Zimbabwe's Delta Corporation: A Game-Changing Case Study

Zimbabwe's Top Companies Like Delta Corporation Have Mastered This One Thing Better than Global Companies Such As General Electric (GE).

This must-read case study covers 20 years of corporate history and will change how you see Executives in Africa!

🧵+ V11s 👇🏾

In 2000 Delta Corporation wasn't only a beverage company it had a hand in many unrelated businesses. It was into hotels, casinos, supermarkets, furniture as well as being a drinks manufacturer. In short, it was what is called a #conglomerate.

A conglomerate is a company that owns multiple unrelated businesses like Delta did in 2000: they sold beer, soft drinks, groceries, furniture, ran hotels, and more.

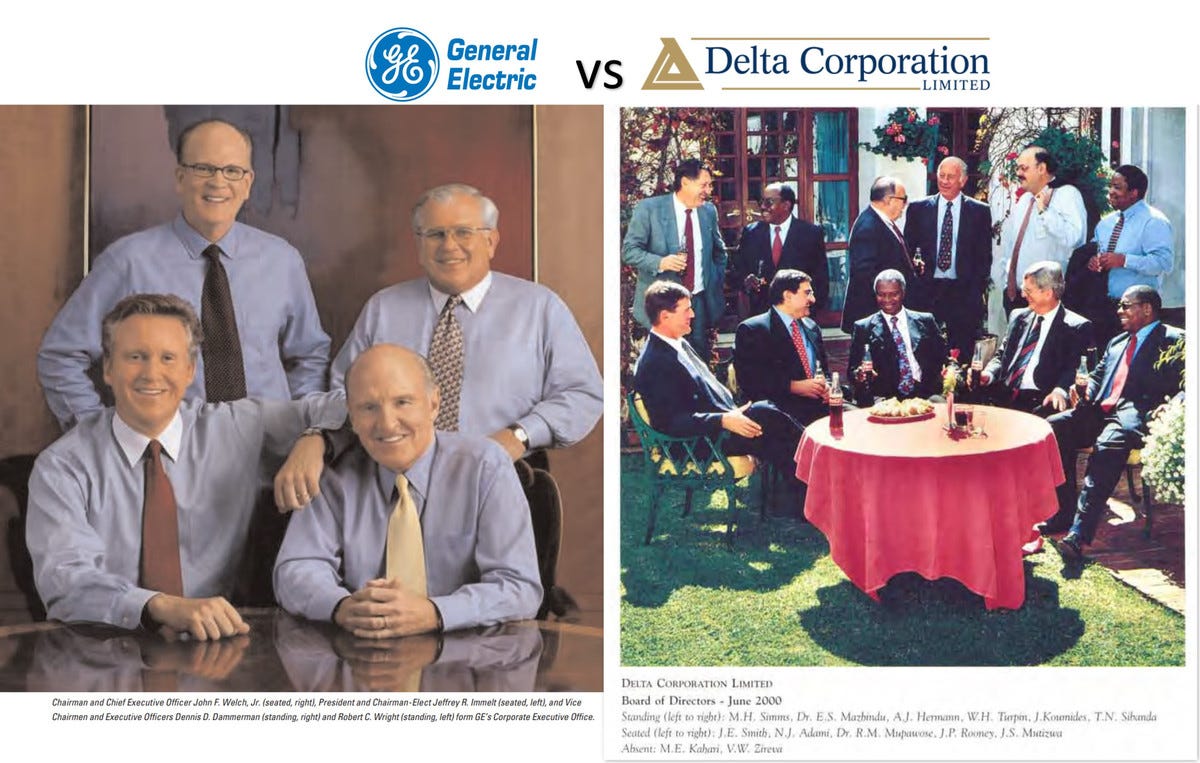

This was popular back then. General Electric (GE), the world's biggest company at the time, was a conglomerate.

The theoretical advantage of conglomerates is that being in unrelated businesses is a hedge. The bad times in one business or industry are offset by good times in another.

The major criticism of conglomerates is they lack focus and are unnecessarily complex.

