Cracks Beneath the Property Boom? What Zimbabwe’s Pension Data Reveals.

High valuations, low yields and struggling tenants

In its latest report, the Insurance and Pensions Commission revealed that pension funds have once again marked up the value of their property portfolios — even as rental yields slipped to just 3.7%.

At the same time, the very companies that contribute to these pension funds — and rent space from them — have increased their overdue payments by 37%.

How much longer can property valuations keep rising?

About the Insurance and Pensions Commission (IPEC)

IPEC regulates Zimbabwe’s largest institutional investors — pension funds and insurance companies, which together hold and deploy the biggest pools of long-term capital in the economy.

Because of the above, IPEC reports can show you what is happening and what might happen next in the entire economy.

This week, IPEC released their 2025 Q1 Pension report. Let’s unpack.

Are Property Prices in Zimbabwe Getting Too High?

There are logical reasons why property prices in Zimbabwe appear to be so high.

We covered that in this post here. However, some data points raise questions about whether cracks are starting to emerge in valuations.

In the latest report, total assets increased by 10%. However, a lot of that growth was driven by revaluation gains, including those from fair value adjustments to “investment properties.”

Simply put, pensions estimated their property portfolios to be more valuable at the end of March 2025 than they were at the end of December 2024.

What stands out is the yield on that property portfolio — essentially rental income divided by property value. This number is similar to your return on investment.

Calculated, the yield works out to just 3.7%.

That is not great.

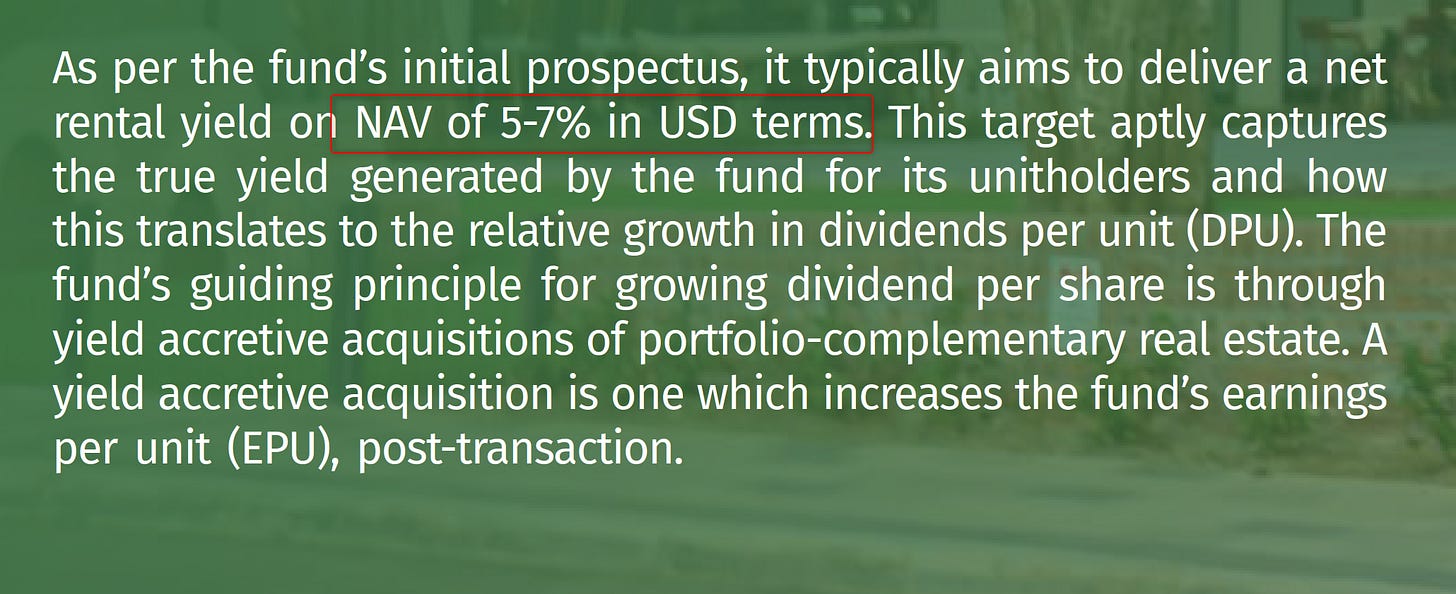

For reference, Tigere Property Fund, which owns Highlands Park, targets a yield of between 5% and 7% for a relatively low-risk property portfolio.

If this were just a single property, it wouldn’t be much of a concern. Low yields can result from temporary tenant turnover or contracts with escalation clauses that kick in over time.

