Visuals: Innscor, Econet, MTN and Airtel

Today, we are featuring four companies in Visuals: Innscor Africa, Airtel Zambia, MTN South Africa and Econet Wireless Zimbabwe.

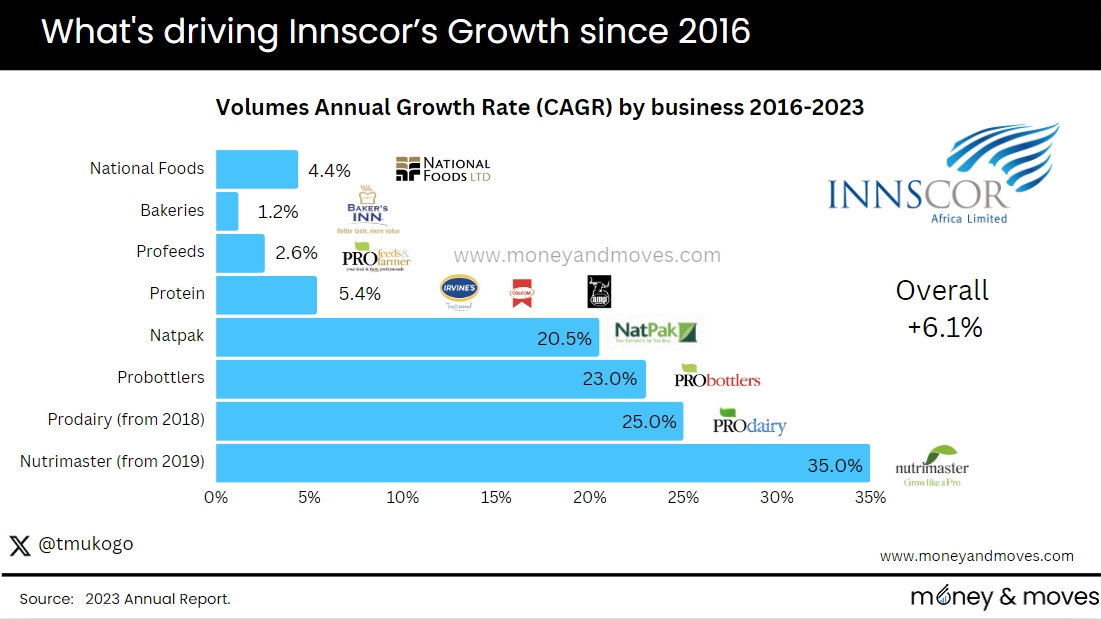

Innscor’s Impressive Growth

Innscor Africa, a manufacturer of consumer staples and durable goods, recorded an impressive 6.1% annual growth rate between 2016 and 2023, at a time when most companies in Zimbabwe were contracting.

Volumes sold are the most reliable measure of growth over this period since hyperinflation made ZWL's financial numbers more difficult to interpret.

Innscor has also now started reporting numbers in USD since its listing on the USD-denominated VFEX in 2023 and some analysts now project that its revenues will exceed $1 billion within the next year, up from $804 million.

This growth highlights Innscor’s dominance in Zimbabwe, where it is hard to go a day without using a product that Innscor sells.

This also raises another question.

Is it still Innscor Africa or now just Innscor Zimbabwe?

In 2013, Innscor generated 19% of its revenue from the Rest of Africa; with the balance of 81% from Zimbabwe. This was sufficient a mix to say that Innscor was a business operating in Africa.

However, by 2023, Zimbabwe made up 99.9% of total revenue with only 0.1% from the Rest of Africa.

Part of this is due to the demerger and sale of other businesses like Simbisa Brands and the Spar franchise, but it does make you wonder if there has also been an intentional drive to be more focused on Zimbabwe.

I have some more thoughts on this, which I will share soon in a more detailed post dedicated to Innscor, but here are some questions worth asking.

Does Innscor’s dominance mean it's much easier for them to make money in Zimbabwe compared to other markets—even if other markets are, in theory, more attractive?

Does being good at doing business in Zimbabwe make you less capable of doing business elsewhere?

I will unpack this in another post soon.

Increasing data revenue is Important. Is Zambia leading the way?

The importance of data revenue for telcos across all markets has increased. The biggest leap, however, appears to be in Zambia, where the leading telco, Airtel, has seen the contribution of data revenue to its total revenue triple.

Despite starting at similar levels in 2015 with a 14% contribution, Econet's revenue share from data hasn't grown as much as Airtel Zambia’s. This could perhaps be a result of the high cost of data in Zimbabwe, which has resulted in customers limiting their use as much as possible.

MTN has a higher share of data revenue than the others but also from a much higher starting point in 2015. The fact that Airtel now has about the same split as MTN shows just how much data uptake has been.

This may also indicate that Zambia has made more progress than Zimbabwe and even South Africa in recent years in terms of increasing the accessibility of the internet in the country.

Another data point in line with the above is that Zambia was the first country among the three to license Starlink. Zimbabwe has now followed suit, but little progress has been made in South Africa so far.

I recently covered topics related to telcos and internet pricing, so if you want to explore those topics further, consider checking out the articles linked below.

Thanks for reading. Don’t forget to share with your network and subscribe if you haven’t done so! If you enjoyed the visuals, please let us know.