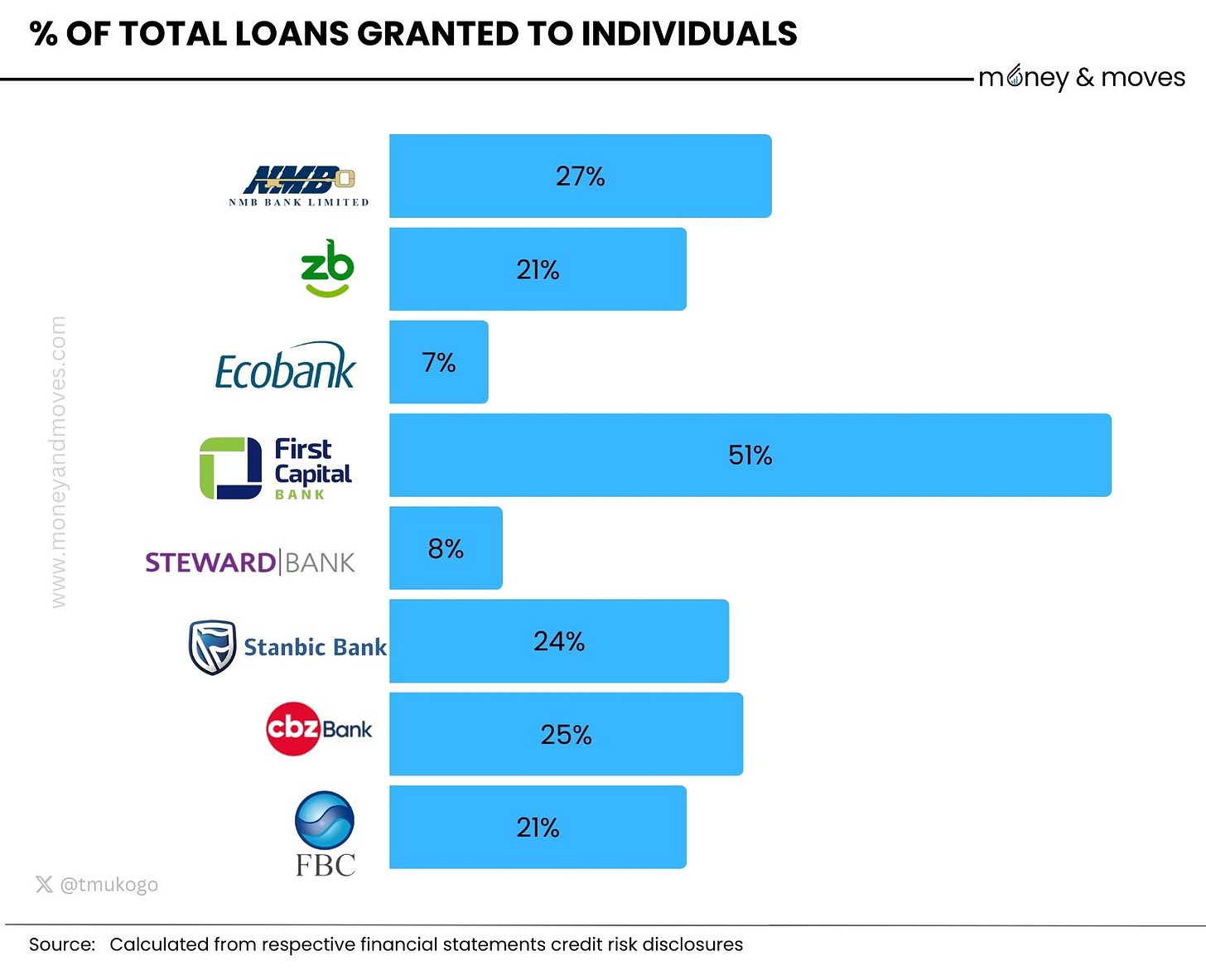

Visual: Who Are Zimbabwean Banks Lending To?

A breakdown of how much Zimbabwean banks lend to individuals vs corporates featuring Steward Bank, CBZ, First Capital, FBC and others.

Who are Zimbabwean Banks Lending To?