However, in this case, it represents 967 pension funds and over $1 billion in property — a substantial sample that may indicate a structural trend.

If Yields Are Low, Why Are Valuations Increasing?

Normally, if yields are low, you wouldn’t expect the value of properties to keep rising.

But part of this may be a timing issue.

If you own a property that is still under development, it would temporarily distort the calculation of the rental yield mentioned above, as you would have an asset that isn’t generating rental income yet.

That could partly explain why the yield is so low, although not sufficient to close the gap.

However, even if that’s the explanation, it still raises the question: if all the properties are completed, who will take on all the newly created demand?

The IPEC report showed that contribution arrears from companies increased by 37%, reaching $93 million.

In other words, companies are struggling to pay pension contributions, a sign of a challenging Zimbabwean economic environment.

If more companies can’t afford to pay pension contributions, doesn’t that indicate that fewer companies can afford to pay rent?

If so, can property continue to boom while businesses struggle?

There Will Be Winners & Losers

The data points above do not mean that the property boom is over — far from it. As mentioned before, there are probably still a few years to go.

However, what I think will happen is that we will start to see more losers in the property space.

In the early days of a market boom, nearly anyone can make money; however, over time, this changes.

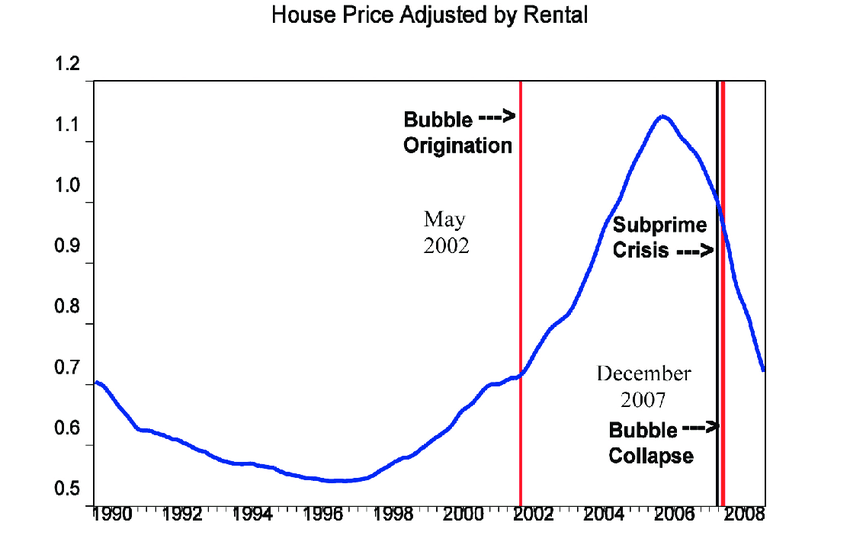

An interesting case study is the global financial crisis back in 2008, which was triggered in part by a property boom.

In his book The Big Short, Michael Lewis describes a nanny who, at the peak of the housing boom, owned six houses.

How? She borrowed money to buy her first house. As property prices kept going up, she borrowed more and more, repeating the process until she owned six houses.

At that time, everyone investing in property was making money. You didn't need to be an expert when the market was doing well.

However, when the market crashed, she was unable to make her mortgage payments and lost everything.

While debt is not as much of a problem in Zimbabwe, there will be some property investments that look like winners today that will end up big losers tomorrow.

Where’s the Money? What’s the Move?

They say you can’t go wrong with property. I say you can’t go wrong with quality.

Even as the property boom continues for a few more years, the money is in quality.

There will be a surge of new developments and opportunities in the space, but many will fail to deliver the expected returns. This is already what the IPEC report is signalling.

Linked to the quality, I think the same still applies to listed companies.

Even though the stock market has been depressed, high-quality companies are still offering decent dividend yields, despite the challenges, and still have significant upside potential.

It could also be a move to diversify investments. Currently, over half of property owners have more than 80% of their wealth tied up in property. Now could be a time to rebalance.

The best time to diversify is when you don’t need to.

Thanks for reading. Think someone in your network should see this analysis? Forward this email – you could help them make better investment decisions.

Additional articles worth checking out on Property in Zimbabwe

Why Zimbabwean Property Prices Defy Gravity

When Investing in Property Beats the Stock Market (And When It Doesn't)

Property Rich, Capital Poor: Zimbabwe's Growth Dilemma

Free Online Course

I recently published a free short course with Isaac Jonas, titled "Investing in the US Stock Market for Beginners." It’s now available on YouTube! You can check it out here.

PS:This article is based on public information and my own analysis, which could be incomplete or just wrong. It is intended for educational purposes only, and readers are encouraged to do their own research and reach their own conclusions.