Stanbic's Financial Results: A Solid Performance, But a Missed Opportunity?

Solid numbers, but an unusual move for a bank could be limiting returns

In Zimbabwe, banking does not exist in the typical sense.

Last week, we said that what you typically have are payment processors and custodians.

However, I missed out on another category.

Stanbic Bank's financial results indicate another business area that banks are entering, which could have a significant impact on the future.

Let’s Unpack!

Stanbic Bank’s Financial Performance

Stanbic Zimbabwe reports its financial statements in ZWG, which we ordinarily wouldn't attempt to analyse.

However, since the currency has been relatively stable from January 2025 to June 2025, we can attempt to make sense of it.

Nevertheless, all amounts converted to USD should be considered rough estimates rather than exact amounts.

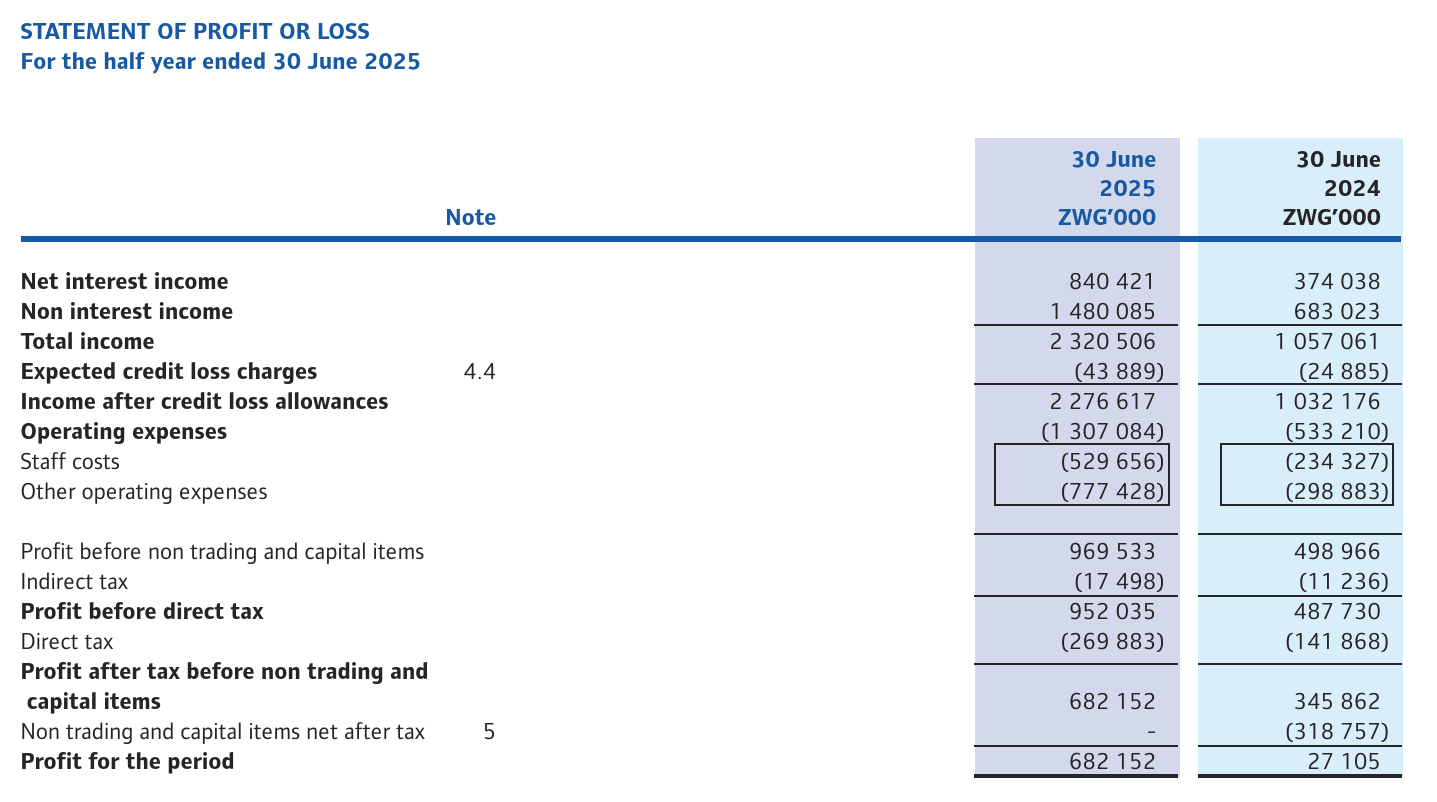

Total income was ZWG 2.3 billion, or roughly $85 million (using a rate of 27.6), with interest income accounting for about 36% of the total.

