Property Rich, Capital Poor: Zimbabwe's Growth Dilemma

Could Zimbabwe's property wealth hinder business investment and growth?

Over half of Zimbabwean property owners have more than 80% of their net worth tied to property, compared to about 39% in the United States.

This is a problem that can also have a damaging impact for businesses and in the long run for property owners.

Here is what every property owner, investor and entrepreneur needs to know.

More Money, More Property

The chart below is from an online poll that asked property owners what portion of their net worth was tied up in property.

Of the respondents, 56% responded that more than 80% of their net worth was held in property.

This is not surprising.

Based on the research conducted in the last few articles focused on capital allocation into property compared to other asset classes (you can read them here and here), we identified that individual and institutional investors have disproportionately invested in property.

This is understandable, but may also present a big problem from an economic and business growth perspective.

For businesses to thrive, “risk capital” is needed.

Risk capital is money invested in new ventures, growing companies, or any entity that has a higher risk profile than the norm but also offers the opportunity for much greater returns.

Money invested in property is what I would call “idle capital”. Property is not easy to divide or sell quickly, so that capital doesn’t “move” much; it essentially stays idle. It also tends to be less risky, especially in markets like Zimbabwe,

If most of your net worth is tied up in property, you are less likely to invest much in other ventures.

Imagine two people with a net worth of $1 million.

One has $1 million in listed shares, and the other has $1 million in property. Who is more likely to invest in a business if you approached both?

The person with listed equities could sell 10% of his holdings and have the money in the bank before the weekend. However, the property owner may not be able to split their portfolio into 10%, and even if they could, selling the property would take too long.