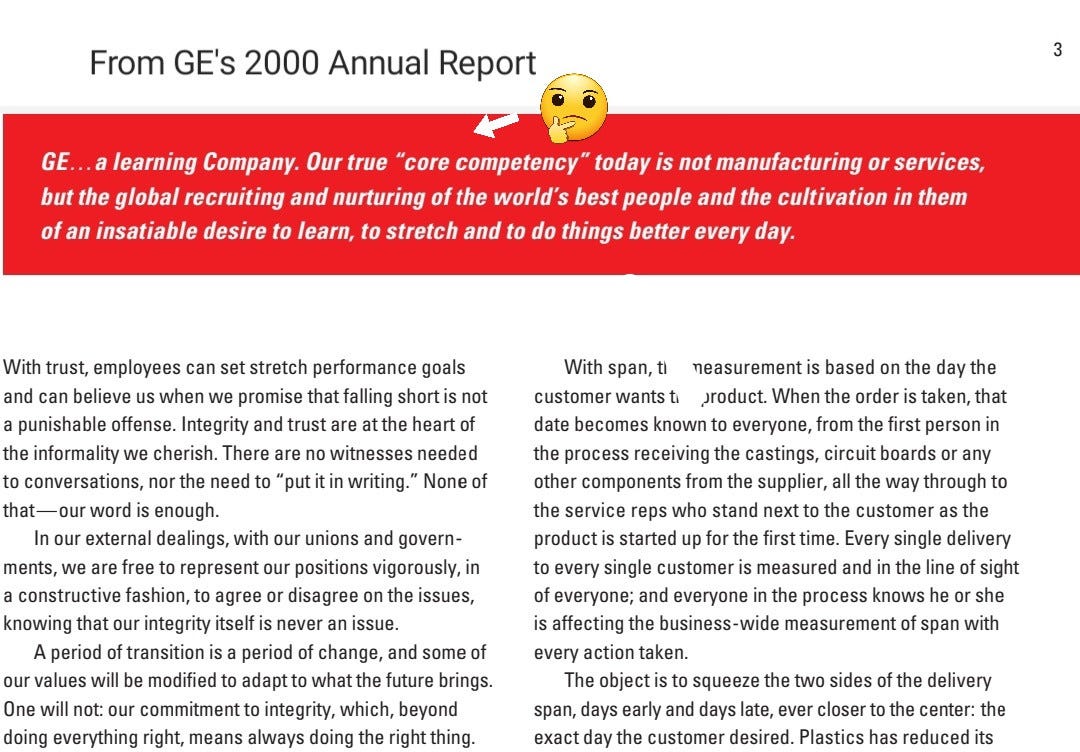

In 2000 GE was 100% persuaded by its conglomerate structure and believed all their different unrelated businesses created intellectual capacity that helped "elevate" GE.

Delta however went a different direction deciding to focus on the Beverages business and sell off everything else. This was a bold move as conglomerate breakups were not as common & meant selling influential businesses like OK, one of the largest retail chains in the country.

By 2001, Delta had disposed of its interests in noncore businesses. The remaining Beverage businesses were now related but still only on paper as they ran independently. Delta needed to reorganize as former Delta CEO Mutizwa says in his book "Personal Crucibels".

Joe Mutizwa and his team needed to persuade many stakeholders. However, in only 24 months the reorganization was complete and Delta had a new vision...'To create a world-class, integrated, total BEVERAGES BUSINESS..."