While a lower ratio than First Capital, which was at 46%, this is a decent amount and indicates that Stanbic is actively lending and not solely relying on fees for its income.

However, this has dropped significantly from ten years ago, in 2015, when Stanbic’s ratio of interest income to total income was 49%, a time when banking was more conventional.

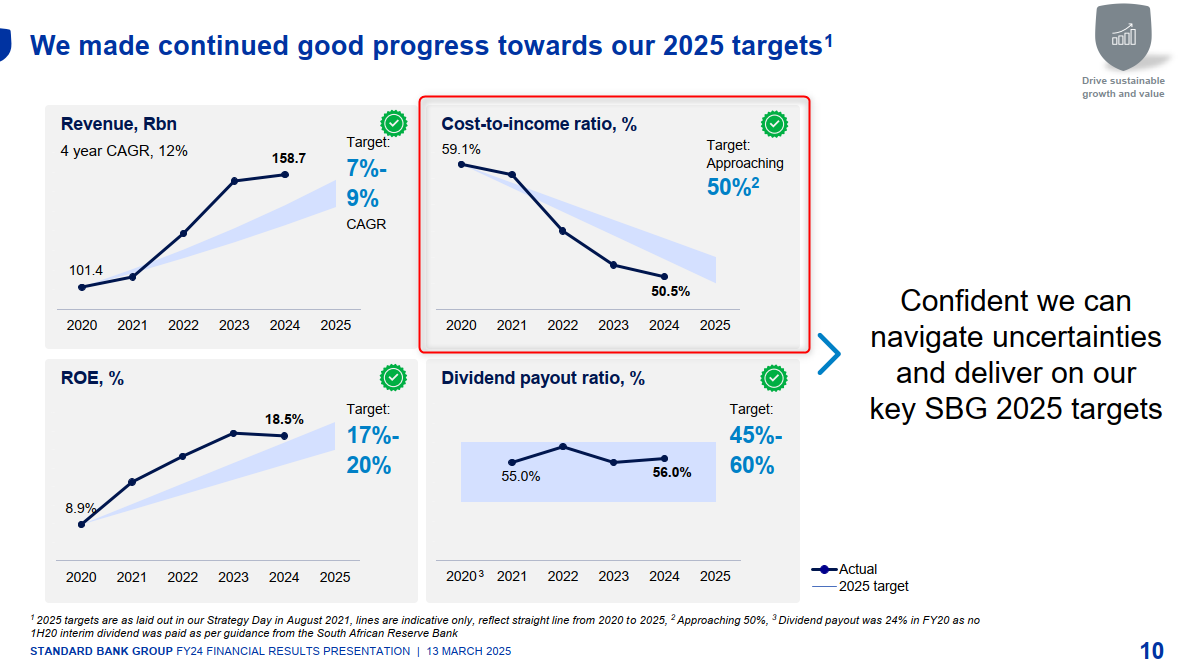

The cost-to-income ratio, for 2025, was 56%, which may indicate some room to cut costs, as the general target is below 50%.

For example, Stanbic's parent company, Standard Bank Group, has been on a journey to reduce its cost-to-income ratio to under 50% for the last few years and is nearing its goal.

It would make sense for Stanbic to also work towards a similar goal, although it is also possible that ZWG is distorting the ratio and Stanbic is much closer to the target.

Overall, Stanbic recorded a profit of ZWG 682 million, or approximately $22 million, for the first half of the year, which is a good result.

