Innscor's Financial Results: Money Never Sleeps

While others hedge and wait, Innscor doubles down

Innscor recently released its results, showing blockbuster revenue growth that is unexpected from a billion-dollar company in a lagging economy, at a time when others are hedging their risks due to de-dollarisation concerns.

For Innscor, however, it's full speed ahead.

Their results offer a valuable lesson for any business leader in capital allocation, conviction, and striking when opportunity arises.

Let’s unpack!

Innscor’s Financial Results

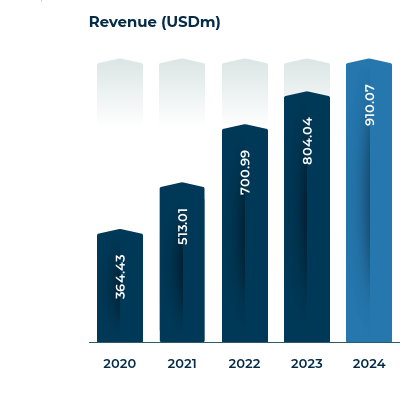

Innscor posted a solid set of numbers, with the highlight being revenue growth of 19% to reach $1.09 billion.

That increase from last year was $176 million. To put that growth into perspective, it represents more revenue than Dairiboard, which holds a 37% market share in the country's milk market.

In addition, in 2021, Innscor's revenue was about $513 million, so they have added $500 million of revenue in less than five years.

To also put that growth into perspective, it represents more revenue than Seedco, Edgars, NMB, African Sun, Tanganda, Ariston, and Proplastics combined.

What is driving this growth? We will unpack that later on, but for now, we also need to examine the profit, which came in at $51 million, resulting in a net profit margin of 4.7%, down from 5.3% last year.

The EBITDA margin (which can represent operating profit) was also down from 9.5% to 8.9%.

If there is an area where Innscor would want to improve, it is in profitability.

While revenue growth has been excellent, profit has suffered.

The below shows Innscor’s Revenue and EBITDA margin, and you can clearly see that it has been dropping from around 15% to 9%. That is $60 million worth of EBITDA.

Some of this is by design. Innscor launched The Buffalo Brewing Company in 2021 to compete with Delta Corporation. This business is likely to have been loss-making initially as it builds up.

Another reason for the lower margin is the sugar tax introduced in 2024, which Innscor was unable to pass on to customers fully.

However, even if we add back the $10 million of sugar tax, the EBITDA margin would still be less than 10%, significantly lower than the 15% from earlier.

Also, the main challenges seem to be with its Protein Division, which includes Colcom, Irvines and AMP.

One theory I have regarding margin compression in general is around the increased informalization of the Economy. When customers are shopping in less formal retail stores, the aesthetic feel of the place matters less. Pricing becomes the primary consideration.

This means that for a manufacturer like Innscor to compete effectively and grow volumes, it must offer attractive pricing for informal retailers to push its products. As a result, margins suffer.

Overall, Innscor achieved a solid set of results, but profitability still leaves room for improvement. Some of this will come naturally as new business segments grow and become profitable; others will require a bit of work.

One benefit of the profitability is its “high quality," meaning it effectively converts into cash flow. Innscor generated $104 million in cash from its $51 million profit— a very good cash conversion ratio.

However, the highlight has been the exceptional revenue growth, which merits further examination.

Innscor’s Growth: Money Never Sleeps

If there is one superpower that Innscor has had, it is exceptional capital allocation.

Capital allocation is the distribution, re-distribution, and investment of financial resources to maximise stakeholder profit. In short, it's about identifying opportunities and knowing how to organise, structure and deploy your capital to make the most of those opportunities.

This is one of the most challenging tasks for executive teams to accomplish effectively, and it often determines whether they succeed or fail. One of the reasons OK Zimbabwe ended up in distress was due to issues with capital allocation, which we flagged back in 2023.

Innscor, on the other hand, has consistently made sound allocation decisions.

Whether through mergers and acquisitions (M&A), joint ventures, demergers, or new businesses, Innscor continually finds opportunities to drive growth and maximise returns. Innscor’s money never sleeps.

Below is a visual showing the evolution of the group that clearly showns just how active the company is.

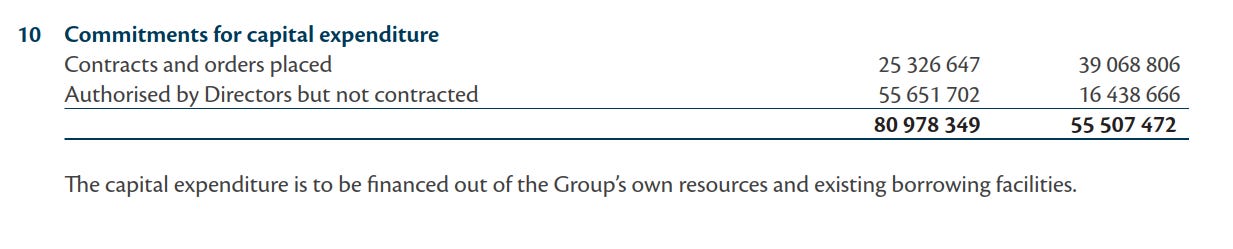

In recent years, the emphasis has shifted to internal investment, resulting in massive growth in capital expenditure (CAPEX). Annual CAPEX rose from $8 million in 2020 to more than $70 million in 2024.

Innscor is also not slowing down. As of the half-year ended June 30, 2025, the company has committed another $81 million in CAPEX, indicating further growth is expected in the future.

This is a very intresting point.

While more and more companies are hedging by holding property, for example, Innscor appears to be pushing full speed ahead, despite discussions about phasing out the US dollar by 2030.

It appears that the Innscor approach is to make your money work today and then deal with 2030 topics when and if they arise.

Capital is always being deployed. Money never sleeps.

Where’s the Money? What’s the Move?

A common trend among top-performing companies, whether in terms of growth like Innscor or stock returns like First Capital, is that they are capitalising on current opportunities without trying to overengineer the future.

As mentioned in an earlier post, Zimbabweans suffer from a condition I refer to as Hyperinflation Induced Trauma that can paralyse taking action due to a fear that hyperinflation will return again.

While the fear is understandable, it may not be the best way to make decisions. As Warren Buffett says, to make money, you often need to “be greedy when others are fearful”.

Some businesses are holding back from investing due to concerns about the potential consequences if the US dollar is phased out and hyperinflation returns post-2030.

While this is a valid risk, it is also an “extinction-level risk”. If 2008-style hyperinflation returns, all companies will struggle, even those that have hedged.

So perhaps it’s better to dance now while the DJ is still playing, because if the music gets cut off, then everyone will have to go home.

So a few questions to reflect on as we end.

Are you allocating your time, effort, and capital toward the opportunities that have the highest return or are you withholding resources out of fear of what might happen?

Are you waiting for clarity that will never come to make your next bold move?

Is the capital you are investing generating positive returns, and if so, why are you not trying to invest more?

Great read as usual. I think Colcom, Irvines and AMP are particularly unsuited to the informal retail market because of the perishable nature of their goods. Seems like that's one of the few areas of retail that are safe from informalisation by design or am I missing something?🤣

Great read. Would like to follow OKs resuscitation and what went wrong in the first place. Hope i didn't miss it.