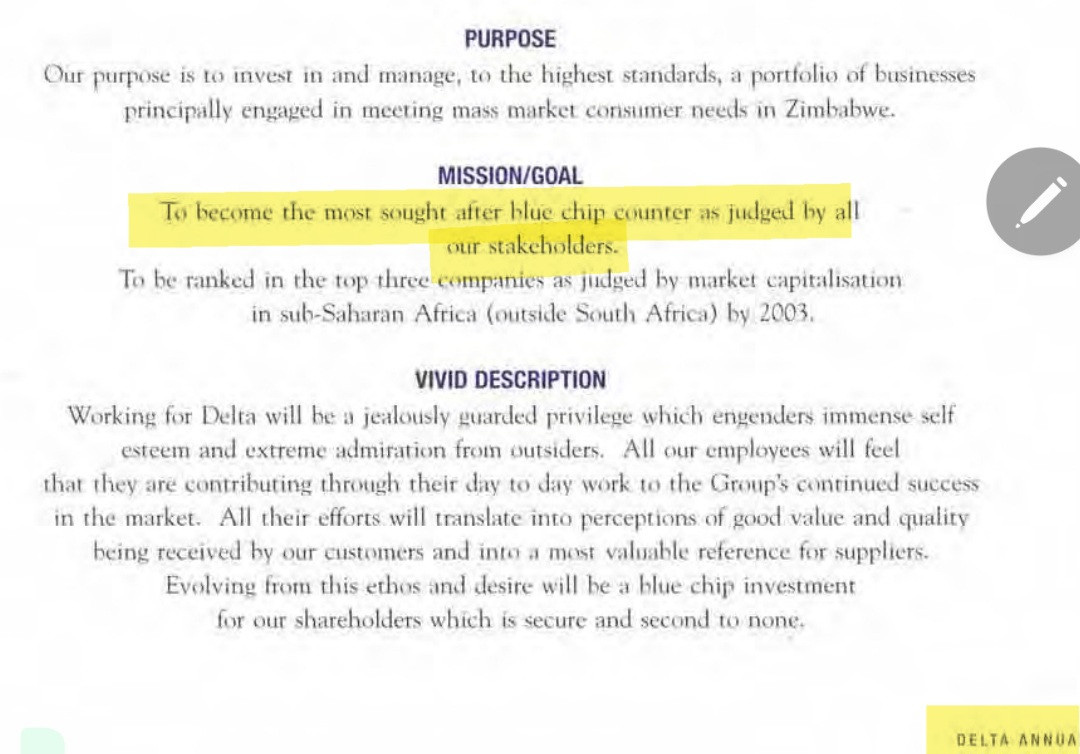

Delta now had a vision focused on a specific business, which wasn't the case before (1st image is Delta's vision before).

GE, however, was still vague. They didn't even see the need to highlight competencies in any business. They believed their "core competency" was people🤔.

As Delta was selling off unrelated businesses GE was trying to buy more with a $45bn bid for Honeywell. GE was into Aircraft Engines, Plastics, Household Appliances, Finance, Software, Power Plants, TV Broadcasting, Healthcare, & more..🤯. A total of 13 different businesses.

Over the next 20 yrs, GE & Delta encountered major challenges. In 2001, GE had to deal with the 9/11 terrorist attacks, while Delta faced economic instability in Zim. In 2008, GE faced the global financial crisis, Delta battled extreme hyperinflation & political turmoil

20 years later, Delta has navigated these challenges, executed its vision, and is the largest company in 🇿🇼, whereas GE has struggled. GE's stock price has fallen over 60% since 2000 & it has been on an aggressive turnaround plan that has included huge cuts to dividends.