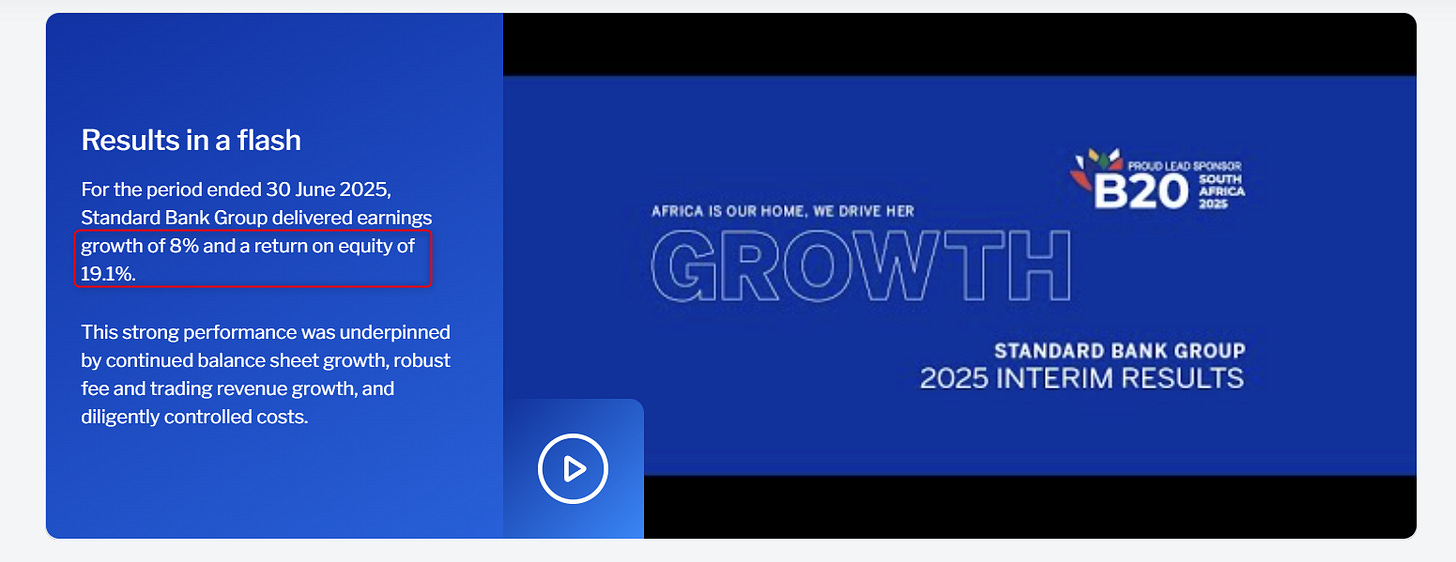

Another area to look at is Return on Equity (ROE).

Return on Equity measures how much profit you make from your net assets. This is an important KPI for banks. Standard Bank Group regularly refers to return on equity in its own results.

Stanbic's return on equity was 24% (after adjusting for exchange gains). This is higher than the overall Standard Bank Group's rate, at 19%, but lower than it was in 2015, at 27%.

At 24% ROE, however, this is on the high end of its peer group in Zimbabwe and demonstrates a strong showing, but it could be even higher.

One factor that weighed on the returns is what could be called a modification to the traditional banking business model.

Stanbic has also become a property company.

Something you wouldn't expect to see in a bank, but this is Zimbabwe.

Stanbic’s Property Portfolio

As of June 30, 2025, Stanbic held ZWG 1.8 billion of investment property (roughly $70 million using a rate of 27.6). This is a big number.

Investment Properties are properties you own to rent out, to gain capital appreciation, or both. Ordinarily, banks don't hold investment property. In fact, Capitec in South Africa, which is over ten times bigger than Stanbic, has no investment property at all.

Why does Stanbic have an investment property portfolio that is bigger than the market cap of some property developers on the Zimbabwean Stock Exchange?

Why Banks Are Getting into Property

If you are a bank with a large holding of ZWG balances, property solves three problems.

Firstly, it’s a way to preserve value. Property has historically performed well in both hyperinflationary times and also in more stable times under dollarisation. As a result, you would rather hold property than ZWG balances.

Secondly, banks have a lot of capital to deploy. For Stanbic, that was in the tens of millions of dollars. Property is one of the few asset classes that can absorb that money without impacting the market.

Thirdly, property is a massive “Bureau de Change”. For some reason, there is an unofficial rule that rentals should be paid in USD, even if tenants don’t earn all of their income in USD.