The US Advantage: Access to Risk Capital

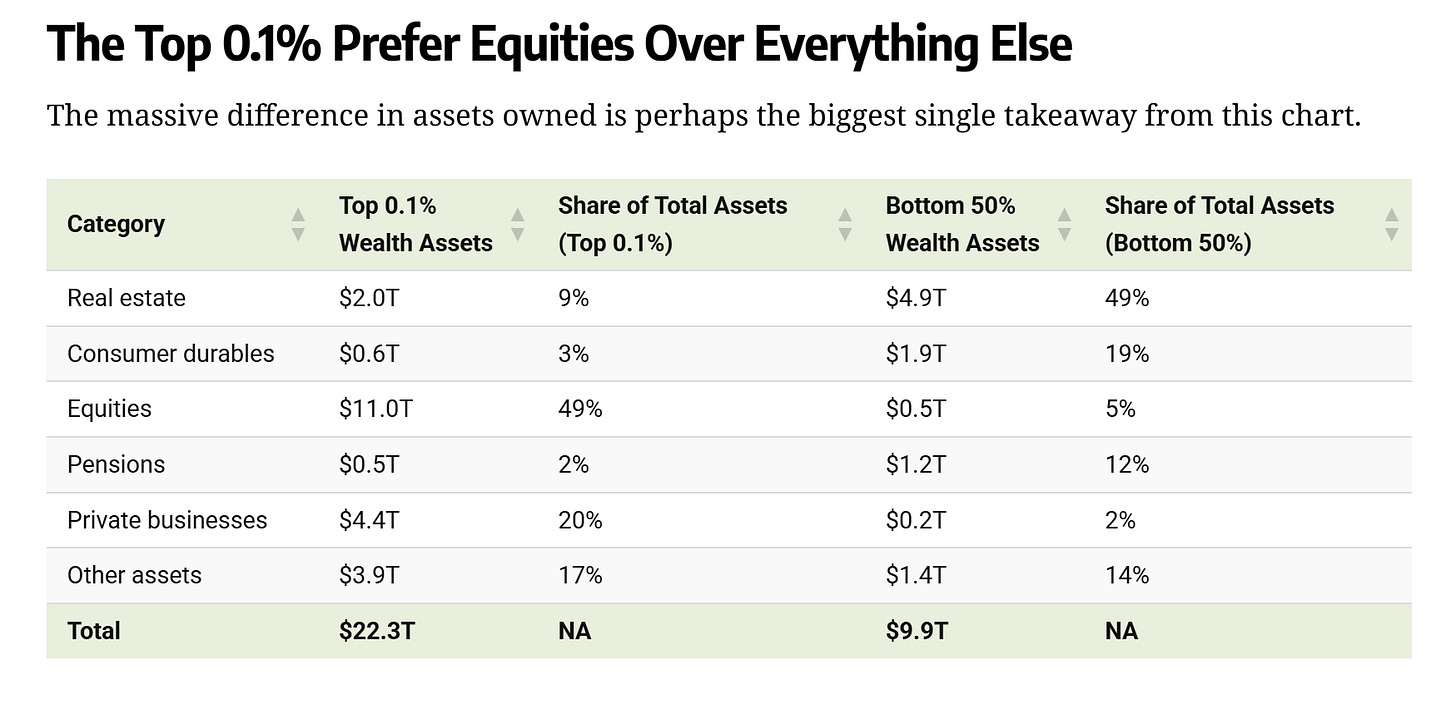

The situation in the US is completely different. Although 39% of household wealth is in property, that is not even the full story. Looking at the top income earners, the amount in property (real estate) is only 9%, and the majority is in Equities and Private Businesses, at 69%.

The higher proportion of capital allocated to equities and companies is arguably one reason why the US leads in business.

Jeff Bezos (Amazon’s Founder) explains this point below.

In the clip, he highlights that the US's biggest advantage is its ability to raise capital.

“You can raise 50 million dollars of seed capital to do something that only has a 10% chance of working.”- Jess Bezos on the big advantage that the US has.

In Zimbabwe, this is currently the opposite.

Capital is hard to raise.

Even the former and current CEO of OK Zimbabwe, Willard Zireva (if this sounds confusing, read about it here), once remarked that he struggled to raise capital for his business ventures.

If the highly connected CEO of one of the country's largest retailers struggled with raising capital, how much more will other entrepreneurs?

Zimbabwe needs more capital to drive economic growth.

The challenge is that institutions and individuals with capital mainly deploy it into property. In the long run, this could lead to more property available than there are businesses and employees that can afford to rent it.

Where’s the Money, What’s the Move?

Businesses in Zimbabwe are starved of capital. The banking sector’s limited lending also contributes to this situation.

The current loan-to-deposit ratio, which measures how much of a bank's money is given out in loans, is 59% for USD balances and 50% for ZWG Balances. Compare this with South Africa's, which sits at 96%.

It is also worth noting that deposits in Zimbabwe are already low, as people often do not bank their cash, which further highlights the limited number of loans being granted.

As a result, if you have capital to invest or lend, there is probably a lot of demand. This perhaps explains the growth in the microfinance industry.

In September 2023, there were 258 thousand active microfinance loan clients. One year later, that number had more than doubled to 549 thousand.

From a policy perspective, there needs ot be a push to invest more in other asset classes.

After all, a sustained boom in property needs to be driven by increased economic activity, with companies expanding to new locations and hiring more people who need housing.

The only way that happens is if capital is made available to build new businesses and drive economic growth.

Thanks! We still need to get that appointment set up by the way!

Fully agree I think. There is a need for more capital. Venture Capital is great although wouldn't advocate for the US model. I think our markets not mature enough.

It needs to be more patient.

Beginning to look forward to seeing your name in the inbox!

Since we are not Zimbabwean we cannot be certain but are prepared to bet that an extremely high % of those whose net worth is tied to property is an investment in their own residence. Which means that if they approach a bank for a loan to fund a business venture the bank's are likely to want to security and usually that will then be provided by using the property (meaning that if the business fails the residential home is also at risk. And sales in execution notoriously deliver returns below the actual worth of the property. In SA a measure has been introduced to reduce the incidence of a debtor's residential property being sold at"bargain basement" prices.

But the real answer lies in the development of a true venture capital market and approach to financing (which doesn't exist in SA either). Venture Capital investors know that around 7/10 of investments will fail, 2 may come close to breaking even, and only 1 may earn enough to make up for all the losses incurred across the other investments.

South African's largely have a risk averse approach. In the USA and Canada investors seem more willing to take a chance - but then because they have numbers on their side they also tend

to make smaller individual investment but across many counters.

Keep well - looking forward to next Thursday