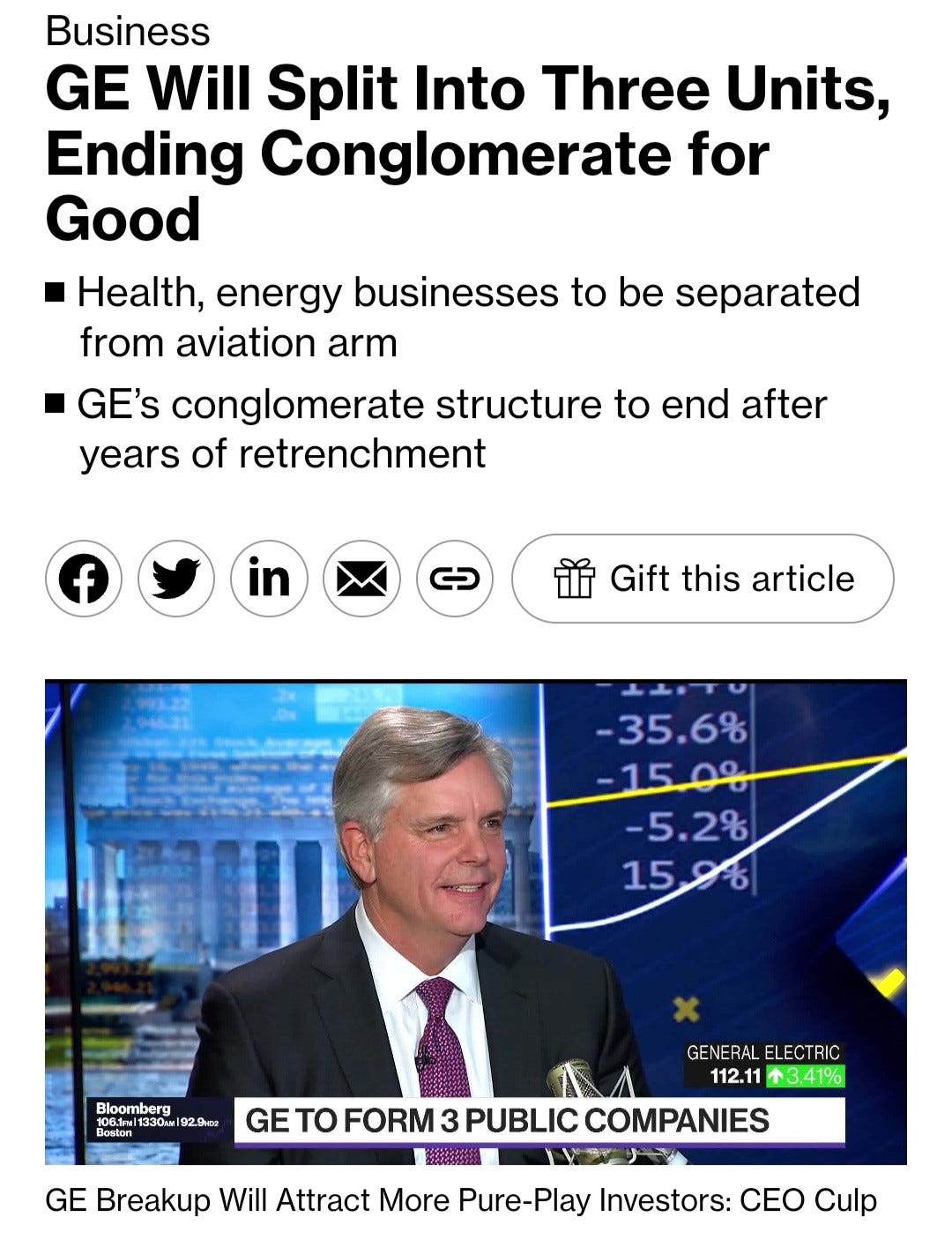

How can we know that this poor performance is also linked to GE's conglomerate structure? In 2021, as part of the turnaround, GE announced it was breaking into 3 separate businesses in order to be more focused on something that Delta had done 20 years earlier.

How do we know Delta's structure prepared them better? Meikles, one of Delta's peers maintained a conglomerate structure and its performance has lagged behind Delta. In addition in 2001, Meikles also started to unbundle starting with its tea business, Tangada.

Other peers that have been resilient such as Innscor and Econet have made similar moves..Econet Wireless unbundled Ecocash & Steward Bank in 2018 to set up a more finance-focused Casava Smartech (now Ecocash Holdings).