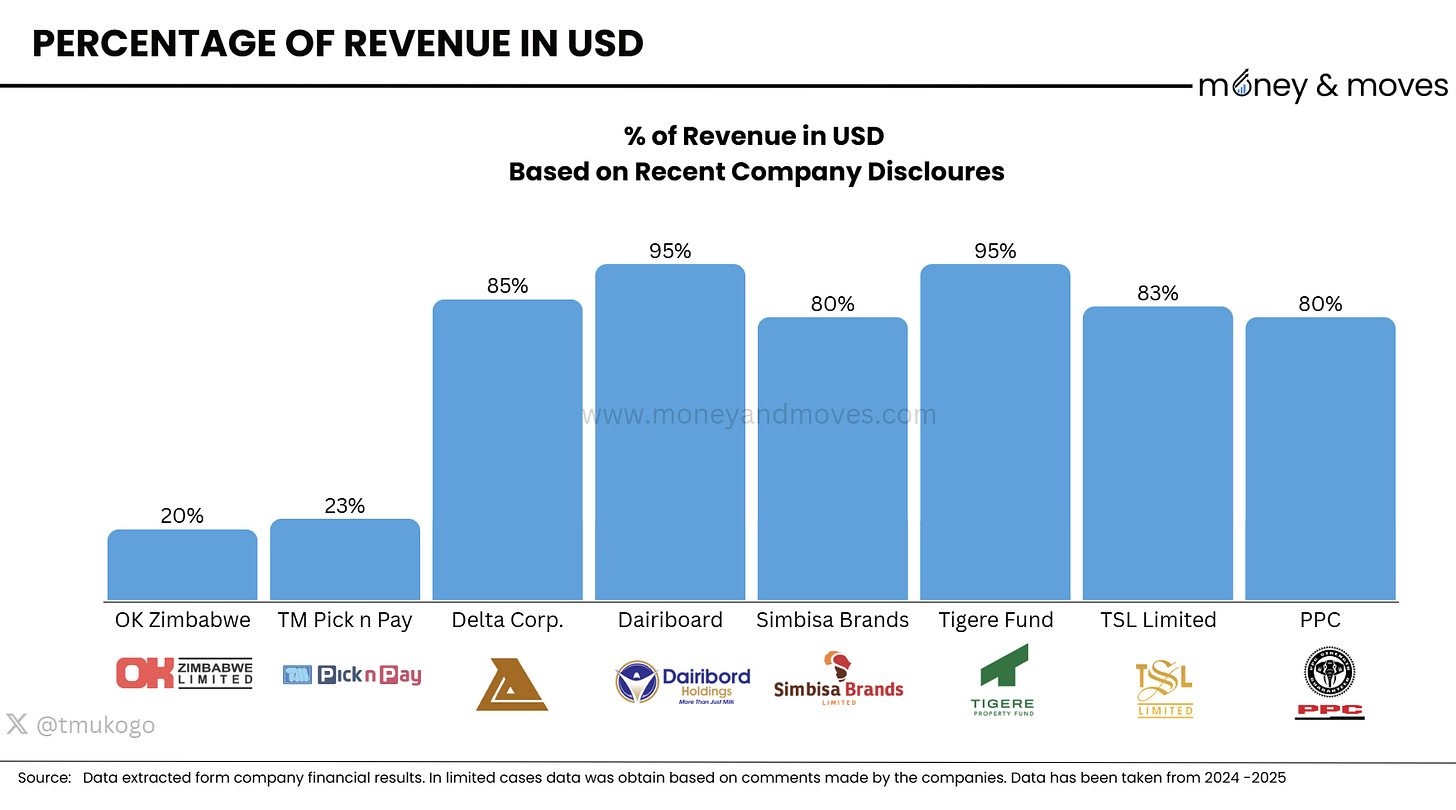

Below is a chart showing the percentage of revenue that companies receive in USD, and you can see Tigere Property Fund has the highest share of income in USD at 95%. Dairiboard is at the same level, but that also includes exports, so the local share of income in USD would be lower.

By spending ZWG to buy or develop properties, you effectively utilise ZWG to generate USD returns, a trade most would gladly make.

Based on the above reasons, one would have to assume that this is why Stanbic has built up such a big property portfolio, and to their credit, this was a smart strategy.

The question is, should Stanbic keep this portfolio?

