Smart Move or Tired Solution? OK Zimbabwe Rehires CEO

Is bringing back former executives the solution or a step backward?

Last week, in the article “OK Zimbabwe — Game Over", we explained that the situation at OK Zimbabwe (OKZ) had gotten so bad that OKZ had no choice but to implement significant changes.

This week, OKZ announced that it had parted ways with three executives, including CEO Max Karombo, who has been replaced by former CEO Willard Zireva.

There has been a lot of discussion regarding whether rehiring the former executives is a wise decision or if the board is running out of ideas.

Here are some data points to consider.

Experience vs Fresh Ideas

Willard Zireva started his career with OK Zimbabwe as the finance director in 1984 (at 30), rose to managing director by 1990, and later took over Delta’s entire retail business, including Pelhams.

When OKZ was demerged from Delta Corporation in 2001, he became its CEO for the next 16 years, retiring in 2017.

This means that few people in the country have the amount of experience he has, especially in the retail sector.

He also led OKZ during its most successful period in recent times, between 2010 and 2017. When he retired, OKZ had a revenue of $472 million and a profit of $6 million.

Some will point to the favourable environment at the time, which must have helped, but he can say he had a successful run.

It is worth noting that in his last 5 years with OKZ, TM Pick n Pay started catching up.

In 2012, OKZ's revenue was $413 million, while TM Pick n Pay's was $296 million. By 2017, OKZ had grown by about 15% to reach $472 million, while TM Pick n Pay saw a 40% increase to $414 million. TM Pick n Pay was growing faster than OKZ.

One could argue that towards the end of his tenure, OKZ didn’t do more to reinvent itself when the company was doing well.

We mentioned this before when we compared how active Innscor was between 2009 and 2022, reshaping itself. On the other hand, OK only added OK Mart as a new business or acquisition between 2009 and 2022.

That said, OKZ’s recent attempts to reshape themselves have also not worked out.

In the last few years, OKZ acquired Food Lovers and started Alowell Pharmacies and Vimbai Capital. Those moves don’t seem to have made much of a difference.

So, was Zireva right to have kept OKZ simple and focused? Or had the opportunity already been missed?

Whatever the case, evidence suggests that Willard Zireva's experience and reputation is still very solid, which may explain why the OKZ Board saw him as the ideal person to lead OKZ during this time.

What about fresh ideas?

The retail market has changed significantly since Zireva’s days when formal retailers dominated. Now, even large companies are scrambling to sell into the informal market.

Doesn’t OKZ need someone who can come in with fresh ideas and who is more familiar with the new dynamic in the retail space?

This would be a valid concern if this were a long-term hire. However, this is a short-term arrangement, and it should ideally end by the end of the year.

At present, what OKZ needs the most is not so much fresh ideas but a credible negotiator who is respected and can help inspire stakeholder confidence.

And when it comes to stakeholders, OKZ has a lot.

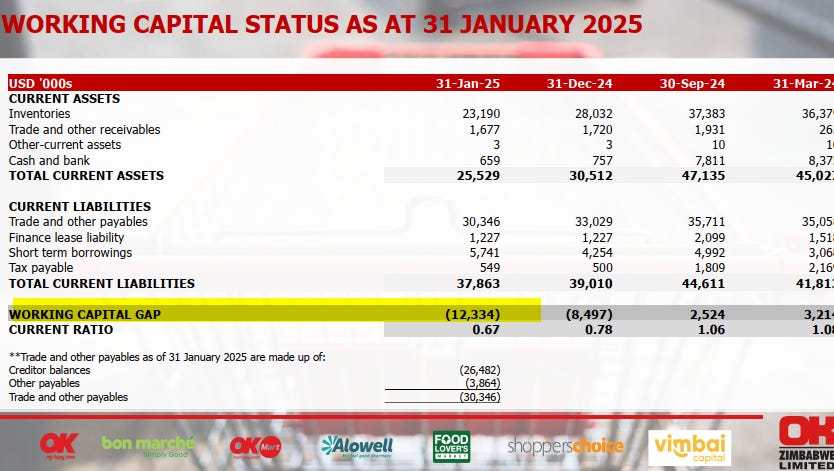

We estimated OKZ’s USD creditors at about $10 million; now, we have the actual total: $14 million.