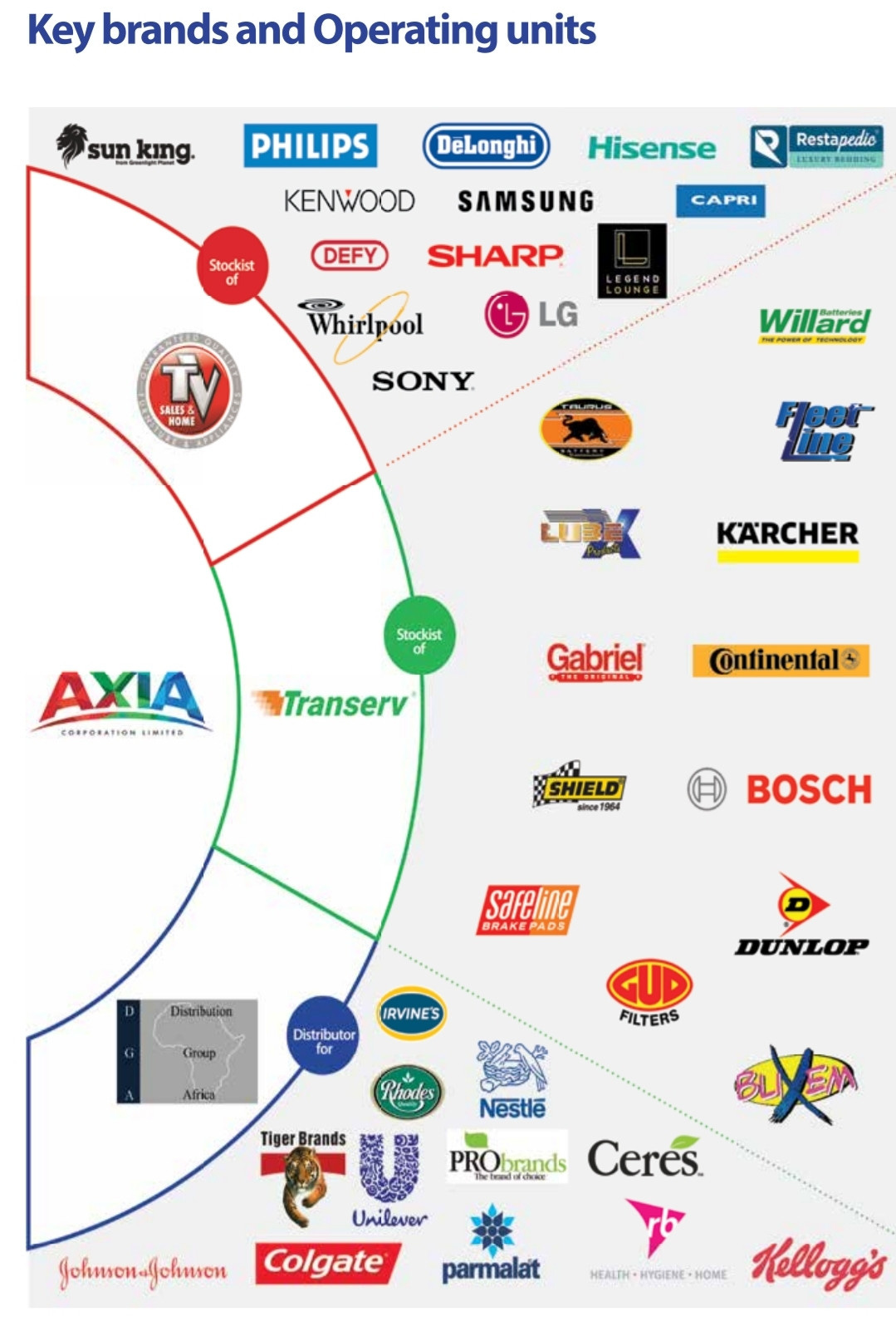

Innscor has been particularly good at spinouts. In 2015, it spun out Simbisa Brands to focus on Quick Service Restaurants (see images). Then, in 2016, it spun out Axia to focus on household and durable goods retail.

In both cases, one of the key goals was to improve focus.

If you look at the 10 biggest companies in the world only one of them, Berkshire Hathaway run by Warren Buffett, is a conglomerate. But even Buffet doesn't classify Berkshire as a typical conglomerate and further highlights the issues of conglomerates

In summary, Delta was better prepared for the future than GE. Often we think of best practices only coming from Europe or the US but in this case, Executives from Zimbabwe did a great job with their corporate strategy to best prepare their companies for success.

Takeaway 1: Companies benefit from having a core focus and operating in related fields where previous competencies can be leveraged. When entering unrelated fields, it's better to establish an independent entity with a separate team possessing industry-specific knowledge.

Takeaway 2: This principle applies to companies but to some extent can be applied universally. Without focus, you can end up a jack of all trades and master of none.

And one more thing...

If you enjoyed the thread above, you may also enjoy my last two threads on finance & strategy. Additional Tread (1/2)

https://twitter.com/tmukogo/status/1682320244818288641?s=20

Additional Tread (2/2)

Great analysis, though I think you only took a snapshot in time and used that to make a specific argument. GE and Delta are two different businesses with different histories and contexts that lead to them being the Companies that they are. It’s only from an appreciation of their unique stories where one can seat and analyze the merits(or none thereoff) of each company’s strategy. I look forward to reading more of your analysis of Delta considering they expansion strategy outside of Zim through the sorghum beer brands which is worth watching in the long term and their missteps with their mahewu brand where brand value was destroyed as a result of a strategy being forced upon delta by Coca-Cola (a perfect example of African companies not having confidence in their own competencies and understanding of their local markets).

Going to Delta’s analyst briefing today, would be interested to see how the story continues. Great work.