Investment Property Returns vs Lending Returns

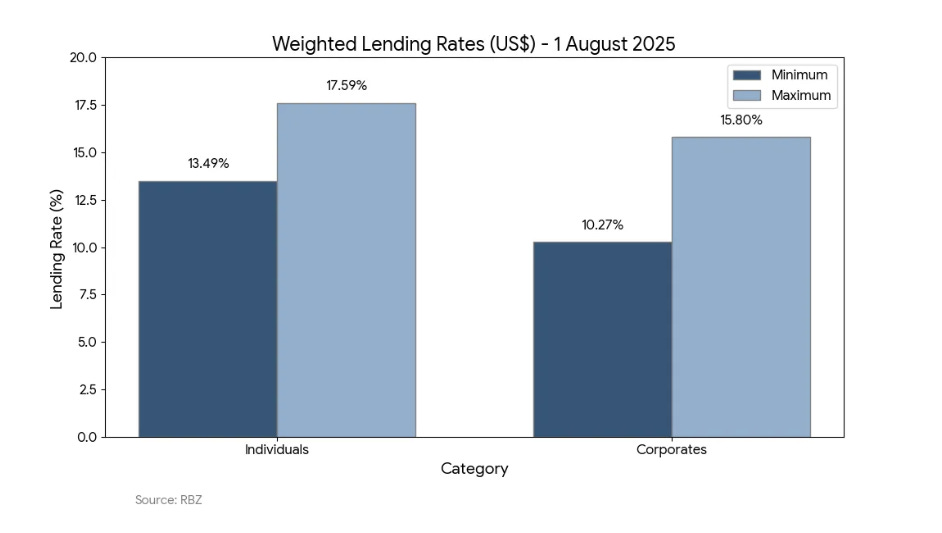

Rental properties typically yield a net return of approximately 5% to 7%. However, as we discovered last week, if you are lending in Zimbabwe, you can generate interest in the range of 18%.

As a result, if the $70 million of capital is invested in property generating a 5% to 7% return, rather than loans and advances offering 10% to 18% interest, Stanbic could be missing out on around 10% extra returns from this capital.

This also doesn’t factor in the additional fees Stanbic can levy when lending.

This calculation is a simplification, of course; it’s not certain that they would have been able to lend all the money. But it demonstrates that Stanbic is not operating at "full speed" and has adopted a conservative approach.

I think a strong case could be made that Stanbic should be trimming its property portfolio. They could even offer mortgages to existing customers to purchase the properties, which would also be a low-risk option.

Overall, Stanbic posted a good set of results, and I think they can be pleased with the outcome, as they seem to be one of the better performing banks.

Their investment property portfolio was a clever defensive play; now the key is being able to time the transition into “offence” to maximise their returns.

Where’s the Money, What’s the Move?

Banks are not lending significantly in Zimbabwe. The loan-to-deposit ratio, which measures the proportion of a bank's deposited funds that are lent out, for the Zimbabwean banking sector was 53% in June 2024, compared to 85% in South Africa.

Any player who can enter the market and lend while managing risk effectively will likely succeed.

Stanbic's play in the property market also helps to understand why property prices in Zimbabwe defy gravity.

If a bank, whose core business is lending money, would rather hold onto property, then imagine players whose core business is investing in property.

Naturally, this results in a lot of demand but limited supply. However, there is a limit and an end to all market trends.

I also think it's possible that banks may come under pressure from regulators to start unwinding their property portfolios, as this can suffocate lending, which is vital for economic growth.

What do you think?

Thanks for reading. Think someone in your network should see this? Forward this email – you could help them make an important strategic decision.

P.S. Please treat all amounts converted into USD with caution. These figures are not intended to be exact and may be off by 20% or more. However, the underlying principles and analysis still apply.

What to Read Next

If you found the above intresting, here are a few more posts to check out.

Return on equity on it’s own is not a KPI, it is a just an indicator. To be a PI you have to measure the indicator against another metric. In this case you measure return on equity against the cost of equity or against a target value of return on equity.

To calculate the cost of equity for Stanbic or any other company in Zimbabwe, you'll need to consider the unique challenges of emerging market valuations. You can use the Capital Asset Pricing Model adjusted for country risk or the dividend growth model.