OKZ’s creditor list looks like the Champions League of business in Zimbabwe. Innscor, Delta, National Foods, Mega Mart, Dairboard, Seedco, and many more.

To manage all these creditors and also all the smaller ones, the CEO must be able to inspire confidence.

I think the OKZ board sees Willard Zireva as the person who can do that—a well-known name with a solid reputation and lots of experience.

Based on all the data points above, it seems like a reasonable step to take to bring Zireva back to OKZ for this interim period.

It was also probably not easy to persuade him to join OKZ. After over thirty successful years as an executive, stepping out of retirement to deal with creditors was probably not on his retirement vision board.

What could happen next? Where’s the Money, What’s the Move?

Much of what we mentioned last week still holds regarding what happens next; here is an extract of what we expected to see:

“changes in shareholding, changes to executive leadership, board reconstruction, the sale of certain players (assets), and cutting costs.

Some of the above has already happened.

I still think OK needs a bailout from “Big Brother”.

To close the $12 million working capital hole, trading their way out doesn’t seem viable.

In 2017, when sales were much better, OKZ made $6 million in profit. Even with that, it would take 2 years to generate the $12 million in extra profit needed.

OKZ also doesn’t have many assets they can sell to raise money, and even if they did, the banks probably would have gotten to them by now.

The best source of capital injection is a bailout.

The good news is that I think OKZ is still a high-potential asset that many people could find attractive.

It is also too big to fail. Even with its struggles, OKZ was still employing four thousand people. Imagine the impact of a complete collapse.

I also wouldn’t write off OKZ yet.

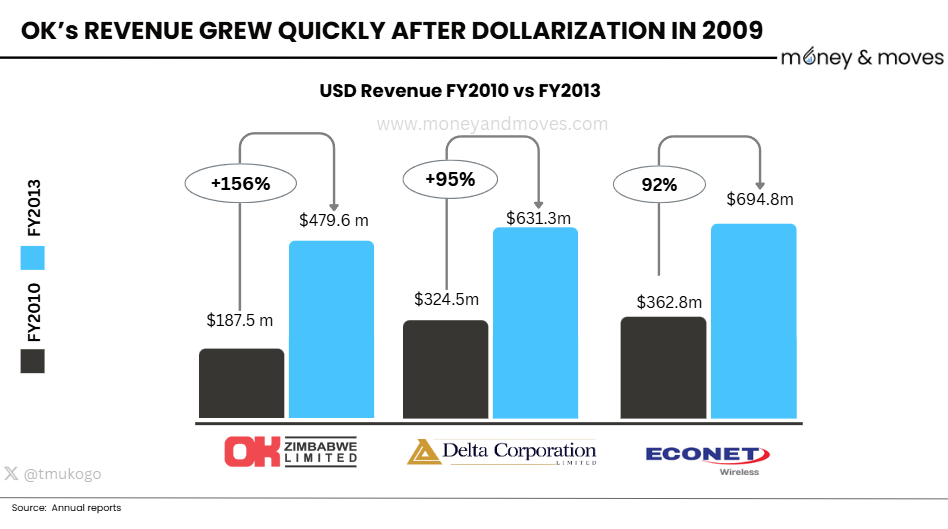

As shared earlier, post-dollarisation, OKZ had a much quicker rebound than most other companies, as shown below.

I think this means OKZ can be an attractive asset, which is also why I think the possibility of a bail-out is high, and since the banks won’t give OKZ money, it will have to come from new or existing shareholders.

What do you think?

PS: I am working with publicly verifiable information, so my analysis could be incorrect or incomplete.

Best move under the circumstances

Another source for a bailout was supposed to be from Gvt of Zw. There is no doubt about the influence OK Zim on the economy as a whole. Employment, taxes, support to agric sector, global image projected by failure of such a massive entity etc. We have seen it in major economies, gvts coming on board to bail out major players with grants and concessionary loans. Though I doubt much if that will happen.