This visual shows the proportion of total loan balances held in personal lending (loans to individuals) compared to other classes of lending, such as business lending.

In other words, the chart highlights which banks lend the most money to people rather than corporations and other institutions.

The outlier is First Capital Bank at 51%, which we covered this week and highlighted this ratio as a potential driver of its strong performance.

The low ratio of Steward Bank at 8% is surprising. Historically, Steward Bank was positioned to become a leading retail bank through its partnership with EcoCash and Econet, even enabling customers to open a bank account on their phone in just 60 seconds.

I would have thought they would have a stronger presence in retail lending as well, but it doesn't seem to have been the case, as at their year-end, 29 February 2025.

Perhaps this is a temporary situation, as Steward Bank is in the process of transitioning after being acquired by TN Group and rebranding as TN CyberTech Bank, with the ambition of becoming a Neo-Bank (a digital-only bank that operates primarily through mobile apps and websites.)

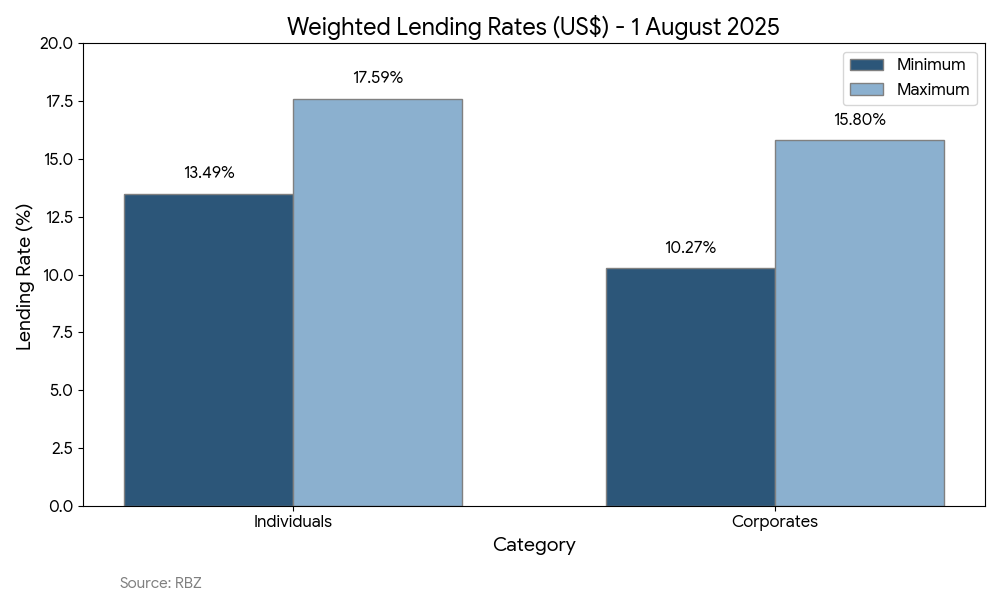

What Interest Rates Are Banks Lending At?

Another interesting data point to look at is the lending rates for individuals compared to those for corporates.

Based on the RBZ data from August, the average weighted interest rates for banks when lending to individuals ranged from 13.49% to 17.59%, and for businesses, from 10.27% to 15.80%.

The above also seems to highlight another advantage.

You make more money on loans lending to individuals than lending to corporates.

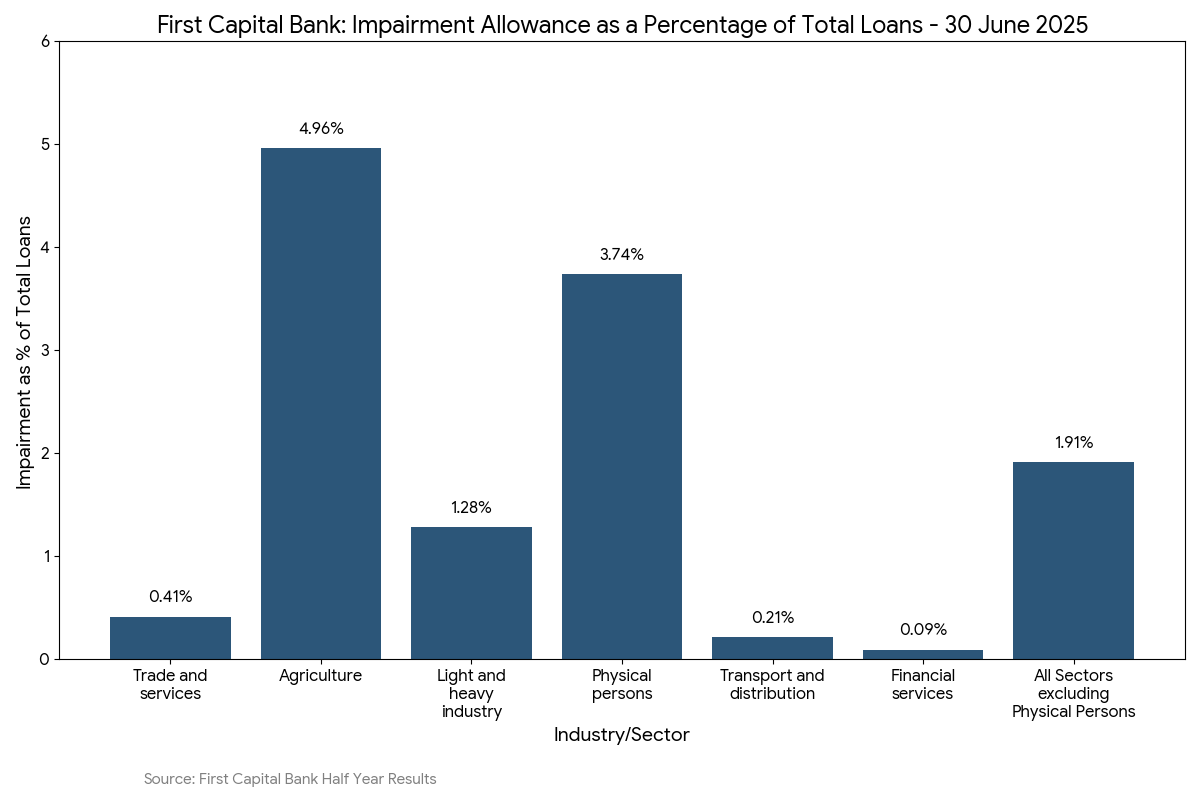

The Risk of Lending to Individuals

The question then is, does the higher return come with much more risk and is the risk worth the return?

This would require much more extensive research, but we can at least examine one data point to get an indication. Please note this is a simplification, intended to provide a high-level estimate.

The following chart shows First Capital Bank’s impairment allowance as a percentage of the total balance calculated from its latest results.

This essentially shows the estimated percentage of loans that may not be repaid, grouped by category.

From the chart, we observe two key points: loans to Physical Persons, i.e., individuals, seem riskier, with an allowance of 3.74% compared to the average of all other sectors at 1.91%. This trend was also the case in the previous year.

To assess the risk-to-reward ratio, we know that the average interest rates for banks when lending to individuals ranged from 13.49% to 17.59%, and for businesses, from 10.27% to 15.80%.

So, taking the middle of the range for each, the figures would be 15.54% for individuals and 13.04% for corporates.

This means by lending to individuals instead of corporates, you would generate 2.50% additional interest (15.54% - 13.04%), but then take on 1.83% more risk (3.75% -1.91%).

This indicates that lending to individuals leaves you with 0.67% additional margin; in other words, in this case, it’s more profitable than lending to corporates.

This is obviously a simplification and does not account for the terms of the loan and various factors.

It does, however, indicate that there is sufficient evidence to suggest that the reward of lending to individuals could outweigh the risk.

What do you think?

In Case You Missed It

Below is the article published this week, where we unpacked the First Capital’s results.

Next week, we will also look at another major bank's performance.

Thanks for reading. Think someone in your network should see this? Forward this email – you could help them make an important strategic decision.

PS: I am working with publicly available information, and so I could be wrong or missing something in my analysis.

Which category has a greater percentage of non-performing loans. Just imagining what those returns could look like once we factor that in.

Would be interesting to see what regional peers look like as well eg. SA big banks. I know it may not be comparing apples to apples but 🤷🏿♂️